Yasonya/iStock via Getty Images

Intro

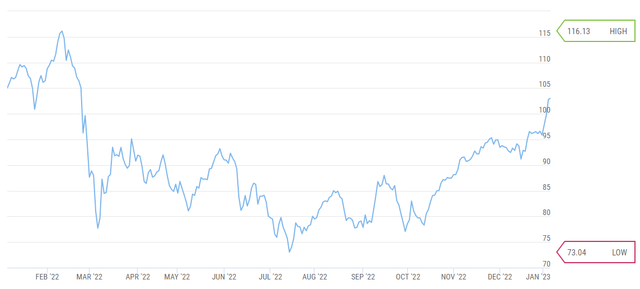

European banks are caught between a favorable interest rate environment and recession and geopolitical risks. Sector performance, as measured by the Euro Stoxx Banks Index is largely flat Y/Y having recovered from steep losses over the summer of 2022:

Chart 1. Movements in the Euro Stoxx Banks Index over the past year

While it is fair to argue bank stocks have been overbought over the short-term on further rate hikes expected by the ECB, I will compare ABN AMRO (OTCPK:AAVMY) and ING (NYSE:ING) with a bird’s eye overview to assess which is the better pick over the medium term.

Before looking at the key performance indicators of the banks I want to highlight an area of concern which comes with rising interest rates, namely falling house prices.

Mortgage Exposure

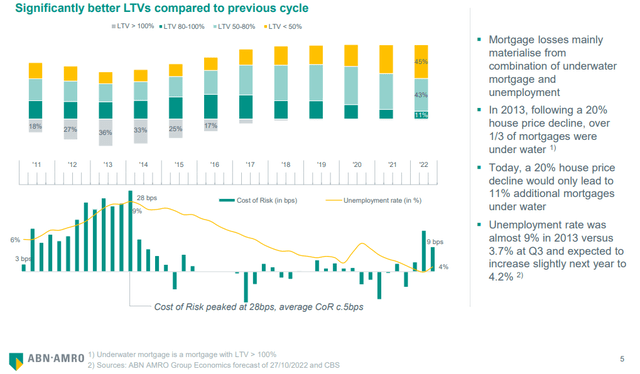

ABN AMRO is the market leader in Dutch mortgages with a 19.1% share in Q3. The bank highlighted that even if house prices fell by 20%, only 11% of extra mortgages will be underwater:

ABN AMRO Q3 2022 Results Presentation

A report by Rabobank published before the hawkish surprise by the ECB in December envisaged a 3% drop in 2023, to be followed by a 1.5% decline in 2024. Overall, the cumulative drop by the end of 2024, relative to Q3 2022, is seen at 6.6%.

Overall the situation appears manageable but after years of strong gains risks are clearly on the downside.

End of Q3 2022 Comparison

Having highlighted a key risk for both lenders, let’s turn to the key performance indicators (Q1-Q3):

| ABN AMRO | ING | |

| ROE | 9.4% | 6.7% |

| Tax Rate | 20% | 30.4% |

| Cost/Income Ratio | 68.3% | 60.7% |

| Price/Tangible Book | 0.63 | 0.90 |

| CET1 Capital | 15.2% | 14.3%* |

| MDA Requirement | 9.7% | 10.5% |

| MDA Buffer | 5.5% | 3.8% |

Source: Author’s calculations based on Q3 2022 company disclosures.

First thing to mention is that ING’s 14.3% CET1 capital is pro-forma after the €1.5 billion capital distribution announced with the Q3 results. On December 30, ING announced it had repurchased shares for €1.2 billion, with the remainder – €297 million – set for cash payment on January 16. Naturally I adjusted the tangible book value to reflect the benefit of the buyback (about 0.07 EUR/share to 13.54 EUR/share after deducting €1.1 billion of intangibles).

Looking at profitability in terms of ROE, ABN AMRO comes out ahead thanks to a negligible cost of risk (1 basis point due to reserve releases) and a lower tax rate of 20% this year. For reference, for large Dutch corporates the rate is 25.8%. Likewise ING incurred a higher tax rate due to non-deductibility of Polish mortgage charges.

On the capital front, ABN AMRO is clearly ahead, especially after the last capital return tranche by ING. The 1.7% surplus in MDA buffer is a key point of attention for the next year as the bank will evaluate its 15% CET1 threshold for stock buybacks. Furthermore, ABN AMRO currently estimates a higher Basel IV CET1 ratio of around 16% (compared to the 15.2% currently reported under Basel III) which may provide a boost upon the new standard coming into force in 2025.

Long-Term Targets Comparison

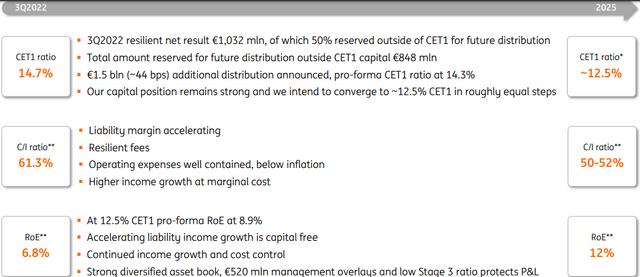

At the end of the day it all boils down to long-term profitability targets. Here is where ABN AMRO stands as of Q3 2022:

ABN AMRO Q3 2022 Roadshow Booklet

The ROE of 9.4% is currently in the 8-10% range, albeit thanks to some temporary factors as outlined above.

Turning our attention to ING’s progress on 2025 goals:

ING Q3 2022 Results Presentation

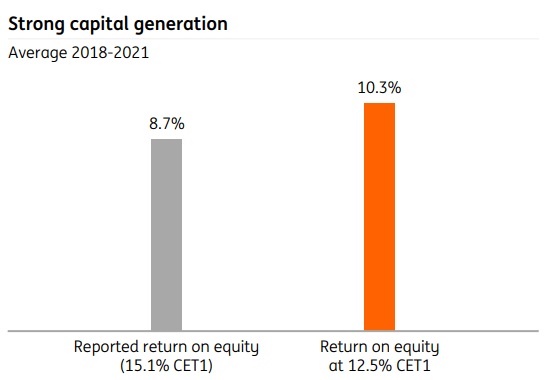

On the surface, ING’s 12% target is 2% above ABN AMRO’s 10% aspiration. However, the 12% target is based on a 12.5% CET1 ratio. In other words, in entails ING returning the marginally less profitable portions of its excess capital position to shareholders. Case in point, in the period 2018-2021 the difference between reported return on equity (8.7%) and return on equity based on CET1 of 12.5% (10.3%) was 1.6%:

ING Q3 2022 Results Presentation

To sum up, it is feasible to expect some sort of similar ROE bump should ABN AMRO target a lower CET1 ratio as ING plans to do (ING currently sits on €6 billion of structural excess capital it plans to return in roughly equal steps).

Investment Thesis

It is fair to assume that with a price/tangible book of about 0.9 ING has a required return of circa 13.3% against its 12% ROE target (this approach is imperfect as far as it does not account for incremental returns from surplus capital or the time needed to attain a 12% ROE). Applying the 13.3% requirement for ABN AMRO (with its 10% ROE target) would bring the fair price/tangible book for the smaller Dutch lender at about 0.75, or some 19% higher than today.

On top of that, all else equal, due to its stronger capital position we can expect that ABN AMRO will deliver larger one-off shareholder distributions. Last but not least, it may benefit from a stronger capital position once Basel IV is implemented.

Is ING expensive then? Perhaps one can argue it is on a relative basis to ABN AMRO as long as both banks reach their targets. But the €6 billion of surplus capital will cushion any near-term selling pressure. What’s more, on an absolute basis the 12% ROE is a decent return for a top tier bank and whether you get a chance to buy it at a larger discount is never certain.

Last but not least, ING will take a bigger hit to tangible book value from EUR strength in Q4 as it has a larger international footprint.

The main risk I see in buying ABN AMRO after the recent rally is that you are comparing it with one of the more expensive but quality banks such as ING, while if you look at other large European banks, you may reach a different conclusion regarding its revaluation potential.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment