JHVEPhoto/iStock Editorial via Getty Images

Since being spun-off from Pfizer (PFE) in 2013, Zoetis (NYSE:ZTS) has proven to be a tremendous investment with shares more than quadrupling. With its large product portfolio, Zoetis has capitalized on a tremendous bull market in Americans’ pet spending. Last year, Americans spent $110 billion on their pets, about $31 billion of which was for veterinary products. That is about double the 2013 level. With shares now down over 20%, investors may be tempted to buy into this proven long-term performer at a discount. I would urge patience because while shares have fallen the valuation remains expensive for a business that faces several headwinds.

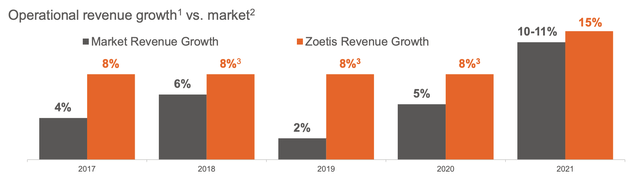

Zoetis generates about 61% of its revenue from pets (or “companion animals”). The remaining 39% comes from livestock, primarily cattle, hogs, and chicken. Of its 300 products, over 14 generate at least $100 million in sales. With a large number of blockbuster drugs and a diversified product mix, Zoetis has less risk from one market segment performing better than another or a product going off patent, though these can still be drags. Zoetis has consistently been able to grow faster than the veterinary market, in keeping with its strong share price performance.

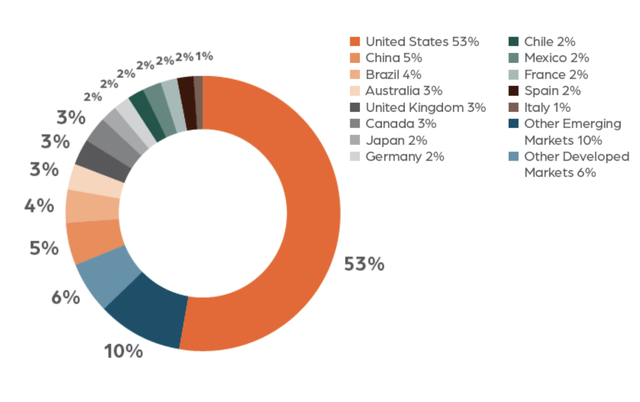

In addition to being diversified across products, Zoetis’s operations are spread around the globe. Just over half of its business comes from the United States. The rest is well spread across the world with no country above 5%, though China with its large hog population and Brazil with its cattle population are the next largest markets for Zoetis. As we see in Zoetis’s most recent earnings, these overseas operations are becoming a headwind.

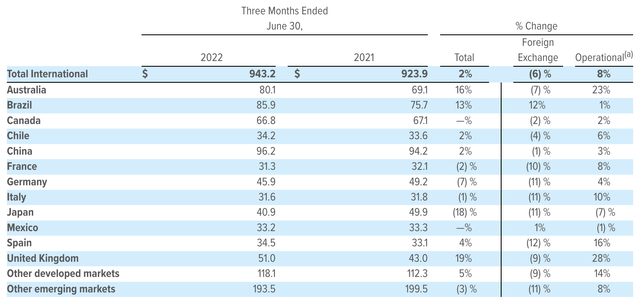

In the company’s second quarter, Zoetis reported 8% operational revenue growth and 9% operational net income growth. Foreign exchange was a 3% headwind, taking reported growth down to 5% and kept reported profits flat at $567 million. The companion business generated 14% growth. The livestock unit saw a 1% decline as generics take hold-this impact was felt most strongly in the US where sales fell 7% due to competition-driven declines in cattle and chicken where Draxxin and Zoamix have gone off patent. Livestock owners will be quicker to move to lower-cost alternatives as like any other business, they will be trying to maximize margins and reduce costs. These generic competitors are going to remain a headwind for the livestock business. Additionally, China’s hog population has also declined from its peak due to swine flu, reducing sales in that market.

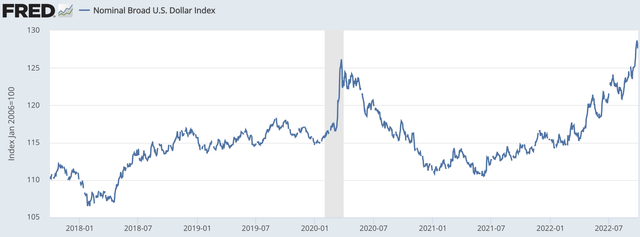

The 3% currency headwind were widespread given just how strong the US dollar has been. Outside of Brazil and Mexico, it was a drag everywhere, and in many markets the strength of the dollar was an over-10% headwind.

Unfortunately, this headwind is not ending anytime soon. As you can see below, the US dollar has reached new heights, so this drag will get worse in coming quarters. Given how aggressively the Fed is raising interest rates, weak growth in China amid its COVID-zero policy, and Europe’s trade deficit widening due to its need to buy expensive LNG, the US dollar’s fundamentals are quite strong. Consequently, this strong dollar regime is likely to persist, which will be an ongoing headwind for multinational firms like Zoetis. Based on the impact seen so far this year, the continued rise in the dollar this quarter pose an up to 5% downside risk to revenue and 10% to net income.

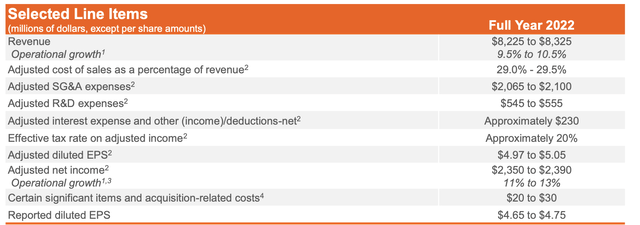

Despite the operational revenue growth reported last quarter, management narrowed guidance after the quarter to $8.23-$8.33 billion in revenue, representing about 10% growth. Adjusted net income will be about $2.37 billion, or up about 12% resulting in adjusted EPS of $5. However, given the dollar strengthening during the third quarter, combined with competition from generic livestock products, I see risks to guidance skewed to the downside. With an earnings multiple that is still 30x, there is little margin for error.

Additionally, while the pet unit is performing much better than the livestock unit, the unit is not without its challenges. Sadly, there are reports of pets being increasingly returned to shelters after a surge in demand after COVID-19 lockdowns. Just as Zoetis benefitted from the surge in pet demand in 2020 and 2021, the normalization we are seeing could be a headwind for revenue growth.

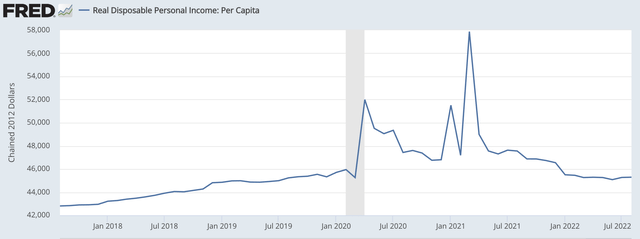

There is discretionary element to having a pet and purchasing veterinary care. Zoetis’s tenure as a public company has been during a solid expansion in economic activity, supporting increased veterinary expenditures. Now, consumers are feeling the pinch from rising inflation. In fact, real per capita disposable incomes are now about $650 lower than pre-COVID.

To be clear, I am not suggesting that veterinary spending is poised to fall dramatically. But in a world of tightening budgets, there is downside risk to the double-digit revenue growth that Zoetis has been able to generate as consumers scrutinize every aspect of their budget. With a 30x multiple off the midpoint of guidance, but a rising dollar, tight consumer budgets, and generic competition, the potential bad news is not in the stock. Slower growth can be sufficient to reduce a stock price with this premium multiple.

Now, one clear positive is that in the first half of the year, the company has repurchased $812 million of stock, more than double last year’s pace. The $450 million bought during Q2 was a company record. Thanks to these buybacks, the share count has fallen by about 1.2% to 477 million. Adjusting for working capital movements, underlying free cash flow in the first half was about $1.05 billion, creating scope for the company to sustain this elevated buyback pace.

Zoetis’s shares are down, but at 30x earnings and 35x free cash flow, they are not cheap, particularly in a world of higher interest rates. Given the company’s history of generating solid growth, I would be willing to pay a premium vs the market for its shares. I do think investors will have a chance to pick up shares at $120-125 or about 25x the $4.90-$5.00 in EPS I expect the company to earn. For now at over $150, investors should continue to steer clear of Zoetis. Valuation is excessive given currency and operational headwinds facing the business.

Be the first to comment