PM Images

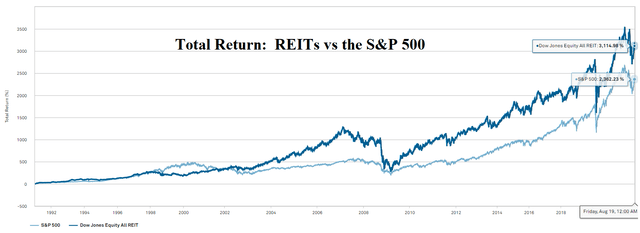

REITs remain a great source of dividend income as they have growth akin to that of the S&P, but a high yield akin to that of bonds. This combination of capital appreciation and dividends has netted a superior total return over the long term.

S&P Global Market Intelligence

Regarding dividends, I want to present 2 opposing views in this article:

- Academic view in which dividend yield is largely irrelevant

- Investment practitioner’s view in which dividends drive returns

I believe a full understanding of both viewpoints is essential to really grasping responsible dividend investing.

Once we establish the framework with which to view dividends, I will dive into the dividend statistics of 125 dividend paying REITs and find 5 that I believe have the best prospects for impactful near term dividend raises.

Academic view on dividends

From a strict theoretical finance perspective, dividends do not impact the value of a stock. Whether a company pays no dividend or a 10% dividend its enterprise value should be the same.

Why?

The value of a company is the present value of all future cashflows. The cashflows are the same either way with a dividend merely being an elective decision on whether to pay out those cashflows to shareholders or to retain them at the company.

For example, a company could pay $1 million in dividends to shareholders or retain that $1 million. If it is paid out, the investor can then reinvest the dividend into whatever opportunities are available. Similarly, if it is retained, the company can reinvest that $1 million into whatever opportunities are available.

Either way, the cashflows are compounding and in theory the company has access to the same set of investment opportunities as the shareholder. Even opportunities proprietary to the company can be mirrored by the individual by reinvesting the dividend in the same company via a DRIP.

Thus, the dividend policy of how much to pay or even whether to pay at all is irrelevant to the value of a company. The academic perspective holds logical merit, yet years of experience in the market paint a different picture.

When a company cuts its dividend, the stock price almost always drops materially. Similarly, dividend raises tend to result in stock price growth. How can this be when the dividend payout does not actually impact true fundamental value?

Practitioner’s viewpoint of dividends

The academic’s perspective is couched in the ceteris paribus clause. All else equal, it is true that a dividend cut or raise does not impact a company’s fundamental value.

In the real world, however, investors are dealing with imperfect information. We are constantly forced to make inferences based on partial information to ascertain the true underlying value of a company.

It is this partial information that makes dividends so valuable as a clue for more accurate inferences.

We can look at a company and see its historic cashflows and use that along with known information about business operations to estimate future cashflows, but shareholders are always going to know less than management. At best, investors find out the information on a delayed basis, but often certain things remain unknown indefinitely.

As such, dividends serve as a strong signal from which one can situationally infer strength.

If company X had earnings of $10 and paid a dividend of $8 in the trailing 12 months and now it is raising its dividend to $10 annually, it is a very strong sign that earnings are now well north of $10.

Management may not be able to tell the market yet its source of confidence as new business might still be in negotiation, but it can raise the dividend without harming its negotiation power. (Technically, it is the board that makes dividend decisions but really they are doing it on management’s recommendation)

If the same company cut its dividend to $4 from $8, it probably means something is wrong.

So yes, while the academics are right that the dividend cut or raise in of itself does not impact fundamental value, we as practitioners can surmise that the ceteris paribus condition is no longer true.

All else is NOT equal.

Thus, in the real world, dividend raises, particularly repeated dividend raises, usually lead to stock prices going up and dividend cuts usually lead to stock prices dropping.

REIT dividends today

To get a sense for where REIT dividends are today, I looked at the 125 stocks in the equity REIT universe that are both profitable and pay non-zero dividends.

- Average dividend yield – 4.4%

- Average 2022 FFO payout ratio 74%

- Average 2023 FFO payout ratio 60%

Particularly interesting to me is the delta between the 2022 payout ratio and the 2023 payout ratio. The absolute dividend used to calculate this is the same, so that is quite a bit of anticipated FFO growth heading into 2023.

Given this data, there should be significant dividend raises over the next year. REIT payout ratios are abnormally low right now because of the pandemic uncertainty, but as the world gets more adept at dealing with it, REITs are regaining the confidence to raise their dividends.

What is the proper payout ratio?

While it is true that REITs have to pay out 90% of their taxable income to retain REIT status, that is largely irrelevant for determining their dividends. Accounting based depreciation shelters much of REIT income so taxable income can often be quite low even when FFO is high. When REITs sell properties, however, it can sometimes trigger a massive capital gain that results in a forced dividend.

This taxable accounting is relevant in some situations, but for 90%+ of REITs it is the sustainability of cashflows that determines the proper payout ratio. Here are the rough sustainable levels of dividend payout with respect to FFO for various REIT sectors.

- Triple net – 90%+

- Retail 75%

- Office 50%

- Hotel 50%

- Industrial 80%

- Apartments 85%

- Tech – various

The differences are largely due to capex requirements and the fundamental stability of cashflows.

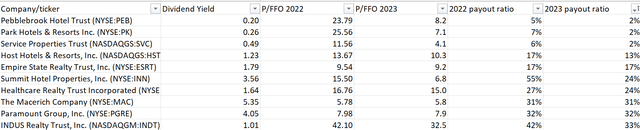

With knowledge of the approximate proper payout ratio and the payout ratio of each individual REIT, one can identify those that are better able to raise their dividend going forward. If we look at the 10 REITs with the lowest 2023 FFO payout ratios, I think most of these will be raising their dividend.

S&P Global Market Intelligence

However, I don’t expect these raises to be all that impactful for 2 reasons:

- The absolute yield of these REITs is quite low

- The raises represent recovery of pre-pandemic yield rather than true raises since these REITs recently cut

A more impactful raise is going to be on a REIT that already pays a good yield and where the raise is indicative of fundamental success. Here are the 5 that I think are likely to raise in the near term where it will have a significant impact on market price:

#1: Kite Realty (KRG)

Kite has a 68% payout ratio on current FFO which is close to appropriate for a retail REIT, but it has huge organic growth ahead due to a lease up of some vacant space in combination with 20%+ positive increases to rent as leases roll over. This takes the FFO payout ratio down to 45% in 2023 providing ample room for continued raises.

Management seems to like consistency and is on a pattern of raising the dividend every quarter. I expect this to continue for at least two years.

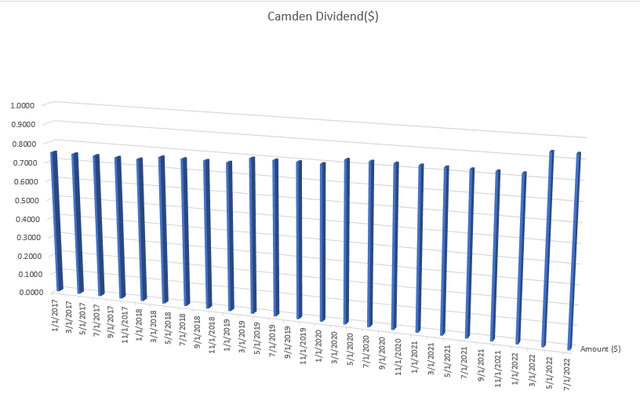

#2: Camden Property Trust (CPT)

Camden has a 63% payout ratio on current FFO but much like Kite, growth in 2023 will take it down to 52%. Management runs the company fairly conservatively so I don’t think they will go to a high payout ratio, but I think they will raise enough to keep payout in the mid 60s. This will add nicely to their already strong track record of dividend growth.

S&P Global Market Intelligence

#3: Brixmor (BRX)

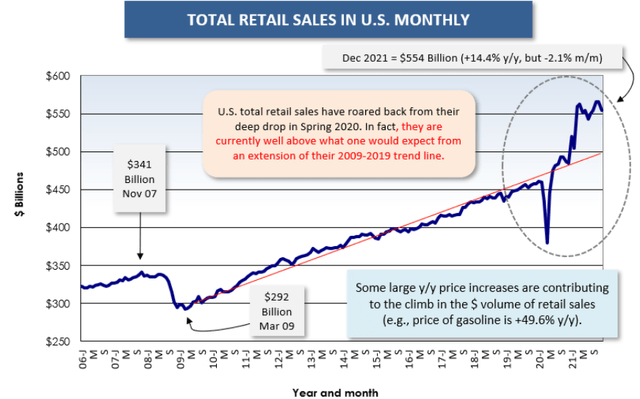

Much of the shopping center sector could be on this list. The conservatively managed REITs almost universally cut their dividends in response to COVID, because of the unknown magnitude of damage. As it turns out, reduced profitability was quite temporary with retail sales already above pre-pandemic levels.

This has more than fully repaired market lease rates for retail real estate, but it takes a bit for the market rates to filter into contractual rates since that happens upon lease expiry.

As such the next few years will be boom growth years for the shopping center REITs resulting in big FFO/share and dividend growth. BRX’s dividend looks particularly primed for growth with 4.0% current yield and only a 47% payout ratio on 2023 FFO.

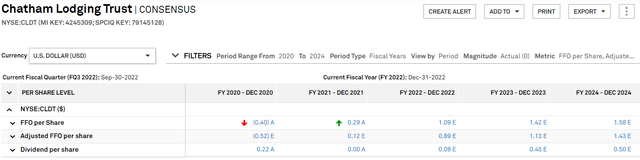

#4: Chatham Lodging (CLDT)

Hotels were hit even harder than retail by the pandemic. For hotels the damage went far beyond uncertainty in that it basically shut down their business while the companies still had to pay operating costs.

As a result, most of the hotel REITs suspended their dividends. Profitability has begun to return with Chatham expected to get to $1.58 in FFO by 2024.

S&P Global Market Intelligence

As the FFO returns, CLDT will likely resume paying a dividend. While I don’t think dividend raises have much impact from companies with low dividend yields, the initiation of a dividend can really move a stock price.

Institutional investors often have mandates as to which types of stocks that they can and cannot invest in and those on the more value end of the spectrum might have a requirement that stocks pay a dividend. Thus, in initiating its dividend, CLDT will gain access to an additional cohort of investors who cannot or will not invest in it now.

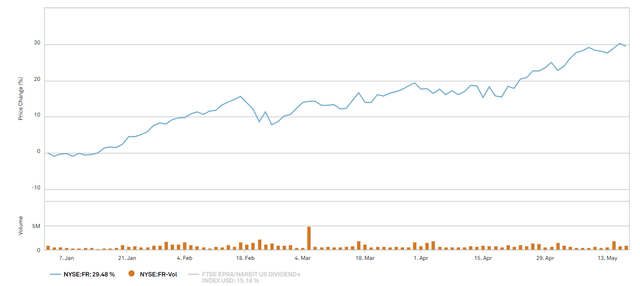

We have previously observed the dividend initiation pop on First Industrial (FR) as it re-initiated its dividend in 2013.

S&P Global Market Intelligence

CLDT could see a similar increase in its investor pool as it resumes dividend payment.

#5: Uniti Group (UNIT)

Earlier I said that 90%+ of REIT dividends are not determined by tax accounting. Well, UNIT is that other 10%.

The company has a massive pipeline of accretive fiber development projects so it wants to retain as much capital as possible resulting in its 37% payout ratio on 2023 FFO.

However, as the company is no longer suffering one time tax losses as a result of the Windstream renegotiation it is losing the ability to shelter its income. As such, many, including myself, believe they will be forced to raise their dividend in the next year for tax reasons.

I believe this raise would be particularly well received by the market because UNIT is already yielding about 6%.

Be the first to comment