imaginima/E+ via Getty Images

Perhaps no up and coming technology appeals to our science fiction fueled imaginations quite like artificial intelligence (A.I.). At the same time, no up and coming technology is having more impact on revolutionizing the daily human experience. Tech mega caps like Amazon (AMZN) are turning our homes into A.I. powered machines with smart consumer products that make our lights turn on, order dinner, and tell us the latest weather and news at the sound of our voice. Google (GOOG) (GOOGL) and Microsoft (MSFT) have turned our internet experience into a custom-made experience where the news articles and ads we see are tailored to our interests using A.I. powered algorithms. Meta Platforms (META) has done the same with the social media experience. Meanwhile, Tesla (TSLA) and many other companies are busy trying to turn the mobility experience into an A.I. powered experience, an achievement that would free up untold hours that are currently being lost to operating vehicles while simultaneously dramatically reducing car accidents, saving millions of lives and billions of dollars in the process.

Corporate America is becoming even more transformed and disrupted with A.I. technologies as we rapidly transition into the so-called “Fourth Industrial Revolution.” In this article, we will discuss our three favorite A.I. businesses that are transforming industry and we believe are opportunistically priced and positioned to win big for investors over the next decade.

#1. Palantir Technologies (PLTR)

PLTR is a leading data analytics and A.I. company that supports the operations of leading corporations, Western and Western-aligned government agencies, and even innovative startups through its Foundry (commercial enterprise) and Gotham (government agency) platforms. In particular, PLTR’s Apollo’s Edge-A.I. platform provides backbone technical infrastructure for A.I. and machine learning via its Meta-Constellation software. This package implements A.I. with satellite constellations to provide unique insights to decision makers. As a result, PLTR is poised to benefit from growth in the space exploration industry alongside growth in A.I. technology and applications.

The company’s potential is enormous as the company’s total addressable market is well north of $120 billion and is expected to grow at a 25%+ CAGR over the next decade. Meanwhile, PLTR’s revenue is expected to come in at around $2 billion in 2022, meaning that the revenue growth runway is virtually limitless here. As a result, it is not surprising that the company is growing revenues rapidly (41.1% revenue growth rate in 2021 and ~30% revenue growth is expected in 2022). With the company continuing to scale, and forecasted by analysts to grow at a 33.8% CAGR through 2026, PLTR should see exponential growth over the next decade.

We expect the stock price to appreciate substantially higher because normalized earnings per share are expected to grow to $0.75 by 2026. At a 40x P/E ratio (our fair value estimate at current interest rate levels for a company growing earnings per share at a 30% rate), PLTR would command a $30 price in 4.5 years, translating to an impressive 30% CAGR between now and then.

#2. NVIDIA (NVDA)

NVDA has a very impressive intellectual property portfolio and R&D segment that gives it a strong competitive positioning in the A.I. space. With a leading position in the GPU space, NVDA is poised to thrive as autonomous driving takes off while also benefiting from strong growth momentum in the data center, gaming, and professional visualization industries.

Its autonomous driving business could generate particularly exciting growth as its GPU and SoC sales could see massive growth from automaker and automotive supplier demand for outfitting crucial portions of autonomous driving systems. NVDA has already become a key player in TSLA’s autonomous vehicle program as well as at several others. In fact, Sam Abuelsamid from Navigant Research recently stated:

Virtually every company working on AVs is utilizing NVIDIA in its compute stack.

According to recent data from Allied Market Research, the global autonomous vehicle market could exceed $500 billion in less than five years. Given that NVDA’s current autonomous vehicle revenue generation is roughly one-thousandth of this despite its leading technology position in crucial parts of this industry, the upside is clear here.

Meanwhile, after the massive sell-off in the share price, NVDA looks attractively valued. Its EV/EBITDA multiple is 25.05x and its Price to Normalized Earnings ratio is 28.98x, whereas its five-year average EV/EBITDA is 39.4x and its five-year average Price to Normalized Earnings ratio is 39.68x. With its competitive advantages that are as compelling as ever and its growth runway that remains robust (normalized earnings per share are expected to compound at ~20% annually over the next half decade), the stock looks poised to deliver double-digit annualized returns and quite possibly much more for the foreseeable future.

#3. Broadcom (AVGO)

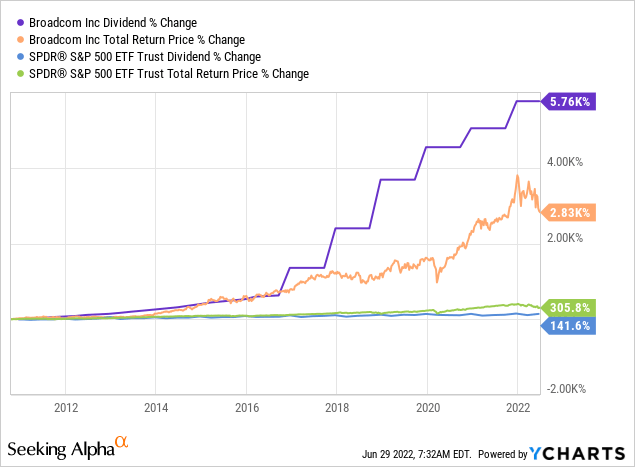

AVGO has proven itself as a phenomenal dividend growth stock, totally crushing the S&P 500 (SPY) in terms of total returns and especially in terms of dividend growth over the years:

Meanwhile, dividend growth is expected to remain strong for the foreseeable future, with a 14.4% increase in 2022 total dividends expected and a 12% increase expected for 2023.

This growth is likely to continue for the foreseeable future thanks to AVGO’s 23 category-leading semiconductor and infrastructure software divisions, tens of thousands of patents, and multi-billion-dollar R&D budget which should serve to continue compounding their technological advantages over competitors and expand their total addressable market.

AVGO also habitually reinvests its massive amounts of free cash flow into strategic and accretive acquisitions that have both advanced its growth and improved the quality of its revenues. In particular, AVGO has targeted software businesses as a more stable source of recurring revenue to complement its cyclical semiconductor business. AVGO’s growth engine will be powered by A.I. powered businesses such as software, data centers, and 5G communications which are facilitating enterprise automation.

The stock price also looks very attractive here thanks to the recent pullback in the market. Despite having a strong investment grade balance sheet, durable competitive advantages, and robust growth, the EV/EBITDA multiple is just 10.69x, the Price to Normalized Earnings ratio is only 12.63x, and the Free Cash Flow multiple is a mere 11.22x below to its five-year respective averages of 11.30x, 14.16x, and 12.88x.

Investor Takeaway

Right now, investors have a golden opportunity before them. A.I. has proven that it is here to stay, and it is ready to transform both our daily experience and industry, creating greater convenience and hundreds of billions of dollars in wealth for individuals and corporations alike. At the same time, the recent sell-off in tech stocks means that these rapidly growing companies are on sale. By purchasing stocks like PLTR, NVDA, and AVGO while they are cheap, investors can set themselves up to generate potentially massive total returns for the next decade and potentially beyond.

Be the first to comment