Emirhan Karamuk/iStock Editorial via Getty Images

Investment Thesis

Mercedes Benz (OTCPK:MBGAF, OTCPK:MBGYY) is one of the world’s best-known and most recognizable luxury car brands. Since its foundation in 1926, the company has become a global symbol of quality, style, and innovation. As the automotive industry continues to evolve, Mercedes-Benz’s strategy must also adapt to remain a market leader. The company’s future strategy is leveraging its strong brand identity, focusing on the high-end segment and electric cars. The valuation is extremely low compared to the competition, and the dividend yield is high.

The future requires a new strategy

The focus on electric vehicles is not just by choice. Bans on classic cars are becoming increasingly likely and have already been decided in some cases. For example, the EU wants to ban the sale of new combustion engine vehicles from 2035. Even if something should change again, car manufacturers have no choice but to adapt and focus entirely on electric vehicles. Otherwise, they will be left behind by the competition. Mercedes plans that all new cars will be electric from 2030.

Focus on high-end and high margins

Until now, Mercedes has been active in almost all price segments. This strategy has been under pressure for years, competing with very low-priced Chinese and other manufacturers. And now, this trend also seems to continue with electric vehicles. Next year BYD is expected to launch its low-cost entry-level line called Seagull, starting at $12,500. Mercedes doesn’t want to get involved in this price war; after all, it has an excellent image and is a world-renowned brand.

Mercedes wants to target a higher price range in the future. The company wants to evolve into an authentic noble brand and focus on top-end luxury. What advantages, then, will this step bring? Why should this step be taken in the first place?

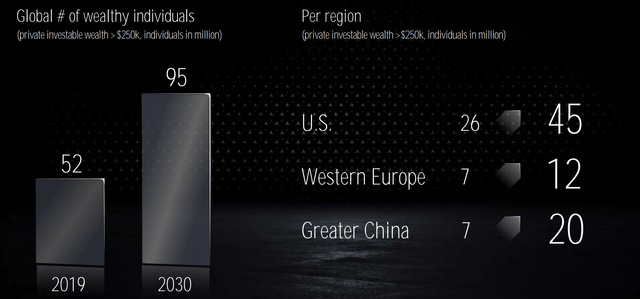

CEO Ola Källenius explains this shift in strategy in terms of higher profit margins. The automaker set sales records last year with its high-class models Maybach, AMG, G-Class, S-Class, and EQS. There are also monetary factors that the automaker wants to take advantage of. Globally, the number of wealthy people is increasing, especially among older generations. Furthermore, this segment has historically demonstrated above-average crisis resistance and durability.

In the case of luxury goods, it is also easier to implement price increases, and the increased costs for the necessary materials are less significant. At the moment, the battery costs are around $128 per kilowatt-hour, although this figure constantly fluctuates. In the Tesla Model Y, a 60KWh is built-in, corresponding to costs of $7680. That’s why Tesla has raised its prices, and BYD will supposedly put a sodium-based battery in its low-cost model next year.

Q3 results

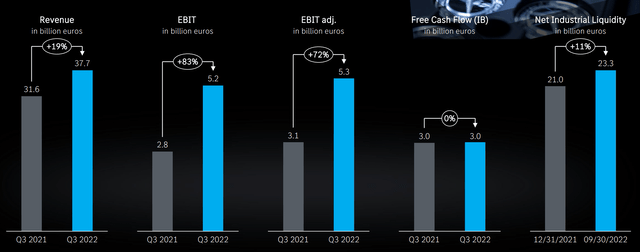

In the last quarter, the company generated revenues of €37.7B, an increase of 19 percent compared to the same period of the previous year. More than 530,000 cars were sold. Despite the ongoing supply bottlenecks for semiconductors, the company achieved a substantial 38 percent increase compared to 2021. The bottom line is an EBIT of €5.2B, a rise of 83 percent. The free cash flow was €3B, and earnings per share €3.66. High-end luxury car sales were up 5%, and electric car sales were up 39%. Electric cars accounted for a total of 85K of the 530k sales.

Valuation

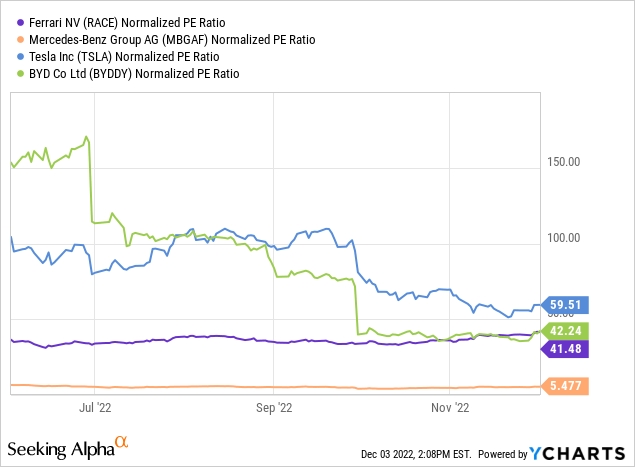

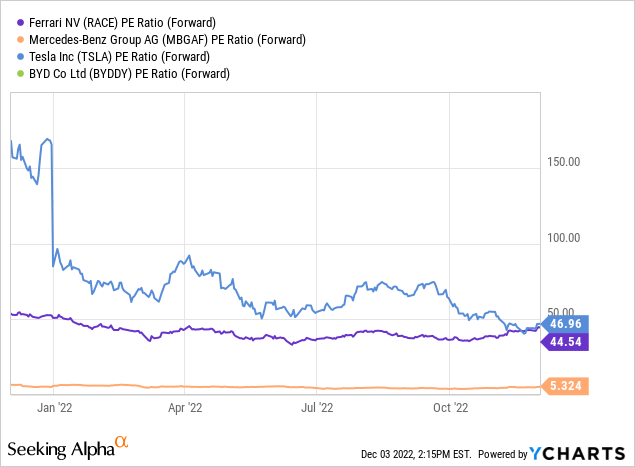

With only one quarter left, it is safe to assume that analyst estimates will be pretty accurate. $12.70 earnings per share are expected, and the current share price is $67.70. A comparison with the competition shows how cheap this is.

However, it must be said that many competitors have had significantly higher growth rates in recent years, and these continue to be assumed. Therefore, another graph with the forward PE ratio. I don’t know why BYD is missing here, but according to Seeking Alpha, it is 32. You can see that the difference between Tesla and BYD is getting smaller but still huge.

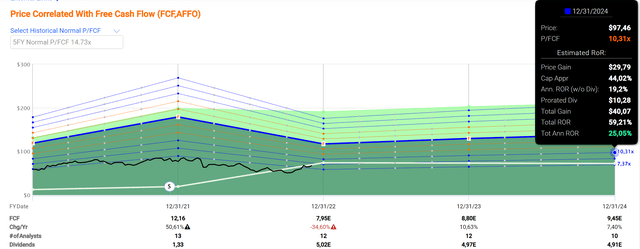

According to FAST Graphs, the stock historically trades at 14.7x free cash flow on average. Currently, it is trading at 8x. Assuming only a 10x valuation until the end of 2024, an annual return of 25% would be possible.

There are several reasons for this low valuation. First, classic car manufacturers were undervalued in the course of the hype compared to electric car startups. It was assumed they were technologically too far behind and slow to make the turnaround. Therefore, electric car startups were attributed absurdly high valuations and profitable car manufacturers were sold off. In the meantime, however, one can see that these companies managed to adapt very quickly.

Furthermore, there has been a general outflow of capital from European stocks to American stocks for months. This is partly understandable given the geopolitical situation and the pressure within Europe. However, it is only partly understandable because Mercedes, for example, is a globally active company. In this respect, a company like Tesla will suffer just as much when European purchasing power dwindles.

Dividend

Like many German companies, Mercedes only pays out dividends once a year. The last one in April 2022 was for fiscal 2021 and was $5.26. Based on the current share price, the yield is 7.7%. However, the next one will probably be lower, as overall earnings per share are expected to be 47% lower than in 2021.

Risks

Of course, these sales estimates over the next few years are not sure, but they are subject to numerous risks, especially in such a sensitive sector as the automotive industry.

Economists are warning that Europe or the whole world could enter a deep recession in the coming months. If this were to happen, it would very likely have a direct negative impact on consumer sentiment and would also very likely affect the cyclical Mercedes share.

The supply bottlenecks still need to be resolved and will only be once China ends its constant lockdowns. The energy crisis will likely hurt the business, as much production is in Germany. In addition, competition is becoming stronger. Mercedes has always had a very high quality, but with electric cars, the cards are more or less reshuffled as past innovations play less of a role. Instead, things like autonomous driving, software, and connectivity become essential.

Conclusion

Mercedes has recovered very well from the catastrophic situation in Covid times. Although they now have more competition and new challenges due to the sudden shift to electric cars, they at least do have a clear strategy. I think the share price has been pulled down too much, especially when you compare the company to the competition. Given the low valuation, all risks are sufficiently priced in, and the stock still has a lot of upside compared to its historical average valuations. Therefore, I believe a buy is a profitable investment with a view to the next few years.

Be the first to comment