malerapaso/iStock via Getty Images

Thesis

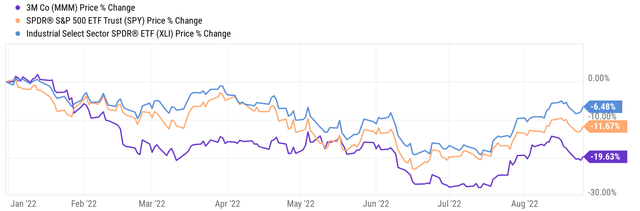

The 3M Company (NYSE:MMM) has paid dividends for more than 100 years and increased payouts consecutively for 60 years. And it must be on many DGIs’ radars lately because of its price correction and valuation contraction. To wit, it has suffered a total loss of almost 20% YTD. In contrast, the overall market lost about 6.5% and the industrial sector lost about 11.6% during the same period.

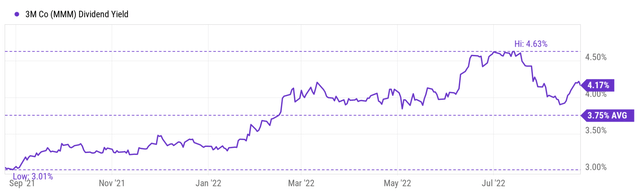

Such substantial price correction has resulted in a surge in its dividend yield as you can see from the following chart. Currently, the dividend for MMM is 4.17%, very attractive in both absolute and relative terms. It is more than a whole 1% above treasury rates and almost 3x higher than the yield from the S&P 500, 2.8%. In the past 10 years, the dividend yield for MMM has oscillated in a range between 3% and 4.6% with an average of 3.75%. Therefore, its current dividend yield is also significantly above its own historical average by 33% (i.e., 1/3). You will see later the valuation is indeed attractive judged by other metrics in addition too.

Of course, readers following MMM would know that a large reason for the recent price correction and valuation contraction involves the ongoing lawsuits. In this article, I will discuss the implications of the lawsuits in more detail. My view is that the risks associated with the lawsuit have not been properly priced in (potential losses could total up to $100 billion). Furthermore, the business is facing strong headwinds on both lines. The top line has recently been plagued by declines from the Safety and Industrial and Transportation and Electronics operations, the global supply chain disruptions, and the Russian/Ukraine situation. On the cost side, inflation headwinds and labor shortages are creating pressure on margins.

And again, my overall feeling is that the higher yield and valuation discount do not properly compensate for such uncertainties, as we will explore further next.

Valuation attractive by other metrics too

Let’s examine the valuation discount more closely by other metrics. The next chart shows its price to CFO (cash from operations) in the past 10 years. The valuation for MMM has fluctuated in the past decade between 9.7x CFO and 25x CFO with a long-term average of 15.7x. Its current valuation is about 13.7x CFO on a TTM basis as seen. And it is below its historical average by almost 13%. On a FWD basis, its valuation is about 11.4x CFO, about 27% discount from its historical average, close to the discount indicated by the dividend yield above.

In terms of P/E multiple, the median P/E for the stock in the past 10 years is 20.5x. And its current TTM P/E (on Non-GAAP basis) is 14.4x and FWD P/E (on Non-GAAP basis also) is 13.7x, about 30% and 33% lower than the long-term median, respectively.

So, there is no doubt that valuation is under a sizable contraction. And next, let’s examine the risks.

The earplug lawsuits

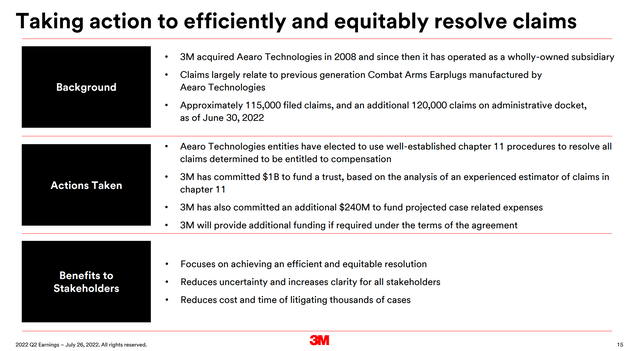

For readers not familiar with earplug lawsuits, the following comments from its CEO Mike Roman in the Q2 earnings report provide a good recap (abridged and emphases added by me):

… to provide some context, in 2008, 3M acquired Aearo Technologies, which manufactured Combat Arms Earplugs. Since the acquisition, Aearo has continued to operate as a wholly owned subsidiary of 3M. These products provided effective hearing protection when used properly, and we stand by their performance… Nonetheless, there has been an extraordinary increase in litigation related to Combat Arms.

As of June 30, 2022, there were approximately 115,000 filed claims and an additional 120,000 claims on an administrative docket. The multi-district litigation process and the highly variable outcomes it has generated has not provided certainty or clarity. We believe that litigating these cases individually could take years, if not decades.

Yet the downside is tremendous. For lawsuits with such complexity and scale, I do not believe there is a way to even get a reasonable estimate of the financial impact at this point. But nonetheless, analysts have provided an estimated total impact of up to $100B or even the bankruptcy of the business. Two examples are quoted below.

To me, regardless of the outcome, I just do not think the ~30% value discount properly compensates for such “highly variable outcomes”. Even if the lawsuits are resolved properly and the valuation reverts to the mean, the reversion could take years or even decades as management acknowledged. A 30% discount reversion spread over 5 years would only add about 6% of the annual gain and only 3% if spread over 10 years.

Seeking Alpha News: 3M could face more than $100B in losses and even bankruptcy due to lawsuits brought by veterans who blame their hearing problems on faulty earplugs.

Capital.com report: Testifying before the court last week, corporate solvency expert J.B. Heaton said he believes up to 230,000 lawsuits could eventually force 3M into bankruptcy. “It is more and more likely within the next three several years we’ll see a 3M bankruptcy,” Heaton said before the court, according to reporting from Bloomberg.

Other headwinds

Besides the lawsuits, the business is also facing substantial headwinds due to currency translation, inflation, supply-chain issues, et al.

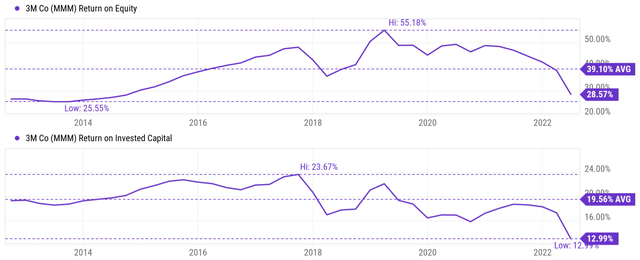

The next chart shows its return on equity (“ROE”) and returns on invested capital (“ROIC”). The distinction between ROE and ROIC (and why ROIC is a more comprehensive measure of profitability) is detailed in my blog article here. As seen, MMM’s ROE currently stands at 28.57%, still a healthy level compared to the overall economy (whose average is about 20%). But compared to its own historical average of 39.1%, the current level is lower by almost a whopping 10%. And note the sharp drop of its ROE since 2021 too.

The ROIC paints about the same picture here. MMM’s ROIC currently stands at 12.9%. Also, note the consistency of MMM’s ROIC over the past till 2021. In the past, it has only fluctuated in a narrow range between 16% and 24% with an average of 19.5%. And its current ROIC is not only below the historical average by a wide margin but is also at the lowest level in a decade.

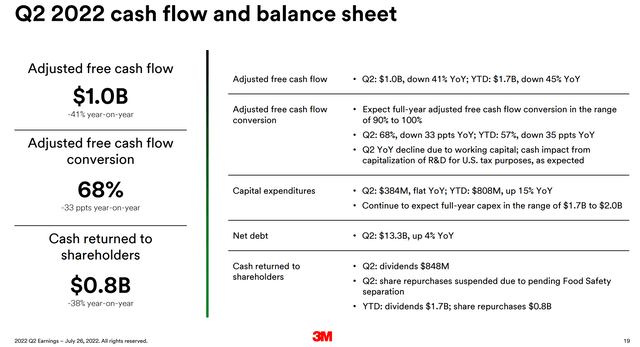

The lower profitability was caused by strong headwinds on both fronts. On the sales front, a multitude of factors has been impacting demands, including the demand decline of its disposable respirators, the China lockdowns due to COVID, global supply chain challenges, and ongoing geopolitical conflicts. On the cost front, the business is dealing with higher raw material costs, higher logistics costs, and also general inflation costs as well. All told, adjusted free cash flow declined to $1.0B in Q2, a 41% decline YoY. And adjusted free cash flow conversion rate deteriorated to 68%, a 33 ppts decline YoY.

Seeking Alpha MMM 2022 Q2 earnings report

Final thoughts and risks

There is no doubt that MMM is currently selling at a sizable discount. A variety of metrics, such as dividend yield, cash flow multiples, and P/E multiples, all show a discount of around 30%.

The thesis is that the ~30% discount is sufficient to compensate for the risks. Even if the perceived risks from the lawsuits are exaggerated, these lawsuits could take years or even decades to resolve as management acknowledged. As such, a 30% discount reversion, IF it actually happens, would only add about a few percent of annual gain (about 3% if spread over 10 years). But the downside of these lawsuits is essentially unlimited.

Besides the risks associated with the lawsuits, the business is also facing substantial headwinds due to currency translation, inflation, supply-chain issues, et al. And for me, it is very likely that these headwinds would persist and keep pressure on its margin and cash flow in the near future.

Be the first to comment