Pavel Muravev/iStock via Getty Images

There are many paths up the mountain of investing success.

Though you might think based on the standard wisdom that the best and ultimate goal in investing is maximal capital appreciation – buying Amazon (AMZN) in the year 2000 or Tesla (TSLA) in 2012. Success by this definition is basically to identify growing companies before everyone else does, buy their stocks, and then hold as the stock price rises significantly faster than the market average.

This is a legitimate form of investing that mostly goes by “growth investing.”

But there are other legitimate strategies and goals in investing.

For example, one might be primarily interested in low-risk, low-beta capital preservation rather than taking somewhat higher risk for higher capital appreciation.

Or one might be a value investor, agnostic about the industry or sector of a company and instead primarily interested in buying at a big discount to its intrinsic value and waiting for the market to reprice the stock back to that fair value.

Likewise, one might be a dividend growth investor, like me, who wishes to grow passive portfolio income by owning growing companies that raise their dividends over time.

Or, finally, one might be a current income investor primarily interested in preserving their capital value while generating as high an income stream as they safely can.

There truly are many paths up the mountain of investing success, because “success” means different things for different people.

However, no matter what your strategy or goals are, every investor would benefit from investing in companies with long growth runways ahead of them from identifiable growth trends in the economy.

Even value investors could benefit from an eye for growth trends. After all, the deep value stocks they pick probably have a higher likelihood of getting noticed by other investors and repricing back to their intrinsic/fair value if there is an identifiable growth trend giving them a boost.

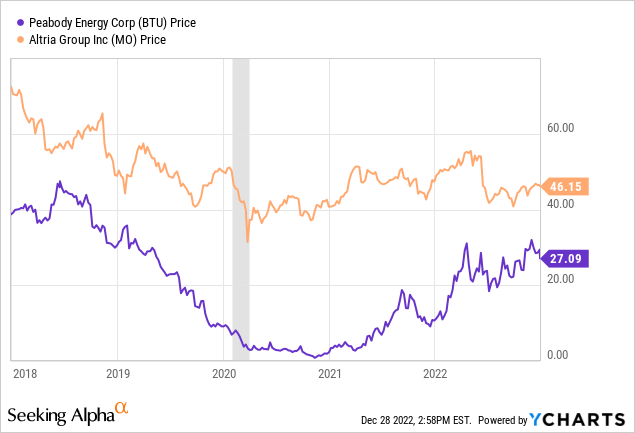

For example, value investors have been making bullish arguments about the substantial discounts to fair value of stocks like coal miner Peabody Energy (BTU) and cigarette maker Altria (MO) for years and years. But these companies operate in dying industries where the “pie” is shrinking rather than growing. What catalysts are there to spur a sustained rally in the stock prices?

Now, to be fair, investors primarily interested in earning current income might find MO an attractive pick with its 8%+ dividend yield that appears to be safe.

The point here is not to decry these particular stocks as “bad investments” but rather to illustrate that all kinds of investing strategies benefit from being situated in growing industries or tapping into growth trends.

In what follows, I identify four growth trends (in no particular order) that I believe will persist for at least the remainder of the 2020s. Surely many others could be mentioned, but these are four on which I have chosen to focus on my own investment portfolio as well as some dividend growth stocks associated with each.

E-Commerce & Omnichannel

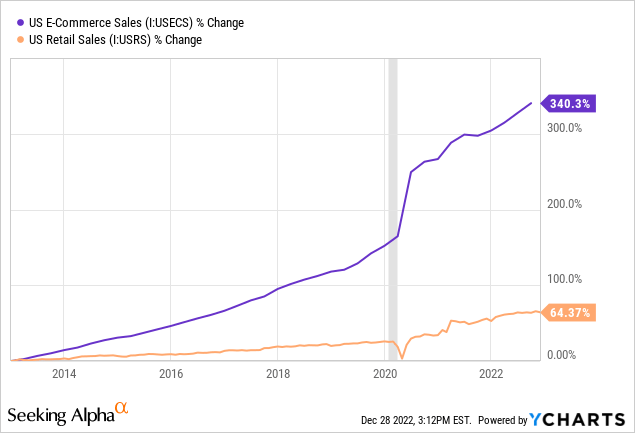

The rise of online shopping could just as easily be called a 2010s growth trend as a 2020s growth trend, but the point is that retail sales generated by online portals or platforms has not yet plateaued. It is still on the rise, and I believe it will continue to increase for the remainder of the decade.

Just look at how much faster e-commerce sales have grown than total retail sales over the past 10 years:

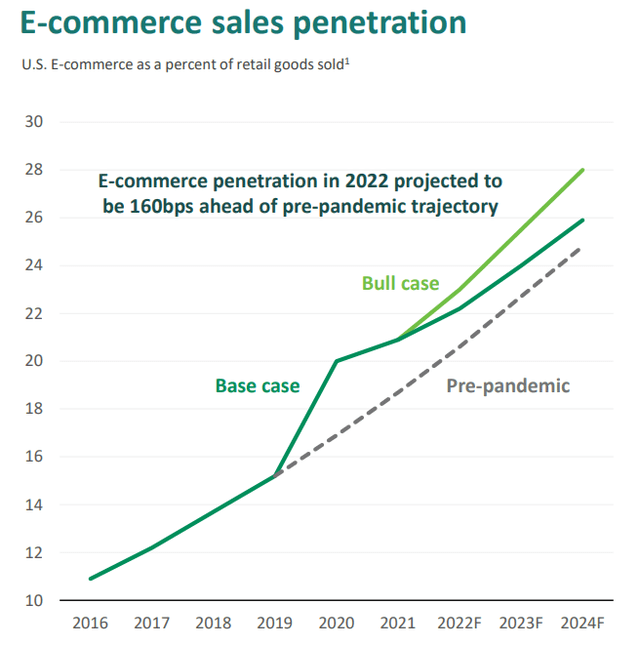

As of the second quarter of 2022, e-commerce accounted for 14.5% of total retail sales, according to the Department of Commerce. But some experts project that share to grow meaningfully in the years ahead. (Note that this chart measures e-commerce sales differently than the Department of Commerce and thus shows a higher percentage of total retail sales.)

Prologis 2022 NAREIT Presentation

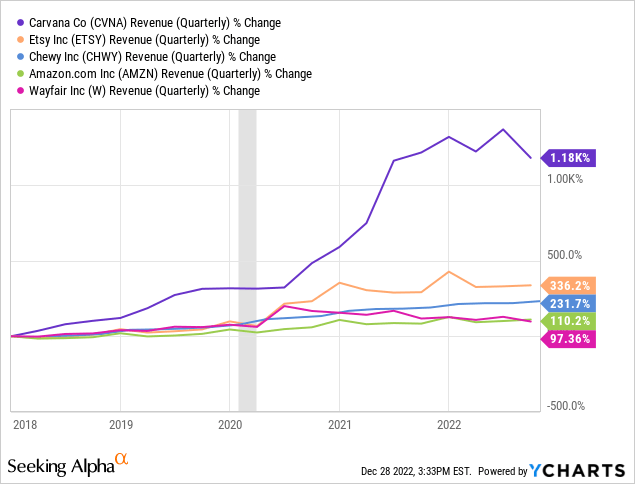

There are some obvious examples of online retailers that one might think of, selling a wide variety of goods from pet food (Chewy (CHWY)) to arts & crafts made by small businesses (Etsy (ETSY)) to furniture (Wayfair (W)) to cars (Carvana (CVNA)). COVID-19 has given a huge boost to these companies, but they were already growing before the pandemic.

Long-term growth investors primarily interested in capital appreciation might consider buying some of these beaten-down online retailers at this time.

As for me, rather than focusing on the rather more obvious picks in the e-commerce space, I choose to invest in the companies that facilitate and support e-commerce indirectly.

| Company | Trend Exposure |

| Agree Realty (ADC) | REIT owning the largest and strongest national retailers with omnichannel platforms, such as Walmart (WMT), Target (TGT), and Kroger (KR) |

| W.P. Carey (WPC) | REIT with 24% of its portfolio in warehouses, many of which are leased to e-commerce or omnichannel retailers |

| STAG Industrial (STAG) | REIT with 40% of its tenant base tied to e-commerce |

| EastGroup Properties (EGP) | REIT owning last-mile industrial parks in Sunbelt markets, many of which are leased to e-commerce or omnichannel retailers |

| Packaging Corp of America (PKG) | Industrial producer of various materials used for shipping of packages, including for e-commerce |

In my view, e-commerce is certainly disrupting real estate, but it is by no means killing brick and mortar retail real estate. Instead, it is causing turnover within retail and creating demand for other types of properties such as warehouses and distribution facilities.

Moreover, many types of retail still remain necessary for the delivery of products to customers, even if shoppers are doing the actual buying online. Think, for instance, about grocery shoppers doing curbside pickup.

Likewise, the more packages being delivered, the more materials for packages will be required. That’s why PKG is one of my favorite dividend growth plays on the e-commerce trend.

Decarbonization & Green Energy

It’s no secret that the green energy transition is well underway and would hard to stop at this point. Not only have the major sources of zero-carbon energy like solar and wind significantly come down in levelized cost per kilowatt of power compared to their fossil fuel rivals, but governments around the world have chosen to majorly favor them over the alternatives.

The US government recently enacted the “Inflation Reduction Act,” which may or may not have much of an impact on inflation but will certainly boost US production of green energy. And in Europe, the government recently enacted “REPowerEU,” which will have a similar effect.

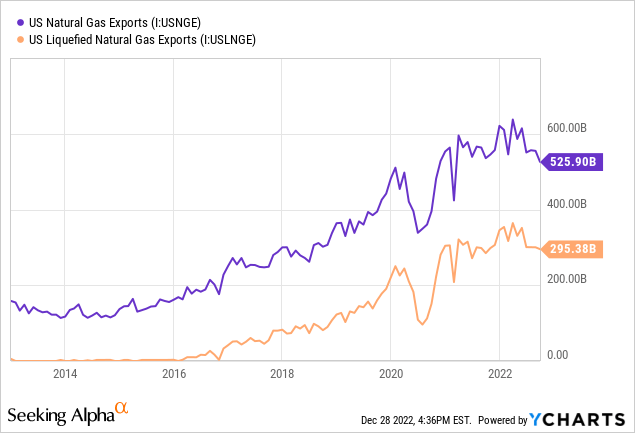

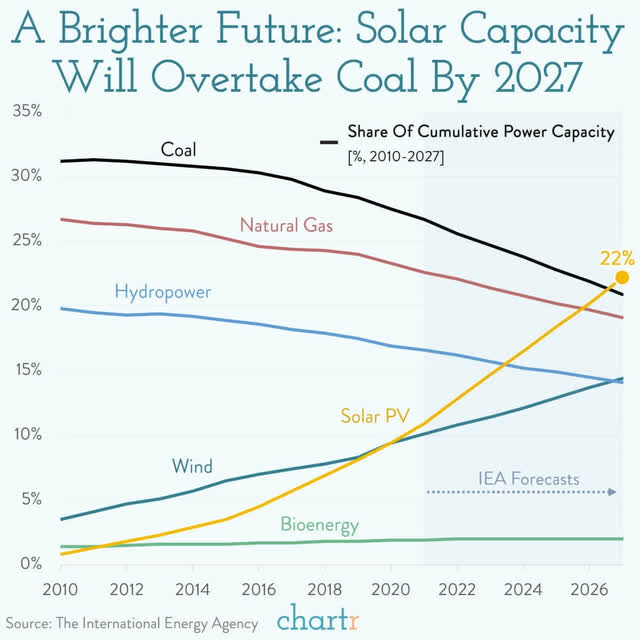

Hence we find the latest projection from the International Energy Agency showing that solar PV panels should overtake coal as the largest energy source for the global utility sector by 2027.

Wind’s share will also grow, though not as fast as solar. Meanwhile, the three major sources of electric power – coal, natural gas, and hydro – will see their shares steadily drop in the coming years as more and more solar arrays are installed and connected to the grid.

My primary preferred method of gaining exposure to this growth trend is straightforward: Own the companies that own, operate, and develop renewable power assets.

| Company | Trend Exposure |

| Brookfield Renewable (BEP, BEPC) | Leading owner/developer of renewable energy assets such as hydropower dams, solar arrays, and wind farms around the world |

| Clearway Energy (CWEN, CWEN.A) | Owner of renewable energy assets such as solar arrays, wind farms, and battery storage facilities in the United States, sponsored by Global Infrastructure Partners and TotalEnergies |

| NextEra Energy Partners (NEP) | Owner of renewable energy assets such as solar arrays, wind farms, and battery storage facilities in the US, sponsored by NextEra Energy Inc. (NEE) |

| Hannon Armstrong Sustainable Infrastructure (HASI) | Leading short-term lender to green energy and decarbonization projects in the US |

| TotalEnergies (TTE) |

Diversified energy supermajor with a fast-growing segment focused on renewable energy and electrification |

| Matthews International (MATW) |

Diversified industrial company with a fast-growing segment specializing in high-tech machinery used to manufacture lithium-ion batteries |

For more detail on the green energy transition and my preferred method of investing in it, see my articles:

Don’t fight the federal government. They are intent on transitioning the power sector to renewables as quickly as possible, and so are a growing number of corporations.

The renewable power producers like BEP, NEP, and CWEN have sold off hard as interest rates have risen, thus raising their cost of capital. But if and when interest rates drop again, these companies should see their growth rates significantly increase as more projects become available.

American Energy Exports

I do not view this growth trend as being in conflict with the growth in renewables but rather complementary.

Most of the world is weaning itself off of Russian oil and gas, which previous to the invasion of Ukraine made up around 10% of the world’s supply. This is creating a gap that American oil & gas can step in to fill.

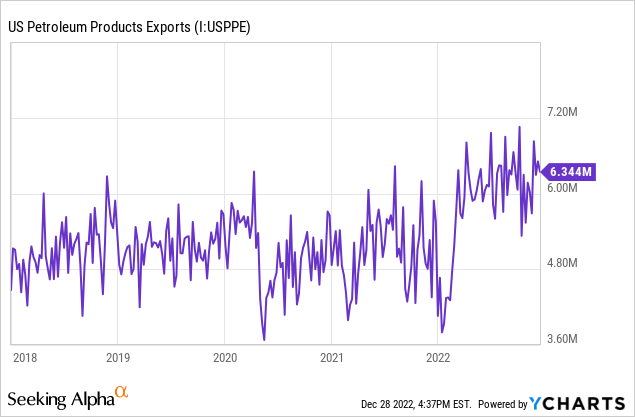

Even before the pandemic, we saw this trend begin to take off as export facilities began to push liquefied natural gas (“LNG”) out of the country to overseas destinations. If not for a fire outbreak at the Freeport LNG export facility this year, causing multiple delays in reopening (now set for January 2023), LNG exports would have grown strongly this year.

But there are several other LNG export facilities under development right now that should come online in the next few years, along with many LNG import facilities being developed around the world, particularly in Asia and Europe.

Moreover, as the Western world tries to wean itself off of Russian oil, there is an opportunity for American oil producers to benefit. In fact, we can see the big jump up in petroleum exports that began after the Russian invasion of Ukraine in February 2022:

Here are some of my favorite ways to play this trend:

| Company | Trend Exposure |

| Enterprise Products Partners (EPD) | Large MLP with significant export assets, especially in the area of liquid petroleum gases |

| Kinder Morgan (KMI) | Natura gas-focused midstream pipeline & storage operator with ample assets located adjacent to LNG export facilities |

| Enbridge (ENB) | Canadian midstream operator with an LNG export facility under development |

| TotalEnergies | French-domiciled company with a commanding market position in LNG exports from the US |

Automation & AI

It wasn’t that long ago that everyone was talking about how automation and artificial intelligence (“AI”) would soon cause mass unemployment as robots and software programs completely replaced human labor. Now all we can talk about is the labor shortage!

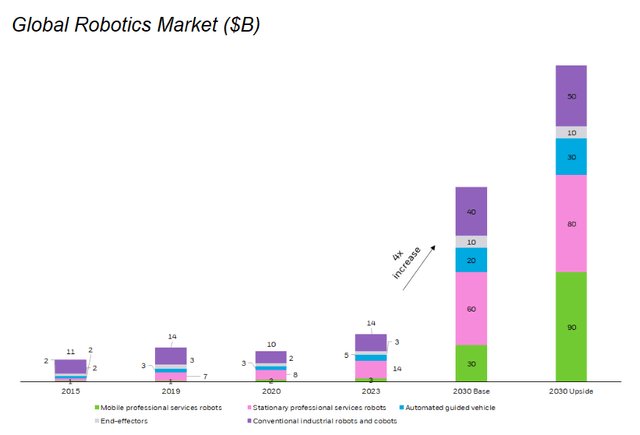

In an increasingly short-staffed world, I think automation and AI will come back into vogue again, this time as a savior instead of a looming menace. With aging demographics all around the world, we are going to have to adapt to fewer laborers than the economy would prefer. Automation, robotization, and AI is the obvious answer to that problem.

We discussed this in greater detail in “Forget Robotics Stocks – Buy These 2 High-Yield Stocks Instead.”

Rather than focus on richly valued robotics and automation stocks that are relatively new companies and scarcely pay dividends, I’ve engaged in some second-level thinking to find some companies that indirectly benefit from this trend.

| Company | Trend Exposure |

| Broadcom (AVGO) | Maker of various semiconductors that end up in a wide variety of electronics products |

| Leggett & Platt (LEG) | Industrial company with lots of factories in developed countries where robots can be most useful |

| W.P. Carey (WPC) | REIT that often provides capital financing for its tenants to invest in cutting edge automation at their manufacturing or logistics facilities |

| Whirlpool (WHR) | Maker of home appliances with “smart” features such as smartphone controls; these smart appliances have more electronics and parts that can break and require replacement |

Another robot company I’ve had my eye on is Rockwell Automation (ROK), provider of various industrial robots and automation machinery, but the stock price has remained stubbornly above my “buy” range.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment