Galeanu Mihai

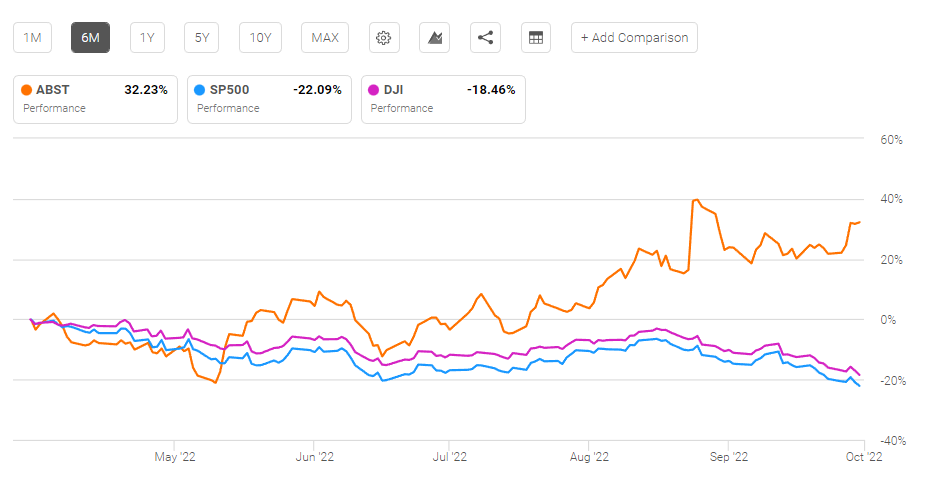

A global recession is probably coming. The World Bank is hinting that a recession could be possible because of rising inflation and tightening financial policies. The stock performance of Absolute Software Corporation (NASDAQ:ABST) should inspire us all that many investors remain optimistic. ABST’s 6-month performance is 32.23%, notably outperforming SP500’s -22.09% and DJI’s -18.46%. Absolute Software could deliver revenue CAGR of 30% or higher.

Seeking Alpha Premium

The old favorites Microsoft (MSFT) and Adobe (ADBE) have -30% to -50% YTD price performance. ABST’s YTD is 23.38%. This bullish vibe is thanks to Absolute Software’s recent 65% YoY revenue performance for F2022.

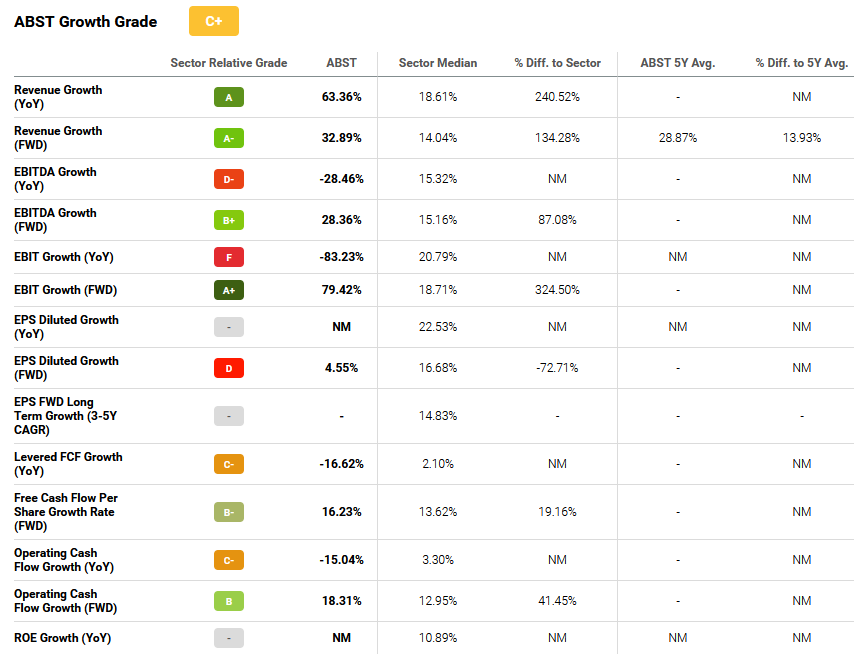

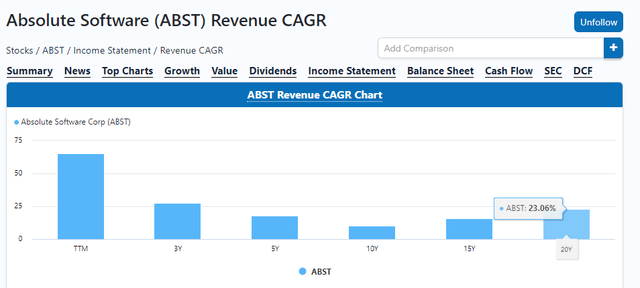

The Quantitative rating algorithm of Seeking Alpha gives ABST a Growth grade of C+. I attribute this to Absolute Software being a Canadian company. It is only recently that Seeking Alpha went big on Canadian tickers. Based on the chart below, Seeking Alpha’s quantitative AI platform has not yet incorporated the 5-year growth CAGR numbers of ABST.

Seeking Alpha Premium

Compare the chart above to the two-decade annual sales performance of ABST. Absolute Software should be in your radar because its 20-year average revenue CAGR is 23.06%.

Invest On Small, Fast-Growing Software Company

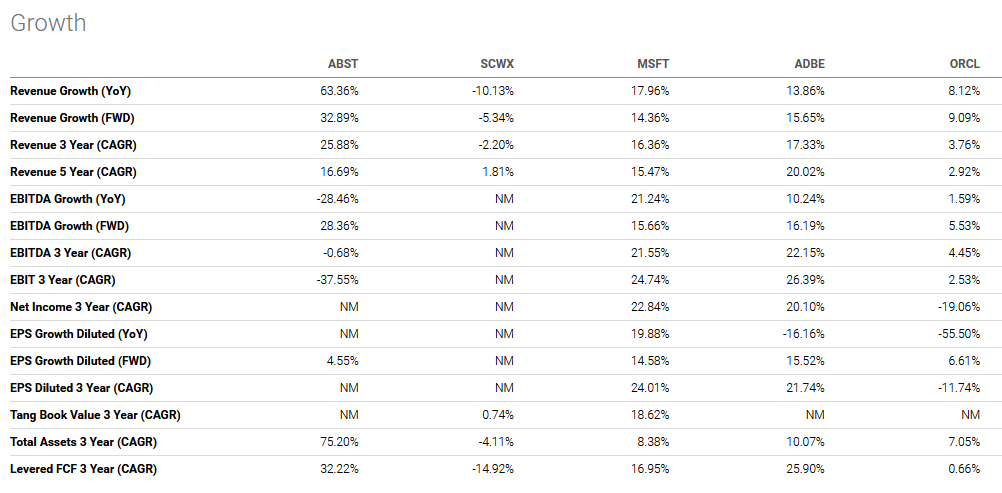

Compared to its much larger SaaS peers, ABST is emerging as the new fast-growth investment. The 3-year revenue CAGR of ABST is 25.88%. This is more impressive than Microsoft’s 16.36% or Adobe’s 17.33%.

Seeking Alpha Premium

Why am I comparing the tiny ABST against giants MSFT and ADBE? The small ones always have the greater growth potential because the giants are already peaking. This reality is why people dumped their MSFT and ADBE shares this year. Those giants are falling hard because they can no longer sustain the high growth expectations of traders/investors.

Downside Potential

Due to its small size, Absolute Software’s bottom line will suffer for years to come. We invest in small promising companies because of their future growth potential. We speculate that they might become multi-bagger winners three or five years from now.

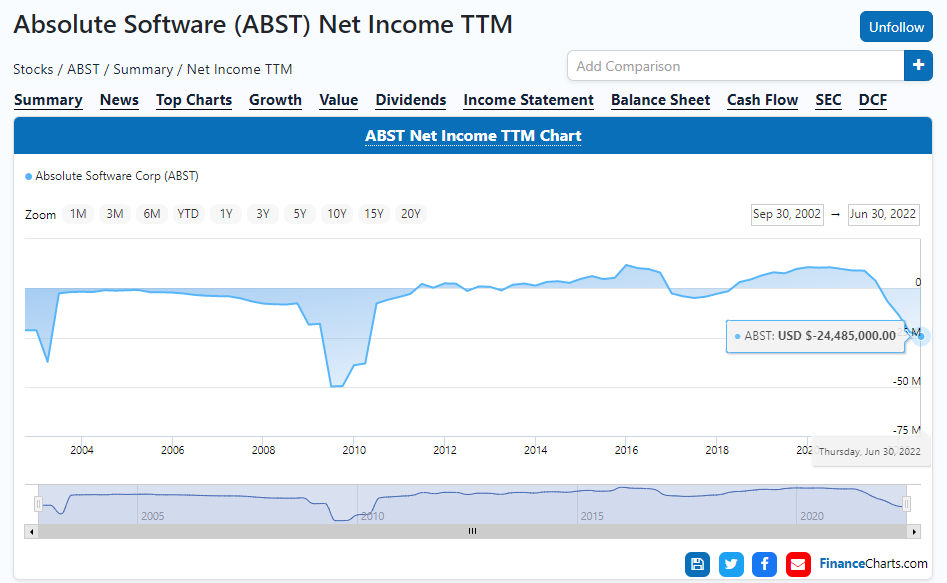

ABST might suffer net losses for the next few years. Its 20-year net income chart below shows it never was a consistently profitable company. This should not be a dealbreaker. Most Investors still put growth potential as the no. 1 factor when it comes to evaluating stocks.

FinanceCharts

Absolute Software reported a net loss of $5 million for Q4 F2022. The stock still shot up +17% right after its August 23 ER. A multitude of traders and investors are in love with that amazing +65% YoY growth in revenue.

Going forward, there’s the risk that ABST might lose its favored status from investors if it delivers less than 23% YoY revenue CAGR.

High Growth Is Sustainable

It is relatively small, but Absolute Software Corporation has a diverse portfolio of cybersecurity software products. I am just a computer technician/graphic designer, but I’m already impressed by that “self-healing” Zero Trust ecosystem. ABST can sustain its average 20-year revenue CAGR of 23%. Absolute Software can monitor, secure, and recover any device wherever it is located.

ABST is a buy because it allows companies/organizations to become the 24/7 Big Brother to their employees’ computers, smartphones, and tablets. It could be unethical, but salaried men are subject to their employers’ whims and paranoia. Companies and organizations issue free take-home laptops and other computing devices to their employees. They come with pre-installed cybersecurity/monitoring software.

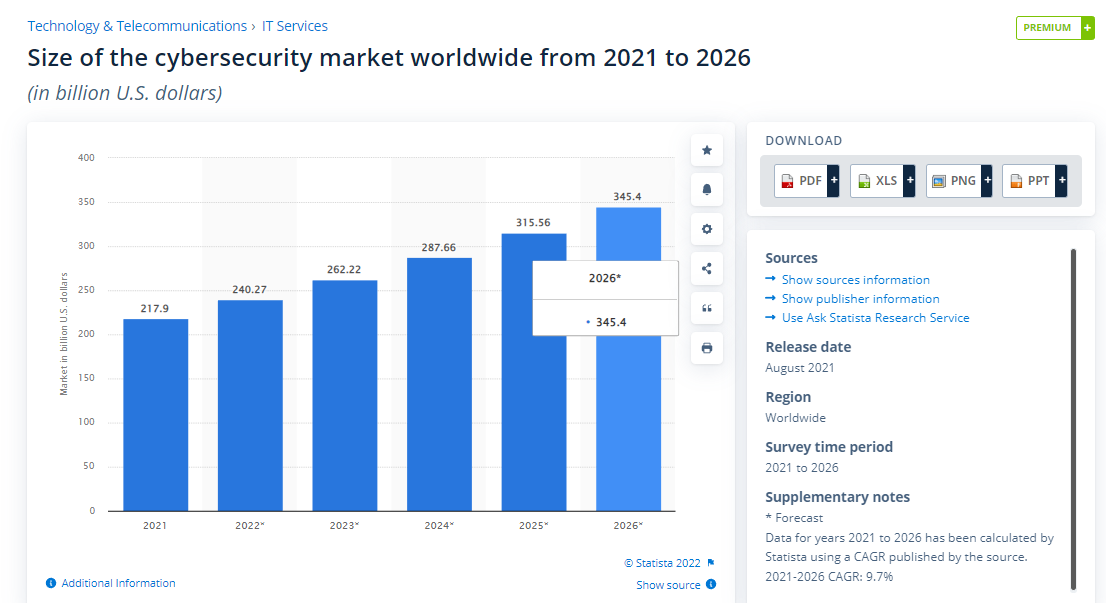

This reality is why the cybersecurity industry became a $217.9 billion opportunity last year. It is expected to grow into a $345.4 billion business by 2026.

Statista Premium

Standing On The Shoulder of Giants

Absolute Software, therefore, is involved in a fast-growing industry. Its endpoint security products/solutions won over the trust of Microsoft and dozens more computing-related giants. Even China-based Lenovo (OTCPK:LNVGY, OTCPK:LNVGF) is using the self-healing Zero Trust platform of Absolute Software. The investment quality of ABST is greatly enhanced by its long list of A1-tier customers.

Absolute Software Corporation

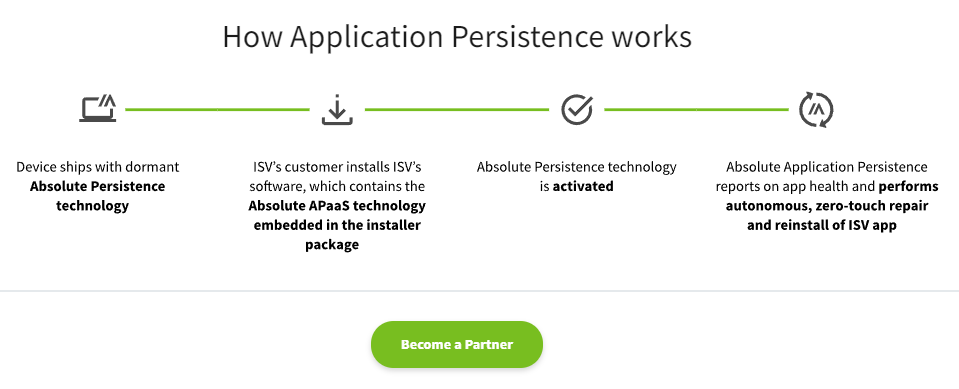

Lenovo and those other brands above that make PCs and smartphones/tablets are using Absolute Software’s Application Persistence product. The screenshot below explains why Absolute Software-protected computers are attractive to corporate IT buyers. They can tell Lenovo or HP Inc. (HPQ) to deliver desktop or laptops with pre-installed Absolute Software’s Absolute APaaS (Application Persistence as a Service) product.

Absolute Software Corp.

Top PC manufacturers could be the major contributors to ABST’s $209.5 ARR (annual recurring revenue).

Final Thoughts

ABST is a small but rising star in the cybersecurity software industry. Aggressive low pricing is why could again deliver a 65% YoY revenue growth for F2023. I am already happy with its 20-year average CAGR of 23%. Any company that could do 20% sales growth rate is already a high-growth star.

Value-wise, ABST is trading at 2.95x TTM Price/Sales ratio. This is reasonable if you compare it to MSFT’s 8.81x.

Having the trust of much bigger firms means Absolute Software is now a potential takeover target for SaaS leaders like Microsoft, IBM (IBM), and Google (GOOG, GOOGL). The market cap of ABST is less than $700 million. Its recent annual revenue is $197.3 million.

Microsoft has over $104 billion in cash. Buying Absolute Software Corporation and incorporating it under its Microsoft 365 could attract more customers. Microsoft needs new suites of software to compete better against Google’s Workspace. Microsoft 365’s global market share is now only 48.08%. Google Workspace has 46.44%.

If you are a Microsoft 365 subscriber, then you know it doesn’t come with persistent, self-healing cybersecurity protection. This is dangerous because Microsoft 365 apps are online and collaborative by design.

Absolute Software Corporation can automate software audit. A little tweaking and Microsoft 365 active inputs and outputs could also be tracked and protected.

Be the first to comment