Andrii Dodonov/iStock via Getty Images

There really can be no peace without justice. There can be no justice without truth. And there can be no truth unless someone rises up to tell you the truth.

Louis Farrakhan, religious leader.

The retirement industry is abuzz about a new batch of lawsuits against plans that use BlackRock target date funds (TDFs). Miller Shah LLP has charged a host of plan sponsors with breaching their fiduciary responsibilities by making low fees their sole selection criterion, regardless of performance and other considerations.

They allege that BlackRock’s TDFs have underperformed and that fiduciaries weren’t even looking. The low fee requirement is ubiquitous because many have lost lawsuits for paying excessive fees.

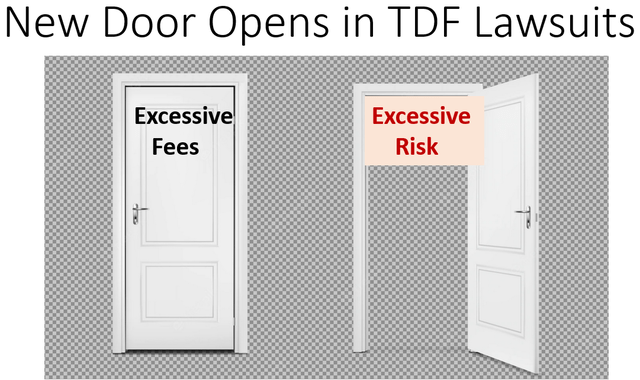

The courts will decide the merits of these new lawsuits. The important consequence is that a whole new door has been opened for TDF lawsuits, a door that can and should address a potential crime, in the same manner that lawsuits successfully corrected excessive fees.

This new door is Excessive Risk. Most target date funds are taking excessive risk near their target dates.

Underperformance in TDFs

The Excessive Fees door was the only one open for TDF lawsuits. This new door swings open performance-related lawsuits. Until now, low-risk TDFs underperformed but that pendulum is swinging to high-risk funds underperforming with losses that exceed safer funds.

The difference now is that excessive risk is becoming painfully obvious. Excessive risk was rewarded until now, but that doesn’t make it right. The Duty of Care holds fiduciaries responsible for harm to beneficiaries that should have been avoided. It’s like our duty to protect our young children, covering electrical outlets and installing cabinet latches.

Defaulted beneficiaries deserve and want to be protected as they near retirement.

Excessive risk redux

This isn’t the first time we’ve observed the potential excessive risk breach of the Duty of Care. In 2008 TDFs for those near retirement lost more than 30%, and it created a public outcry that arguably should have brought lawsuits but did not. I wrote about the potential for lawsuits in Target Date Fund ‘Safe Harbors’ Attract A Minefield Of Possible Litigation.

At that time, I interviewed a prominent ERISA attorney and asked him why there were no lawsuits, to which he replied:

Regarding fund companies: “Mutual funds are protected by a very narrow statute of limitations and those cases had to be filed back in 2009, no later than early 2010 to make it through…since no one had the right data to present to the teams who could afford to take this on effectively at that time, they were not filed and the mutual fund providers escaped the liability for their wrongdoing. We will need another 2008 to get them.”

Regarding plan fiduciaries: “Bottom line with fiduciaries, they believe any line of crap their providers tell them when it comes to DC plan monies. They simply do not vet these products effectively, some because they don’t know where to start, others because it’s not a priority. They should be sued for the adoption of the vehicles and could be successfully litigated against, but the apple is much smaller for the plan cases rather than the provider cases.”

This time is different because:

- The plaintiff’s bar is primed and ready to pursue wrongdoing. I am personally speaking to a few law firms about preparing for big losses in TDFs, possibly even bigger than 2008. The harm to beneficiaries could be disastrous.

- In 2008 TDFs held only $200 billion. Now there’s more than $3.5 trillion. The stakes are much higher.

- Our 78 million baby boomers were not in the Risk Zone in 2008. Most will spend this decade in the Risk Zone.

- TDF risk has actually increased, rather than decreased, since 2008 because the performance horse race was being won by the riskiest in my opinion. At one point, Fidelity proudly announced a risk increase to compete with the likes of T. Rowe Price.

- There are safety standards for TDFs that weren’t recognized in 2008, but are now, discussed below.

The new door has a safety standard

The new door for lawsuits is not underperformance per se. It’s excessive risk that is manifested in excessive investment losses. The definition of “excessive” can be found in surveys of beneficiaries and consultants. These surveys report that a loss of more than 10% by someone near retirement is excessive.

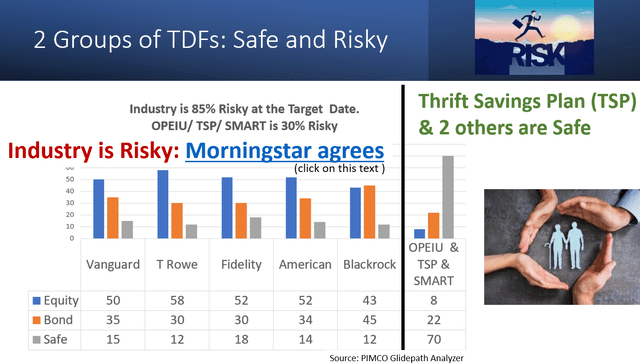

This new door requires a safety standard. Until now, Vanguard TDFs have been the standard, but a recent Congressional inquiry holds out the Federal Thrift Savings Plan (TSP) as a better standard. The idea is that TDFs should be safe at the target date. The TSP is only 30% in risky assets at the target date, while the industry is 85% risky, as shown in the following.

Two types of TDFs: Safe and Risky

Most fiduciaries only know the Risky Group of TDFs, and likely believe that they can’t all get sued, possibly equating popularity with procedural prudence. But most fiduciaries paid excessive fees until lawsuits stopped that nonsense.

Substantive prudence triumphs.

The Safe group of TDFs is small. The TSP is joined by the Office and Other Professional Employees International Union (OPEIU), one of the largest AFL-CIO unions, and the SMART Target Date Fund Index.

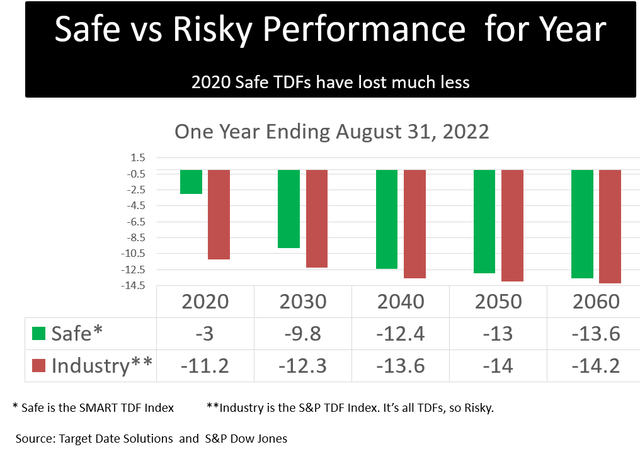

The following shows the recent performance of the 2 groups.

Target Date Solutions and S&P Dow Jones

The Industry (Risky) has “excessive” (below 10%) losses of 11.2% in its 2020 funds, versus losses of only 3% for the Safe group.

Conclusion

There are good reasons to expect continuing deepening losses in stock and bond markets that will be felt most by those near retirement in TDFs. It will get worse, in my opinion.

The greater the harm, the greater the foul.

The door is open to correct this breach of the fiduciary duty to protect beneficiaries who default their investment decision to their employer. Most assets in TDFs are there by default. It is the most popular Qualified Default Investment Alternative (QDIA).

The plaintiff’s bar is watching. They might be the heroes in the next 2008-like debacle.

Be the first to comment