LilliDay/E+ via Getty Images

We can check the bear-market box for the S&P 500 after yesterday’s dismal performance. The index is now down 22% from its January all-time high. After Friday’s report that the Consumer Price Index rose to a new high of 8.6% for May, investors are growing fearful that the Fed will raise short-term rates by 75 basis points at its meeting on Wednesday. That fear led to a steep sell off in the bond market, driving 2- and 10-year Treasury yields to approximately 3.4%, which are both highs we have not seen in more than a decade.

The rise in interest rates led to broad and indiscriminate selling in the stock market with 30 stocks declining for every 1 that advanced on the NYSE. Worse yet, 85% of the volume on the NYSE has been on the downside on each of the past three trading days, which has not happened since June 2020. Cryptocurrencies fell to new lows with Bitcoin down double digits, and even the safe haven of gold was under pressure from the strength of the dollar. This feels like capitulation in what has been one of the worst starts to a year on record.

Finviz

Yet the carnage on Wall Street can’t be seen on Main Street. Sure, consumers are in a horrible mood based on sentiment surveys, but they are still packing planes, restaurants, malls and theatres. They are attending sporting events and taking road trips. We are not booming like the early days of reopening, but there are no signs that a recession is on the horizon. That is the growing consensus among market pundits who are convinced that the lower and middles classes don’t have the savings or income to survive an 8.6% inflation rate, no matter how long it lasts. Therefore, a recession is a given.

CNBC

Markets have historically been discounting mechanisms from the standpoint that they move in advance of developments in the real economy. For this reason, the plunge in financial markets has convinced many that a long and deep recession is inevitable. At the same time, markets overshoot at extremes in both directions, and the developments markets expect don’t always transpire. If markets were always accurate in forecasting where the economy would be in 6-12 months, why were 2-year Treasury yields close to zero last fall and the S&P 500 at new all-time highs just six months ago? Could both be as wrong today as they were 6-9 months ago?

I think that if we were going to see a recession this year it would have started by now. There are no indications in the economic data that we are close to a contraction today. In fact, during the horrific month of May when the rate of inflation was at a new high of 8.6% consumers ratcheted up their spending by 0.9% above April’s total. Consumption was wide spread across goods and services with the only exception being gasoline and other energy goods. Now we learn that even gasoline consumption is on the rise year-over-year, despite the national average for a gallon of gas surpassing $5.

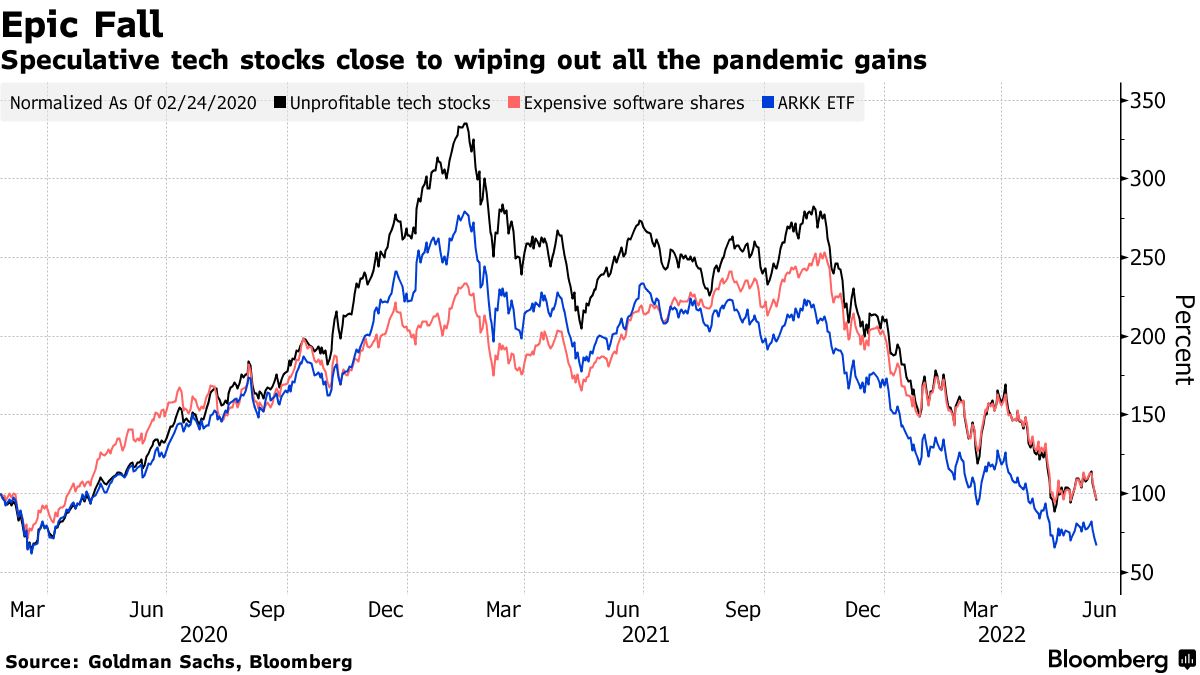

At the same time, the carnage on Wall Street has been so devastating in certain corners of the market that it feels more like a depression than a recession. The cryptocurrency market was a $3 trillion dollar industry that has now lost more than two thirds of its value. Speculative growth stocks have completely wiped out all of their bull market gains. For participants in these markets, it is a depression, but the risks appear to be largely wrung out.

Bloomberg

There is one thing I think everyone can agree upon, which is that stocks will not find support and start to recover until we see a peak in the rate of inflation and long-term interest rates. I have not given up on my second-half recovery for the S&P 500, but it has clearly been delayed and will start from lower levels than I anticipated because I was convinced that the 8.5% print for the Consumer Price Index was the peak. I was wrong. Still, I think we are very close, if not there now, and history shows us that the S&P 500 produces outsized gains from the point at which inflation peaks no matter how rapidly the rate declines. The Leuthold Group’s James Paulson noted yesterday that the S&P 500 gained an average of 13.2% over the 12-month period that followed the peak rate during the past 17 inflationary periods. It did not matter whether a recession resulted or not.

Remember that bear markets are short term relative to bull markets, and that the majority of the damage they cause tends to done once the bear-market decline is complete.

Be the first to comment