Sezeryadigar

Value investing has been a term used by many. However, the practice of value investing changes from investor to investor. Slight changes in investing processes is only normal due to varying risk tolerances and goals. One of the founders of value investing is Benjamin Graham, better known for his book “The Intelligent Investor”. Graham was also a teacher of the most famous investor of all time: Warren Buffet.

Graham’s number

Throughout the years, Benjamin Graham created a formula to calculate the maximum price an investor should be willing to pay for a security. Anything below the calculated price means the security is undervalued and signals a possible entry point.

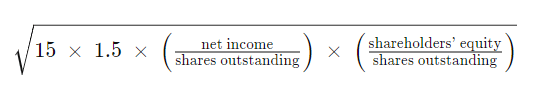

The formula to calculate Graham’s number takes a maximum price-to-earnings ratio of 15x and a maximum price to book value of 1.5x into account. As a result, Graham’s number can be calculated with the following formula:

Investopedia

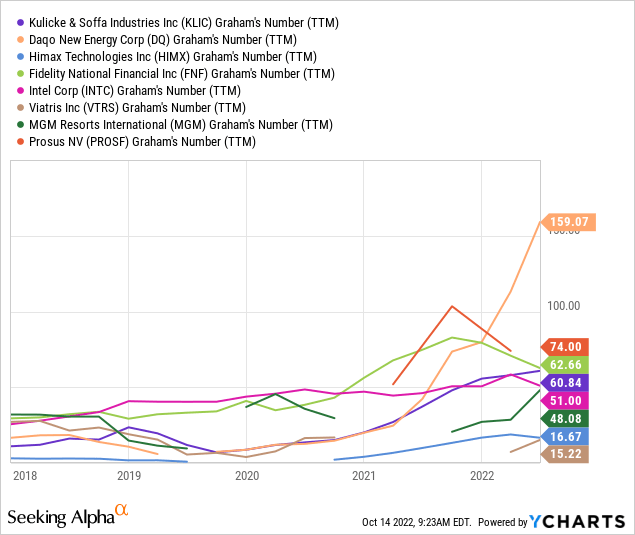

It is important to understand that this formula covers just two metrics, subsequently it is not an absolute way to analyze your stocks. Nonetheless, it can still be a useful tool to see how strongly undervalued your investment is in the present. Therefore, I have ran Graham’s formula through my portfolio and found quite some candidates.

| Ticker | Stock price (16/10) | Graham’s number | Upside potential |

| KLIC | $37.50 | 60.84 | 62.24% |

| DQ | $50.72 | 159.07 | 213.62% |

| HIMX | $5.27 | 16.67 | 216.31% |

| FNF | $37.91 | 62.66 | 65.28% |

| INTC | $25.91 | 51.00 | 96.83% |

| VTRS | $9.55 | 15.22 | 59.37% |

| MGM | $30.64 | 48.08 | 56.91% |

| OTCPK:PROSF | €51.15 | 74.00 | 44.67% |

The stocks in my list are either unrecognized and underappreciated or have extremely bad sentiment. For the that reason, the stocks have little room to go lower based solely on a valuation viewpoint. Although this is the first time I am plotting my stocks centered on Graham’s number, the upside potential does align pretty well with my own valuation strategy. Currently my highest weighted stock is Daqo New Energy, on the other hand Prosus is my lowest weighted stock in this list.

Do keep in mind that external risks can underappreciated a stock more or less predicated on the risk factor. For that reason, it is not wise to weight your portfolio only around the possible upside potential. The risk-reward balance must be favorable at all times.

Kulicke and Soffa Industries Inc. (KLIC)

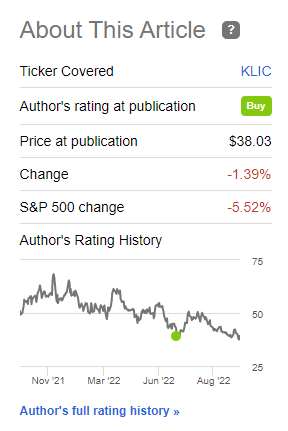

Kulicke and Soffa designs and manufactures capital equipment and tools used to assemble semiconductor devices. Since my last article on KLIC the stock has outperformed the S&P 500.

Seeking Alpha

I concluded back then:

Kulicke And Soffa Industries is well-positioned for the future with a proven track record that supports their business performance. The stock is a great pick for value investors that love to pile into (misleading) bad sentiment. Furthermore, the company is grossly undervalued compared to its peers and has the balance sheet to survive a cyclical downtrend. For these reasons, I assign a Buy rating on Kulicke And Soffa Industries.

The thesis I prescribed back then still applies: patience will be rewarded. At the moment, a cyclical downturn might be imminent. Nonetheless, the strong balance sheet will protect the downside with, inter alia share buybacks.

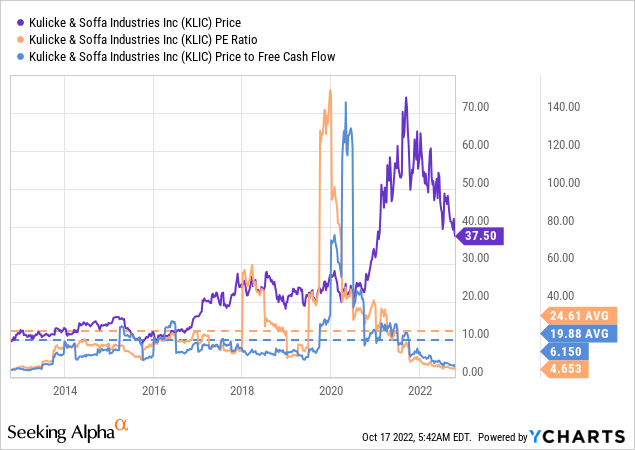

Historically, the company is trading at fairly low valuations. If earnings would be cut in half the company would still trade at a discount compared to past valuation.

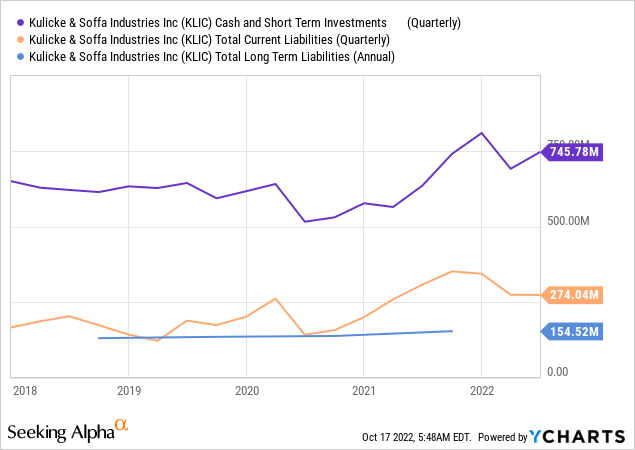

The fortress balance sheet and the low valuation confirm that this stock has little room to go lower. The company has 34% of their market cap in cash and short term investments combined with $274million in current liabilities and $0 in long term debt.

Daqo New Energy Corp. (DQ)

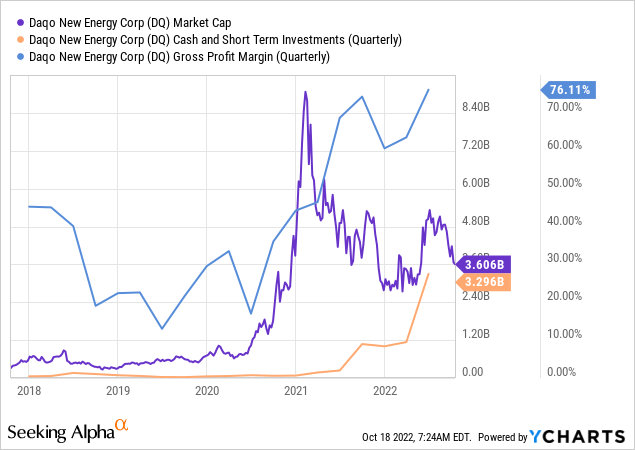

Daqo New Energy is a high-purity polysilicon manufacturer based in China. The company has designed an extremely efficient rate between the amount of polysilicon obtained and the production costs. Since my last article on DQ, the stock has fallen together with the whole solar industry. Nevertheless, I am still convinced it will outperform the market by a wide margin.

Seeking Alpha

My takeaway in the article:

The market trend is going in the right direction, making Daqo New Energy one of the most profitable companies. In addition, the strong operational performance and management decisions lead the company to a bright future. N-type polysilicon prevents new players from entering the market and give Daqo a greater chance in achieving long-term success. For these reasons, I assign a Strong Buy rating on Daqo New Energy.

On the 14th of October, the company announced a 5-year polysilicon deal with Shuangliang Silicon Materials ( 双良硅材料 ) to supply their fast growing solar wafer business. Xinjiang Daqo and Inner Mongolia Daqo will provide Shuangliang with a total amount of 150,300 MT high-purity mono-grade polysilicon from 2022 to 2027. Currently, this is more than the production volume in the full year of 2022.

On the 18th of October, the company announced another 5-year polysilicon deal with a solar manufacturing company with a total supply of 46,200 MT from 2023 to 2027.

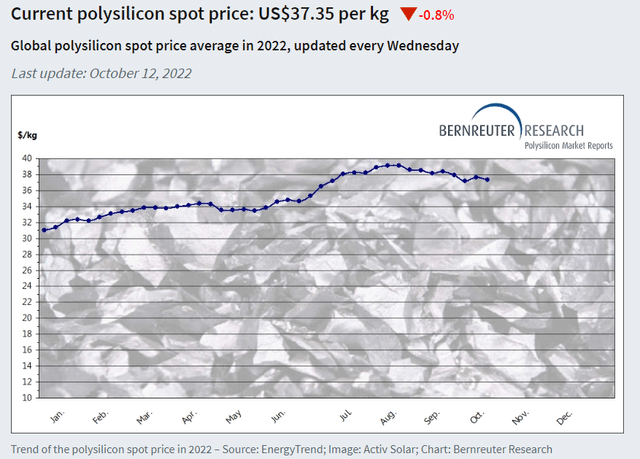

The stabilization of high polysilicon prices give Daqo abnormal earnings, which result into a fortress balance sheet and no debt. The wafer expansion is still higher than the polysilicon expansion, causing gaps in supply and demand. With no signs yet of lower polysilicon prices, investors could expect high dividends or share buybacks. Once the China-U.S. auditing problems are resolved, this stock could reach new-highs rather soon.

Bernreuter

Himax Technologies, Inc. (HIMX)

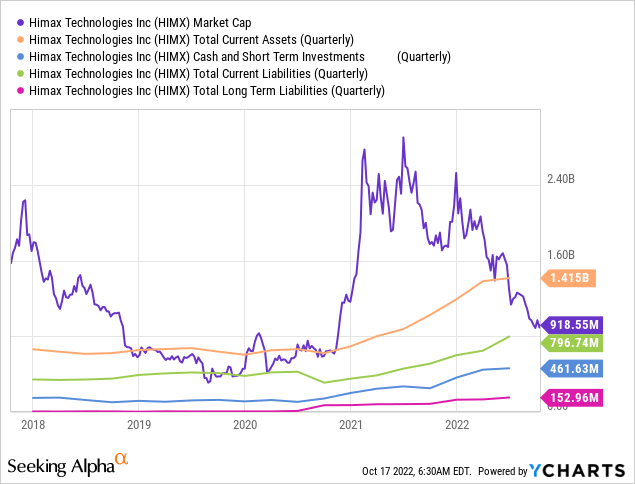

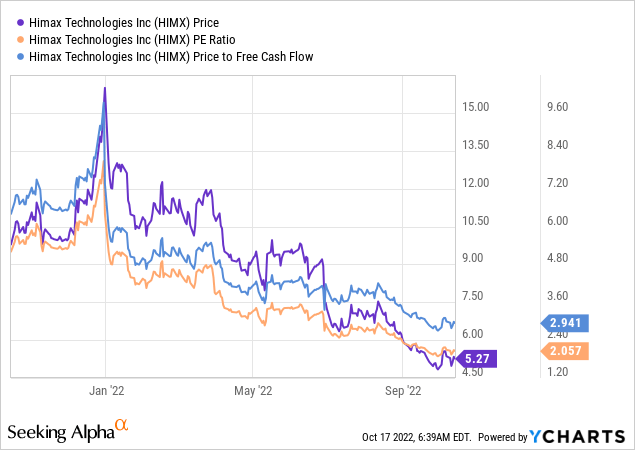

Himax is a fabless semiconductor company that designs chips for mostly display solutions. The company is growing revenues fast in the automotive industry, which improves their product mix. As a result, Himax has now a higher margin business. Like I said above, a cyclical downturn in the semiconductor industry might be imminent. However, the stock seems to be already priced for the worst.

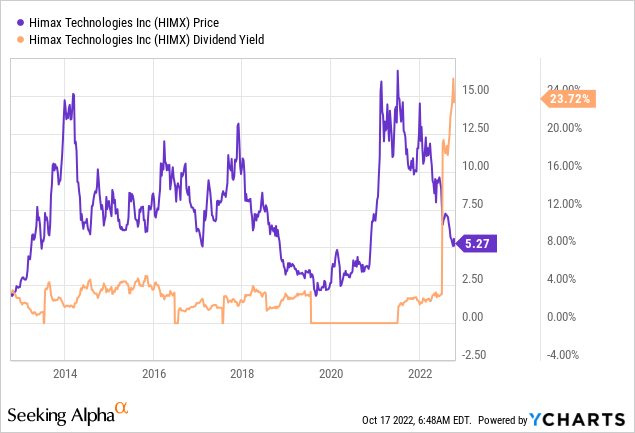

Himax has a lower margin business and long term performance than Kulicke & Soffa industries, for that reason I think KLIC offers a better risk-reward balance. That aside, Himax offers a great dividend at current prices. The question is how stable earnings will be going forward.

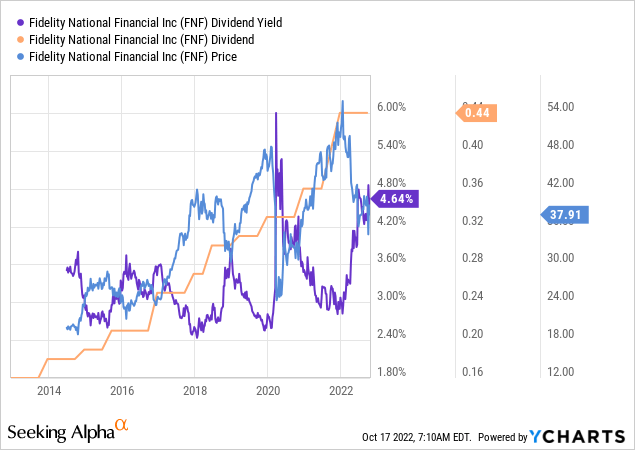

Fidelity National Financial, Inc. (FNF)

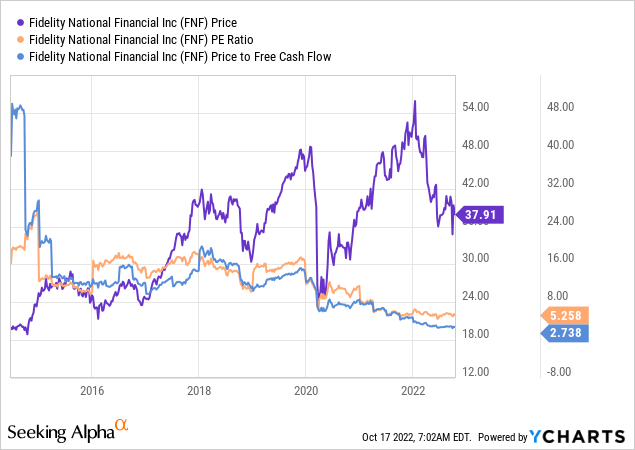

Fidelity National Financial is a title insurance and settlement services provider for the real estate and mortgage industry. Historically, the stock is trading at all-time low valuations, caused by weakness in the title business.

Every time, the dividend yield of Fidelity hit a high it meant you should buy the stock. In my view, it is no different this time. The 4.64% is very attractive at current valuation. FNF is a very safe dividend stock with a 22% payout ratio and a 6 year growth of dividend.

Thomas Lott wrote a great full analysis on Fidelity National Financial, in case you are interested to know more. In his latest article he concluded this:

Even better, FNF is extremely cheap. The spinoff should unlock some value in Q4 too. On the negative side, the headwinds to the title business are real but well known at this point. This is a more than average cyclical/volatile industry. Hard to see it not priced into the stock barring a Great Depression.

EPS and home financings peaked in Q2 2021 so we may have another couple of quarters of tough comps. But seem to be fast approaching a bottom.

In contrast to the title business, F&G benefits from higher interest rates and has kept earnings from falling too much.

Finally, we have to mention that we view the business model as best in class. No question it is extremely cash generative. EBITDA is $3.0 billion and capex only $130 million give or take. Management is top notch too. The F&G acquisition was a home run. A great compounder here.

In housing, our long term view is that inflation likely drives home prices higher, but in a worst case is down in the single digits next year. There is a huge shortage of homes in this country, and as wages move higher with inflation, affordability improves.

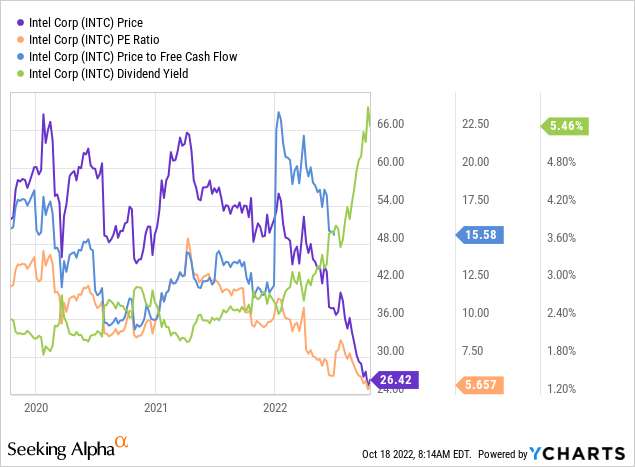

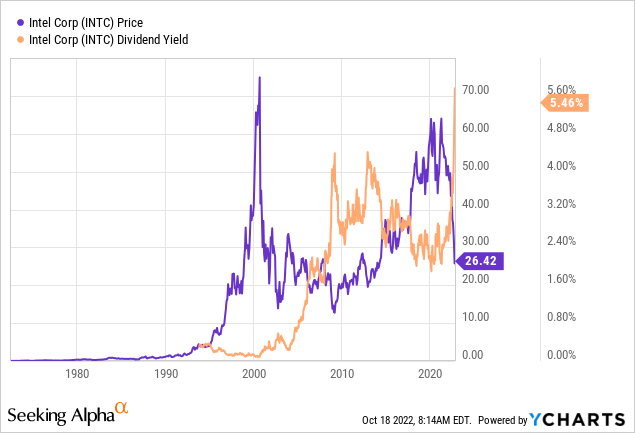

Intel Corporation (INTC)

Intel is the largest semiconductor company by revenue, which makes it a real blue chip company. Intel is well discussed on Seeking Alpha and has a strong bull and bear side. In my opinion, it is currently hard to be a bear on Intel. Although I am informed about the competition from Nvidia (NVDA) and AMD, it still doesn’t really bother me. Solely based on revenue both Nvidia and AMD are still smaller companies compared to intel. But they are worth equal the amount or even more than Intel. Therefore, I think Nvidia and AMD have too many bulls and Intel has too many bears.

Bad sentiment always opens up opportunities for value investors. At current valuation, it is hard to see much downside risk on the stock. Next to that, the dividend yield is a great bonus to wait for the turnaround in growth. Intel has been a great investment before at peaking dividend yields.

Free cash flow has turned negative to fund new investments. A cut in dividends could be imminent, these funds have a good place in share buybacks or to help speed up the turnaround process. To get returns from intel you will have to be patient and look for an investment horizon of at least 5 years.

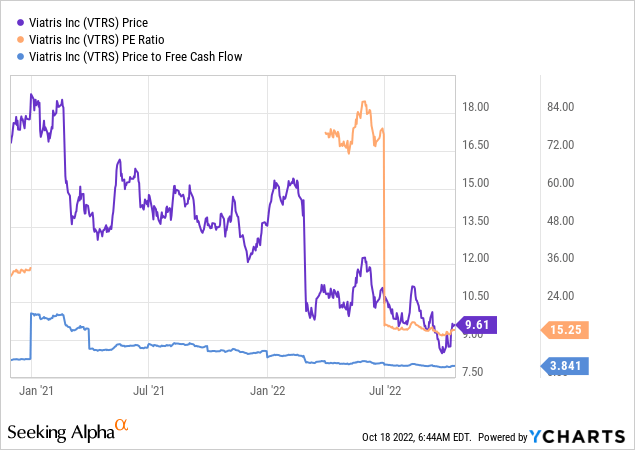

Viatris Inc. (VTRS)

Viatris is a pharmaceutical company, that was formed through a spinoff-merger of Mylan and Upjohn (a division of Pfizer (PFE)). A spinoff is the epitome of the Efficient-Market Hypothesis being incorrect. The imbalance of short term supply and demand can create underappreciated stocks, for example caused by the institutional selling of a small-capitalization spinoff.

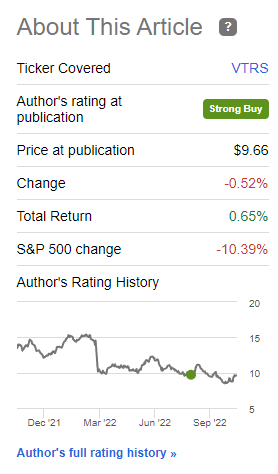

Since my latest article on Viatris, the stock outperformed the S&P 500, which might signal that we are near a bottom for this stock.

Seeking Alpha

On the 1st of August, I concluded:

I rate Viatris a Strong Buy below $10 per share. The risk reward balance is favorable for long-term investors. The dividend yield and the undervaluation are too attractive to ignore. Looking at the high free cash flow yield and EV to EBTIDA ratio, few peers are even close to Viatris. Additionally, The management team is aware of the risks and is proactively keeping them at bay. Finally, a buyback program can boost the stock price into a positive momentum environment.

So far, my thesis has not changed.

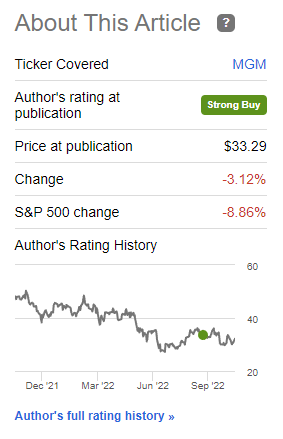

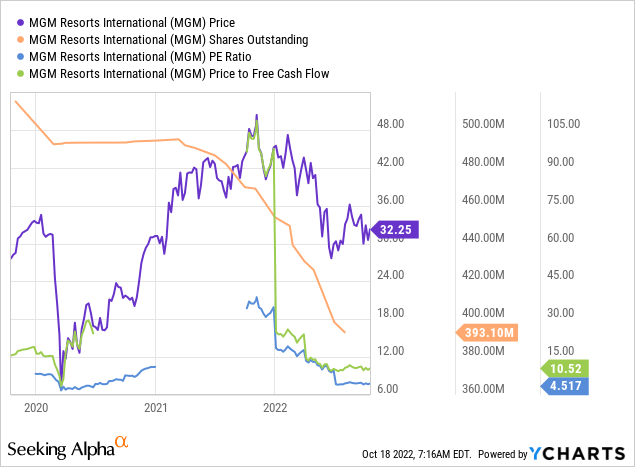

MGM Resorts International (MGM)

MGM Resorts is an American global hospitality and entertainment company. The company has been recovering fairly well after the COVID-19 crisis. Surprisingly enough the stock has outperformed the S&P 500 since my latest article, while Jamie Dimon warns that the U.S. is likely to tip into a recession.

Seeking Alpha

On the 27 of August, I concluded:

I rate MGM Resorts a Strong Buy at $35 per share. The company’s business performance and management execution led to a great recovery after the pandemic. At the current price, long-term investors are likely to get rewarded. The stock is undervalued, while investors ignore the possible recovery of the business in Macau together with the growth and expected profitability of BetMGM. Finally, the buyback program shows investors that the business is healthy and will reward investors.

A recession is definitely a risk for the casino business. Nonetheless, at the current valuation there seems to be a support level. The high amount of share buybacks can also prevent the stock from going lower.

Prosus is a global investment group and one of the largest technology investors with investments in Tencent, Bux, Delivery Hero, Trip.com and many more. Tencent is by far their largest holding with a value around $84.8 billion compared to their total asset value of $116.5 billion.

The company has recently decided to do a share buyback program to close the discount to its net asset value (NAV).

To get a view of the whole picture you should check out the article of Heavy Moat Investments. I agree with his following takeaway:

Considering that Prosus is committed to getting this discount to acceptable levels(which I assume are around 10-25%) there is still enough upside in the stock and I rate it a buy. The company still has risks and valid reasons to trade on a discount, just the amount of discount is still quite exaggerated. I will continue to hold onto my shares as long as the discount gap is wide, but contrary to my usual buy and hold strategy, I am planning to sell out of Prosus eventually.

Takeaway

Stocks of all types and sizes are declining in price, as the S&P 500 is fighting in bear territory. The time has come to reassess the risk-reward balance on your favorite stocks to experience excellent long-term returns. Investing can’t be done without bulls and bears, that is why I want to hear from you. Write down your opinions in the comment section below. Thank you for taking your time to read my article.

Be the first to comment