wdstock/iStock Editorial via Getty Images

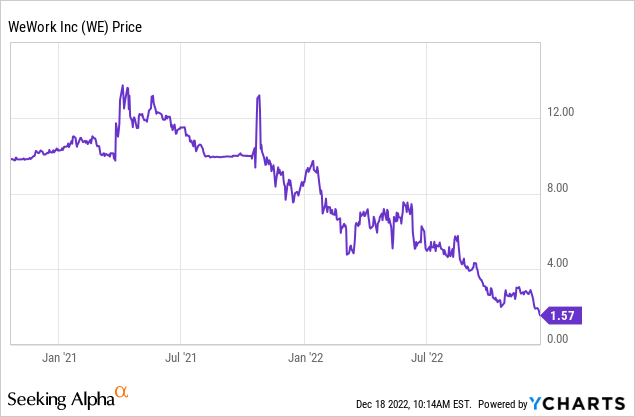

It may come as no surprise to many that WeWork (NYSE:WE) could file for bankruptcy in 2023 because they have a failed business model and have potential liquidity problems that are impacted by certain details in the U.S. Bankruptcy Code. Changes caused by the pandemic as to how and where people work had an overall negative impact on WeWork. They continue to burn cash and, even if SoftBank is willing to extend debt maturities, it will not be enough to keep them out of court, in my opinion. A world-wide recession could be the final catalyst that puts them in bankruptcy at least in the U.S.

(Note: the above price chart includes the earlier SPAC stock prices of BowX)

Failed Business Model

WeWork’s business model is based on a basic old school real estate model that a number of my business associates have used for years. My business partners would lease the entire first floor of a commercial building in Manhattan and get very favorable leasing rates because they have a strong financial record. They would then divide the area into multiple units and rent those at much higher amounts per square foot to other businesses, which often resulted in very nice profits for my partners.

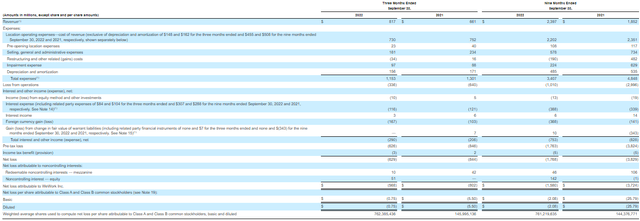

WeWork leases large areas in an office building and then offers desk space and offices to those not able/willing to rent traditional offices. The problem for WeWork is the margin between what they pay and what they receive from their customers has not been enough to cover the very large administrative/marketing/advertising expenses. For example, WeWork had $2.397 billion nine-month total revenue and total lease expenses were $1.896 billion, which resulted in a $501 million gross profit margin. This $501 million did not cover the $406 million in other costs at locations, $578 million selling, general and administrative expenses, $116 million interest expense, and other income items. The bottom line result for the nine months was WeWork reported a loss of $629 million.

3Q and 9 Month Income Statement-2022 and 2021

(Note: the results per share for 2022 reflect a much higher average number of shares outstanding than in 2021 because of the massive number of new shares issued under the SPAC merger transaction, which effectively reduces the reported loss per share.)

Less than robust occupancy rates have had a negative impact on results. It is unclear what average occupancy rate level would result in finally breaking even. Optimal pricing for their services seems to be problematic for management as well, in my opinion.

The dramatic change on where businesspeople actually now work as a result of the pandemic has had a negative impact on their already shaky operating model. Before the pandemic, many businesspeople wanted a business location to call their business “home” and there was a certain perceived stigma if a new business operated out of someone’s house/apartment/basement/garage. That is no longer the case. The stigma is pretty much gone because even partners at major law firms and investment firms work from home now. Before people wanted access to a nice conference room if they needed to meet with customers. Now, meeting via Zoom is an accepted business practice. There is much less need/demand for a nice conference room. They can also use the old standard business lunch at a restaurant for a meeting. They don’t really need WeWork services.

WeWork has been closing some locations and in November they announced that 40 more locations will close. In Ch.11 in the U.S. under section 365 WeWork would have the potential to accept or reject leases, which is a strong incentive to go into Ch.11 to restructure. I covered the details involving leases and section 365 in a recent Bed Bath & Beyond (BBBY) article. The problem, however, is that more than half their offices are located outside of the U.S. and each country/location has their own regulations on leases and bankruptcy/administration/insolvency. There are potential problems regarding filing for bankruptcy in the U.S. and the impact on foreign operations, which I may cover in detail in a future article.

Needing Additional Cash for Operations

WeWork continues to burn cash and may need additional cash in the near future. This is amazing given that WeWork received $800 million (80 million shares) under a PIPE and $333 million from the SPAC trust account in October 2021 under a SPAC merger deal with BowX Acquisition Corp. Plus, they received an additional $150 million (15 million shares) from Cushman & Wakefield (CWK).

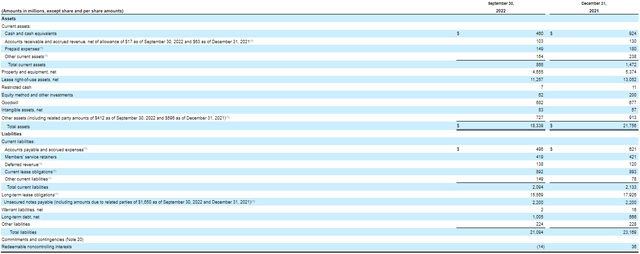

For the first nine months of 2022, they used $645 million cash for operations. The problem currently is that their cash position as of September 30 is actually worse than it appears. They reported a cash position of $460 million, but if you add accounts receivable amount of $103 million to that number and then subtract out the huge accounts payable figure of $496 million, you get only $69 million. If WeWork continues to burn cash, these numbers could get even worse. This accounts payable number is troubling, in my opinion, because it is about 50% of total expenses in 3Q after deducting depreciation/amortization expenses. I don’t know what to make of this. Are they not paying bills in a timely manner? The reality is that those owed money under accounts payable are effectively helping WeWork’s cash liquidity. What happens if payment terms become more restrictive?

Balance Sheet

Recharacterization of Debt to Equity in Bankruptcy

Many investors expect that SoftBank (OTCPK:SFTBY) will loan WeWork additional cash to keep it afloat. That assertion, however, ignores some details in the U.S. Bankruptcy Code. If WeWork eventually does file for Ch.11 bankruptcy that loan, in my opinion, could be recharacterized by a bankruptcy court as equity under section 105(a) and would, therefore, be in the same lowest class for recovery under a Ch.11 reorganization plan as WE shareholders. This is clearly a very complex issue.

Claim holders, such as unsecured creditors, may assert in bankruptcy court that a new loan by SoftBank is actually equity interest in order for that claim class to get a better recovery under a Ch.11 reorganization plan because if the new loan is recharacterized as equity it would move down the priority level to the bottom. It could also be used just as a bargaining tool by various stakeholders, including WE shareholders, to get better recovery terms.

The problem is that the various federal courts have different interpretations of the authority of a bankruptcy court to recharacterize debt as equity under section 105(a). SCOTUS in June 2017 granted a writ of certiorari for a case, PEM Entities LLC v. Eric M. Levin (16-492), that would have hopefully given some clarity on this issue. The case was never heard because the parties settled the case a few weeks after the writ was issued, and SCOTUS does not hear settled cases. (Interesting note on this SCOTUS case. One of Eddie Lampert’s law firms was involved in this case. Why was the case settled and, therefore, not heard by SCOTUS? If SCOTUS ruled that a bankruptcy court could fairly easily decide under section 105(a) to recharacterize debt as equity it would have had an extremely negative impact, in my opinion, on Lampert because he had made many very large loans to Sears Holdings that might have been recharacterized as equity if Sears filed for bankruptcy.)

If WeWork does eventually file for bankruptcy, I would expect them to file in the Southern District of New York because their headquarters is in Manhattan. In 2021, a SDNY bankruptcy court did recharacterize debt as equity interest in the Ch.11 case of Live Primary LLC. (Oddly, Live Primary was a shared office space startup company.) That decision was based mostly on AutoStyle Plastics, Inc., 269 F.3d 726, 747-48 (6th Cir. 2001) that requires looking at a long list of factors for recharacterization, but the list was not to be used as a “scorecard” requiring that each one was to be met – they are just some guideline considerations. The factors:

(1) the names given to the instruments, if any, evidencing the indebtedness; (2) the presence or absence of a fixed maturity date and schedule of payments; (3) the presence or absence of a fixed rate of interest and interest payments; (4) the source of repayments; (5) the adequacy or inadequacy of capitalization; (6) the identity of interest between the creditor and the stockholder; (7) the security, if any, for the advances; (8) the corporation’s ability to obtain financing from outside lending institutions; (9) the extent to which the advances were subordinated to the claims of outside creditors; (10) the extent to which the advances were used to acquire capital assets; and (11) the presence or absence of a sinking fund to provide repayments.

Some may assert that the recharacterization risk would actually be a strong reason for SoftBank not to ever allow WeWork to file for Ch.11 bankruptcy because all their debt that SoftBank holds could be recharacterized as the lowest priority class – equity. In theory, some claim holders could try to assert that, but it would be extremely unlikely, in my opinion, because when notes were purchased by SoftBank there were many other financing activities also taking place by other parties, such as the $800 million PIPE transaction. WeWork was able to get other financing from other sources. (See #8 above.) Currently, I don’t see other sources for financing other than Softbank, which is one of the major reasons, in my opinion, why any new loan from Softbank could be recharacterized as equity interest. To avoid this risk, the terms would have to be extremely restrictive, including a very high interest rate, to make it look like a real “loan” to a high-risk company and not an equity interest transaction. A very high interest rate would have a negative impact on cash/cash flow, which is the primary reason for the loan.

Conclusion

The issue is really additional cash is needed. I would assume that SoftBank would agree to the extension of any maturing debt. So, maturing debt is not the key issue regarding a bankruptcy filing. In my opinion, I am not sure that SoftBank is willing to take risk that any new loans to WeWork could be recharacterized as equity interest by a SDNY bankruptcy judge if WeWork files for Ch.11 in the future.

Since WeWork has a failed business model that continues to burn cash and there is a risk of a bankruptcy filing, especially if there is a worldwide recession, I rate WE stock a sell.

Be the first to comment