designer491

Co-produced with “Hidden Opportunities”

Do you like watching movies? I particularly enjoy thrillers, and the best ones, in my opinion, are those that have a powerful villain with a well-scripted “evil” plot. After all, Die Hard wouldn’t have been so enjoyable if not for Hans Gruber, right?

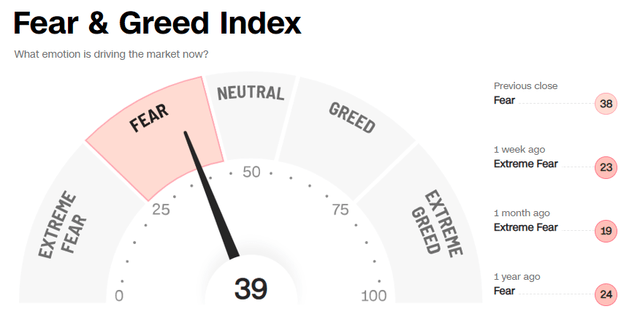

Mr. Bear Market is the villain in our story, much like those villains from the James Bond movies. His plots often make it look like the world is ending, and he has so far been quite successful in wreaking havoc, making everyone run away in fear. Then at the end, the evil plot falls apart and the feared destruction never occurs.

During recessions, investors are scared. Fear causes them to seek safety. Preferred shares have implied safety in their name – their dividends take priority (get preferred treatment) over common stock dividends. If the company breaks up, preferred shares get priority treatment after bonds. Therefore, these securities are “safer” when our economy faces challenges. That being said, preferred securities also trade in the same market and can decline during bear markets. Yet, their design gives them more protection (for income investors) than common shares.

As income investors, we must utilize inefficiencies in the market to lock in high yields and get paid to wait for Mr. Market to realize the irrationality. This report discusses two pairs of preferred securities with up to 8% yields that you should add to your shopping basket.

Pick #1: Necessity Retail Preferreds, Yield 8%

The Necessity Retail REIT, Inc. (RTL) (known as American Finance Trust until February 2022) operates 1,029 freestanding single-tenant properties that are net leased to creditworthy tenants in among the highly essential retail businesses in America. (Source: May 2022 Investor Presentation)

May 2022 Investor Presentation

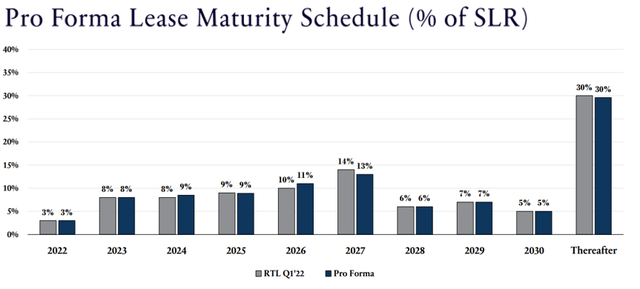

If you live in the U.S., you have likely shopped at one of RTL’s tenants in the past month. 63% of RTL’s portfolio annualized Straight-Line Rent (‘SLR’) is derived from Necessity-Based retail tenants that are expected to be more resilient to e-commerce and economic cycles than traditional retail. At the end of Q1 2022, RTL reported 91.4% portfolio occupancy and a weighted average lease term of 7.4 years.

May 2022 Investor Presentation

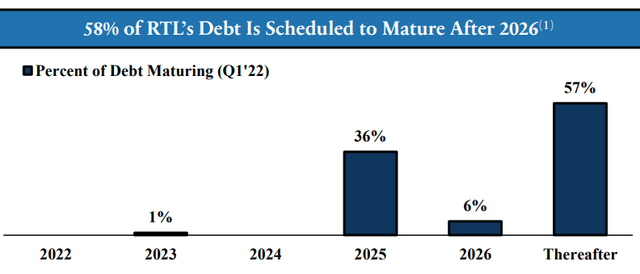

With a weighted average debt maturity of 5.3 years and less than 1% of its debt maturing through 2024, RTL has significant flexibility with its near-term cash flow.

May 2022 Investor Presentation

Speaking of debt, you will be pleased to note that as of Q1 2022, RTL reported 2.9x interest rate coverage and that 84.2% of its debt is fixed-rate. Moreover, the REIT’s weighted average interest rate was 3.7%

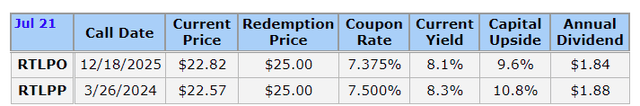

Given RTL has a healthy balance sheet, let us now discuss its preferred stock, which is trading at an attractive discount:

- 7.50% Series A Redeemable Cumulative Perpetual Preferred Stock (RTLPP)

- 7.375% Series C Redeemable Cumulative Perpetual Preferred Stock (RTLPO).

FY2021 10-K tells us that RTL pays $21.3 million annually towards preferred dividends. The REIT ended Q1 2022 with $97.2 million in cash (and $255 million in liquidity), indicating 4.6x cash coverage for the preferred dividends. The preferred dividends are cumulative, meaning if any past payments have been missed, the dividends owed must be paid out to preferred shareholders first, before any dividends can be paid to common shares. Today, RTLPO and RTLPP have ~10% upside at redemption and provide yields of 8%.

With RTLPO, you have a solid opportunity to buy a well-covered 8% yield from a REIT that caters to highly essential businesses – those with non-seasonal non-cyclical demand and are immune to recession pressures.

Pick #2: TDS Preferred Stock, Yield 7.3%

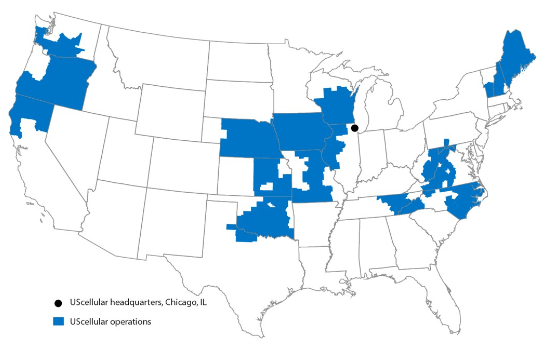

Telephone and Data Systems, Inc. (TDS) is an 83% owner of U.S. Cellular (USM). YTD 2022, 77% of TDS revenue came from USM, which happens to be the 4th largest wireless company in the U.S. behind Verizon (VZ), AT&T (T), and T-Mobile (TMUS), with 4.8 million paid subscribers. (Source: TDS Quarterly Report)

TDS Quarterly Report

Q1 performance shows that TDS’ Adj. EBITDA covers its quarterly interest payments by 11.2x. This indicates that the company has a healthy cash flow situation and can comfortably meet its debt obligations. 60% of TDS’ long-term debt is fixed-rate, and its weighted average interest rate on debt at the end of Q1 was 4.6%. Notably, ~2% of TDS’ $3.25 million debt is due by 2026, signaling that the company has adequate flexibility with its cash flow in the near term.

And TDS needs this flexibility. Being a runner-up in a mature market means USM needs to maintain high Capex to stay competitive in the market, especially when everyone is aggressively spending to roll out 5G and improve overall user experience. This would worry me if I were a USM (or TDS) common shareholder, particularly in this environment of rising interest rates. However, I am more interested in investing in TDS preferred shares:

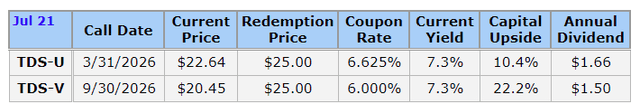

- 6.625% Series UU Cumulative Redeemable Perpetual Preferred (TDS.PU)

- 6.60% Series VV Cumulative Redeemable Perpetual Preferred (TDS.PV).

TDS-U and TDS-V have cumulative dividends and trade at a healthy discount to par value. Current price levels indicate significant capital upside if they were to be called.

As a result of depressed prices, TDS preferreds have a current yield of 7.3%. The yield in a taxable account would be even higher because the “qualified” dividends receive favorable tax rates. TDS is expected to spend $68 million in preferred dividends this year, which is well covered by its cash and cash equivalents of approx. $250 million (Note: TDS reported $549 million in cash and cash equivalents, but this includes USM cash which TDS cannot directly access).

Looking at TDS’ balance sheet and income statement, it is clear that the preferred distributions enjoy a strong level of safety, despite our economy being on its trajectory of rising rates. Telecom is a stable business with inelastic demand, making the 7.3% yielding TDS-U or TDS-V solid picks in these uncertain times.

Dreamstime

Conclusion

Harry Potter wouldn’t be “The Boy Who Lived” if there was no Voldemort. Similarly, we need antagonists to give flavor to our portfolios. Bear markets are the perfect antagonist for us to take suitable enrichment actions. Rather than running away from them in fear, we must use them to boost our cash flow and enter the upcoming bull market with a more robust portfolio.

We particularly like preferred securities during times of uncertainty. Thanks to this bear market, several are deeply discounted, and investing in them comes with several benefits for income investors:

-

You pay less to buy big yields.

-

You are well-positioned for significant capital upside as the market recovers.

-

Your investment enjoys better protection (from an income perspective) than the common stock.

Like preferred securities and are looking for more investment ideas like these? The HDO model portfolio has over 45 such securities with large yields, carefully selected for consistent, predictable, and reliable income through bull and bear markets. This report discusses four preferred picks with up to 8% yields so you can collect money through the chaos and emerge wealthy and victorious.

Be the first to comment