FatCamera/E+ via Getty Images

Investment Thesis

AbbVie (NYSE:ABBV) has reported strong financial results for Q1 2022. The company revenues grew by 4% y/y and EBITDA by 7% y/y. However, we see that high inflation in the US, as well as freight costs, will negatively affect the company gross margin. As a result, we have revised the company 2023 gross cost from 26% to 28% of revenue and have revised our target share price downwards from $151 to $143 per share.

The company stock is now fairly valued by the market, and we change the status from BUY to HOLD.

Major companies show revenue growth

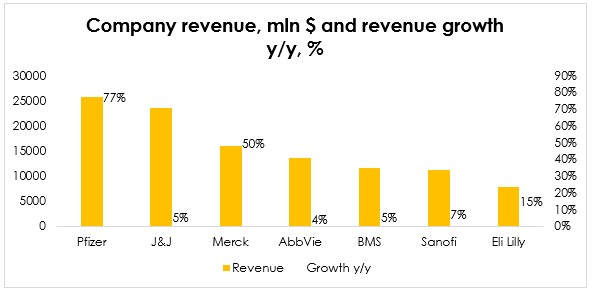

We have selected 7 major companies from the sector based on capitalization, half of them are covered in our research: J&J, Pfizer, Merck, AbbVie, Bristol-Myers Squibb, Eli Lilly, and Sanofi.

Source: Seeking Alpha, calculation by Invest Heroes

The biggest increase in revenue was shown by companies that relate to COVID-19 medications in addition to basic products. In our list these are Pfizer, Merck, and Eli Lilly. Their growth showed double-digit rates in contrast to classic pharmaceutical companies.

All companies connected with COVID-19 treatment have exceeded analysts’ revenue forecasts. Meanwhile, classic pharmaceutical companies represented by J&J and AbbVie have reported slightly below consensus.

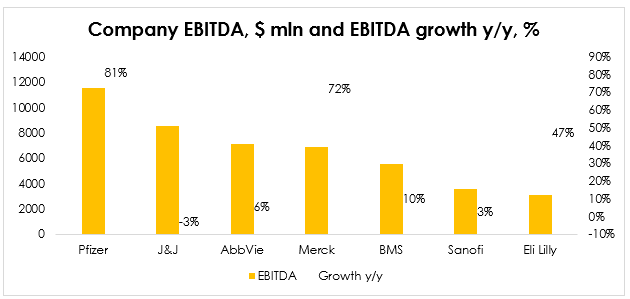

EBITDA margin also shows growth

EBITDA growth has outpaced revenue growth for almost all the companies listed.

Source: Seeking Alpha, calculations by Invest Heroes

J&J is the exception having ceased COVID-19 vaccine development activities. AbbVie has maintained its margin, while all other players have increased it.

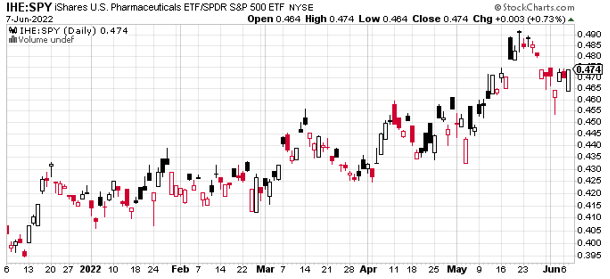

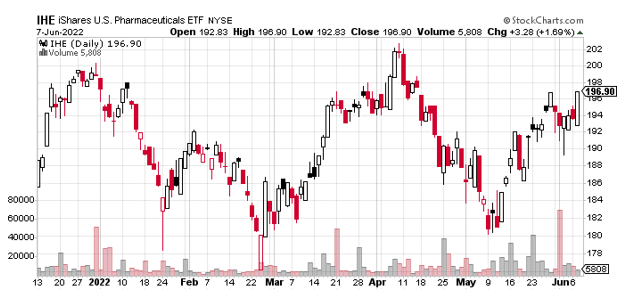

Sector ETF performs better than S&P 500 Index

The ETF for the pharmaceutical sector (IHE) has outperformed the S&P 500 index by 12.7% since the start of the year. Yet the ETF has not changed since the beginning of the year.

Source: StockCharts Source: StockCharts

In the short-term shares of pharmaceutical companies are heading for decline

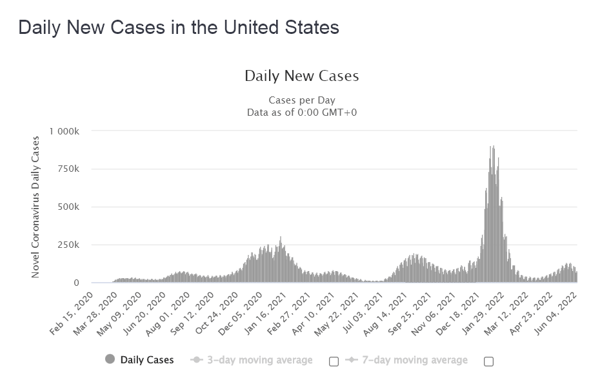

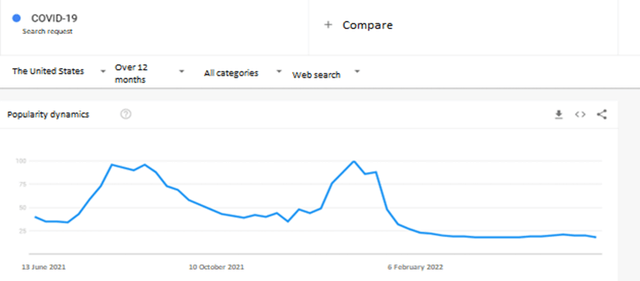

Last year investors preferred shares of pharmaceutical companies that develop vaccines, such as Pfizer or Moderna. Q1 2022 was also marked by the COVID-19 outbreak in the US and China, causing significant increase in vaccine sales and more lockdowns.

However, now we see less new cases and interest towards the virus:

Source: Worldometer Source: Google Trends

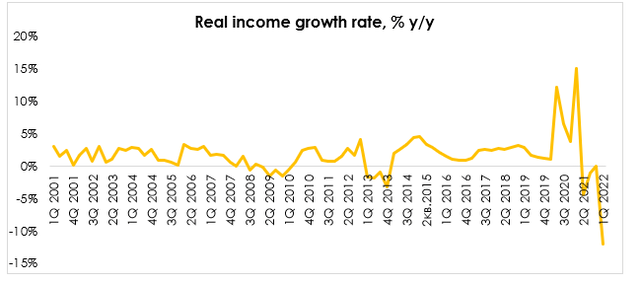

The second factor is the drop in the real income of US citizens. To save money, citizens may partially reject insurance or switch to the most basic options. As a result, the most expensive therapies will become unaffordable for part of the population.

AbbVie now does not have significant upside

The company has reported Q1 2022 results in line with our expectations.

AbbVie’s revenue amounted to $13,54 bln (+4% y/y) compared to the forecast of $13.8 bln being within our expectations.

The company EBITDA amounted to $6.77 bln (+7.1% y/y) compared to the forecast of $6.4 bln, which is in line with our expectations.

The company still has growth drivers for its financial results, but the current share price fully assumes them:

- The recent launch of Skyrizi for psoriatic arthritis treatment and anticipated FDA approval of the drug for Crohn’s disease treatment should also be important growth drivers in the long term.

- Early launch trends for Rinvoq to treat atopic dermatitis and psoriatic arthritis are very encouraging, according to the company management. Commercial access and quantity of paid prescriptions are expected to increase significantly in Q2 2022.

However, high inflation and freight costs are hitting AbbVie margin and as a result we have revised the company gross costs in 2023 from 26% to 28% of revenue and have revised our target share price downwards.

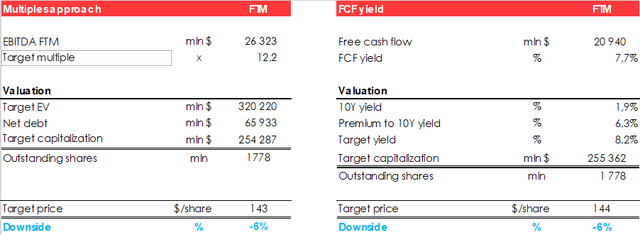

Valuation

AbbVie keeps growing and diversifies its product portfolio to offset the negative impact of the patent expiry of its key pharmaceutical product Humira in 2023. The company now has two new breakthrough drugs- Skyrizi and Rinvoq in process of active commercialization and is actively expanding its aesthetic medicine portfolio. AbbVie also has several important FDA approvals ahead in 2023.

We believe that despite the success of the company, prospects are already set in the AbbVie share price, and we do not recommend buying this issuer’s shares at current prices.

We estimate the fair price of AbbVie shares at $ 143/share. Status – HOLD.

Be the first to comment