Sundry Photography/iStock Editorial via Getty Images

The Federal Reserve released the annual stress test results for America’s largest banks on June 23rd after the market closed. Most of the winners were not a surprise and while no one failed the test, there are a few names which analysts have been quick to point out were losers in the process because their portfolios did not perform as strongly in this test based off of this year’s parameters. After today’s market close, the banks will be releasing their Fed approved capital return programs for shareholders (including changes to dividends and share buybacks).

By all accounts it certainly looks like Wells Fargo (NYSE:WFC) is a winner and that Bank of America (NYSE:BAC) will end up returning less cash to shareholders over the next 12 months than some were anticipating. This news interested us, and we began wondering about a potential pair trade.

Backstory

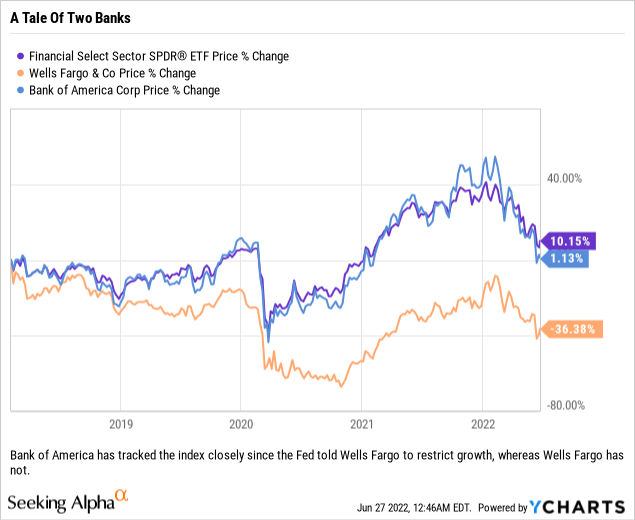

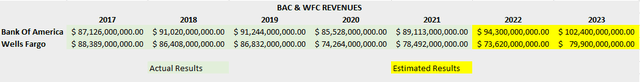

Wells Fargo has not been kind to those who purchased shares back in 2018. While the bank was able to tread water and attempt to keep up with some peers (as measured by the SPDR Financial Select Sector ETF (XLF) as shown below), from 2019 to early 2022 the stock finally began to fall behind many of the other large U.S. financial institutions. The outperformance of Wells Fargo’s peers is significant, and it is not being driven by just one or two names. Since the recession caused by COVID, we have seen strong profit growth with banks finally able to find growth in areas they had struggled with prior to 2020 (although some have struggled with loan growth). However, Wells Fargo was unable to participate in this growth as they were hampered by the balance sheet restrictions that the Federal Reserve put in place. Rather than being able to grow unencumbered, Wells Fargo was forced to choose between products to offer to clients, choose exactly which products and customers it wanted to keep, and which were best to walk away from.

The table below shows the significant impact that the Fed’s order to restrict growth had on Wells Fargo. The firm went from being a bit larger than Bank of America in 2017 to smaller in 2018, and since then Wells Fargo’s revenues have fallen further behind Bank of America.

Growth restrictions mandated by the Fed have really impacted Wells Fargo, especially when looking at the performance of peers. (Annual Reports, Bloomberg)

So What Is The Trade?

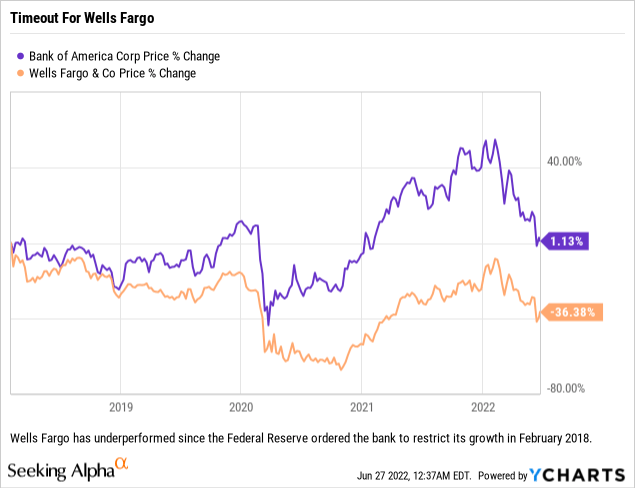

With the stress test results already in hand and banks set to announce their capital plans after the close on Monday, we believe that now may be a good time to go long Wells Fargo and to sell Bank of America. While the chart below shows just how little Bank of America’s shares have moved relative to their price on the day the Fed announced their actions against Wells Fargo, it also shows some significant outperformance relative to Wells Fargo.

But is there more to this? We think so. Remember, perspective is everything, and sometimes one has to change their vantage point in order to see the whole picture.

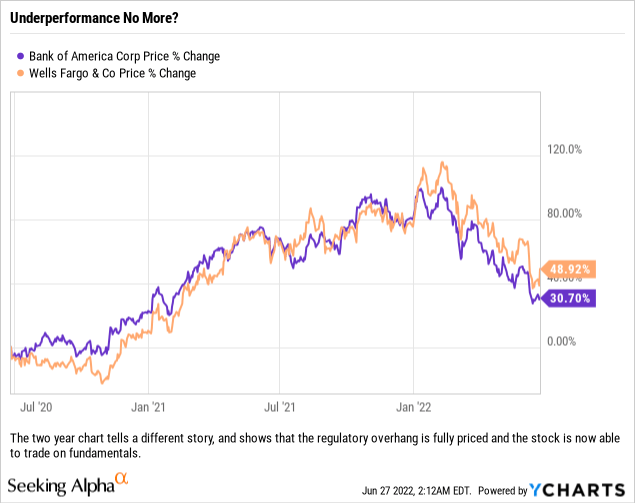

The chart below shows why we think that Wells Fargo has already turned the corner on performance.

Wells Fargo has seen its shares trade much more in line with peers, including Bank of America, in the last two years. This chart looks much better for investors and even though the stock sports outperformance, it is our opinion that this outperformance indicates that investors have finally come around to appreciating the situation surrounding Wells Fargo a bit more and could push shares higher.

So what are we talking about? We believe that the cap on growth has been a blessing in disguise. While Wells Fargo is a much smaller firm, as measured by revenues, it is actually pretty healthy and has been forced to focus on improving the business (in order to get the Fed’s blessing to pursue growth as well as to target higher margin businesses) and returning capital to shareholders. If you cannot grow your balance sheet and grow your business in the banking world today, then you are able to return even more capital to shareholders (because you really cannot do much else with it).

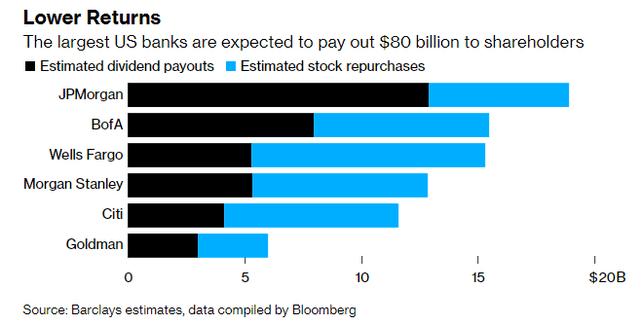

According to Barclays and Bloomberg, most of the largest banks will be returning capital via share repurchases. (Barclays and Bloomberg)

It appears that Wells Fargo will be returning between $15 billion to $15.5 billion to shareholders (with most analysts appearing to be focused on $15.3 billion), however we will have to wait for the announcement after the close today to know the exact amount which the Fed signed off on. Using the $15.3 billion as a ballpark figure, we suspect that Wells Fargo will announce that they are increasing their dividend by $0.20/share per year, or $0.05/share per quarter. This would bring their annual dividend to $1.20/share moving forward. Based on their current share count, this would equate to just about $4.55 billion in dividends for the year, which would leave just under $10 billion available for share repurchases (and at current prices this would enable Wells Fargo to repurchase about 6.5% of their shares outstanding). We think that repurchasing shares is a prudent move in this market, especially with banks holding up pretty well so far.

While Wells Fargo will be utilizing share buybacks for the majority of their capital return programs, Bank of America will be utilizing a more balanced approach. Bank of America may increase their dividend, but probably not by much after the results of the stress test. Bank of America could be returning up to $7.5 billion to shareholders via share repurchases, or about 2.88% of its outstanding shares based off of current market prices and shares outstanding.

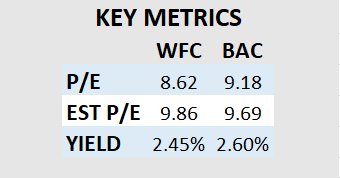

Both banks trade at levels which appear fair when comparing the two against each other. (Bloomberg, Investor Presentations)

In short, on a relative basis (using market capitalization), Wells Fargo will be returning more to shareholders than Bank of America and we think that will help lead to outperformance. The fact that it appears Wells Fargo will be able to repurchase more than double the percentage of shares outstanding than Bank of America (based off of Friday’s closing prices) could be enough to push shares higher on its own. However we suspect that Wells Fargo will also see profitability increase with many of the cost cutting measures that the company put into place over the last 12-18 months and their focus on conducting higher margin business with customers.

Why We Like This Trade

We like this trade because Wells Fargo has identified businesses in their portfolio which have been underperforming and have begun to target improvement. The credit card business is one example, and the company has gotten aggressive in matching competitors’ rewards programs and other card perks to make inroads into wealthier clients’ wallets.

These companies’ valuations are similar when looking at certain metrics and the yields are quite close, which is nice because the long position’s dividend essentially will offset the short’s dividend (eliminating one potential expense to the trade). Also, with the stocks trading in a correlated pattern over the past two years, it would appear that if we are wrong on Bank of America that there is a decent possibility that all boats rise (which is important because the trade makes money if Wells Fargo rises against Bank of America, is breakeven if they both move in tandem, and loses money if Bank of America outperforms Wells Fargo)

Risks

As it pertains to the trade, any time you go short a stock there is now the risk of a meme-type short-squeeze occurring. Going short one stock, to then utilize those same funds to go long another name can compound losses, especially if both sides of the trade move against you.

Looking at this from the viewpoint of the companies’ actual businesses, we think both should hold up in this economy but if the housing market comes to a hard stop, then Wells Fargo might have some strong headwinds due to their mortgage business and recent focus on growing the credit card business (which might see losses spike if people can no longer access equity from their homes).

Worst case scenario would be that the Federal Reserve either freezes banks’ capital plans in the next 12 months because of an economic shock (like they did during COVID) and/or they keep tightening the screws on Wells Fargo if the company does not continue to make progress on improving compliance and other items the regulators wanted the company to improve upon.

How To Trade

A pair trade is supposed to be a market neutral trade, where an investor goes long in one stock for the same dollar amount as the stock that they go short in. We would go short Bank of America in order to go long Wells Fargo.

However, for those who are unwilling to sell short and go long with the essentially borrowed funds (a situation which could lead to a total loss), there are ways to minimize your capital at risk. One could utilize the options market to purchase puts on Bank of America while also purchasing calls on Wells Fargo. You would have to purchase the correct number of contracts to get the trade to balance, but by utilizing options, you would be able to manage your downside risk upfront and know from the time you enter the trade what your total downside risk is.

Be the first to comment