TasfotoNL

Investment Thesis: While ABN AMRO could see a boost in net interest income on the back of higher interest rates, a subsequent decline in residential mortgage demand could be a risk factor.

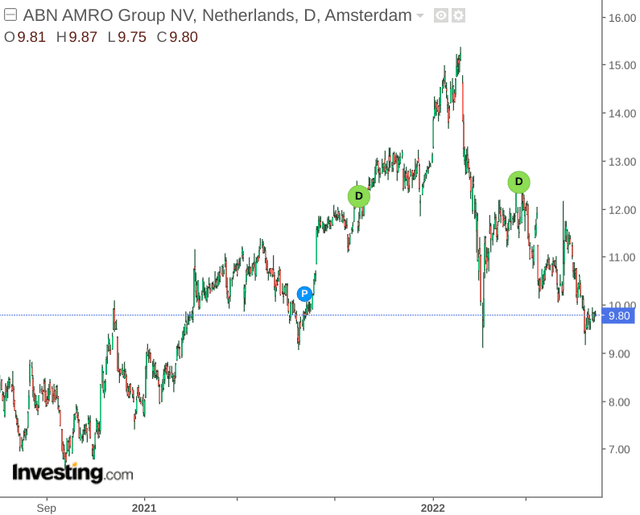

Dutch bank ABN AMRO Bank N.V. (OTCPK:AAVMY) has seen a decline in share price this year – on the back of an increasingly challenging macroeconomic situation.

The purpose of this article is to assess whether ABN AMRO could see renewed upside from here.

Recent Performance

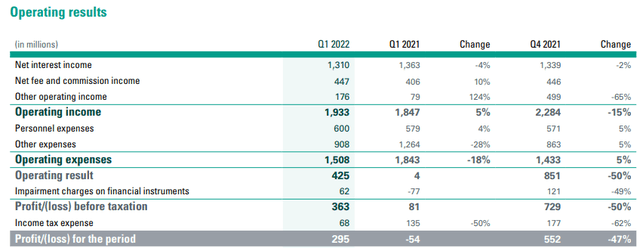

Compared to the previous quarter, we can see that Q1 2022 saw a significant drop in operating income as well as a rise in operating expenses.

ABN AMRO Quarterly Report: First Quarter 2022

With that being said, we can see that net interest income only declined marginally from Q4 2021, while net fee and commission income saw a marginal rise. Other operating income saw the bulk of the decline, with a drop of 65%.

It is noteworthy that net interest income accounted for nearly 70% of total operating income in Q1 2022. As such, a significant determination of profitability will be the degree to which interest rates in Europe rise in an effort to combat inflation. The benchmark interest rate in the Netherlands is currently set at 0.5% – but this stands to rise further if the European Central Bank deems it necessary to implement further rate hikes.

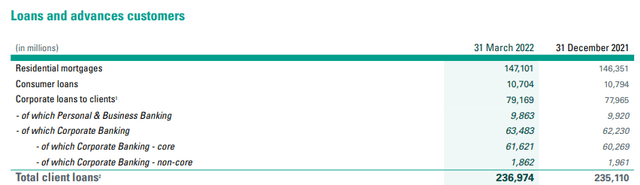

Additionally, we can also observe that Residential Mortgages accounted for 62% of total client loans in March 2022.

ABN AMRO Quarterly Report: First Quarter 2022

The housing market in the Netherlands shows preliminary signs of cooling. It is reported that the average mortgage size has been getting smaller as higher interest rates start to lessen the degree to which potential homeowners are willing to commit to new house purchases.

Therefore, while net interest income stands to rise with higher rates – this could be offset by a subsequent decline in mortgage demand.

Looking Forward

With ABN AMRO Bank Q2 2022 results set for 10 August, net interest income is likely to receive particular attention from investors. While rate hikes may still be in their early stages, investors are likely to look for evidence that ABN AMRO can still raise net interest income on the back of such rate rises. Particularly, if there is a significant drop in demand for residential mortgages, then investors could see this as a bad sign – as it would significantly limit the degree to which ABN AMRO can profit from higher rates.

Additionally, when looking at the company’s loan to assets ratio, we can see that this has decreased slightly from the previous quarter.

| December 2021 | March 2022 | |

| Loans and advances banks | 2801 | 3642 |

| Loans and advances customers | 258251 | 258685 |

| Total assets | 399113 | 421495 |

| Loan to assets ratio | 65.41% | 62.24% |

Source: Figures sourced from ABN AMRO Quarterly Report: First Quarter 2022. Loan to assets ratio calculated by author.

Going forward – a further reduction in this trend (provided total assets continue to increase) could be seen as encouraging – as it lessens the bank’s dependence on loans to finance growth. It would also provide the bank diversification from net interest income, and reduce the impact of a potential drop in mortgage demand as a result of higher rates.

On the other hand, a drop in this ratio can also lessen the opportunity for the bank to profit from higher rates in the future.

Conclusion

To conclude, my overall view on ABN AMRO is that while the decline in operating income in the previous quarter as well as macroeconomic conditions have placed pressure on the stock – the future trajectory depends significantly on whether residential mortgage demand can continue to grow in this environment. Should higher rates dissuade potential buyers, then net interest income growth could stall.

Additionally, investors are likely to look at the loan to assets ratio. While a higher loan to asset ratio would be more favorable in a higher-rate environment (as the bank can profit on higher loan rates) – growth in non-interest income sources would also be welcomed as this lessens the exposure to residential mortgages.

Overall, upcoming quarterly results will be a good telling point as to the future trajectory of this stock.

Be the first to comment