gorodenkoff/iStock via Getty Images

Thesis

AbCellera Biologics (NASDAQ:ABCL) is an undervalued and profitable small-cap drug discovery stock, that investors should have in their portfolio for many years to come. There are many reasons an investor should have confidence in long-term gains when it comes to owning AbCellera stock. In this article we will go through why I believe this stock will have outsized gains, along with what risks the stock may have. After that lets examine AbCellera’s valuation against the competition, and what metrics to pay attention to moving forward.

When I invest in technology companies, I look for founder led CEO companies, where employees want to work at. These companies also have high gross margins, revenue growth, platform business models, strong balance sheets, and in my perspective make the world a better place to live in. AbCellera checks almost all of these boxes and I will elaborate on these points later on.

Founder-Led CEO Company

AbCellera as mentioned earlier is a founder led CEO company and it was founded in 2012 as a spin-off from the University of British Columbia. The PhD and CEO Carl Hansen and his team pioneered a technology platform that integrates microfluidics, next-generation DNA sequencing, machine learning, and artificial intelligence to uncover molecules that are naturally produced by the immune system. These molecules that are naturally produced by the immune system are known as antibodies, and they can be turned into effective therapeutics for numerous diseases.

So why does it matter that this company has a founder led CEO?

In the past few decades Founder led CEO companies have significantly outperformed for shareholders than those that are not founder led. Founders treat their companies as if they were their own children and the success the founder desires for the company aligns much with shareholder expectations. In my opinion Founder CEO can be visionaries and are driving towards results for the long-term and their employee retention is easier as employees want to be a part of that long term vision.

AbCellera Employees Enjoy Working There and Would Refer a Friend

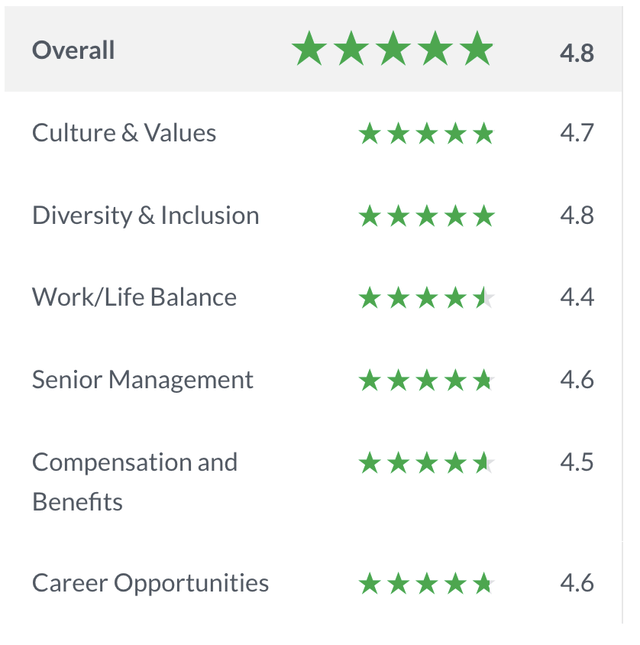

This company appears to have a great company culture and employees rate their experience working there overall 4.8 out of 5 stars. Over 92% of the employees interviewed by Glass Door would recommend working at AbCellera to a friend. See the individual scores below, which lead me to the comment on the great company culture.

Glass Door Ratings for AbCellera Biologics

Insider Ownership is High and CEO Continues to Buy Individual Shares

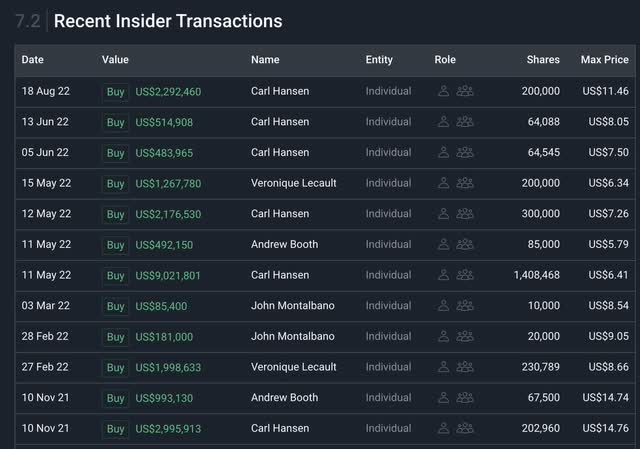

When a company has high insider ownership of shares this can indicate employee and leadership confidence in the stock and the company’s future growth prospects. This also drives alignment with employees and shareholders because there is a common goal for company success. CEO Carl Hansen has been making multiple stock purchases since May 2022, totaling over $14.3M. This brings his ownership to 19.6% and the total insider ownership of shares to 27.4%! Leadership and other employees are buying shares with conviction on the companies’ future potential.

NasdaqGS: ABCL Recent Insider Transactions by Companies or Individuals

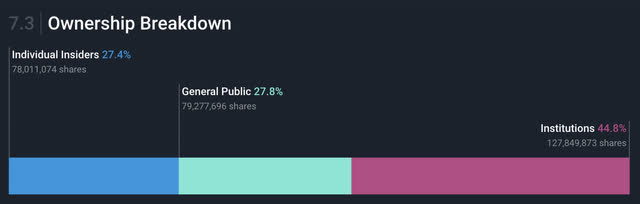

AbCellera Has a Strong Institutional Backing and Percentage of Shareholders

The insider ownership is strong for this small cap company but even stronger with institutions holding nearly 45% of shares. Institutions include the likes of BlackRock Inc., Baillie Gifford & Co, Allianz Asset Management AG, and Capital Research & Management Company. Institutional investment firms rarely invest in small cap stocks due to the potential volatility of shares and risk they could obtain. When you see such a strong number of institutions invested in a small cap stock like AbCellera, this can be an indicator the stock has huge upside and is worth the risk to hold for them.

Financial Data Provided by Standard & Poor’s Capital IQ

Flawless Balance Sheet with Multiple Revenue Streams

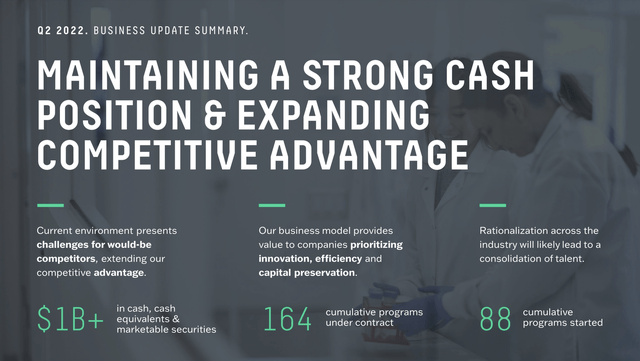

AbCellera Biologics has over $1 billion in cash and cash equivalents with no debt! This company is a technology company that focuses from the antibody target phase all the way through to the Investigational New Drug Application phase, and to deliver faster more robust results. AbCellera makes money multiple ways through research fees, licensing, milestone payments, optional investment shares, and the largest amount through royalties from successful drugs to market. The patented technology software and processes that they use are extremely efficient in operating expenses, allowing a long runway before needing any capital. These efficiencies have helped AbCellera maintain nearly 74% of gross margins and 39.5% net profit margins.

Already AbCellera has continued to build a diverse and large portfolio of different partners to work with and multiple types of healthcare illnesses to address. This fast amount of buy-in that AbCellera has gained from well-known drug companies, venture capitalists, and institutions provide the company a great deal of long-term flexibility.

Screenshot from Q2 Earnings Presentation

AbCellera Is Making the World a Better Place and Collecting Royalties for It

AbCellera spent two years focusing their technology around potential pandemic responses and then was able to partner with Eli Lilly (LLY) for creating the first antibody Bamlanivimab authorized by the FDA for COVID-19 in 2020. AbCellera than worked with them to create bebtelovimab, the most potent antibody treatment that is effective for COVID-19 for all variants still to this date. These two antibody drugs have saved lives and have treated over 2.5M patients.

In June, AbCellera continued to receive royalties for another 150,000 dose order from Eli Lilly to the U.S. Government for continued treatment to COVID-19. During the winter, the company could see additional orders procured by Eli-Lilly which would continue to provide more net profits to add to their foundation of cash and assets for the future.

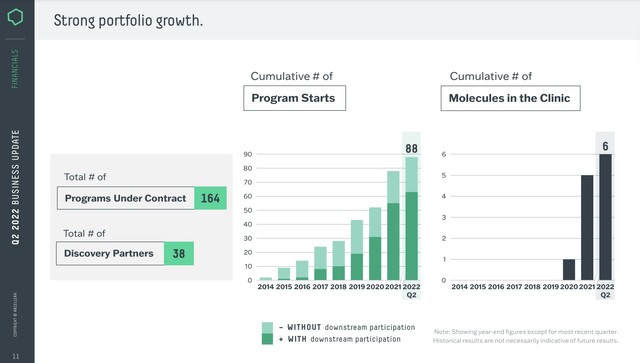

Continued Growth in Partners and Programs Under Contract

This company has another four molecules in clinical stages with partners NovaRock Biotherapeutics, Invetx, inc., and other undisclosed partner. The patented technologies and processes that AbCellera has are enhancing the possibilities for antibody drug discovery and are driving more discovery partnerships. The growing number of partnerships and programs under contract are the two metrics I would recommend paying attention to for measuring the success of AbCellera in the short term. In the image below, you can see the steady ramp up in both metrics, which lead to the higher probability of more antibody drugs being discovered and taken to market.

Q2 FY23 AbCellera Biologics Earnings Presentation

Risks To Be Aware Of

The drug discovery business takes a long time to take a drug to market and investors have to maintain patience throughout this process. AbCellera was able to get their two COVID-19 antibody drugs FDA approved quickly due to the nature of the resources they had & the severity of the pandemic. The drug discovery process and getting the drug to market takes 10-15 years on average with a 90% failure rate, and costs $1-2 billion dollars. AbCellera exists to solve these challenges, speed up the discovery process, improve success rates, and help create drugs for the most difficult diseases.

This is an area of healthcare that is naturally risky with low success rates, high capital expenses, and long timelines. Besides the nature of the industry AbCellera operates in, are there any other risks for this company? The company could see decelerating revenues if the two Eli Lilly COVID-19 antibody drugs stop getting ordered by the government. While revenues could decline in the near future if this happens, the overall operating expenses are very low compared to their $1B fortress of cash. Last quarter the company only spent $34.7M in operating expenses, as this demonstrates business efficiency, it also showcases a long runway AbCellera has before its next successful anti-body drug needs to be discovered to support business operations.

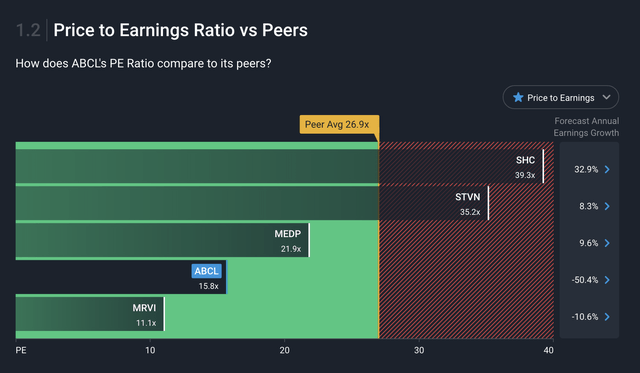

AbCellera is Undervalued Amongst Its Peers

We are currently investing in a stock market that is very volatile and is penalizing companies who are not profitable or overvalued. Abcellera Biologics is neither of these things and very undervalued amongst other peer U.S. Life Science companies (see below).

P/E Comparison to Peer Companies (Simply Wall St.)

Abcellera generated over $500M in revenue in the last trailing twelve months while having a market cap of $3B, giving the stock a price-to-sales ratio of 6.

This company is fundamentally undervalued compared to its peers in its industry but also its 15.8 P/E ratio is much lower than the S&P 500 which is currently trading at a P/E ratio of 22.8.

My Conclusion and What to Look for Later this Year

AbCellera like any company has risk with investing in it, particularly in the short-term, but as a long-term investment I believe the risk is mitigated heavily. I believe this risk is mitigated by the clean and strong balance sheet the company holds, the low OPEX business model it operates under, the growth in partnerships, and the patented and proven technology that this company has to discover molecule combinations for future antibody drugs.

I also like this investment as a safer play for the life sciences and healthcare sector that provides investors diversification in their portfolio, with large upside in the long term. I believe this is just one of the many reasons why this company has such large investment from its employees and institutions, along with their continued growth in partnerships and contract programs.

I am looking for AbCellera to continue building momentum on more drug contracts, partners, which should result to growth in research fees in the near term. Just in this past quarter AbCellera signed two new partnerships with two venture capitalist firms leading to a potential 14 new programs to start. Because of the growth in partnerships previously the company experienced 240% growth in revenue for research fees this past Q2 FY23′. These revenues can continue to fuel and support expansive spending in research and development, which is what you want to see in a technology company building a competitive moat in their industry.

As always, I like to dollar cost average to lower my cost-basis and hold my positions on average for at least five to ten years. It appears institutions, venture capitalists, and insiders at the company are also doubling down on this investment too. AbCellera Biologics is one that I look forward to holding for a long time and will require patience before the true exponential returns could potentially be seen.

Be the first to comment