Watering Money to Make it Grow SteveDF/E+ via Getty Images

It’s not an overstatement to argue that 2022 has been a difficult year for financial markets. Economic and geopolitical uncertainty has led the S&P 500 index to drop 21% through the first half of the year.

Despite this significant decline in the index, the S&P 500 still yields just 1.6%. Unless investors have at least several million dollars in their portfolio, this meager yield may not be able to fully cover the expenses of an average person.

Fortunately, there are dozens of quality, high-yielding stocks out there – what I define as at least double the S&P 500 index’s dividend yield. One of those stocks in my nearly 100-stock portfolio is the pharma stock AbbVie (NYSE:ABBV).

Having not covered AbbVie since last November, I still believe the stock is a buy for yield-hungry investors. Here’s why.

A Wonderful Track Record Of Dividend Growth

With a 3-year dividend growth rate of 10.1% and a 5-year dividend growth rate of 17.5%, there’s no denying that AbbVie has a reputation for high dividend growth. But can the company uphold that record moving forward?

AbbVie’s 3.68% dividend yield is moderately higher than the drug manufacturers – general industry average of 2.89%. But it’s not high enough to raise a red flag in my opinion.

AbbVie recorded $12.70 in adjusted diluted EPS in 2021. Against the $5.20 in dividends per share that were paid during the year, this equates to a 40.9% adjusted diluted EPS payout ratio.

And based on the $14.02 midpoint adjusted diluted EPS guidance for 2022 ($13.92 to $14.12 range), the stock’s payout ratio will improve further this year. That’s because compared to the $5.64 in dividends per share that are slated to be paid in 2022, AbbVie’s adjusted diluted EPS payout ratio will be just 40.2% for the year.

This is a low enough payout ratio that it builds in a margin of safety for AbbVie to withstand the U.S. patent expiration of Humira that will occur in 2023. And it should allow the company to raise its dividend at a rate faster than its earnings growth for the foreseeable future.

With mid-single-digit annual earnings growth looking likely, I am slightly upping my annual dividend growth rate to 6.25% for AbbVie.

Another Excellent Quarter

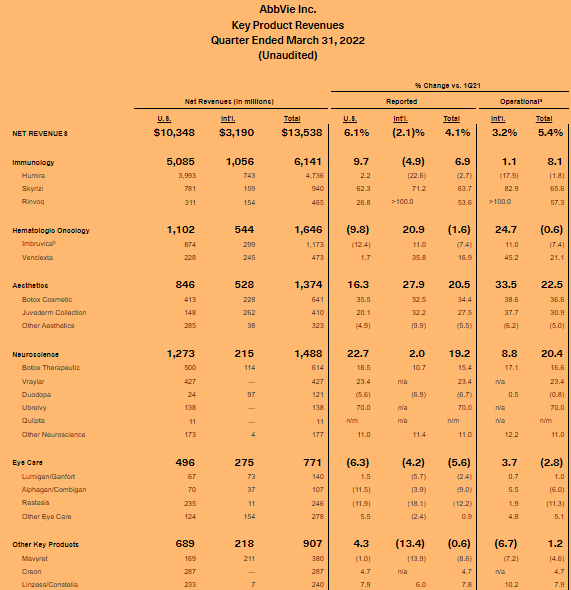

AbbVie Q1 2022 Earnings Press Release

When AbbVie shared its first-quarter earnings results on April 29, the company turned out another impressive quarter for its shareholders. AbbVie posted $13.54 billion of net revenue in the first quarter, which is equivalent to a 4.1% year-over-year growth rate (all details sourced from AbbVie Q1 2022 earnings press release).

Double-digit net revenue growth from three of AbbVie’s five top-selling drugs was more than enough to neutralize single-digit net revenue declines in the other two top-selling drugs (all info according to AbbVie Q1 2022 earnings press release).

AbbVie’s top-selling drug called Humira logged a modest 2.7% net revenue decline to $4.74 billion in the first quarter. Increased competition from biosimilar drugs in the European Union caused a 22.6% drop in the drug’s international revenue during the quarter. This proved to be too much for Humira’s 2.2% net revenue growth in the U.S. to overcome. The company’s second best-selling drug named Imbruvica produced $1.17 billion in net revenue during the quarter, which was a 7.4% dip over the year-ago period (all figures per AbbVie Q1 2022 earnings press release).

AbbVie’s other top-selling products known as Skyrizi, Botox Cosmetic, and Botox Therapeutic combined to generate $2.20 billion in net revenue for the company. For context, this was a blistering 38.7% year-over-year growth rate in net revenue for the three products in the first quarter (calculations made from data sourced from AbbVie Q1 2022 earnings press release and AbbVie Q1 2021 earnings press release).

Moving to AbbVie’s bottom line, the company reported $3.16 in adjusted diluted EPS for the quarter. This works out to a 9.3% growth rate over the year-ago period (info according to AbbVie Q1 2022 earnings press release).

The company’s non-GAAP net margin expanded 180 basis points year-over-year to 41.7% in the first quarter. Along with a 0.2% increase in its weighted-average outstanding diluted share count to 1.78 billion, this explains how AbbVie’s adjusted diluted EPS grew at over double the rate of its net revenue (all figures per AbbVie Q1 2022 earnings press release).

Risks To Consider:

AbbVie looks like a fundamentally healthy stock. But there are still risks to consider.

As it currently stands, AbbVie’s next-gen immunology drugs Skyrizi and Rinvoq, Botox franchises, and antipsychotic drug Vraylar should position the company well in its future beyond Humira. However, it’s important to consider that the launch of new products from competitors in the years ahead could materially alter AbbVie’s future growth outlook.

Until the COVID-19 pandemic, the other risk that never really came to fruition throughout AbbVie’s time as an independent company was a global pandemic. This was a reminder that pandemics can result in reduced doctor visits and new drug prescription volumes, which can pressure the financial results of pharma companies like AbbVie for a while.

A World-Class Business At A Discount

It’s hard to disagree with the position that AbbVie is one of the best businesses in the world. With that being said, investors still need to avoid meaningfully overpaying for even the most elite companies.

This is why I will be using two valuation models to appraise shares of AbbVie.

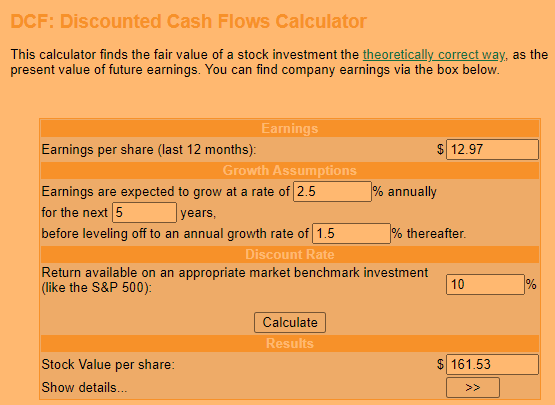

Money Chimp

The first valuation model that I’ll utilize to value AbbVie’s shares is the discounted cash flows model, or DCF model. This consists of three inputs.

The first input into the DCF model is a stock’s trailing twelve-month adjusted diluted EPS. In the case of AbbVie, this amount is $12.97.

The second input for the DCF model is growth assumptions.

I’ll assume a five-year annual growth rate of 2.5% in adjusted diluted EPS. This is around half of my expectations for the company. And I’ll then factor in deceleration to 1.5% annual growth in the years that follow.

The third input into the DCF model is the discount rate, which is the annual total return rate that an investor requires for their efforts. I will use a 10% annual total return requirement.

Using these three inputs for the DCF model, I come out at a fair value of $161.53 a share for the stock. This means that shares of AbbVie are trading at a 5.1% discount to fair value and can provide a 5.4% upside from the current price of $153.30 a share (as of June 30, 2022).

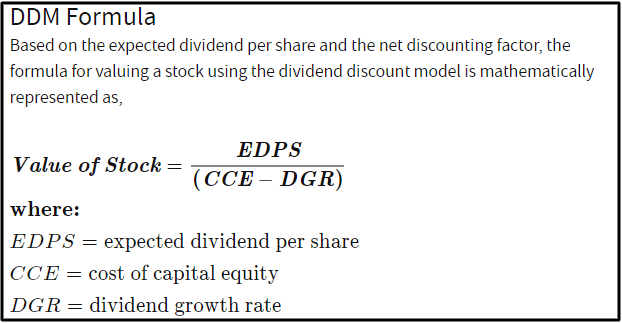

Investopedia

The second valuation model that I will use to estimate the fair value of AbbVie’s shares is the dividend discount model, or DDM. This is comprised of three inputs.

The first input into the DDM is the expected dividend per share, which is the annualized dividend per share. This amount is currently $5.64.

The next input for the DDM is the cost of capital equity, which is the annual total return rate that an investor seeks from their investments. I’ll again use 10% for this input.

The third input into the DDM is the annual dividend growth rate or DGR over the long run. As I noted above, I will assume a 6.25% annual dividend growth rate for AbbVie.

Plugging these inputs into the DDM, I get a fair value of $150.40 a share. This implies that AbbVie’s shares are priced at a 1.9% premium to fair value and pose a 1.9% depreciation from the current share price.

Upon averaging these two fair values together, I compute a fair value of $155.97 a share. This signals that shares of AbbVie are trading at a 1.7% discount to fair value and offer a 1.7% upside from the current share price.

Summary: AbbVie Offers Market-Beating Income And Total Returns

AbbVie is a Dividend King that appears to have many years of dividend growth left in its tank for a couple of reasons. First, the stock’s dividend payout ratio will be around 40% in 2022. And secondly, I’m expecting a 6% annual earnings growth rate over the long haul.

The stock’s 3.7% dividend yield, 6% annual earnings growth, and 0.2% annual valuation multiple expansion should lead to essentially 10% annual total returns over the next decade. This makes AbbVie a smart pick for income investors without sacrificing total returns either.

Be the first to comment