cofotoisme/E+ via Getty Images

A Quick Take On nCino

nCino (NASDAQ:NCNO) recently reported its financial results on June 1, raising revenue estimates for fiscal 2023.

The company provides a software platform for banks to modernize their IT infrastructure and offerings.

Given the worsening macroeconomic environment which may slow sales cycles from increasingly cautious prospects or customers, I’m on Hold for nCino in the near term.

nCino Overview

Wilmington, North Carolina-based nCino was founded to develop cloud-based financial software to assist financial institutions in serving their customers in an efficient and modern manner.

Management is headed by president and Chief Executive Officer Mr. Pierre Naude, who has been with the firm since its founding and was previously Divisional President of S1 Corporation and Vice President and Managing Partner of Unisys.

nCino’s partners include:

-

Consulting Partners – Large- and medium-sized consultants

-

Technology Partners – Financial technology providers

The company’s primary offerings include:

-

Deposit account opening

-

Commercial loan origination

-

Retail loan origination

-

Auto loan decisioning

-

Document management

-

SBA

-

Collateral management

-

Specialty lending and administration

The firm sells multi-year, non-cancellable subscription contracts on a direct sales basis.

nCino markets its offerings on what is called a ‘land and expand’ basis, where a sale is made for a limited set of software tools and the firm seeks to expand its sold offerings within the financial institution as it produces successful outcomes in the first implementations.

nCino’s Market & Competition

According to a 2019 market research report by Gartner, the global market for financial institution IT spending was $63 billion in 2018, of which 29%, or about $18 billion, was for vertical-specific software.

Gartner also estimates that the demand for cloud-based delivery of software to financial institutions will grow at a CAGR of 17% from 2018 to 2023, reaching $29 billion in total value by the end of 2023.

Also, management commissioned a study by Grata that estimated the firm’s serviceable market at more than $10 billion.

The breadth and depth of nCino’s offerings may give it an advantage in a market where vendor bloat may be seen as a negative due to increasingly complex integration overhead.

nCino’s Recent Financial Performance

-

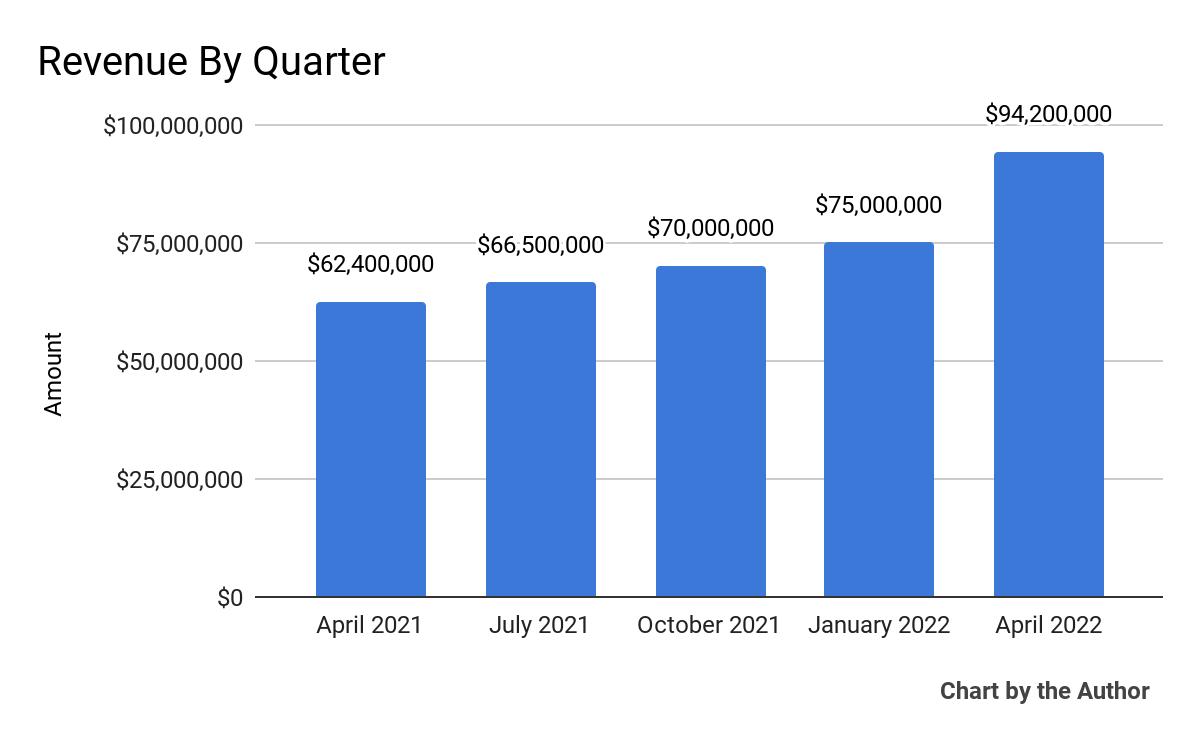

Total revenue by quarter has grown over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

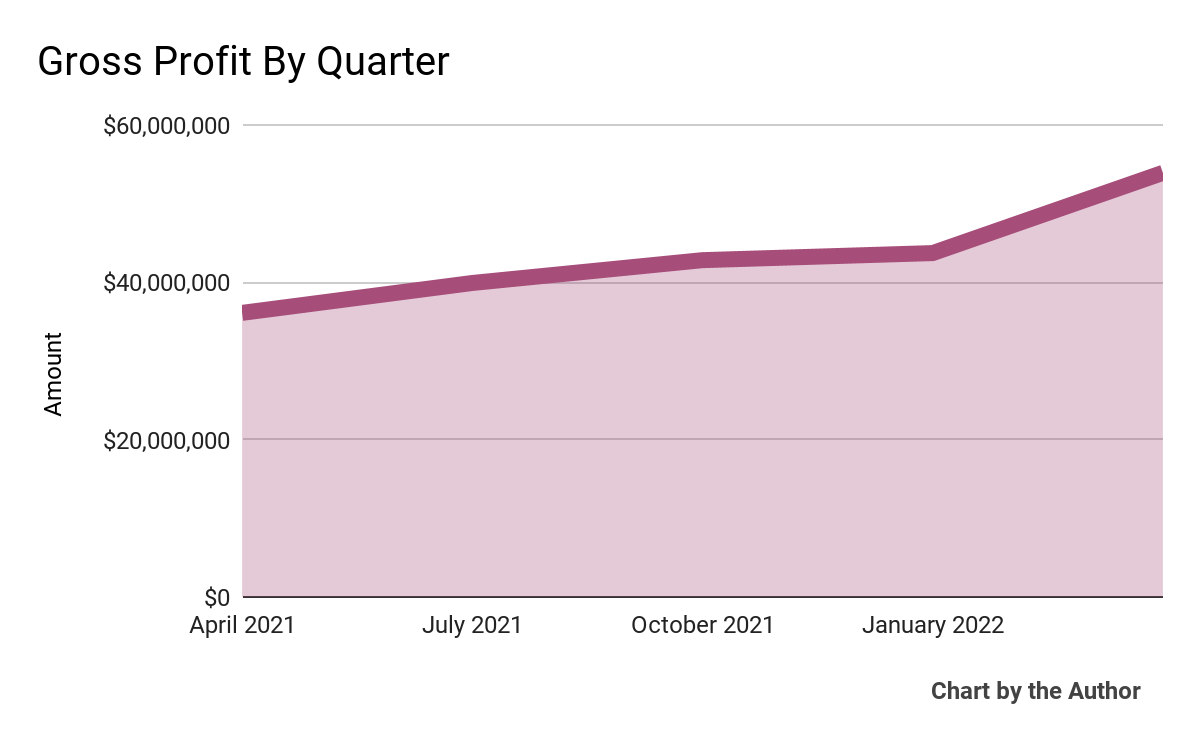

Gross profit by quarter has also grown considerably, as the chart shows below:

5 Quarter Gross Profit (Seeking Alpha)

-

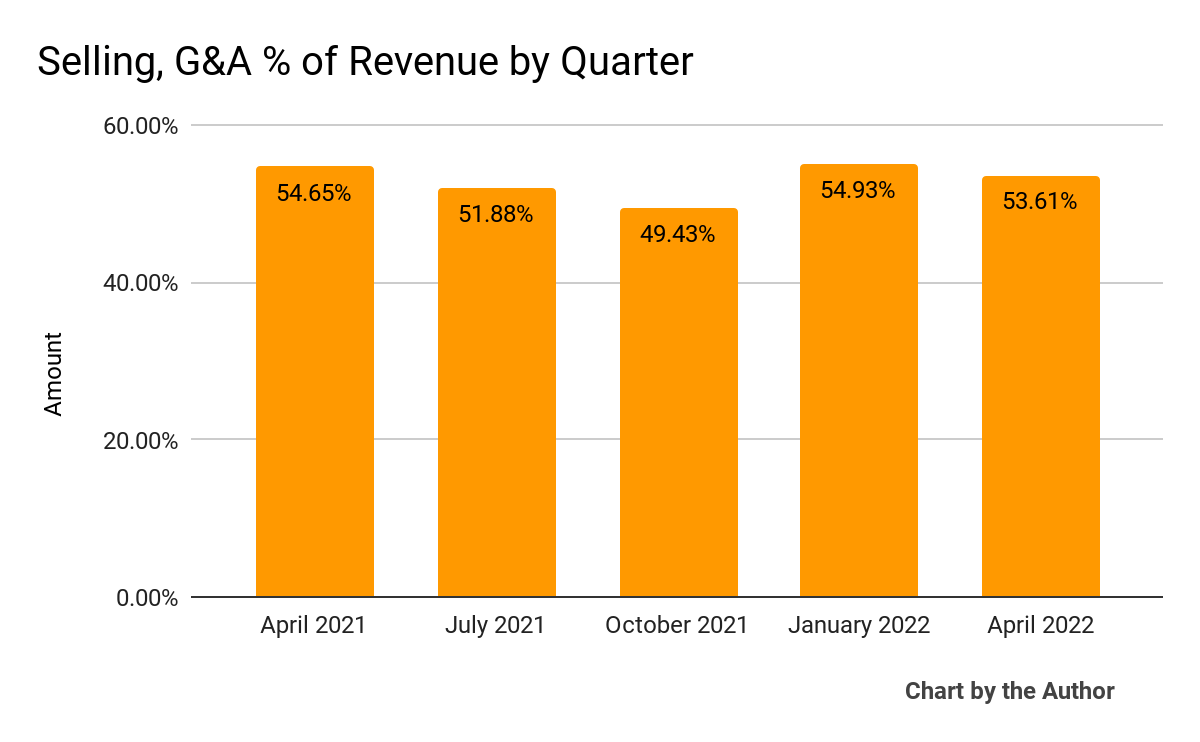

Selling, G&A expenses as a percentage of total revenue by quarter have remained in the 40s and 50s percentiles over the past 5 quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

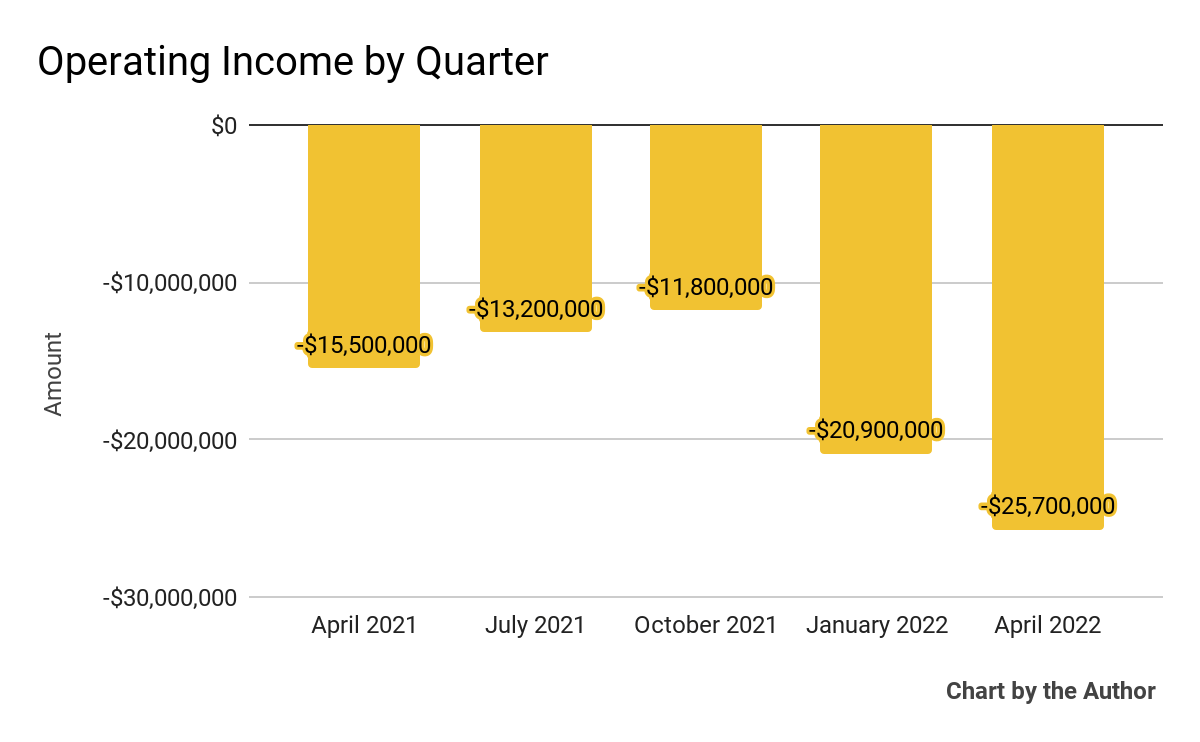

Operating income by quarter has trended lower in the past two quarters:

5 Quarter Operating Income (Seeking Alpha)

-

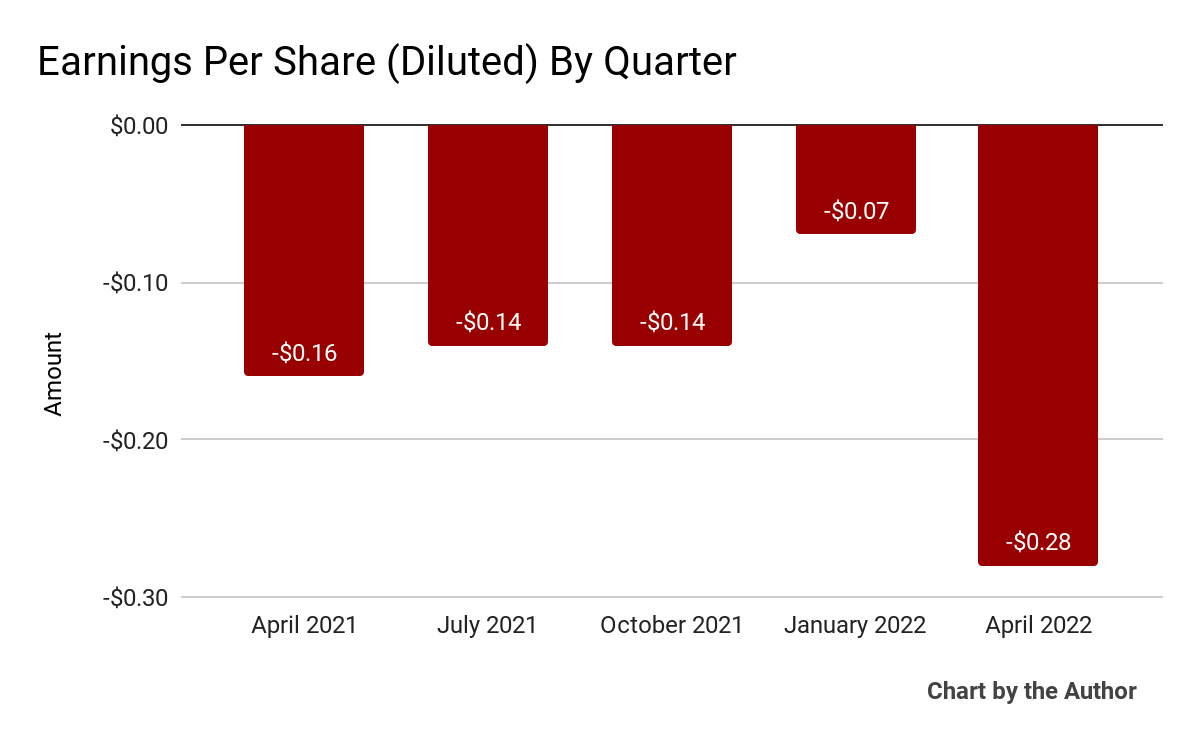

Earnings per share (Diluted) have also remained negative in the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

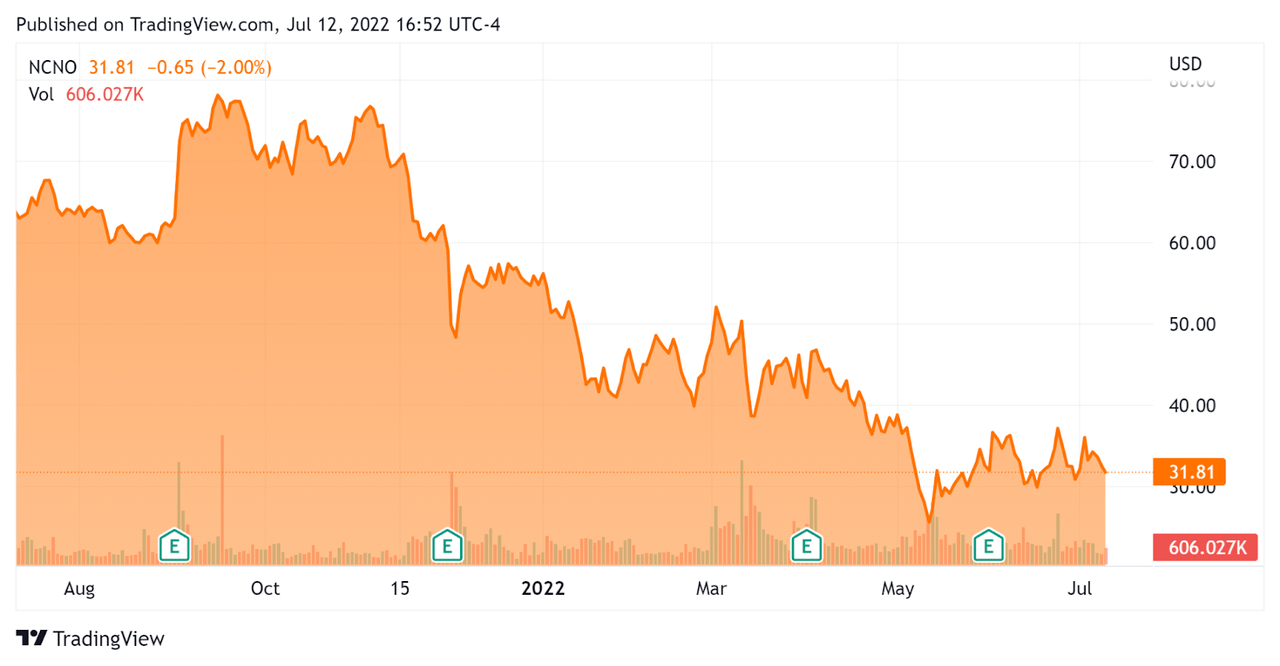

In the past 12 months, NCNO’s stock price has fallen 50.3 percent vs. the U.S. S&P 500 index’s drop of around 12.8 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For nCino

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$3,550,000,000 |

|

Market Capitalization |

$3,580,000,000 |

|

Enterprise Value / Sales [TTM] |

11.61 |

|

Price / Sales [TTM] |

10.68 |

|

Revenue Growth Rate [TTM] |

37.75% |

|

Operating Cash Flow [TTM] |

-$25,540,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.45 |

(Source – Seeking Alpha)

As a reference, a relevant partial and much larger public comparable would be Jack Henry & Associates (JKHY); shown below is a comparison of their primary valuation metrics:

|

Metric |

Jack Henry & Associates |

nCino |

Variance |

|

Enterprise Value / Sales [TTM] |

7.20 |

11.61 |

61.3% |

|

Price / Sales [TTM] |

7.19 |

10.68 |

48.5% |

|

Operating Cash Flow [TTM] |

$497,210,000 |

-$25,540,000 |

-105.1% |

|

Revenue Growth Rate |

11.2% |

37.8% |

238.0% |

(Source – Seeking Alpha)

Commentary On nCino

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted that its bank customer base is ‘well capitalized to date and are still looking to deploy capital to its highest use.’

Furthermore, a rising interest rate environment tends to favor banks in the sense that it can remove some of the interest margin compression seen during very low interest rate periods.

Also, lenders are looking to find operational efficiencies, which the firm’s SimpleNexus automated eClose product can help.

As to its financial results, total revenue grew by 51% year-over-year to $94.2 million, with subscription revenue accounting for 84% of total revenue.

Gross margin improved due to better subscription product mix but GAAP operating losses worsened considerably, reversing the company’s previous slow progress toward operating breakeven.

For the balance sheet, NCNO finished the quarter with $78.7 million in cash and equivalents but used $3.4 million in free cash flow. Its fiscal first and second quarters typically generate cash while its third and fourth fiscal quarters typically use free cash.

Looking ahead, management raised its full-year revenue guidance up to 52% subscription revenue growth and expects to reach non-GAAP operating breakeven and positive free cash flow sometime in fiscal 2024.

Regarding valuation, the market is currently valuing the stock at a forward EV/Revenue multiple of around 8.8x.

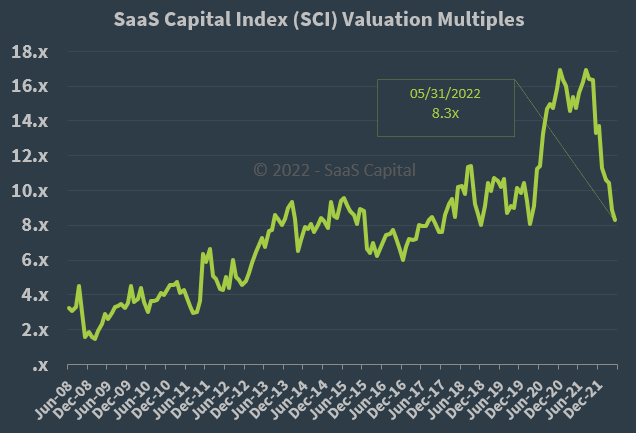

The SaaS Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 8.3x at May 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, NCNO is currently valued by the market at a slight premium to the SaaS Capital Index, at least as of May 31, 2022.

The primary risk to the company’s outlook is a global slowdown or recession, which would slow revenue growth and potentially worsen operating losses.

The company’s worsening GAAP operating losses combined with a recession we may already be in lead me to be cautious on the stock in the near term, although it has seen some support from equity analysts at KeyBanc, Piper Sandler, and Truist.

Given the worsening macroeconomic environment which may slow sales cycles from increasingly cautious prospects or customers, I’m on Hold for nCino in the near term.

Be the first to comment