Torsten Asmus

Article Thesis

Income investors oftentimes see the benefits of investing in healthcare stocks: Solid recession resilience, low capital expenditure requirements which allow for strong cash flows, and long-term growth tailwinds such as changing demographics. In this article, we’ll pitch two large-cap biotech/pharma companies against each other: AbbVie (NYSE:ABBV) and Pfizer (NYSE:PFE).

Why Is Healthcare Good For Income Investors?

Many compelling income stocks are centered around a couple of core industries, such as consumer staples, infrastructure, and healthcare. On the other side, industries such as tech don’t bring out a lot of attractive income stocks. The advantages of the healthcare space include the following: Demand for healthcare services, pharmaceuticals, etc. is not dependent on the strength of the economy. While automobile companies or steel producers can be highly cyclical, the same does not hold true for most healthcare stocks.

Healthcare companies, such as AbbVie and Pfizer, don’t need to invest heavily in new fabs and production assets, unlike energy companies, chip manufacturers, and so on. This is why they have high free cash flow conversion ratios, which makes it easier for them to offer sizeable dividend payouts.

And last but not least, healthcare has been a growth industry for many years, and that will likely remain the same. As populations age in the US and other high-income countries, more and more people require regular treatment and healthcare expenditures keep rising. At the same time, high-growth countries such as China are increasing their healthcare spending as a percentage of overall economic output, which allows for international growth tailwinds. These aren’t short-term factors – instead, these are megatrends that will, I believe, remain in place for a prolonged period of time. I thus believe that healthcare spending will continue to grow at an above-average pace going forward, which benefits the growth outlook of companies that are active in this space.

AbbVie And Pfizer: Declining Core Franchises

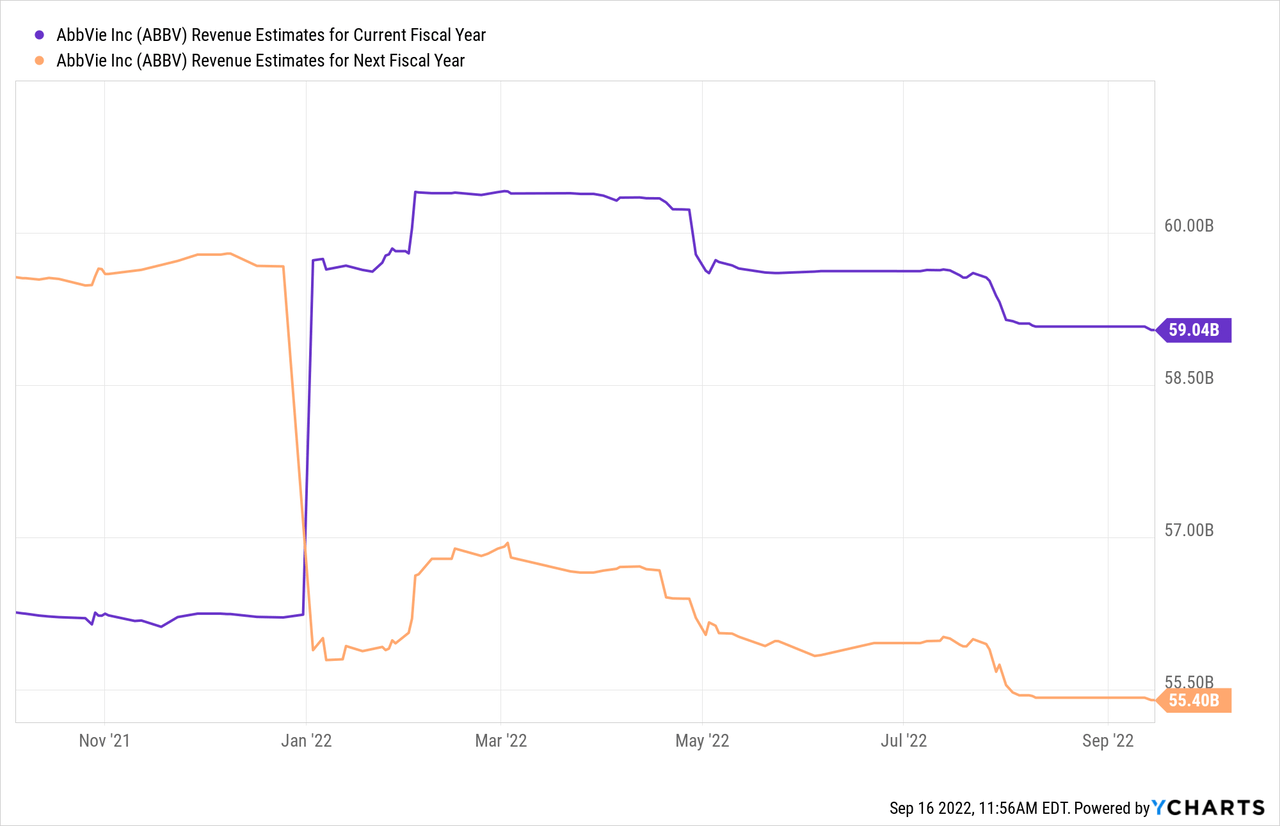

Even though healthcare spending, overall, should continue to grow, not all companies are experiencing growth all of the time. AbbVie and Pfizer share a similarity in that one of their core franchises will decline in the foreseeable future, putting some pressure on overall company-wide growth. In AbbVie’s case, that’s its largest drug, Humira. It will go off-patent in 2023 in the US, while it has already gone off-patent in Europe. This will mean increasing competition from companies that are introducing biosimilars, which will result in market share losses for AbbVie. It’s thus not surprising to see that the analyst community is forecasting a revenue decline next year:

If Wall Street is right, AbbVie’s revenue will drop by 6% next year. Humira revenues will fall more than that, but that will be mostly offset by growth in other products, such as Skyrizi and Rinvoq, which target the same indications as Humira, but also thanks to growth from AbbVie’s oncology portfolio. Still, a small revenue decline seems likely and is also what management has been hinting at.

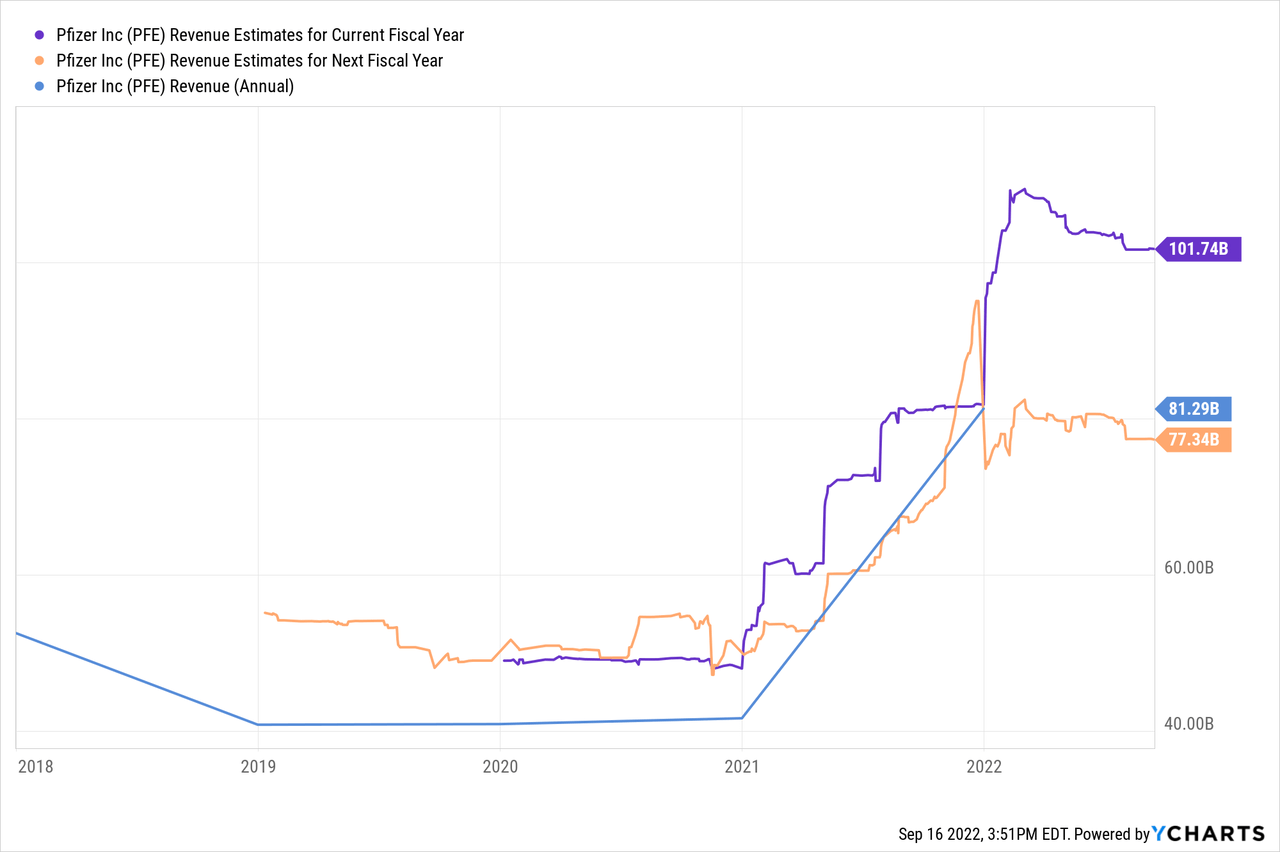

Meanwhile, Pfizer will experience a more pronounced revenue decline next year, as its COVID business will most likely bring in way fewer dollars next year relative to a very strong 2022:

Pfizer is forecasted to generate more than $100 billion in revenue this year, which is an outstanding amount of revenue for a healthcare company. But that’s an absolute outlier, as Pfizer historically has generated $40 billion to $50 billion in sales per year. Revenues are thus expected to drop by around 25% next year, to the high $70 billion range, with further revenue declines being expected for 2024 and beyond. Pfizer benefits from massive sales for its COVID vaccine, co-developed with BioNTech (BNTX). On top of that, Pfizer also is selling its COVID drug Paxlovid, which adds billions in revenue on top of the COVID vaccine sales. Pfizer is thus one of the biggest winners from the pandemic, seeing its sales go through the roof. But as the pandemic is waning and likely coming to an end, it is pretty clear that Pfizer’s massive sales in this franchise will drop a lot going forward. Pfizer’s revenues are hence expected to decline much more than those of AbbVie, which is less reliant on Humira versus Pfizer’s current exposure to its two COVID franchises.

Long-Term Growth Outlook

Both companies will see their revenue come under pressure in the near term, with the impact being larger for Pfizer. That being said, the longer-term growth outlook is solid for both Pfizer and AbbVie. The Humira patent expiration and the decline in the COVID business will be one-time issues. But both companies have deep pipelines, a range of new and growing drugs, and both companies benefit from the aforementioned macro tailwinds for the healthcare industry, mainly the demographic changes that lead to more people requiring treatment in the future.

On top of that, both companies have the ability to grow inorganically. That’s pretty common in the biotech/pharma space and beneficial for both acquirer and acquiree – the large acquirer gets new promising drugs or pipeline assets, while the acquired, usually much smaller company, gets access to a wide sales network and experience when it comes to bringing drugs to the market. Pfizer is a serial acquirer that has done many deals in the past, and AbbVie has also done acquisitions from time to time, including the major Allergan takeover that closed in 2020.

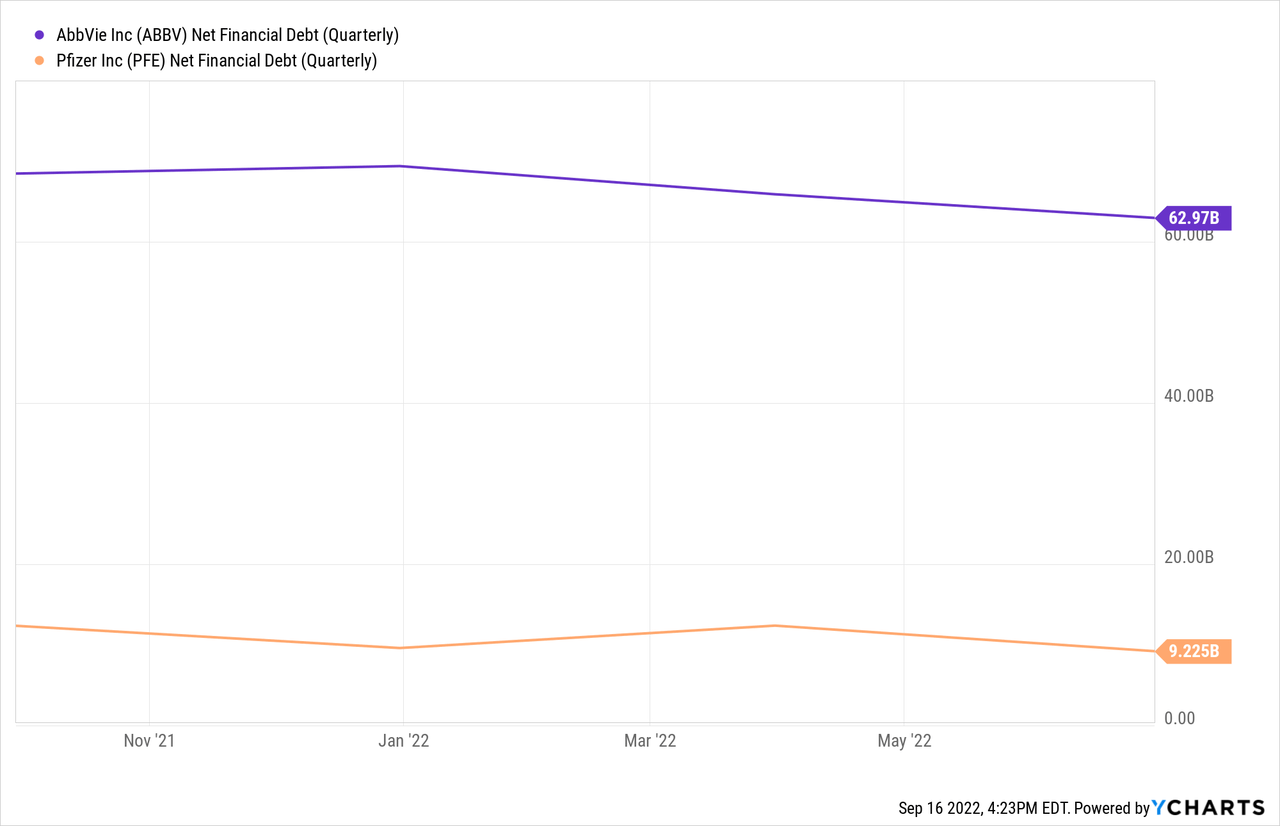

It should be noted that Pfizer’s ability to grow inorganically is way more pronounced than that of AbbVie, due to PFE operating with a much cleaner balance sheet:

Pfizer currently has a pretty low net debt position, relative to the earnings and cash flow it generates. AbbVie is not dangerously indebted, but its leverage is much higher, thanks to a ~$60 billion net debt position – which is equal to around 2x its expected EBITDA for the current year ($32 billion). A 2x leverage ratio is fine for a resilient business without large capex needs, but the company will (and should) bring down its debt in the coming years, thereby limiting its ability to acquire growth assets. Pfizer, meanwhile, has much more potential to add pipeline assets or entire companies as it could easily add billions in debt from its current position of strength.

In 2023, both companies will see their revenue decline, but that decline will be way larger at Pfizer. In 2024, AbbVie is expected to see its revenue grow slightly, which makes sense – the patent expiration for Humira will be lapped and not very impactful any longer, while organic growth from Rinvoq, Skyrizi, Imbruvica and others will allow for a smallish top line increase. That’s also what management has been guiding for, as the company has stated that there would be only one down year. Pfizer is expected to see its revenue decline in 2024 as well, as the COVID business will shrink further, which will not be fully offset by organic growth. It is possible, however, that Pfizer strikes more deals in the coming quarters, which might allow it to prevent its top line from dropping much in 2024. Such deals are not guaranteed, of course, and even if Pfizer pursues them, they might not turn out to be successful. Overall, I believe that AbbVie’s outlook over the next couple of years is better, with Pfizer possibly having the advantage in case they can make some nice deals – especially if there is a larger equity market downturn, that might be the case as a potential acquirer such as Pfizer could be in a strong position.

Valuation And Dividends

Both companies offer dividend yields that are way above what the broad market is offering today. Pfizer’s dividend yield is 3.5% today and its dividend growth rate averaged 6% over the last five years. If that dividend growth rate were to be maintained and if there was no change in its valuation, investors could expect total returns in the 10% range going forward.

Meanwhile, AbbVie offers a dividend yield of 3.9% while its dividend growth rate averaged 17% over the last five years. AbbVie thus wins out when it comes to current yield, and has an excellent historical dividend growth rate – around three times as high as that of Pfizer. But it is very unlikely that AbbVie’s dividend will continue to grow at a high-teens rate going forward. Instead, I do believe that it’s likely that AbbVie’s dividend growth rate will slow down to the mid-single digits going forward, which is more in line with the most recent dividend increase (8%) and which would fit well with the expected earnings per share growth rate over the coming years. AbbVie also has a cleaner growth track record, as it is a Dividend Aristocrat, whereas Pfizer has increased its dividend by “only” 11 years in a row. AbbVie still wins out from a dividend perspective, I believe, but investors shouldn’t assume that ABBV’s historic dividend growth will continue at the same pace.

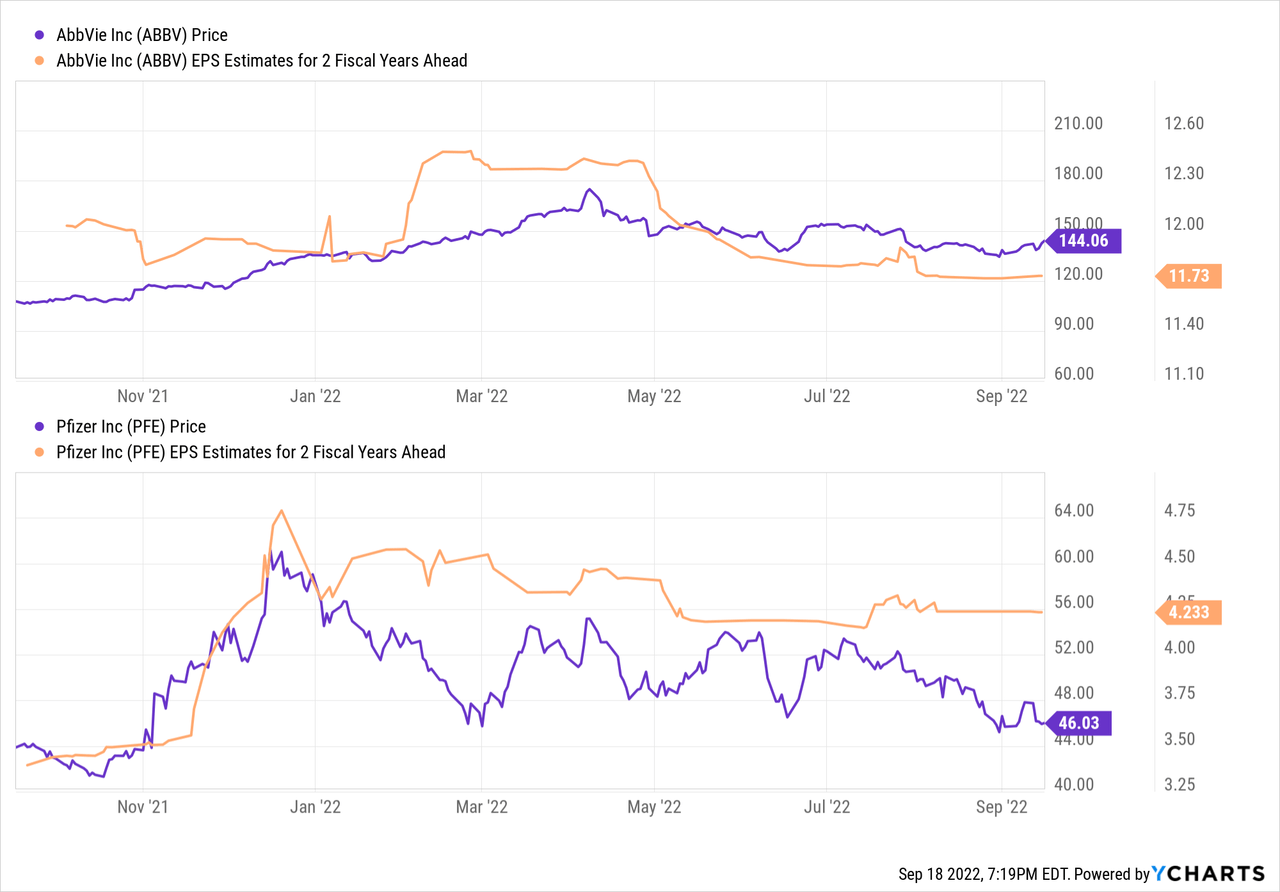

Looking at valuation, both companies are inexpensive based on current-year earnings. Due to the aforementioned growth hurdles in 2023 for both companies, I believe it makes sense to look beyond that and focus on 2024’s expected results:

AbbVie is currently trading with a 12x 2024 earnings multiple, while Pfizer is trading with a 2024 P/E ratio of 11. Pfizer thus looks slightly cheaper. Pfizer also is cheaper on an enterprise value to EBITDA basis, which isn’t too surprising, as its EV is lower due to its significantly smaller net debt position. So while AbbVie looks stronger from an income perspective, Pfizer seems like the better buy from a value or multiple expansion potential perspective.

Takeaway

Both AbbVie and Pfizer look like solid investments today, but both will see their revenue and profit drop next year. At Pfizer, the drop will be more pronounced due to the expected decline for its COVID franchises. AbbVie will feel a more minor hit from the Humira patent expiration, and it is expected that AbbVie will start growing again in 2024, whereas Pfizer will likely have another down year then.

That being said, Pfizer’s stronger balance sheet gives it some optionality when it comes to M&A, and it is trading at a cheaper valuation, potentially making it more attractive for value investors. AbbVie, meanwhile, looks like the better dividend growth pick. All in all, I believe investors can be happy with both. I personally own a position in AbbVie.

Be the first to comment