Stephen Brashear

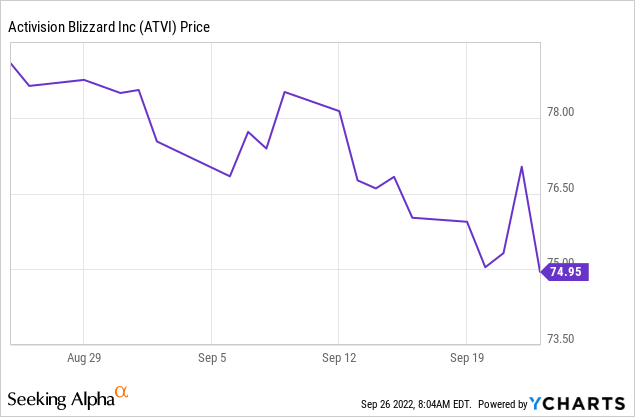

Activision Blizzard (NASDAQ:ATVI) is trading at around $75. Microsoft (MSFT) has a merger agreement to acquire the company at $95. There’s 26% upside to the deal price. The deal is expected to close in about a year (but it could fail earlier). Chris DeMuth Jr. (absolutely worth following) thinks the deal might even close as soon as April 2023. The spread has blown out in the past month, and I suspect that’s mainly due to hedge fund deleveraging and not so much based on the odds of the deal close deteriorating. There’s been news that the U.K. is opening a stage 2 investigation and Europe will do an in-depth review, but in my view, there was virtually no chance the deal would go unchecked there.

Some pressure on the stock is no doubt legitimate as the market has been declining, and if the deal were to break, lower valuations would weigh on the break price for Activision.

The CMA (U.K. regulator) is looking into the deal for the following two reasons (emphasis mine):

Microsoft is one of three large companies, together with Sony (SONY) and Nintendo (OTCPK:NTDOY), that have led the market for gaming consoles for the past 20 years with limited entries from new rivals. Activision Blizzard has some of the world’s best-selling and most recognizable gaming franchises, such as Call of Duty and World of Warcraft. The CMA is concerned that if Microsoft buys Activision Blizzard it could harm rivals, including recent and future entrants into gaming, by refusing them access to Activision Blizzard games or providing access on much worse terms.

The CMA has also received evidence about the potential impact of combining Activision Blizzard with Microsoft’s broader ecosystem. Microsoft already has a leading gaming console (Xbox), a leading cloud platform (Azure), and the leading PC operating system (Windows OS), all of which could be important to its success in cloud gaming. The CMA is concerned that Microsoft could leverage Activision Blizzard’s games together with Microsoft’s strength across console, cloud, and PC operating systems to damage competition in the nascent market for cloud gaming services.

Sorcha O’Carroll, Senior Director of Mergers at the CMA, commented as follows:

Following our Phase 1 investigation, we are concerned that Microsoft could use its control over popular games like Call of Duty and World of Warcraft post-merger to harm rivals, including recent and future rivals in multi-game subscription services and cloud gaming.

Microsoft CEO Satya Nadella isn’t fond of building a huge closed system around the company. Arguably, Microsoft took a different course under his leadership and became a more open company. He’s made some smart acquisitions that weren’t necessarily “market dominating” in nature (as these deals don’t fly with regulators) but were likely valuable to the overall Microsoft ecosystem, like when he acquired Minecraft and LinkedIn. To be honest, I didn’t get either at the time.

To look at competition through the lens of console makers seems very narrow to me. Being a leader for 20 years in consoles is great and all, but there’s a lot of gaming going on outside of consoles (PCs, tablets, smartphones). There are even board games and trading card games that increasingly compete for attention with console games. I’m skeptical that Microsoft is interested in limiting rivals’ access to top Blizzard titles. That would bring down the profits of the acquired company. There’s tremendous value in having a console platform with a wide-ranging supply of titles available (why competition doesn’t take hold in consoles or Mobile OS), but I doubt there’s as much value in restricting content to Microsoft devices. High-end gaming revolves around building enormous and enduring franchises with loyal fan bases. Making titles less available breaks trust and franchises start to deteriorate. It also seems to me that regulators should be able to be appeased by certain promises not to ring-fence assets.

The CMA (and other regulators) also are concerned (and perhaps rightfully so) about Microsoft leveraging Activision Blizzard’s assets to damage competition in the market for cloud gaming services. I think remedies to any concerns should be able to be found here (Microsoft is said to be talking to European regulators since January 2022). Microsoft is the No. 2 in the cloud behind Amazon (AMZN) and with Google (GOOG) (GOOGL) as the other global challenger. China is a market to consider separately. This deal doesn’t appear to me to represent any kind of hurdle for Google or Amazon to continue competing against Microsoft in cloud gaming services.

I’m not sure the deal won’t get shut down. It seems the kind of big tech deal that still has a good chance of passing muster with regulators.

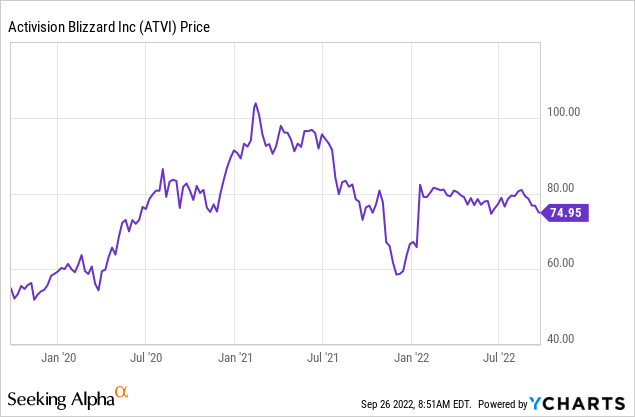

What I like about this deal is how the downside may not be as pronounced as you’d think. It came out mid 21′ that there had been misconduct at the company. A November 2021 Wall Street Journal story also revealed that CEO Bobby Kotick knew about the allegations and protected wrongdoing executives from being fired or punished. This resulted in a tremendous backlash among employees and the fan bases of its games. Naturally, it also tanked the stock price.

This allowed Microsoft to get a deal done at a very reasonable price.

In any case, by the time this deal would finally get shut down (if at all) by some regulating agency, a lot of time will have passed since these events shook up ATVI. The company will have had a lot of time to deal with the events appropriately. Several executives have left the company or were fired. The company also brought in several new officers to change the culture and improve diversity, equity and inclusion. Investors and fans will start looking at big 2023 releases like Diablo IV and Overwatch 2. Could Activision break to $50 or $60 per share? In a market like this, absolutely. But arguably, it would likely start appreciating back up over time. The analyst EPS estimates are interesting, especially if you look a few years out:

ATVI earnings estimates (Seeking Alpha)

The company has almost $10 per share in cash. If you look at an ex-cash basis, the stock would be trading at less than 10x forward earnings. Substantially less if you were to look out to 2027. The company may fall short of these targets, but if it solves its issues and keeps growing, there’s not a lot of reason to trade at these multiples for extended periods.

In summary, I like to add some ATVI shares for around $75. There’s a substantial upside toward $95. I expect the deal will ultimately win over regulators. The deal would drop quite a bit if the deal fails. But not much below $50 I’d think. The stock would later likely recover from such a drop, given a strong balance sheet and earnings (growth) potential.

Be the first to comment