MarsBars

Buying beaten down stocks takes a certain amount of financial and mental fortitude, as is the case right now with former “can’t go wrong” companies such as Amazon (AMZN) and Meta Platforms (META). While those are indeed popular with bargain hunters at the moment, they may not be right for all investors, especially those who rely on income rather than capital gains.

This brings me to Hanesbrands (NYSE:HBI), which is now trading cheaply while giving investors an 8%+ starting yield. In this article, I highlight why HBI is worth a look for bargain-hunting income investors, so let’s get started.

Why HBI?

Hanesbrands is a consumer goods company that produces a range of basic apparel for men, women, and children. It operates through the business segments of Innerwear, Activewear, and International, and over the last 12 months, generated $6.6 billion in total revenue.

HBI stock has been hit hard over the past 12 months, falling by 58% from a high of $18.60 to just $7.20 at present. Of course, the company has seen its share of challenges, with supply chain challenges and a cyber ransomware attack that cost the company $100 million in lost sales, due to its inability to fulfill orders during a three week period in its second fiscal quarter. These factors have led to a 12% short interest in the stock at present.

Moreover, HBI is facing a difficult comparable, as net sales fell by 14% YoY (down 11% constant currency) during its second fiscal quarter. While this may seem like a negative on the surface, it’s worth noting that HBI was a big beneficiary during 2020 and 2021, when many consumers were working and spending more time at home, resulting in very robust at-home comfort wear. Despite the one year decline in sales, HBI’s revenue is still up by 75% on a two-year stacked basis.

Despite HBI’s current challenges, I see promise in its full potential plan, as it seeks to drive efficiencies in its supply chain. This includes consolidation in the Champion distribution network in the U.S., and adding automation to several distribution centers to improve picking and sorting speeds while lower costs.

Furthermore, I see plenty of value in HBI’s brands as it holds a leadership position in innerwear, and Champion is a strong brand that is gaining increasing popularity in North America, Asia, and Europe. Plus, management is focused on innovation across its family of brands, as the CEO noted during the recent conference call:

I’m very pleased with how our Total Support Pouch with X-Temp is performing, both in the US and Australia. This is the first time we’ve launched innovation globally and supported it with a global marketing campaign.

Our Retro Rib product from Australia was launched in the United States under the Hanes brand and is exceeding our expectations. Our top customers are very pleased with the consumer response and we expect to gain additional retail space.

We’re also building innovation platforms around absorbency. We believe this is a meaningful opportunity under our Hanes and Bonds brand, with lots of different usage occasions, ranging from adult and child absorbency to post pregnancy needs for women.

And this is just the start. Our product and innovation pipeline is full. We have a lot of big ideas across our basics and intimates brands that we expect to drive continued retail space gains. I look forward to sharing more of our innovation pipeline toward the end of this year and into 2023.

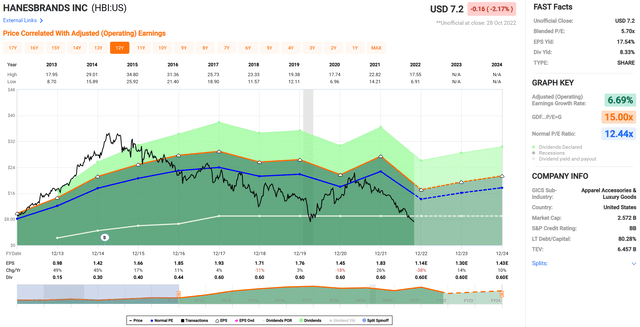

One area that I see potential for improvement is the BB rated balance sheet, and a long-term debt to capital ratio of 80%. This is due in part to HBI’s string of acquisitions in recent years, and I’d like to see leverage trend down. Nonetheless, I see the risks as having more than baked in to the current share price of $7.20 with a blended PE of just 5.7, sitting far below its normal PE of 12.4 over the past 10 years.

HBI Valuation (FAST Graphs)

Notably, HBI’s share price weakness has driven the dividend yield to 8.3%. The dividend is also well-covered by a 37.7% payout ratio. S&P Capital IQ has an average price target of $11.55, implying potential for very strong double digit returns including the dividend.

Investor Takeaway

Despite recent challenges, I believe that Hanesbrands is an attractive investment opportunity at its current share price. I like the company’s focus on driving efficiencies in its supply chain and its strong portfolio of brands. While the balance sheet could be better, I believe the risks are more than priced into the stock at present. With a healthy dividend yield and upside potential to the average price target, I believe Hanesbrands is worth considering for value and income investors.

Be the first to comment