Rich Polk/Getty Images Entertainment

Microsoft (MSFT) agreed to purchase Activision Blizzard, Inc. (NASDAQ:ATVI) for $95 cash per share with the transaction closing in 2023. The FTC is reviewing the deal. The ATVI transaction is a special situation merger arbitrage with double-digit returns upon closing. Investors can park their funds in ATVI to hedge against volatile markets and recession.

Description/Background

The merger arb opportunity materialized after a sexual harassment scandal at ATVI. Activist employees attempted to remove Bobby Kotick as CEO for failing to provide a safe working environment and a cascade of delayed game announcements hit the company’s reputation, dropping the stock from the high $90s to $58. Microsoft sensed an opportunity to expand its gaming division, improving optionality on Xbox content and was confident in its ability to improve Activision’s workplace culture. It made an all cash offer to buy the company for $95 per share. Microsoft will absorb ATVI with approximately one year of its free cash flows, ~$56b in ’21.

The FTC is evaluating the deal and its impact on the $200 Billion gaming market. Activision generated $8 Billion last year and Microsoft will grow its gaming market share from 6.5% in 2020 to 10.7% after the Activision deal closes. With promises to deliver games to all platforms, Microsoft should be able to clear deal scrutiny.

Google search

Microsoft’s president Brad Smith recently claimed the company’s proposed acquisition of Activision Blizzard is proceeding relatively quickly and the process is entering its middle phase.

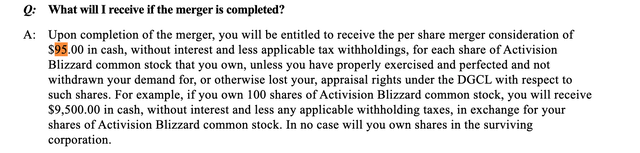

The deal

SEC Activision Deal Proxy

$95 cash per share with a termination fee commitment from Microsoft to Activision if the FTC doesn’t allow the deal to proceed. Termination fee ladder: $2b before Jan 2023, $2.5b Jan-Apr 2023, and $3b Apr – Jul 2023. The deal is expected to close in July of 2023. The worst-case scenario for Activision shareholders is the deal does not materialize by next July and the company generates $2b+ of free cash flows on its own, plus a $2-3b termination fee from Microsoft.

If Activision decides to scrap the deal because it found a better suitor, or for any other reason, the company will owe Microsoft slightly over $2 billion.

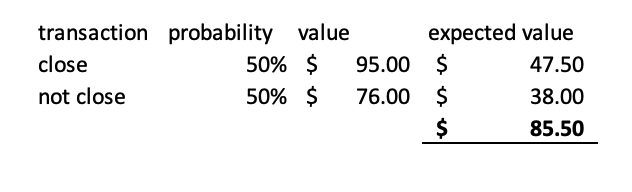

Expected Value

A Binary outcome for the transaction makes this situation a simple risk arbitrage calculation. You either think it will close, or not. Putting 50/50 probability weights on the yes/no outcome, the expected value table is presented below:

Expected Value calculation table

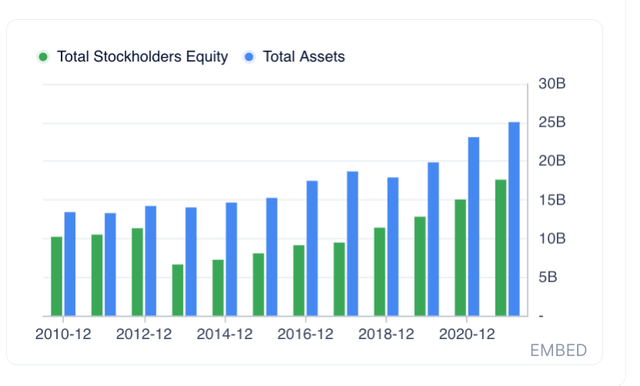

I do not think Activision will drop below $76 per share with another year of positive cash flows, adding $2 billion to the book value, and another $3 billion in breakup fees if the FTC scraps the transaction. The margin of safety is present regardless of the deal closing. Activision is in good financial condition, the balance sheet is strong, and the brand value of its games is significant.

Gurufocus ATVI financials

Arguably, games like Call of Duty, Warcraft, Overwatch, Diablo, Candy Crush, HearthStone, etc., are going to generate a growing revenue stream for years.

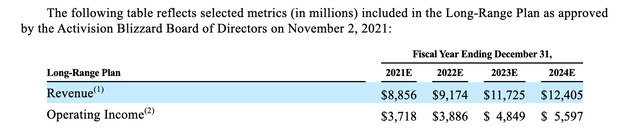

Microsoft proxy on ATVI deal, pro-forma earnings

Holding Activision long-term is a reasonable backup plan, a 2024 15x EBIT multiple yields an $84 Billion market cap, 40% upside from today.

Risks

A Wisconsin-based Call of Duty developer Raven Software’s quality assurance department voted to unionize, possibly causing a headache for Microsoft and other game makers. Production costs would increase and employee project flexibility could suffer when unionized labor is introduced into the fast-paced game development process.

The FTC could scuttle the deal because of antitrust concerns and a deep recession could hurt Activision’s profitability, and valuation multiples would contract significantly.

Catalysts

The arbitrage gap should close the closer we get to the deal date.

Microsoft closing the deal at $95 per share will provide 25% IRR in 12 months.

Conclusion

ATVI presents a rare opportunity to allocate capital with a simple decision tree, either the transaction closes for $95 cash per share for a 25% IRR in 12 months, or it doesn’t, leaving Activision to produce games into the next gaming cycle. In either case, the company should enjoy a profitable future with game pricing adjusted for inflation. Investors should consider adding ATVI to the special situation basket.

Be the first to comment