GeorgePeters

Investment Overview

In my last note on Acadia Pharmaceuticals (NASDAQ:ACAD) published at the end of June I gave the company a bullish rating. This was based on a few factors.

Acadia’s share price had recently dropped from >$25, to $13, after an FDA Advisory Committee (“AdComm”) voted 9-3 against approving its sole commercialized product – the antipsychotic therapy Pimavanserin, approved to treat Parkinson’s Disease Psychosis (“PDP”) under the brand name Nuplazid – for the additional indication of hallucinations and delusions associated with Alzheimer’s disease psychosis (“ADP”).

In November 2020, Acadia’s share price traded >$50, therefore my thinking was that despite this latest setback, the company still had several opportunities in play that could trigger a substantial rise in the stock price.

Firstly, it was possible that the FDA could ignore its AdComm, and opt to approve Nuplazid to treat ADP anyway – its briefing documents released ahead of the AdComm had been suggested it may be in favor of approval. We now know this did not happen, but two more good opportunities do remain in play.

Secondly, Acadia has been guiding a second drug – Trofinetide – through a pivotal study in patients with Rett Syndrome – a debilitating condition involving motor impairment that affects between 6-9k people in the US, for which there are no approved drugs. Management believes Trofinetide could reach ~$500m in annual sales, if approved.

And finally, Pimavanserin is also in Phase 3 studies in Negative Symptoms of Schizophrenia (“NSS”), so the possibility of a label expansion for the drug remains in play.

Fast forward four months – and two set of earnings – and Acadia today trades at more or less the same price as it did at the end of June. After the company released its Q322 earnings results yesterday, I thought it would be a good time to update the investment thesis in light of recent events.

First of all, let’s break down the earnings picture.

Another Loss-Making Quarter Asks Questions Of Business Model

Acadia is, and always has been a heavily loss making company. The average net loss made by the company between 2016 and 2020 stands at $264m, which undermines otherwise impressive top line growth. Since Nuplazid was approved in 2016, revenues have increased from $125m to $484m last year.

Acadia slightly downgraded its guidance from $510 – $540m, to $510 – $520m when announcing Q322 earnings of $130.7m – which was down both sequentially and year-on-year, although only by a few million. Management said that demand growth rose 2% quarter-on-quarter, and that an inventory reduction impacted net sales by ~$7m.

More worryingly perhaps net loss for the quarter was $27.2m, which is significantly worse than the $15m net loss recorded in Q321. Across the first three quarters of the year, Acadia has racked up net losses of $174m, vs. $125m in the prior year period.

Acadia would presumably argue that its SG&A expenses were only $78.1m for the quarter, suggesting a margin of ~40% on sales of Nuplazid, and that the R&D expenses of $81m will be justified by the approval of Trofinetide – its New Drug Application (“NDA”) has now been submitted and the Prescription Drug User Fee Act (“PDUFA”) date – when the FDA announces whether it has been approved for commercial use – is scheduled for March 12, 2023.

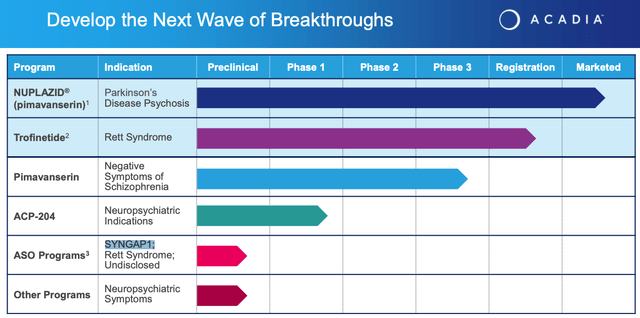

Acadia also is funding studies of Pimavanserin in NSS, and another candidate, ACP-204, through Phase 1 studies in unspecified Neuropsychiatric Indications. In collaboration with Stoke Therapeutics Acadia has an antisense oligonucleotide program targeting the rare genetic condition SYNGAP1, Rett Syndrome, and other undisclosed targets, and there are other preclinical programs ongoing.

Acadia pipeline breakdown (Acadia earnings presentation)

Acadia’s cash position remains strong – the company reported near-term cash of $437m as of Q322, enough to absorb at least 2 more years of heavy losses, although at some point Acadia will be obliged to show that it can be a profitable business. If it cannot do so, it’s share price is unlikely to begin climbing again.

Nuplazid Business Model – Drive Growth In PDP, Target Long-Term Care, Gain Approval in NSS

First of all Acadia needs to ensure that Nuplazid retains or ideally increases its sales of Nuplazid, and despite an average quarter, Acadia Steve Davis told analysts on the Q322 earnings call that prescription growth in the long-term care (“LTC”) market have been increasing, thanks to an increase in LTC occupancy rates, which had fallen during the pandemic. Davis suggested that:

a new admission is a critical time for potential diagnosis of psychosis and potential treatment with NUPLAZID

Meanwhile, in-office patient visits continue to be impacted by the pandemic, Davis told analysts, with no immediate signs of improvement. Acadia’s earnings presentation notes that the company “took a 9.4% price increase on Nuplazid in August,” which implies a net pricing benefit of 3% taking inflation into account.

Although Acadia does not want to price itself out of the market, most Nuplazid patients have their prescriptions covered by Medicare Part D. There’s always a risk that the Centers for Medicaid and Medicare (“CMS”) could stop covering Nuplazid, which would be very damaging for Acadia, but for now at least Nuplazid is cash flow positive for Acadia. Davis also was able to tell analysts that:

the recent publications and presentations of real-world studies comparing the use of NUPLAZID to other antipsychotics, highlight and expand on the favorable safety profile of NUPLAZID for use in PDP patients.

In August, the FDA opted to follow the advice of its AdComm and reject Acadia’s application for Pimavanserin to be approved in ADP. That leaves NSS as the company’s only shot at expanding the label of Nuplazid. It’s a potentially large market – Acadia estimates ~700k patients receiving treatment in the US for Schizophrenia have “persistent negative symptoms.”

Acadia has conducted a Phase 2 pivotal study, ADVANCE-1, which returned positive results, showing that patients receiving the drug plus standard of care (“SoC”) antipsychotics showed a better response than those receiving only SoC, based on Negative Symptom Assessment-16 total score.

A second, Phase 3, pivotal trial continues to enroll patients and is expected by management to reach full enrollment by mid-2023, meaning there’s unlikely to be final data much before 2024. If the data were positive a launch that year may be a possibility, and analysts have speculated that Nuplazid could earn as much as $750m in additional revenues in this indication.

The Trofinetide Rett Syndrome Opportunity

As mentioned, Acadia’s NDA for Tofinetide has been accepted by the FDA and the PDUFA date arrives next March.

Results from Acadia’s 187-patient LAVENDER study of the drug in girls and women between the ages of 5-20 – released in December last year – were positive, with statistically significant improvements observed vs. placebo in both endpoints of Rett Syndrome Behavior Questionnaire (“RSBQ”) and Clinical Global Impression–Improvement (“CGI-I”).

It was an impressive readout given that there are no approved therapies for Rett Syndrome and that several biotechs had tried and failed to develop drugs in this indication before Acadia. The market opportunity is apparently rated as a potentially blockbuster (>$1bn sales per annum), although $500m is the figure suggested by Acadia management.

The FDA has (so far) not requested that an advisory committee be convened to rule on whether to approve Tofinetide, which is potentially a good sign, and should the drug be approved, Acadia is in line to receive a rare pediatric disease review voucher, which it could use itself, or trade to another company, potentially for a triple-digit million sum.

Can ACP-204 Succeed Where Nuplazid Has Failed

Acadia is hopeful that its next generation version of Pimavanserin – ACP-204 – will “build upon the learnings of Pimavanserin in the treatment of neuropsychiatric symptoms,” and perhaps garner approvals in fields such as ADP, or Major Depressive Disorder (“MDD”).

CEO Davis discussed its differentiated mechanism of action (“MoA”) compared to other antipsychotics on the Q322 earnings call, commenting:

Remember, virtually all of the antipsychotics on the market today are thought to work predominantly through blocking dopamine, and in particular, the dopamine D2 receptor. Pimavanserin... works entirely through serotonin, which can provide a very different and favorable safety and tolerability profile.

The drug has so far only made it into a Phase 1 study, but management is confident that “we have a good understanding of where to go and where not to go in the chemical space,” thanks to its work with Pimavanserin. ADP is top of the list of indications to target, Davis told analysts.

Importantly, Acadia seems to believe that the tolerability profile of ADP-204 may be an improvement on Pimavanserin, which was the subject of a lot of negative press as the drug was linked to the deaths of a number of patients in its early years. The FDA subsequently carried out an investigation which concluded:

FDA’s conclusion remains unchanged that the drug’s benefits outweigh its risks for patients with hallucinations and delusions of Parkinson’s disease psychosis.

Conclusion – My Positive Outlook For Acadia Remains Unchanged

After reviewing progress over the past two quarters my position on Acadia has not really changed. Obviously, the door for Nuplazid in ADP has now been officially closed by the FDA, and the company continue to be loss-making – these are the negatives.

But the positives outweigh the negatives in my view. Acadia has been spending money on developing Tofinetide for Rett syndrome, and the outlook here looks somewhat positive based on the better-than-expected performance in the LAVENDER study. It also has been funding the NSS studies for Nuplazid, and again, the data released so far suggests the drug may be able to successfully treat this condition in combo with SoCs.

Then there’s a next-generation version of Pimavanserin progressing through the clinic, and a couple of other programs of note. Acadia has the cash to progress all of these studies without needing to raise more funding – although I would not be surprised if the company did raise funds on the back of a positive event – the Tofinetide approval for example – that generated a rise in the share price.

The outlook for Nuplazid in its current market looks reasonably positive – sales may have flatlined but there is clear demand, which may increase as we emerge from the pandemic that stifled patient office visits and enrolment in long term care programs.

Acadia’s market cap of $2.3bn remains reasonably high for a single-drug company, and the current forward price to sales ratio of nearly 5x also looks a little high. Add another $500m in annual revenues however and it looks too low, and Acadia has two near-term opportunities to realize such an uplift in revenues – a label expansion for Nuplazid, or an approval for Tofinetide.

Tofinetide revenues will grow incrementally rather than rapidly if the drug is approved, but an approval ought to see the share price spike >$20, offering a >40% near-term upside opportunity for investors. Acadia could one day be a >$1bn revenue per annum company, and that ought to lift the share price higher still.

Risk is an inherent part of the drug discovery process, and especially so in central nervous system conditions, where the amount we still don’t know about what works and what doesn’t is frightening. For investors prepared to embrace some risk, however, Acadia presents an intriguing opportunity in my view.

Be the first to comment