onurdongel/E+ via Getty Images

When I was a kid, getting a new toy at Christmas usually meant something I could build like Legos or K’nex. Today, a new toy for me is when a previously expensive REIT drops into an attractive value range. I get to unwrap it and dig into the fundamental details of an entity that was previously too expensive to care about.

Acadia Realty (NYSE:AKR) is that new toy.

It has long been a premium retail REIT with very high sales per square foot and the market traded it accordingly. Historically it has almost always traded at a higher multiple than peers. I viewed it as a good company, but fully priced.

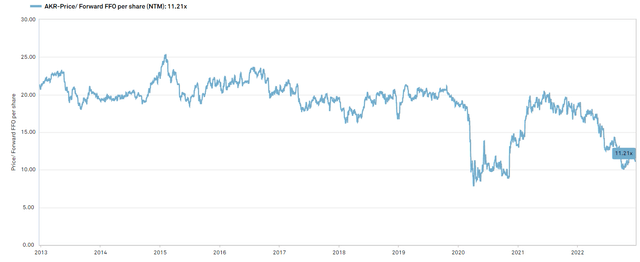

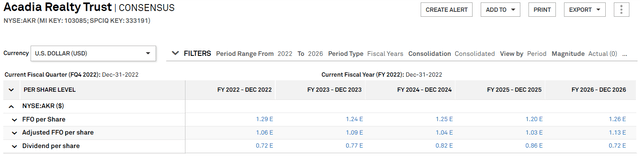

After a decade of trading around 20X forward FFO it is now at 11.2X.

S&P Global Market Intelligence

The valuation looks great, so now it behooves us to verify that it is in fact the great company the whole market assumed it to be.

Quick overview

Acadia is a retail REIT but with a different sort of property. Rather than the drive-up shopping centers with anchor tenants and small shops, Acadia has what is called street retail. Located in highly urban areas with ample foot traffic like downtown Chicago and Manhattan, these are luxury-oriented storefronts with high ceilings and even higher sales per square foot.

This is what Acadia’s real estate tends to look like:

Premier foot traffic locations and this style of real estate epitomize AKR’s portfolio.

In real estate, luxury is often mistaken as being superior, but the luxury spectrum is an entirely separate consideration than what I would consider the real estate quality spectrum which is based on forward net operating income growth.

For example, I would consider extended stay hotels to be higher quality real estate than 5-star, full-service hotels. Class B apartments are better positioned right now than class A apartments.

Luxury is not inherently better or worse real estate than lower end. It is just a consideration to make when looking at forward demand.

With that in mind, I want to spend a bit of time discussing the performance and future outlook for Acadia.

Fundamental history and outlook

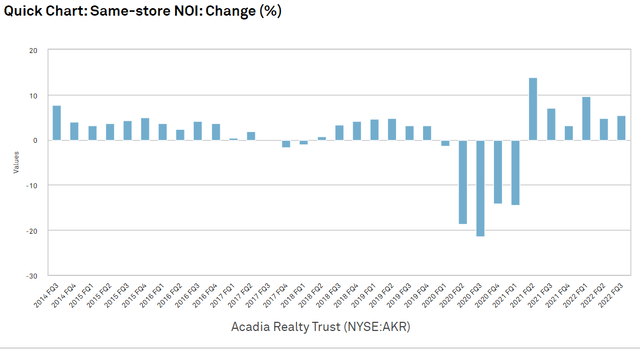

AKR’s properties have generally had consistent growth, but got clobbered in the pandemic.

S&P Global Market Intelligence

The source of the growth is constrained supply. There is a limited amount of land in these densely populated areas so it is difficult to build competing locations. If retailers want to locate in these high foot traffic areas they have to pay premium rent and AKR can generally raise rents each year.

My hunch as to why the pandemic hurt so much is that walk-up locations are frequented by people on their way to and from work. As work-from-home set in, the foot traffic was greatly diminished.

Regular shopping centers were able to replace most of their normal traffic with stuff like BOPIS (buy online pick-up in store) and curbside pickup. Such omni-channel efforts are less effective for storefronts that rely on foot traffic. Someone walking to the store cannot order the same volume of goods as someone doing curbside pickup who might load up their trunk with two weeks-worth of supplies.

In the aftermath of the pandemic, AKR does seem to be rebounding nicely. Leased occupancy is up to 94.3% and rent per square foot is still quite high at $32.97.

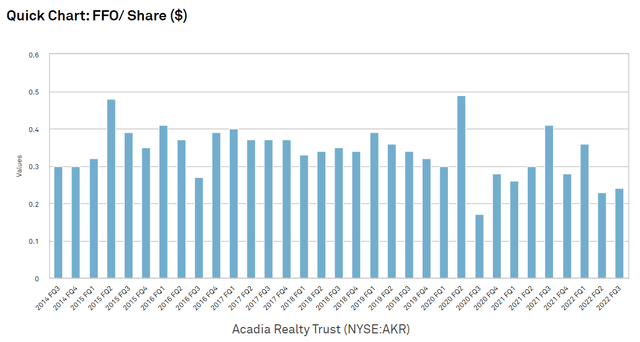

However, FFO has yet to rebound to pre-pandemic levels.

S&P Global Market Intelligence

That said, I think the fundamentals are already in place for FFO to match and then exceed its historic level.

Four big sources of FFO/share growth

- Leasing spreads

- Contractual rent growth

- Acquisitions kicking in

- SNO leases

Leasing spreads are the perennial source of organic growth.

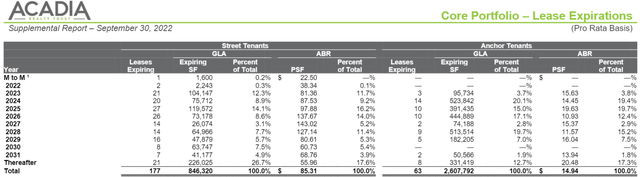

Current leases are about 20% below market rate and AKR will have the opportunity to bump rents up to market as leases roll over. Minimal leases are rolling in the remainder of 2022, but in 2023 11.7% of AKR’s street leases roll and it stays at a mid-teens annual pace through 2028

While we wait for leases to rollover, AKR has roughly 3% annual escalators on its street leases and about 1.5% escalators on the rest of its portfolio resulting in overall contractual rent growth in the low to mid 2% range.

On top of these organic sources of FFO/share growth, there are a couple of timing aspects that suggest run rate earnings are significantly higher than current.

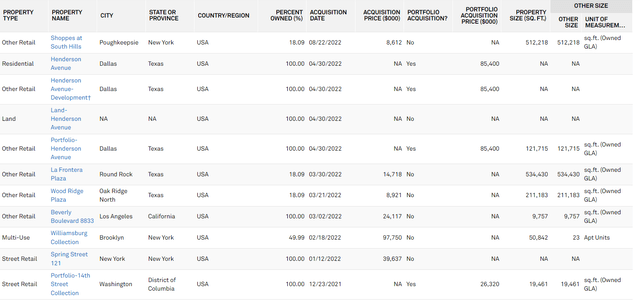

In 2022, AKR had a few hundred million dollars of acquisitions representing volume of about 25% of their market cap.

S&P Global Market Intelligence

The tricky thing with acquisitions is that companies usually have to bear the cost of financing immediately while the cashflows wait until closing. It causes the year of heavy acquisitions to come in light for FFO/share. Going forward, however, the full cashflows will hit the bottom line.

A similar phenomenon is present in leasing activity. Leases get signed well in advance of commencing which provides a runway of visibility into the future.

For AKR specifically, about 5% additional annual base rent is set to kick in on leases already signed but not yet commenced. CFO John Gottfried describes this on the 3Q22 earnings call:

“Our signed but not yet opened pipeline represents an excess of 5% of our in-place ABR. And in terms of timing of the anticipated rent commencement, we estimate that approximately 45% of the ABR or about $3.5 million will commence during the fourth quarter of this year with another 25% commencing in the first half of 2023 and the remaining 30% in the second half. And please note that given the timing of commencements, we won’t get the full benefit in our reported results until the subsequent full annual or quarterly period.”

This rent will trickle in over the next year.

Poised to beat consensus

Between these four sources of growth I think AKR will grow FFO/share somewhere around 5%-10% annually for the next few years.

This substantially beats consensus estimates which strike me as rather pessimistic calling for zero growth.

S&P Global Market Intelligence

Balance sheet and financial health

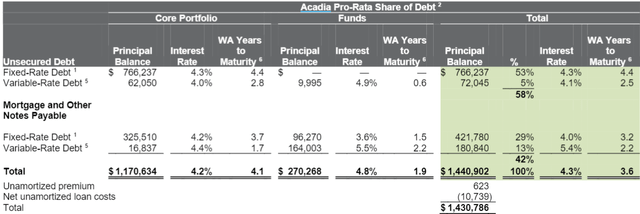

In its 2022 acquisition spree, AKR took on a bit more debt than its normal level resulting in debt to total capital of about 50%. Most of it is fixed rate and they have some hedges on top to fix some of the floating.

As such, I do not consider interest rates to be particularly impactful to near-term cost of debt, but it is worth pointing out that the weighted average term on AKR’s debt is rather short at 3.6 years. Most REITs are between five and 10 years weighted average remaining term of debt.

Generally, I would prefer a longer term structure, but which is better will come down to where interest rates are in a few years.

I don’t see any glaring risks here, but the somewhat higher level of debt makes AKR’s balance sheet slightly below average among its peers.

Valuation

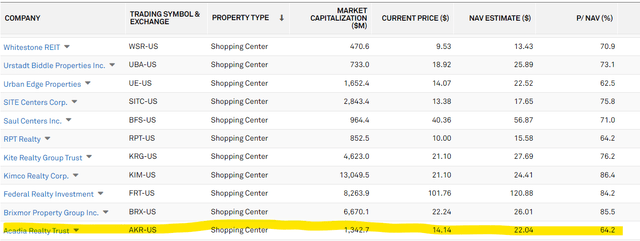

As noted at the outset, AKR’s valuation is fantastic relative to its history, but whether to buy it now or in 2012 is not a real world decision so I think a better way to look at value is to compare AKR today to its peer set today.

On a net asset value (NAV) basis AKR is among the cheapest in its sector at 64% of NAV.

S&P Global Market Intelligence

It has an enterprise value of $250 per square foot which strikes me as remarkably cheap given the location of their properties. Some of their denser locations could go for $1000 per foot in the private market.

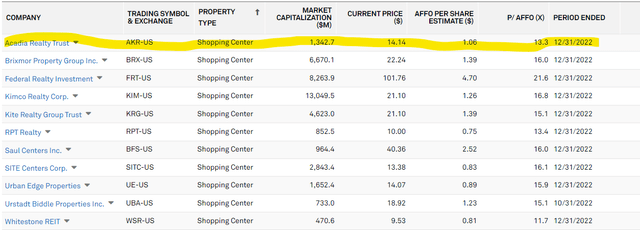

On AFFO the valuation is a bit closer. AKR is cheap at 13.3X forward AFFO, but the whole shopping center sector is trading at low multiples.

S&P Global Market Intelligence

Thus, I think AKR is a good value, but it is not entirely clear to me that it is a better value than some of their peers.

It comes down to one’s views on street storefronts that rely on foot traffic versus the more standard shopping centers with parking lots and anchor tenants. I don’t yet have a strong view on which is better.

Wrapping it up

Overall, I am bullish on the shopping center sector. There are clear risks such as lingering Covid and potential recession, but I think those are more than priced in. When sentiment is as pessimistic as it is today I think the scenario weighted average outcome is significantly positive for the stocks.

AKR is among a basket of stocks in the sector that I think is a good deal today. It is good real estate at a deep discount to replacement cost.

Be the first to comment