Rich Polk

Thesis

On December 8th, the FTC filed a lawsuit to block Microsoft’s (NASDAQ:MSFT) acquisition of Activision Blizzard (NASDAQ:ATVI), which values the latter at a $69 billion valuation. Although I personally estimate that the deal could close at a 50% probability, I do not think the risk/reward for investors is favorable. In my opinion, if the deal fails, ATVI stock could drop by as much as 20% – noting that ATVI is currently valued at a 6x EV/Sales.

For reference, ATVI has strongly outperformed the market year to date, being up 11.5% versus a loss of 18% for the S&P 500 (SPY), respectively.

The FTC Sues to Block Microsoft’s Deal for Activision Blizzard

In a move that was arguably not very unexpected (ATVI shares only down less than 2% after the news) on Thursday 8th December the FTC moved to sue against the Microsoft/Activision deal, with the following argument:

Agency alleges that maker of Xbox would gain control of top video game franchises, enabling it to harm competition in high-performance gaming consoles and subscription services by denying or degrading rivals’ access to its popular content

The vote was given 3 to 1 in favor. Holly Vedova, Director of the FTC’s bureau of competition, commented: (emphasis added)

Today we seek to stop Microsoft from gaining control over a leading independent game studio and using it to harm competition in multiple dynamic and fast-growing gaming markets.

Although the statement sounds alarming, the danger that Microsoft forms a monopoly in any form is quite low: Even with the takeover of Activision, Microsoft would only be the third-biggest gaming company in terms of revenue globally, behind Tencent (OTCPK:TCEHY) and Sony (SONY). Moreover, Microsoft has stated multiple times that the combined entity will not restrict access to Activision-developed games. In that context, Activision has recently signed a 10-year contract for Call of Duty with Nintendo.

This is why both Microsoft and Activision are confident that the deal will close: Activision Blizzard CEO Bobby Kotick commented:

I want to reinforce my confidence that this deal will close. The allegation that this deal is anticompetitive doesn’t align with the facts, and we believe we’ll win this challenge.

And Microsoft’s Brad Smith signaled that the software giant will not drop the deal without a fight.

[we have] been committed since Day One to addressing competition concerns …

… While we believed in giving peace a chance, we have complete confidence in our case and welcome the opportunity to present our case in court.

Without The Microsoft Deal, Activision Is Likely Not Worth $71/share

A survey among Seeking Alpha readers highlighted that the downside case for ATVI is anchored at $71/share (approximately 5% downside). But this estimation is too optimistic, I argue.

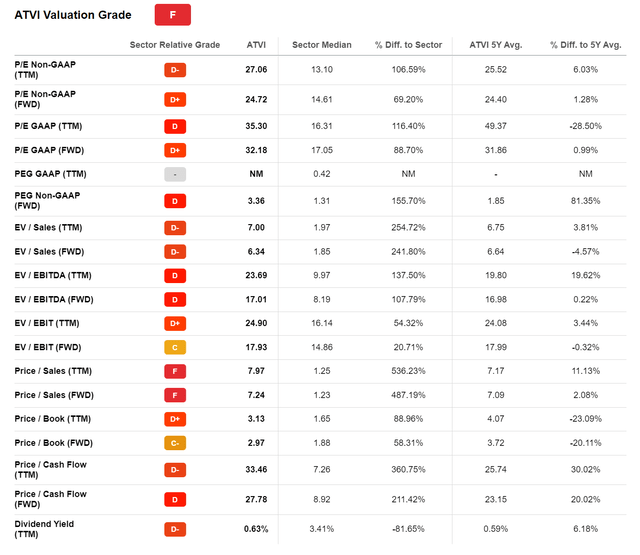

I would like to point out that the hope for a $69 billion deal has kept ATVI stock at rich multiples. As of mid-December, ATVI is trading at an EV/Sales of 7x and an EV/EBITDA of 24x – implying a valuation premium to the industry median of approximately 240% and 137%, respectively.

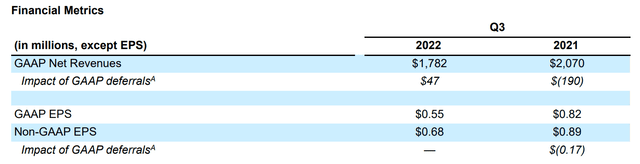

In my opinion, such a rich valuation is not justified and does not correctly reflect ATVI’s fundamental challenges. Revenues for Q3 2022 dropped by almost 15% versus the same period in 2021, to $1.78 billion. Respectively, GAAP EPS fell 33% to $0.68.

Activision Blizzard Q3 Results

Moreover, NetEase (NTES) results for the September quarter 2022 disclosed that the Chinese game developer will not continue to publish Activision games from January 2023 onwards – which will give additional pressure on ATVI’s financials.

As previously disclosed, NetEase has entered into certain licensing agreements covering the publication of several Blizzard titles in Chinese mainland. These licenses will expire in January 2023 …

… and will not be renewed.

Although Activision has disclosed that the revenue share from the NetEase partnership is only 3% of the company’s total sales, investors should consider that this loss of revenues will almost one-to-one materialize as a loss of profits, given that the licensing structure of the partnership requires almost no cost of sales and operating expenses.

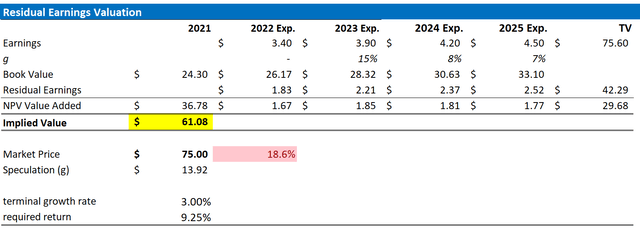

Residual Earnings Model

So, what would ATVI be worth on a standalone basis?

To derive a more precise estimate of a company’s fair implied valuation (without the Microsoft deal), I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my Activision stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, the analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on ATVI’s cost of equity at 9.25%.

- For the terminal growth rate after 2025, I apply 3%, which I believe to be still conservative (approximately 0.5 – 1 percentage points above nominal GDP growth).

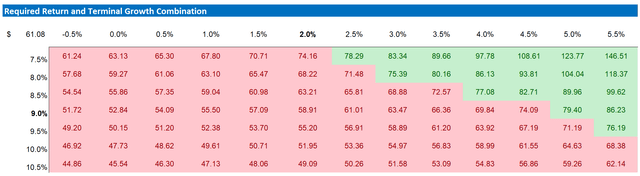

- Investors with different assumptions regarding ATVI’s cost of capital and terminal growth may take reference from the sensitivity table enclosed.

Given the above assumptions, I calculate a base-case target price for Activision of about $61.08/share.

Analyst Consensus EPS; Author’s Calculation

My base case target price does not calculate a lot of upside. But investors should also consider the risk-reward profile. To test various assumptions of ATVI’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note that the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus EPS; Author’s Calculation

Conclusion

ATVI investors need the Microsoft deal to go through. Otherwise, it is likely that the stock could drop to $61.08/share, which would mean a loss of almost 20%.

Personally, I estimate that the deal will close with 50% probability – supporting a very neutral assessment on the event. This would mean that my expectancy value for ATVI shares is approximately $73.5/share (0.5*$86 plus 0.5*$61). Although $73.5/share is not much lower than the current $75 trading price, it is still lower. And in my opinion, other tech investment opportunities provide a much better risk-reward opportunity.

Be the first to comment