SIphotography/iStock via Getty Images

Introduction

It was just three weeks ago I wrote my first Micron (NASDAQ:MU) article in over two years. In that article, I shared the price at which I would start buying Micron stock. The price I was referring to was $49.23, which Micron recently hit. And so, as promised, I bought my first of two potential tranches in the stock with an approximate 1% portfolio weighting. Soon after my Micron article, I also wrote articles on Nvidia (NVDA) and Advanced Micro Devices (AMD) where I shared the same purchasing strategy I have with Micron, along with my buy prices for those stocks as well. Currently, Nvidia and AMD stock are about 15% away from their respective buy prices, but I suspect soon enough they will follow Micron’s lead and fall down to buyable levels as well.

Since I recently wrote full articles on each one of these stocks explaining my full buying strategy, and at the end of this article I share links to those articles for the specifics regarding each stock. Many readers, particularly AMD shareholders, took serious issue with my buy prices for the stock, especially the deep ones. So in this article, I’m going to include some specific reasoning as to why I have two buy prices for these three particular stocks, and why the second buy price appears to be so deep. Additionally, I will also share six general lessons about investing in deeply cyclical semiconductor stocks to help add some color as to why my strategy includes such deep buy prices.

Lesson #1: History is more powerful than narratives

Often when I warn investors about the dangers or potential downside of deep cyclical stocks like Micron, Nvidia, and AMD, many of the responses that I get are effectively telling me “It’s different this time.” And, it just so happens that the narrative about things being “different this time” is often true. But here is the thing: When the narrative is true is when following it is often most dangerous. The reason for that is because often the way investors process the “It’s different this time” narrative is to think that because the business metrics are better than they have been in the past, it follows that the stock price will behave positively as well. And the truth is, that when it comes to the stock prices of historically deeply cyclical businesses, history will almost always overpower the prevailing narrative and sell the stock price into a deep decline, even if it’s true that things are different this time.

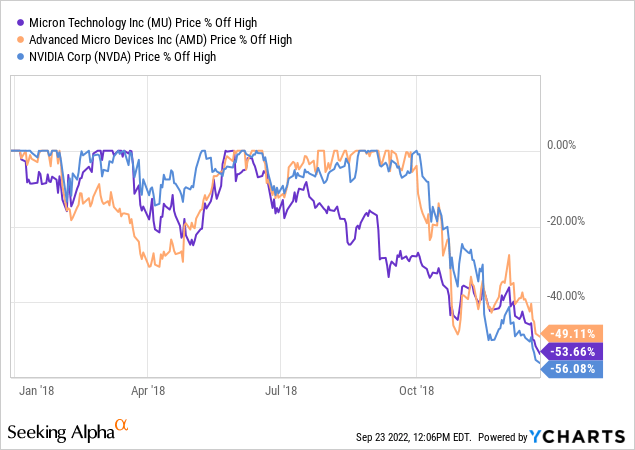

Below is a drawdown chart of Micron, AMD, and Nvidia starting in January 2018 through the lows put in on the 24th of December 2018.

This was not distant history. It was only 3 or 4 years ago.

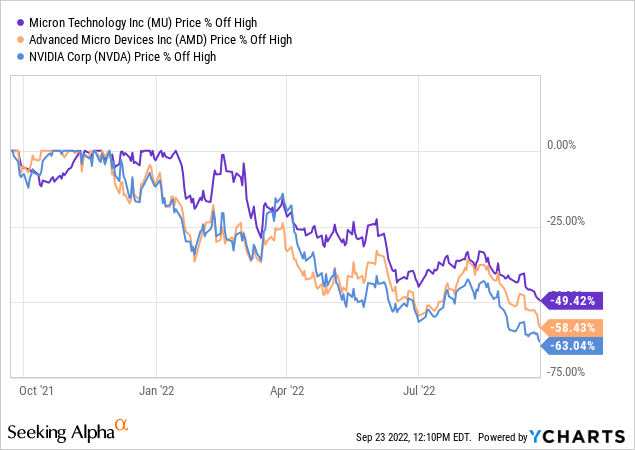

Now let’s take a look at how these stocks are performing this year.

We have very similar price declines across the board. In other words, history was a very good predictor of how these stocks have performed during a downcycle as measured off their highs. All the stories about how much different (and better) these businesses are compared to the past, even if correct, have meant absolutely nothing when it comes to predicting the downside in the stock price. Conversely, history has been an excellent predictor of how these stock prices have behaved this year.

Importantly, there is a key difference between 2018 and 2022. The reason these stocks bottomed in late December of 2018 had nothing to do with the individual stocks or businesses themselves. It had to do with the fact that Jay Powell and the Federal Reserve announced they would stop raising interest rates and stop tightening monetary policy, and instead, the Federal Reserve reversed course. That is when these stocks bottomed in 2018. Now, Powell and the Fed have taken the exact opposite stance, and have instead virtually promised to keep raising interest rates and tightening financial conditions. That means the “Fed put” that stopped these stock declines in December of 2018 isn’t going to be there in the near future, and more downside is likely. So, the only thing that is “different this time” that actually matters for the stock, is that there is no near-term rescue from the Fed coming, and that’s a big negative.

Lesson #2: Prices move before earnings

When it comes to deep cyclical stocks (stocks whose earnings fall a lot during downturns) price almost always leads earnings during a down cycle. This principle applies to virtually all deep cyclical stocks and not just semiconductors. Professional investors understand how dangerous these types of stocks can be during an economic contraction. So, usually at the earliest signs of an economic contraction (like when the Fed starts tightening financial conditions), the prices of deep cyclical stocks start falling ... even while earnings and revenue growth are still quite good.

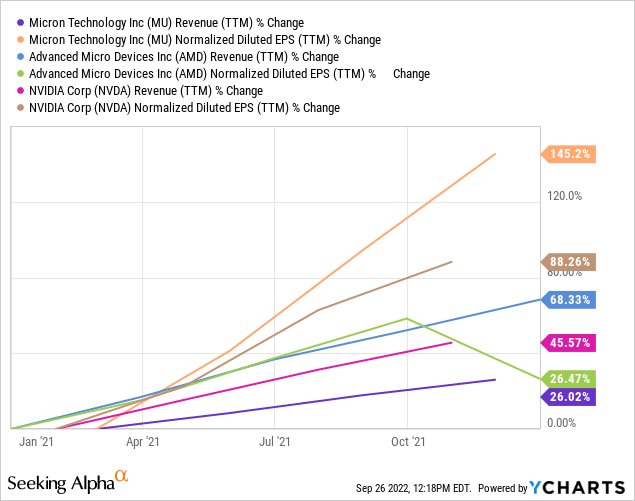

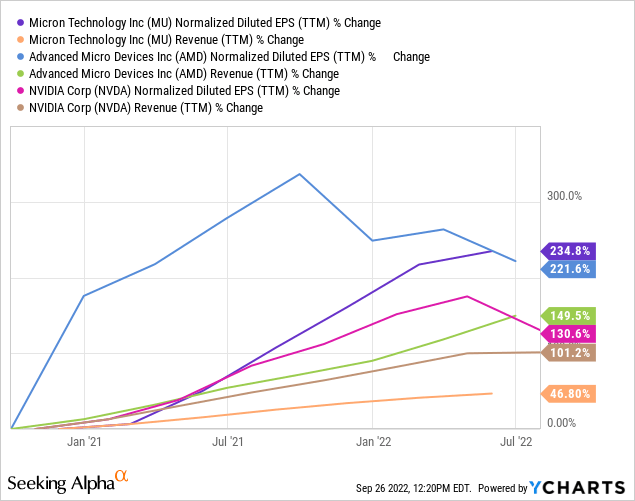

Most of these stock prices started falling at the beginning of this year, or slightly before. Above is a graph that shows the revenue and EPS trend leading into the beginning of the price decline. AMD’s normalized EPS was the only metric that had even shown a tiny bit of weakness. In fact, even today, most of these metrics still look strong.

These two-year trends are probably not what you would typically expect to see from stocks that are down more than -50% off their highs. In fact, AMD is still expected to grow Adjusted Operating Earnings next year:

FAST Graphs

AMD’s earnings are moving in one direction while the stock price has moved steadily in the opposite direction for nearly a year now. It’s no wonder AMD shareholders are perplexed by this price action.

But the truth is, this is perfectly normal for deep cyclical stocks. The market will almost always start selling these stocks at the first sign of a downcycle or economic downturn because professional investors know that these types of stocks can fall a lot. And this trend is not limited to semiconductors. You will find it in other deep cyclical stocks like industrials as well. Only the stock price will tell you the truth about these stocks during a downturn. This is why my policy with deep cyclical stocks is to sell them soon after they start making new highs. Often they keep going up, but since I have no reliable way of knowing when the market will start to sell them off, and they can lose a lot of money very quickly, I’m okay leaving some money on the table near the top of the cycle in exchange for preserving my capital.

This brings me to my next lesson.

Lesson #3: Quality doesn’t matter on the way down

When it comes to deep cyclical stocks, the quality of the business doesn’t matter that much during the down cycle. The reason for this is because the market is selling the stocks based on the anticipation of something bad happening, and then, because these stocks sell off so deeply, usually the sell-off feeds on itself and keeps going, collecting momentum traders along the way. The strongest believers in the businesses are often the most disappointed because they never imagined their beloved investment could fall -70% in the first place. So, what you typically see is that high-quality businesses and lower-quality businesses in the same industry sell off in a roughly similar fashion. Quality simply doesn’t save investors in deep cyclicals from a drawdown.

However, quality does make a difference when it comes to the eventual recovery. Low-quality cyclicals often go bankrupt or get bought out at a very low price, or have a very slow recovery. And few of them go on to make new highs again in a timely manner, of say, five years or less. So, while quality will not save investors much in terms of a drawdown, it can make a huge difference when it comes to the recovery. So the best policy is to only buy the deep cyclical stocks that have proven they have bounced back strong from previous downturns, and so are therefore likely to do it again.

Micron, AMD, and Nvidia are all high-quality, deep cyclical businesses, and they should all bounce back from this downturn eventually, but that doesn’t mean they can’t fall very deep in the meantime.

Lesson #4 Fundamentals and recent trends don’t matter for deep cyclicals

Because earnings fluctuate so much, using metrics like P/E ratios, PEG ratios, and revenue trends are basically useless. Often in the comment sections of my articles, I will have readers share stats like these, pointing out how cheap a deeply cyclical stock has become. But what they don’t understand is that earnings can fall a lot and do so in a hurry. For example, analysts are just now starting to predict Micron’s earnings will fall next year:

FAST Graphs

Micron currently trades at about a 6 P/E ratio based on trailing earnings. But we can see in the graph above that now analysts are expecting nearly a -50% decline in EPS next year (and my experience has been usually it turns out to be a worse decline than analysts expect) so that really isn’t a 6 P/E if the “E” is cut in half, it’s a 12 P/E. And back when the stock was near its peak at the beginning of the year, and double where it trades now, it would have been a 24 P/E based on next year’s earnings. So, any metric that has to do with earnings and revenues with deep cyclicals is pretty useless, and that’s why I mostly ignore them for these types of stocks.

Lesson #5: It’s easier to determine if a stock price will recover its highs than to know at what price it will bottom.

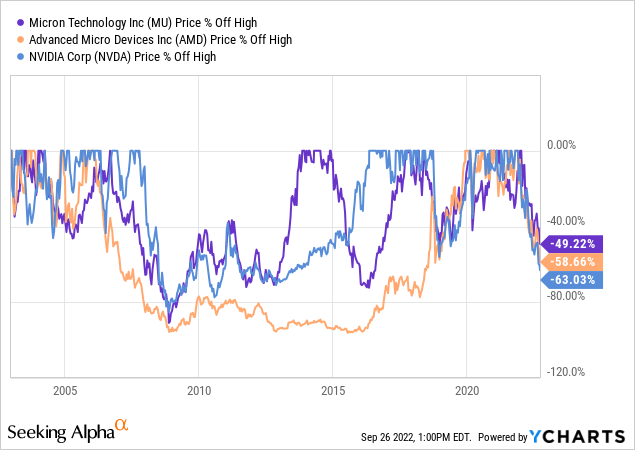

When it comes to deep cyclicals, they can have price swings that are much deeper than many investors suspect. Here is a price drawdown chart of Micron, AMD, and Nvidia since 2003.

Historical drawdowns over -50% are routine for these stocks and all of them have fallen more than -80% in the past during recessions. During this downturn, they are behaving similarly. But it’s very difficult to know whether this particular downturn will be one in which they fall -65% off their highs or -85% off their highs.

But, one thing we do know about all of these stocks is that over the medium-term of 3-5 years, there is a very good probability that they will probably at least get close to returning to their old highs again. Eventually, inventory overhangs will clear, the economy will find a bottom, the Federal Reserve will stop raising interest rates, and because these are some of the best businesses in their industry, they will eventually start making lots of money again and earnings growth will return. So, while nothing is guaranteed, there is a high probability that these stocks will someday reach their old highs again. What this does is allow us when potentially buying the stocks, to determine what sort of return we are looking for over, say, five years. I recently bought Micron when it was about -50% off its highs. That means if it makes new highs at some point in the future, I will have a 100% return. Knowing this outcome has a good probability to happen, means that I can find some price that I think has a high probability of occurring, and also one that will produce medium-term returns that are acceptable to me and set my buy price there, which is what I did with Micron. A 100% medium-term return is acceptable to me for Micron, so I bought it. I think Nvidia and AMD have a high probability to fall deeper, so I haven’t bought them, yet. But I will when acceptable prices hit.

Micron might end up falling -80% off its highs because it has done so in the past. When I have really deep cyclicals like this I like to have two buy prices. The first has a high probability of occurring and also a high probability of producing good returns. The second has a lower probability of hitting, but if it does, it can produce exceptional returns if I buy there. Sometimes in order to get that 100% eventual return, you have to be willing to sit through some very big drawdowns in the process, so having the right mindset and game plan going in is important.

Lesson #6: Psychology is very important. You always want to be thinking like a buyer during a down cycle.

For a run-of-the-mill cyclical stock I typically just have one buy price that I establish and if the stock hits that price, I take a small position and hold it, waiting for the eventual upcycle. But for truly deep cyclicals that can fall 80% or more off their highs, I usually have two potential buy prices. The first is one that I think I can get a very good return on if the cycle eventually turns up, and the second one is purposefully very deep, often about -80% off the highs.

Part of having these very deep buy prices in mind, is that I’m simply looking for an opportunity to get a fantastic return. If you buy a stock -80% off its high, and it eventually returns to the high price, you get a 400% return. So, there is certainly an incentive in that regard. But another very important reason I have a second buy price that is very deep, is that it helps with the psychology of holding a stock that is down a lot if you are thinking about buying more (but do not buy too soon), rather than thinking about how you bought too soon.

If you buy a stock when it is -50% off its high, and it eventually falls -75% off its high, that doesn’t mean you had to hold through a -25% drawdown. It means you had to hold through a -50% drawdown. (Imagine a stock that peaks at $100 per share, it falls -50% to $50 per share and you buy some. Then it goes on to fall -75% off its high to $25 per share. Going from $50 to $25 is a -50% decline.) It can be pretty discouraging to have this happen to a stock when you thought you were buying it cheap, and that kind of price action can convince a lot of people that they made a mistake, pushing them to sell.

The dynamic changes a lot if instead of focusing on how much your first position is down, you are focused on how close the stock is getting to your deep price, where you will buy more. Additionally, having that deep buy price in mind when you buy the stock the first time, means you have to acknowledge that there is a chance that the stock can continue to fall a lot, even after you buy it. So, while it’s never fun to see a stock you bought move way down, it’s much easier to deal with it, if you already have a plan for such a situation, and you know it has happened in the past and the stock has eventually recovered, even from a very deep drawdown.

Conclusion

There are cyclical stocks, and then there are really deep cyclical stocks like Micron, AMD, and Nvidia. They are a special breed, and they require unique treatment by investors. The lessons I shared here are some that I have learned over time by specializing in deep cyclical stocks, just as I do in my marketplace service, The Cyclical Investor’s Club. But, you don’t have to be a member there to read about my approach to these three stocks this cycle. Because I think this information is so important for retail investors to understand I have published public articles on all three of them individually: “Here’s The Price I’ll Start Buying Nvidia“, “If Micron Hits This Price, I’ll Start Buying“, and “Here’s The Price I’ll Start Buying AMD“. Those articles will have all of the individual information on my buying approach for each stock. I sincerely hope this information helps investors who wonder what has been going on with the prices of these stocks this year, and provides some useful tips for how to think about them as investments.

Be the first to comment