Smederevac

It’s been a few months since I bought FreightCar America Inc. (NASDAQ:RAIL) ahead of their most recent earnings announcement. Since then, the shares are up about 1.4% against a loss of 8.23% for the S&P 500. My regulars know what time it is, but in case you’re new here, it’s time to brag. Do I like bragging about a 9.6% outperformance over 2 ½ months? Yes, I do. For the record, I love this activity. Anyway, much has happened at the firm, so I thought I’d review the name yet again to see if it makes sense to buy more, sell, or hold. I’ll make that determination by reviewing the latest earnings call, and triangulate what FreightCar is saying with what its competitors are saying in order to develop a more full understanding of industry dynamics. I’ll also comment on the latest financial results, and I’m going to review the stock to see if the valuation makes sense or not.

I’m of the view that FreightCar America is an excellent investment at the moment. While the company is cyclical over the long term, it’s very much in a growth phase at the moment, given the dynamics of the industry. Importantly, FreightCar America is experiencing the same positive dynamics we’re seeing at Greenbrier and Trinity. The company’s Mexican facility is coming along nicely, and I expect further growth into 2023 and beyond. In spite of this, the shares remain relatively inexpensive in my view. The combination of growth business and cheap stock is too powerful to pass up in my view, so I’ll be adding to the position today. Finally, I remind readers of the insider buying here that I wrote about previously. I like being on the same side of the table as the people who know this business better than anyone.

Notes From The Conference Call

When I review a given “space”, I like to compare what each competitor is saying at a given time in order to spot discrepancies, which themselves might be profitable opportunities, and to get a sense of what’s going on with the industry at large. To that end, I want to offer up the highlights of the company’s most recent earnings call. You can read the entirety of the call yourselves, and if you’re considering buying this stock I would urge you to do so. Being the generous soul that I am, though, I’ll provide you the highlights below for your enjoyment and edification.

-

The momentum of this business continued to grow in the second quarter and was driven largely by the need to replace the ageing fleet of railcars and by tightness on the rail network. This is consistent with what we heard on the Greenbrier call that I wrote about Greenbrier call I wrote about here. FreightCar made the additional point that some of the speculative buying has fallen away as interest rates have risen.

-

The company produced and delivered 468 cars during the quarter, even though it was operating just 2 production lines. The company delivered EBITDA of $2.3 million on less than 500 railcars delivered. Although the point wasn’t made explicitly on the call, I would note that this speaks to the production improvements we’ve seen and the improved “per railcar” margins the company is producing. Also, given that not all railcars are the same (some are far more complex to produce, some are far more profitable), the fact that the company achieved this suggests a newfound discipline to seek profitable growth, and not just growth for its own sake.

-

The company was awarded 1,045 new orders, while turning down a comparable number of new orders. Again, this is further evidence of a newfound discipline of seeking profitable growth.

-

The company is forecasting revenue of between $340-$360 million on deliveries of between 3,000 and 3,200 railcars. About 2,000 (or 62.5%) of these railcars will be delivered in the back half of the year, which is further proof that production is ramping up nicely.

-

The Castanos facility is growing well. The wheel and axle shop and the 162,000 square foot fabrication shop are coming online, and the company will have completed the new assembly building with additional production lines by January of 2023. When the current growth phase has been completed, the company will have approximately 1 million square feet under roof at their 125 acre campus, which is located 160 miles from Laredo and Eagle Pass, Texas.

-

The CEO made the following observations on the call

“While our financial results are improving significantly, we continue to navigate substantive supply chain and inflationary headwinds that persist and put downward pressure on both us and the industry. To date, the team has done an excellent job in mitigating the associated effects, but these headwinds are felt and expected to challenge us through at least the end of this year.

In my view, that may have been a fair comment to make way back in August of this year, but the input cost situation is dynamic, as we learned from the Greenbrier call I cited above. Since FreightCar America is affected by the same dynamics, I would expect that FreightCar America, too, will see some relief from the headwinds cited by the CEO. If they don’t see such relief, that’ll cause me to reconsider the bullish thesis. In that circumstance, the obvious question would be “how come Greenbrier and Trinity are managing to get past all of this and FreightCar America isn’t?” We’re not there, yet, but I’ll keep an eye on it.

There you have it. In my view, those are the most relevant highlights from the most recent conference call. They confirm my bullish thesis, and they seem to align with what’s being said by FreightCar’s competitors. I will keep an eye on the cost structure here, because if FreightCar America is the odd man out in being able to reduce the input costs, I’d pivot away from a bullish thesis.

Financial Snapshot

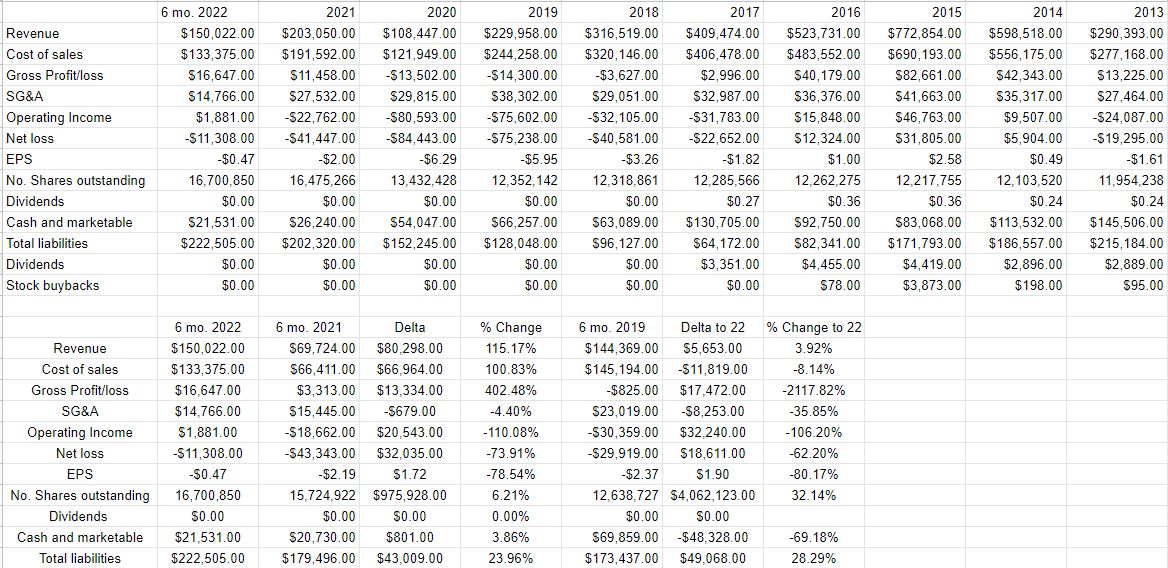

I think the latest financial performance out of FreightCar is rather good. For example, revenue is up fully 115% relative to the same period last year, and gross profit is up a whopping $13.3 million, or 403% (!). While this sort of business can be characterized as cyclical over the long term, it seems to me to be very much in a growth phase at the moment. Additionally, net loss has shrunk dramatically relative to 2022, swinging positively by $32 million over the year. The capital structure has deteriorated somewhat, with long term debt up by about $2.5 million, but cash on the books still represents a whopping 26.25% of long term debt, so I’m not overly concerned about the balance sheet at this point.

You may remember that we suffered from a global pandemic during much of 2021, though, and thus may reasonably suspect that any comparisons to 2021 may be a bit vacuous. After all, it’s easy to outperform a period of imposed economic lockdown. If that’s your worry, then fret no longer, because I also compared the most recent performance to the same period in 2019. Revenue for the first six months of 2022 was about 4% greater than 2019, and net loss has improved by $18.6 million. The improvement isn’t as dramatic, but it’s still impressive.

Given the financial results, the dynamics of the industry at the moment, I’d be happy to buy more at the right price.

FreightCar America Financials (FreightCar America investor relations)

The Stock

If you read my stuff regularly you know what time it is. It’s the time where I turn into a bit of a “buzzkill” as the young people say, because we’ve reached the point of the article where I remind everyone that a company is distinct from its stock. It’s here where I remind everyone that an interesting, growth business like this one can be a terrible investment at the wrong price. The company buys various inputs, like steel, adds value to these, and then sells the results. The stock, on the other hand, is a piece of paper that gets traded around in a public market and is influenced by a great many factors, many of which are only peripherally related to the underlying business. While the stock price is certainly impacted by the company’s recent financial performance, it’s also impacted by the crowd’s ever-changing views about the company’s future financial performance. The stock price also is potentially impacted by the crowd’s ever-changing perspectives on the relative merits of “stocks” as an asset class. While my FreightCar America call is up nicely since I made it a few months ago, how much higher would it have gone if the overall market hadn’t sold off since then? I raise this question because it gives me yet another chance to brag, but it also offers an interesting thought experiment about a counterfactual. It’s impossible to prove this definitively, but I think it’s reasonable to suggest that FreightCar would have a higher price if there wasn’t such softness in the overall market. For all of these reasons, the stock is a much more volatile thing than the underlying business. While this is tiresome, it’s potentially profitable. If we can spot the discrepancies between the crowd’s take on a given business, and the assumptions embedded in the price, we can earn a profit. I absolutely hate to brag about it, but I feel a need to remind investors yet again that I’ve used this approach to successfully trade this name among others. You should never lie to your readers, and I just lied to all of you, and I’m sorry for that. I absolutely love to brag about this call.

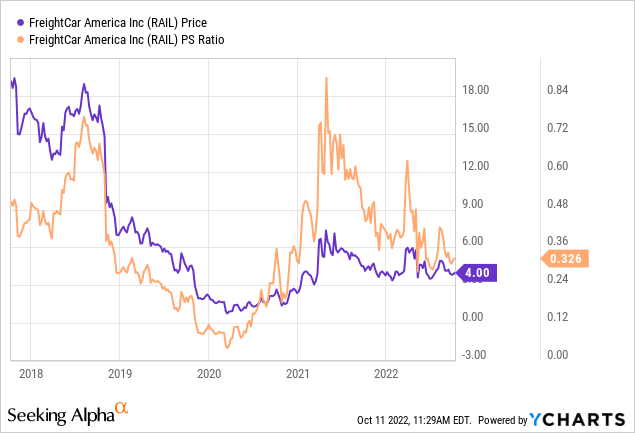

Finally, I should point out that I’ve found that cheaper stocks offer a higher risk-adjusted return, so I like to buy shares when I consider them to be cheap and eschew them when they get expensive. If you’re one of my regular reader/victims you know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. Unfortunately, there are no earnings or free cash flow here (yet), but in my previous missive on this name I determined that it was cheap when the market was paying about $.32 for $1 of sales. The valuation has really budged per the following:

Source: YCharts

In order to validate (or refute) this view, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to John Wiley at the moment suggests the market is assuming that this company will not grow at all from current levels, which I consider to be nicely pessimistic. Given the above, I’ll be adding to my FreightCar position today.

But Wait, There’s More

In my previous missive on this name, I made much about the fact that insiders have bought recently. Specifically, I referenced the fact that on June 16th, Michael Riordan purchased another 2,500 shares to bring his total to 70,807 shares. I don’t want to repeat the section here, because as my regulars know I absolutely hate to repeat myself, but I do want to note it again. When I’m on the same side of the trade as the people who “live and breathe” the business, I feel rather good.

Be the first to comment