bunhill

I can’t tell you the exact day or time, but I can tell you the place. I was standing in the security line at San Francisco Airport (SFO) as I refreshed my phone’s stock quotes. That moment was very memorable when I saw my unrealized gain on a single stock now exceed $10 million.

Mind you, that was in 2012 dollars, before this last decade of inflation. I only lived in a $1,200/month apartment. Actually $600, since it was a 2 bed/2bath and half was mine. Being Los Angeles, that price was far from the lap of luxury. So yeah, an extra $10M wasn’t just pocket change.

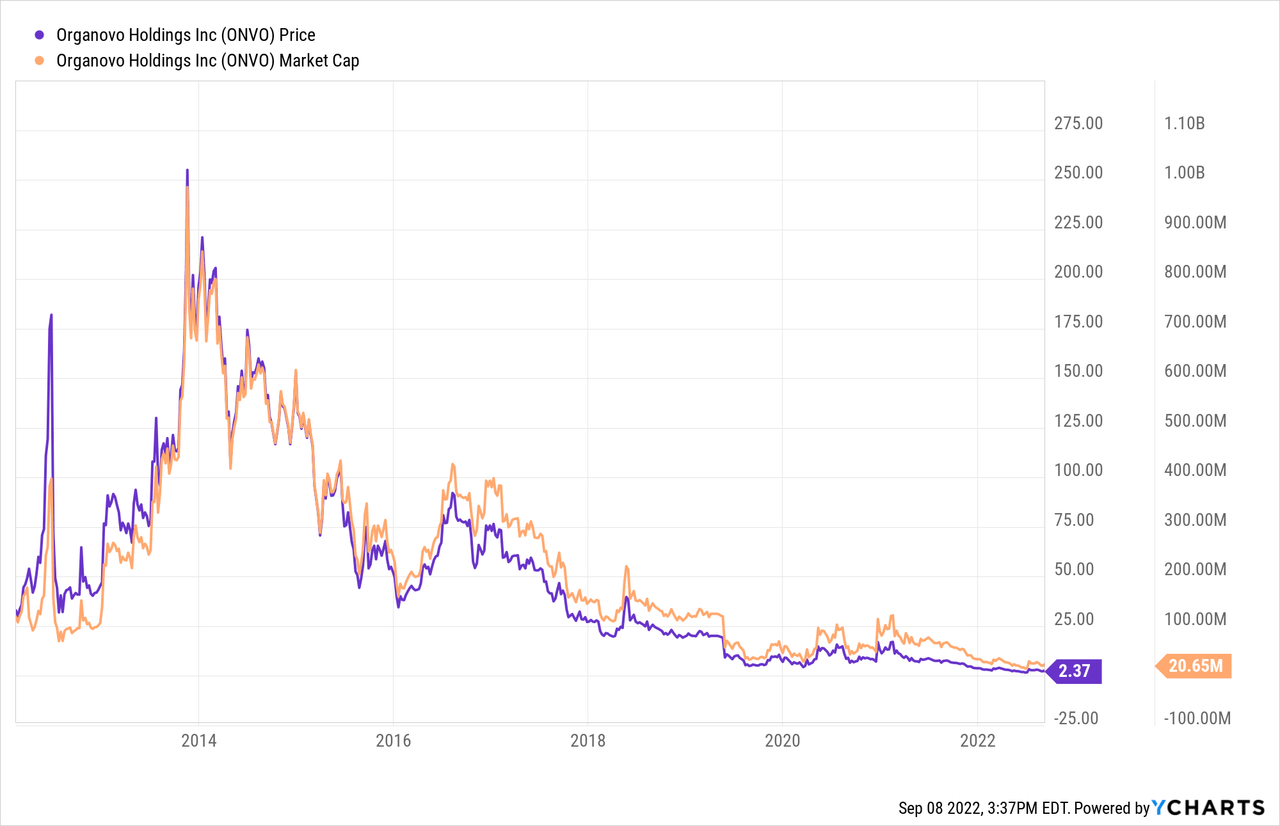

Organovo Holdings (ONVO) went public in 2012. I started investing in the company long before that, coming out of the Great Recession. At that time, you could count the employees with one hand.

I plowed virtually all of my earnings from my Internet business into this private company. If I recall correctly, I was the largest individual (non-entity) shareholder listed on their S-1 filing (aside from the founders) at the time of their public debut.

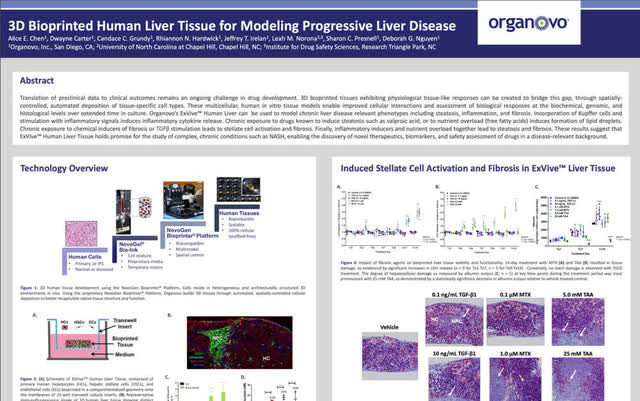

Organovo was at the forefront of what was then a relatively unknown field: bioprinting. There are about 200 different cell types in the human body. Did you ever think what would happen if you arranged them cell-by-cell, like Legos, and attempted to build a body part? Turns out, the cells know what to do once they’re in the proper configuration, even though we don’t know how or why.

By bioprinting cells into desired configurations, you can create living tissues. For example, blood vessels are made of endothelial cells (ECs), which line the inside, and vascular smooth muscle cells (VSMCs), which regulate vessel stability. Take these along with the structural support of elastin (a protein) and you can bioprint a blood vessel that can live, grow, and pump inside a bioreactor – an environment which mimics the inside of a body.

I studied every word of every issued and pending patent in this space. Organovo had a monopoly on the technology, in terms of scaffoldless bioprinting involving multiple cells.

While tissue and organ replacements may be the first uses which come to your mind; those would likely require at least a billion dollars to bring even the simplest to market. There was money to be made in the here and now doing toxicology testing for pharma companies.

Drug-induced hepatotoxicity is the most common reason drugs fail during FDA trials. About half the time. Preliminary toxicity screenings using rodent models don’t always work – e.g., those designer rats coming from Charles River Laboratories (CRL).

Organovo’s solution was to print miniature livers – using human cells – and contract out to pharma companies for testing. Each contract was in the six figures and some were seven. Within about 2 years after I started investing in them, they were bringing in around $2M in revenue annually to this. This was before going public. If they would have remained a small and efficient private company, they could have stayed the course at near breakeven.

But what do they do? The same foolish thing most growth companies do. They put the cart before the horse. Rather than scale revenue before growing, they do the reverse. Of course, growth plans never go as expected, so now you have a bloated overhead without the anticipated revenue to support it.

When money is easy to come by – as it typically is for public companies – once these startups get addicted to the drug of dilutive fundraising, they just can’t stop themselves. I swear, they’re worse than crack addicts.

Oh, and speaking of growth companies addicted to foolishly spending shareholder money, my first introduction to Cathie Wood was in 2014. That’s when she jumped on the Organovo bandwagon with her ARK Invest (ARKK) funds. Based on her positioning in multiple funds, you might argue it almost rivaled her enthusiasm for Tesla (TSLA). But to make a long story short, Organovo’s outcome was just a tad different…

That brings me to my first question for Buyandhold 2012. If you didn’t read my interview with him in July, you can check it out here. He has never sold a single share of stock in his 52 years of investing. What started as a $4k portfolio grew into $87M. Yes, he added money along the way, but about two-thirds of that came from dividends.

Buyandhold 2012’s reasoning, which I fully agree with, is that we have no way of knowing which losers may eventually turn into gigantic winners.

There are countless companies which were in dire straits, even on the verge of bankruptcy, that later went on to become 100-baggers and beyond. No one could have predicted such outcomes.

We, humans, like to think we have control over things, but ultimately, we control nothing. Even the greatest minds have knowledge which is quite negligible in the grand scheme. In addition to us all being idiots, we fool ourselves into believing we can predict the infinite variables of chance which dictate how the future unfolds.

Where I disagree with him is that there really should be a few exceptions to the never-sell rule. I agree with letting your winners ride. The whole don’t-cut-the-flowers-and-water-the-weeds thing. I also agree it’s okay to let your winners overtake your portfolio. If you started out with 20 stocks, each with a 5% weighting, and 1 or 2 grew into 70%, that’s okay in my book.

What I’m not okay with is the idea that if you started with a very concentrated bet, that you should force yourself to keep it forever. Let’s say you invested 70% or even 99% into one thing, with that weighting on day one. Isn’t it prudent to eventually take some off the table?

It’s one thing if you have a nest egg and a steady job/career. After all, if you lost it all with that concentrated bet, you still had your paycheck to count on. It’s another thing if you don’t have that or a well-off family to fall back on.

Q: Rather than a hypothetical, I wanted to start with a real-life scenario where $10M is on the line. Actually more like $20M, if we were to take the all-time highs of Organovo.

Unlike some random stock, I know this company intimately. I see they are making bad decisions, one after another. There is the retirement of the CFO I trusted and the departure of key scientific talent. Just as Cathie Wood comes along and thinks the company is going the right direction, I think they’re now going the totally wrong direction.

Should I – a self-employed college dropout – sell at least some of the stock? Your answer can’t be that I should go back in time and make a smaller investment, because we’re dealing with the facts here. Regardless of whether you agree or disagree with my past decision, that’s the situation. What should I have done in that moment – hold steady or sell some?

A: I have to contort myself into a pretzel to answer that question without admitting that it was the right decision to SELL. I said it. That word SELL. I need a drink.

Okay, here goes.

As much as it pains me to say this……and it pains me as much as it would pain my mother to say her real age…..you made the right decision when you decided to……..(I’m starting to hyperventilate)……when you decided to……please ask the women and children to leave the room…….when you decided to s-e-l-l.

There. I said it. I never thought I would live to see the day when I would say that once in a blue moon it is the right decision to sell.

But intelligence is the ability to change. So I have changed my tune on the never sell under any circumstances rule.

That’s what happens when you think too much. You find out that almost every rule has an exception. That’s why they say that ignorance is bliss until you don’t see the train coming.

Wow! He said the s-word! Now I am hyperventilating too. Never did I think I would hear such foul language out of Buyandhold 2012’s mouth. If he would have answered differently, I already had prepared in my mind about 724 similar questions. I was going to keep asking them until he finally said the s-word. Mission accomplished on first try!

For those wondering, yes I did eventually get out of Organovo. When I saw that unrealized gain in the TSA line at SFO, I was on my way back home after meeting with a potential buyer of my company.

Even though selling my company was a bigger priority than selling some ONVO, this is a good example of why you need a game plan in place before you need/want to sell an investment. You need to understand your options and the possible circumstances before they arise, because they may pop up when you’re busy and unprepared (as I was).

Since my shares were restricted, I was told by the underwriter I couldn’t sell them for 12 months. Much later I found out that was incorrect. In fact, they were selling at or near the top themselves! If I had more time to investigate this, I probably would have discovered they gave me bad info on the restrictive legend and would have taken action much earlier.

Even though I did make a few million on Organovo, it wasn’t a good investment when you consider the immense risk I took, as well as the money I left on the table by letting Wall Street suits tell me one thing while they did another. Also, I missed out on other investment opportunities I would have taken, but didn’t, because I didn’t think I could sell some to de-risk. As such, my other capital was in beyond-boring, low-risk investments.

Is “fake selling” against your rule?

Technically, I am a very active investor. However, I am not a trader. Most of my selling is related to minimizing my cost basis on a given position.

Take Micron (MU) as a recent example. Last month I bought a few hundred shares at prices ranging from $61 down to $55. When it rebounded for one day to $61 (August 25th), I unloaded my $61 shares. A few days later I bought them back at a lower price. The net effect is being left with the same number of shares, but now at a lower average cost.

Some may accuse me of trying to bottom-tick the market. Perhaps. I do like getting things at the best prices possible. However, this is really about taxes.

If you plan on selling a given stock in the near or intermediate future, then you realize the benefit of paying a higher price. This is because your gains will be smaller and hence, you will be taxed less.

However, if you never plan on selling or at least, not for many years, then that “tax break” of overpaying for a stock isn’t benefiting you anytime soon. Maybe never, if you never sell. As such, it’s way more important to get in at the lowest possible prices. After all, paying less means more money for more investments.

Q: First off, I’m telling your mom you said the s-word. I’m not sure how she will feel about this potty mouth of yours.

In today’s world of zero commission trades and the ease of doing so from your phone, you can see why I love to “fake sell” stocks constantly. Being that you started investing 52 years ago, I completely understand why you don’t. Nor did I do this when I started 22 or so years ago, given the expense of commissions relative to my miniscule portfolio. Back when you started investing, commissions were crazy and they required physical trips to the broker’s office. Of course today, you are too dumb to operate a cell phone or computer, so I wouldn’t expect this out of you now.

A: Don’t try to ingratiate yourself with me by reminding me that I am a Luddite in good standing. You managed to get the S-word out of me, which I never thought anyone could do.

Q: Well with that said, do you approve of what I call fake selling, so long as you end up with the same number of shares you initially set out to purchase?

A: NO.

Way too complicated for me.

I like KISS.

Keep it simple, stupid.

I was just a simple country boy who grew up near a tobacco farm in Connecticut. So I like to keep my investing rules simple.

No fake selling.

I hope your next question does not involve the S-word.

More money is lost in the stock market by selling than perhaps any other mistake that an investor can make. That’s why Warren Buffett says that the ideal holding period is forever. So I plan to hold all of my stocks forever or until I die, whichever comes first.

Hmm… it sounds like my continued use of the s-word is really starting to upset him. Let’s see how far I can push this. Perhaps I can manipulate him into saying the s-word again.

Q: KISS? Since you wrote it in all caps, I assume you are talking about the band. Yeah, I like KISS too. I remember doing this gig with them, in 2009 or 2010. It was a Superbowl commercial for Dr. Pepper. My job was to play a production assistant and hand Gene Simmons a can of Dr. Pepper on camera. We must have done 20+ takes of that shot alone. It was a long shoot, at least 14 hours. As you can imagine, Gene and I chatted quite a bit. He is a brilliant businessman and investor. I can tell you with near certainty, he wouldn’t approve of your close-minded investment approach. Especially related to tax benefits. So if you truly like KISS – like you claim – then you should at least be open to fake selling.

A: Is Gene Simmons the guy with the very long tongue?

He should keep it in his mouth.

And I am not at all open to fake selling. I don’t like fake things.

That’s why I don’t like breast implants. And I hate fake Christmas trees.

So no fake selling for me. In fact, no selling for me at all unless I am forced to sell by a cash buyout. That has worked for me for 52 years and I always say if it ain’t broke don’t fix it.

Although it’s not in the context I wanted, at least I am succeeding in getting him to write the word sell multiple times. Something he goes out of his way to avoid doing in comments.

What about tax loss harvesting?

Another popular form of fake selling is tax loss harvesting. Let’s say you have 100 shares of a given stock and the price has gone down 50% since your purchase. You might double down and buy another 100 shares. Then 31 days later, you sell the first lot of 100, as to make that loss realized. The end result is that you are still left with 100 shares, but you now also have a capital loss which can offset your gains elsewhere.

Buyandhold 2012 may try to give me the rebuttal that he doesn’t need capital losses, because he doesn’t have capital gains from stock sales to offset. That’s not entirely correct. On occasion, there are forced buyouts of companies he owns, which is essentially a forced sale. Also, capital losses can be used to offset gains in many types of real estate sales, business sales, and other things.

Q: I know you are trying to get out of Dodge (Connecticut) and make Florida your primary residence, with Nova Scotia your summer residence. You are selling or plan to sell your rental properties in Connecticut, as well as your house there. I assume you will have capital gains on those.

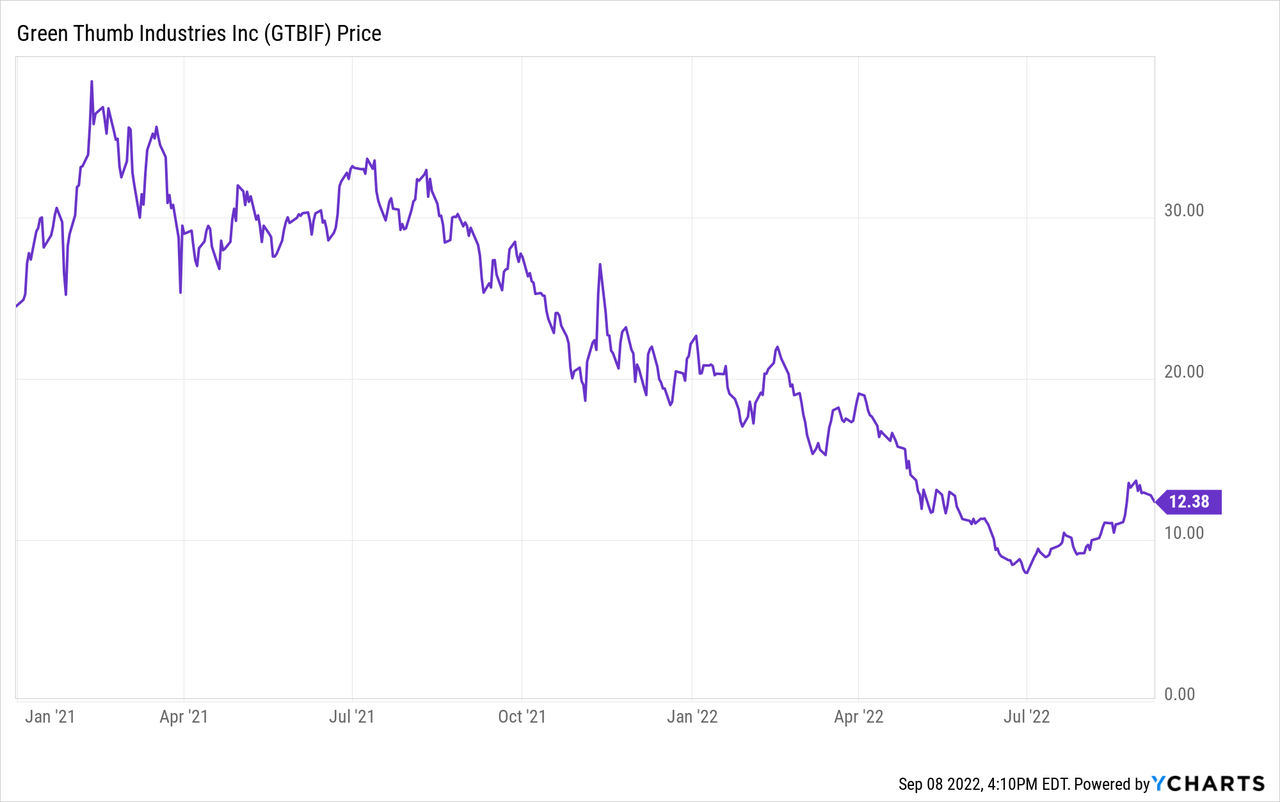

I recall that within the last 2 years or so, you purchased fuboTV (FUBO) and Green Thumb Industries (OTCQX:GTBIF). You must be down around 70-80% or more on those. Surely there are other dogs. Why not do tax loss harvesting on those as I describe, so you can reduce the tax bill on your real estate sales?

A: You had to mention Green Thumb Industries.

Did you know that is one of the worst performing stocks of the past ten years? Thank God I haven’t owned it that long. And thank God I don’t own much of it.

My worst investment was actually GE, but that’s something I don’t like to talk about.

Everyone tells me that I should do tax loss harvesting to reduce my tax bill. Everyone except my mother. And since she is the best investor that I know personally, I don’t plan to dabble in tax loss harvesting.

I look at it this way, suppose I sell Green Thumb Industries for tax loss harvesting and then it gets bought out? But the real question is: What was I thinking when I bought that awful stock?

I guess nobody bats 1,000.

Q: Yes, I know you have been immensely traumatized by GE, which is why I didn’t bring that one up. When it comes to GTBIF, remember I said fake selling, not outright selling. You could double-down on it and then in 31 days, sell your first half of the shares. That way you would realize the tax loss and at no point in time would you ever own less than the number of shares you own right now (making your buyout risk argument null). So, why not do that?

A: Why not?

Because my understanding of “fake selling” is fuzzy at best.

I feel as if I am looking at a television that needs horizontal and vertical adjustment. I just don’t quite get it. And that’s an understatement.

Warren Buffett used to say “buy what you know.” Peter Lynch said the same thing. The same thing applies to types of investing. I don’t really understand “fake selling” any more than I understand “naked puts.”

So until I am reincarnated into an investor who understands “naked puts” and “fake selling,” I won’t be doing either one of them.

Hmm… as dumb as he may be with technology, he’s certainly not dumb. However, I suspect he’s playing dumb here because otherwise, he would have to admit that the selling strategy I propose makes sense for him to do.

In part two, we will find out exactly what will happen to his fortune when he dies. I assure you, there are some harsh criticisms I put forth when I hear his plan! We’ll also hear his thoughts on a few stocks, including the number one he is itching to buy. However given the length of the interview, the editors asked if I could break it up, so you’ll have to wait a bit to find out.

Be the first to comment