Lemon_tm/iStock via Getty Images

The Fed has already hiked rates by 1.5% so far in 2022.

It started in March with a small 0.25% hike.

It then accelerated the pace with a 0.50% hike in May.

And finally, it hiked rates by a 0.75% hike in June, which was the biggest rate hike since 1994.

What’s more, it is widely expected that the Fed will again hike interest rates by another 0.75% in July and possibly again in September.

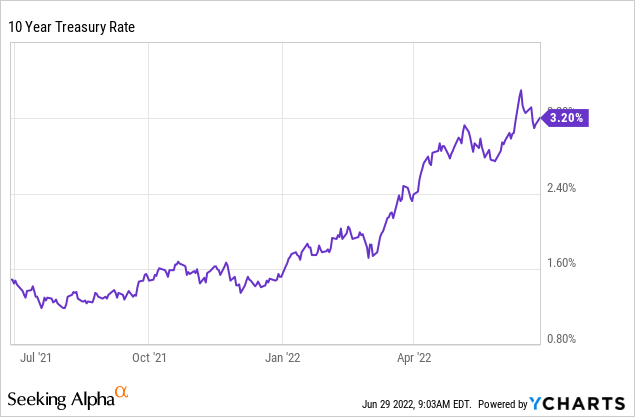

As a result, treasury rates have experienced one of the fastest surges in their history:

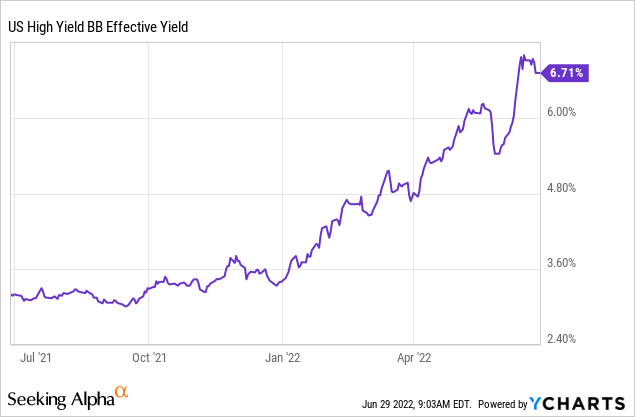

The yields of junk bonds have also doubled and now reached 6.7%:

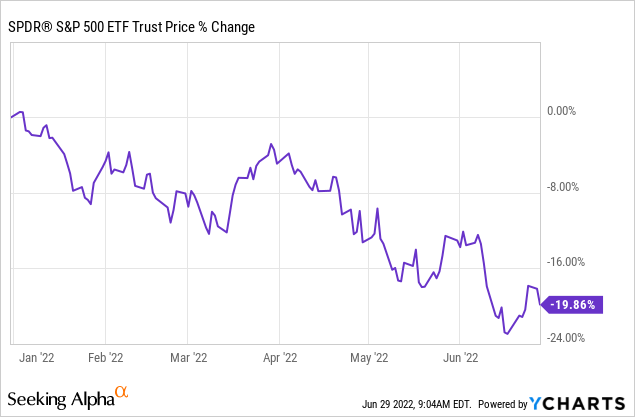

Naturally, this is causing a lot of concerns among investors because interest rates act like gravity on the valuations of companies.

The higher the interest rates, the lower the valuations…

You simply cannot justify the same valuation multiples if interest rates are materially higher and this explains why the entire stock market (SPY) has been dropping lately:

REIT investors seem to be particularly worried right now.

That’s because REITs are perceived to be “bond-like” investments that react negatively to higher interest rates.

After all, real estate is often largely financed with debt, and therefore, the value and profitability of these investments are directly tied to interest rates.

With interest rates expected to soon be hiked again, many appear to believe that now is a good time to sell. If you take a moment to read the comment sections of REIT articles, you will regularly find people arguing that you should avoid REITs at all costs in today’s environment.

So here’s my warning to you: don’t listen to the noise.

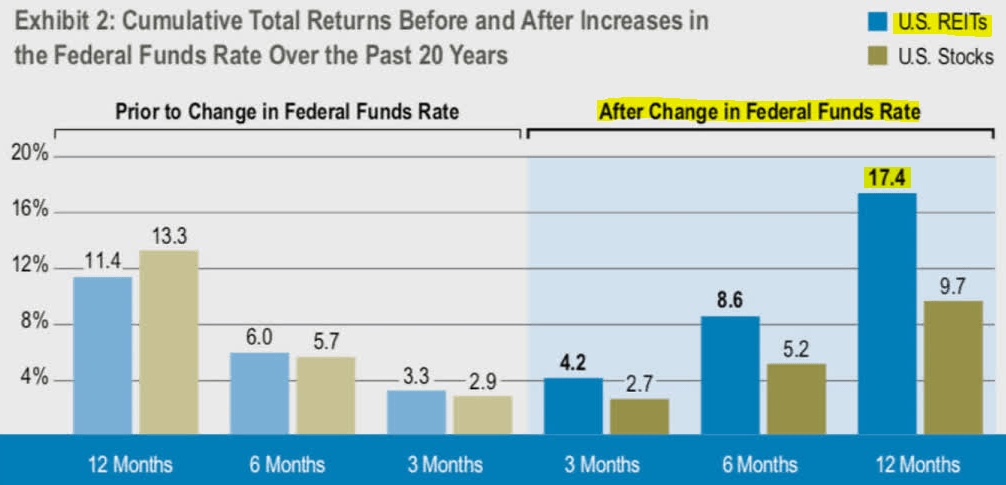

Historically, it has never been a good idea to sell REITs after a sell-off that was driven by rising interest rates in an inflationary environment. On the contrary, it has always been a good idea to buy the dips as REITs tend to rapidly recover and outperform the broader market.

From the below chart, you can see that REITs (VNQ) have historically generated a 17% average return in the 12 months following a rate hike:

REITs outperform when interest rates rise (Cohen & Steers)

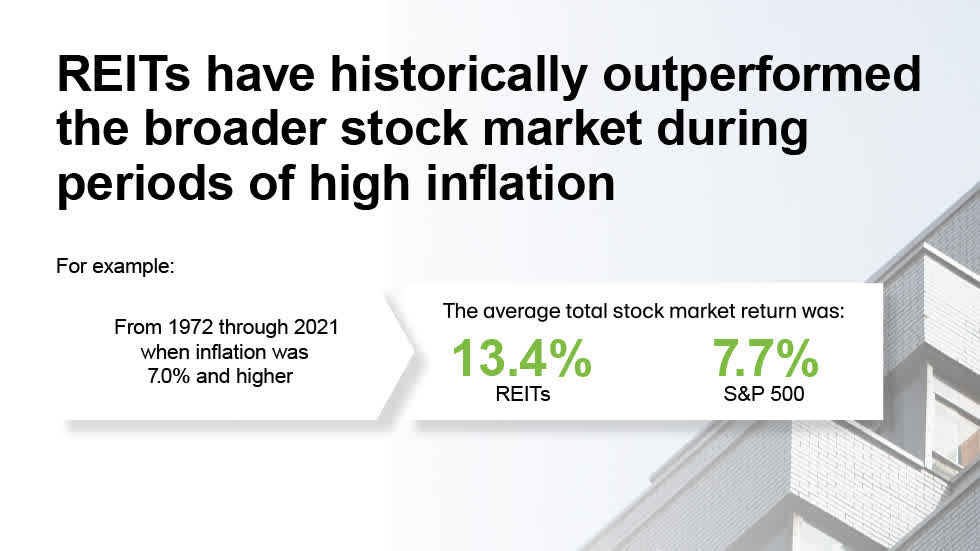

And from this additional chart, you can see that REITs tend to be particularly rewarding investments when inflation is above 7%:

REITs outperform when inflation is high (NAREIT)

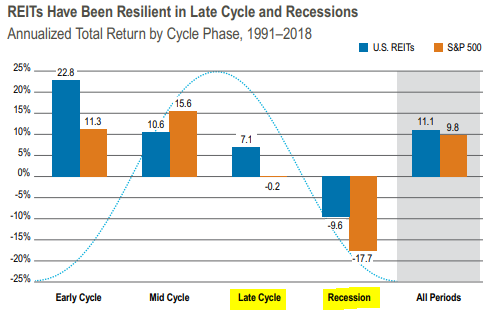

REITs also outperform in late cycles and provide far better downside protection during recessions:

REITs outperform during recessions (Cohen & Steers)

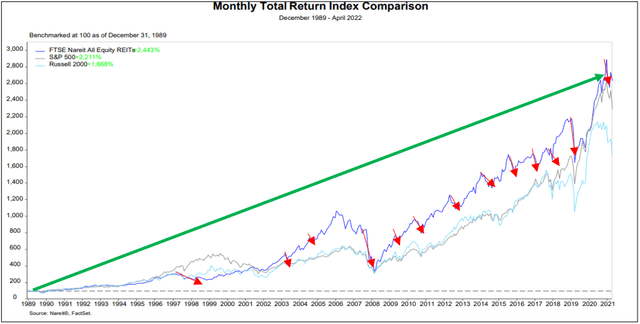

And here’s an extra chart for those of you who are particularly pessimistic: REITs have always, I repeat always, rapidly recovered from all past selloffs in their history. Buying the dips in REITs has literally always paid off handsomely:

To make my warning even clearer: now definitely isn’t a time to be avoiding or selling REITs.

The people who claim that REITs should be avoided are reacting emotionally to the recent market sell-off, but they are missing the big picture.

Yes, all else held equal, higher interest rates are negative for REITs.

But all is NOT held equal, and there are many offsetting factors that are important to consider as you evaluate their future prospects. Here are the three most important ones:

Inflation

Firstly, you have to ask yourself why interest rates are rising. Today, they are rising rapidly because inflation is at a multi-decade high. Inflation benefits real estate investments in at least four different ways:

(1) It leads to rising rental income. Rents are rising the fastest in 15 years at the moment.

(2) It increases the replacement value of your real estate.

(3) It inflates your debt, increasing the real value of your equity in the property.

(4) And finally, it makes new real estate developments less competitive, reducing new supply, and increasing the value of existing assets.

The positive impact of high inflation can be very significant for REITs and it cannot be ignored when evaluating the impact of rising interest rates.

Balance sheet strength

The impact of rising rates depends heavily on how leveraged you are and how you have structured your debt. Sure, if you are heavily leveraged, have short maturities, and mostly variable debt, then the impact of rising rates will be significant.

But that’s not REITs operate. Today, the average loan-to-value of the REIT sector is just 35%. Beyond that, most REITs use primarily fixed-rate debt. And finally, they have locked their rates for many years to come with the average debt maturity of around 8 years.

Put simply, REIT balance sheets are today the strongest in their entire history and therefore, the negative impact of rising interest rates is not significant. In many cases, there is no impact for years, and by then, the debt will have lost significant real value and rents will have risen a lot higher due to the inflation.

Previously, we showed you that REITs tend to outperform when inflation is high and interest rates are rising and it is simply because the positive impact of inflation is far greater than the negative impact of rising rates. The inflation benefits 100% of your capital, but the rising rates only impact 35% of the capital, and the impact is often delayed over many years.

Valuations

Finally, and perhaps most importantly, you always have to ask: how much are you paying because that directly influences the risk-to-reward of your investment.

Even if rising rates had a very negative impact on REITs (which isn’t the case), they could still be attractive investments if this was already priced in and REITs were offered at discounted valuations.

You cannot simply say “avoid REITs due to rising rates” because the market is a forward-looking machine and this is likely already priced in if that’s the narrative.

Today, REITs are priced at their lowest valuations in years according to GreenStreetAdvisors. Premiums to NAV have turned into large discounts to NAV.

It is not uncommon to find large blue-chips trading at 15-20x FFO. That’s very compelling for investment-grade rated REITs with steady and predictable growth prospects. To give you an example, Alexandria Real Estate (ARE), the biggest owner of life science buildings, is currently priced at 18x FFO and that’s despite being one of the bluest blue chips in the REIT world. Its rents are currently about 40% below market, providing a predictable path to organic growth, and since the company has a fortress balance sheet, the impact of higher interest rates is negligible.

Life science building (Alexandria Real Estate)

If, like us, you are an active investor and want to maximize returns, you can find even better deals by being selective and focusing on smaller and lesser-known REITs.

Today, many of them are priced at just ~10x FFO and up to a 50% discount to the underlying value of their properties.

This essentially means that you get to buy professionally managed, liquid, and diversified real estate at 50 cents on the dollar and with a 10% cash flow yield after all expenses.

A good example would be Whitestone REIT (WSR). The small-cap owns essential strip centers in rapidly growing sunbelt markets like Austin, Texas, and Phoenix, Arizona. It is expected to grow FFO per share by 15%+ in 2022 and yet, it is priced at right around 10x FFO at the moment and a steep discount relative to the value of its real estate.

Its rents are growing rapidly because its markets are experiencing strong growth and it has short leases. We estimate that the company has 50% upside and while you wait, it also pays you a 5% dividend yield. WSR is just one example among many others, but it illustrates quite well that it is hard to go wrong when you get to buy good assets with growing cash flows at a bargain valuation. Rising rates are just one thing among many other factors to consider.

Strip centers with essential retailers (Whitestone REIT)

Bottom Line

The bottom line is that it is a big mistake to sell or avoid REITs simply because interest rates are rising. There are other more important things to consider.

Inflation benefits REITs.

Balance sheets are the strongest ever.

And valuations are deeply discounted.

So you’ve been warned: those who write comments saying “avoid REITs due to rising interest rates” don’t really know what they are talking about in my opinion.

Historically, the opposite has been true. REITs have outperformed and generated strong positive returns during times of rising interest rates, and given that REITs are today discounted, have strong balance sheets, and benefit from the surging inflation, this time likely won’t be different.

We are aggressively buying the dips and expect to profit as the narrative shifts in the coming years.

Be the first to comment