Hispanolistic/E+ via Getty Images

Regret for the things we did can be tempered by time; it is regret for the things we did not do that is inconsolable. ― Sydney J. Harris

Today, we revisit 3D Systems Corporation (NYSE:DDD) for the first time since February. We concluded our first article on the following recommendation around the stock:

Discretion is the better part of valor around this name at the moment and I have no investment recommendation around the stock at this time. The company seems to have potential and its balance sheet seems solid. Fourth quarter results should be out shortly, giving investors another set of updated data points to consider.

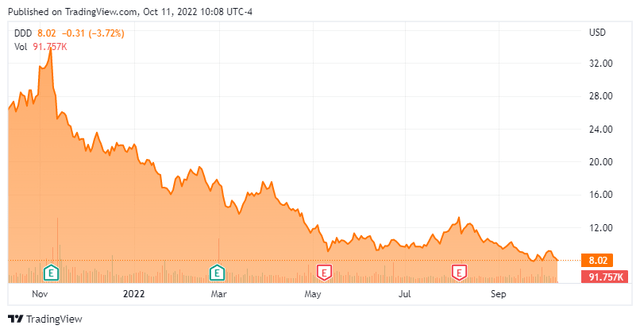

That conclusion seems prescient in hindsight as the stock has been more than cut in half since we last looked at it. There has been a few new quarterly reports posted since then and the stock is obviously much cheaper than it was when we posted our first research on it. Therefore, it feels like a good time to revisit 3D Systems to see if the shares have fallen enough to be in buy territory. An updated analysis follows below.

Company Overview:

3D Systems Corporation is a South Carolina provider of 3D printing and digital manufacturing solutions as well as focuses on regenerative medicine, 3D software, bioprinting, and industrial solutions. The stock currently trades around eight bucks a share and sports an approximate market capitalization of $1.1 billion.

The company continues to make small acquisitions to expand its product offerings and capabilities. Soon after our last piece on 3D Systems, it announced it was purchasing Kumovis, a Germany-based additive manufacturing solutions provider for personalized healthcare applications. It made another small acquisition of a German based additive concern, dp polar, in early August. Recently the company disclosed it was providing $15 million of startup capital for a new wholly-owned biotechnology firm called Systemic Bio, which will use advanced bioprinting technologies in drug discovery and development. In all, the company made investments and purchases of nearly $85 million in the first half of 2022.

Second Quarter Results:

On August 8th, the company posted second quarter numbers. The company had a non-GAAP loss of seven cents a share. The consensus was looking for 3D Systems to break even on a Non-GAAP basis in the quarter. Revenue fell nearly 14% on a year-over-year basis to $140 million, more than $5 million light of expectations.

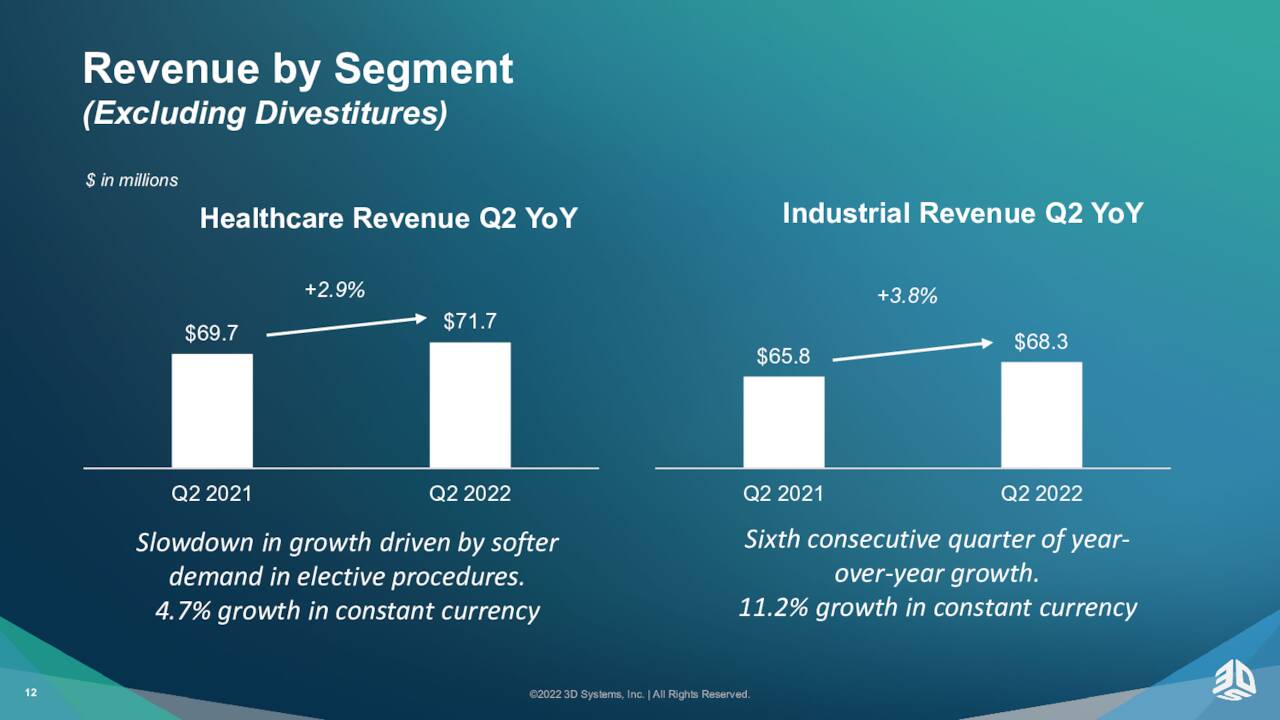

August Company Presentation

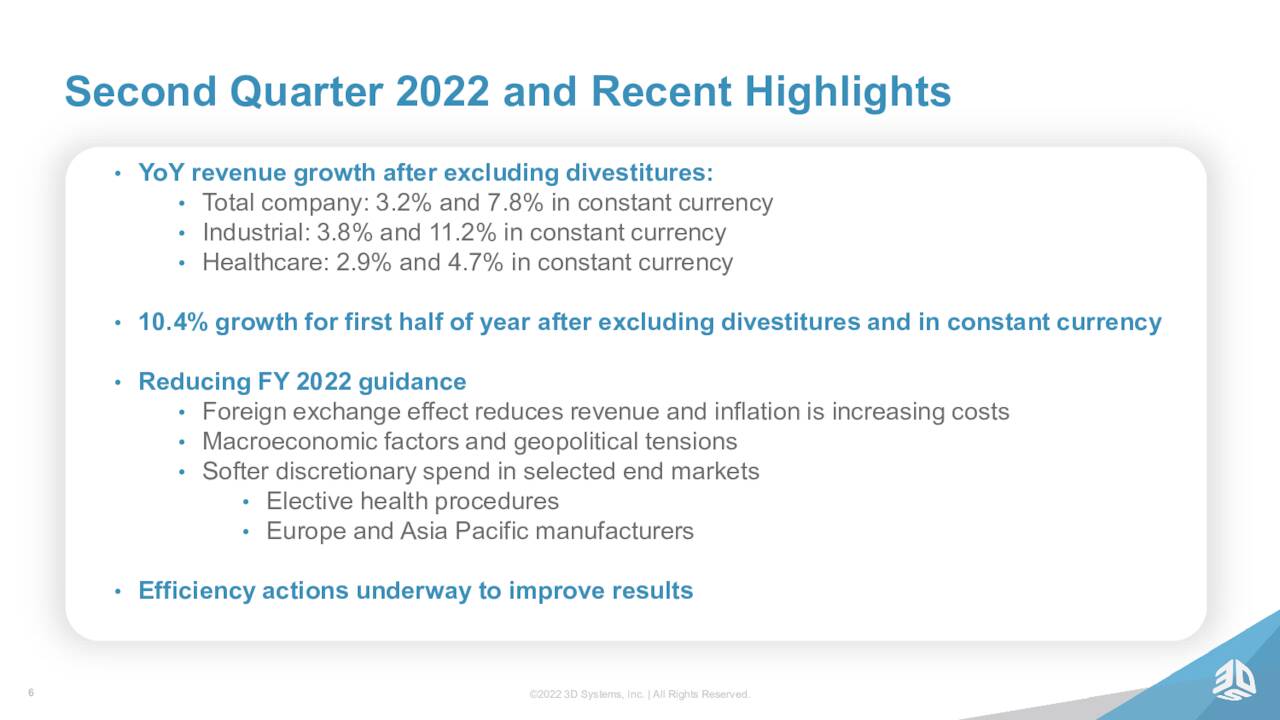

It is important to note that accounting for the divestures noted in our last article and in constant currency, revenue rose just over 10% in the first half of 2022 (up 7.8% in the second quarter) from the same period a year ago.

August Company Presentation

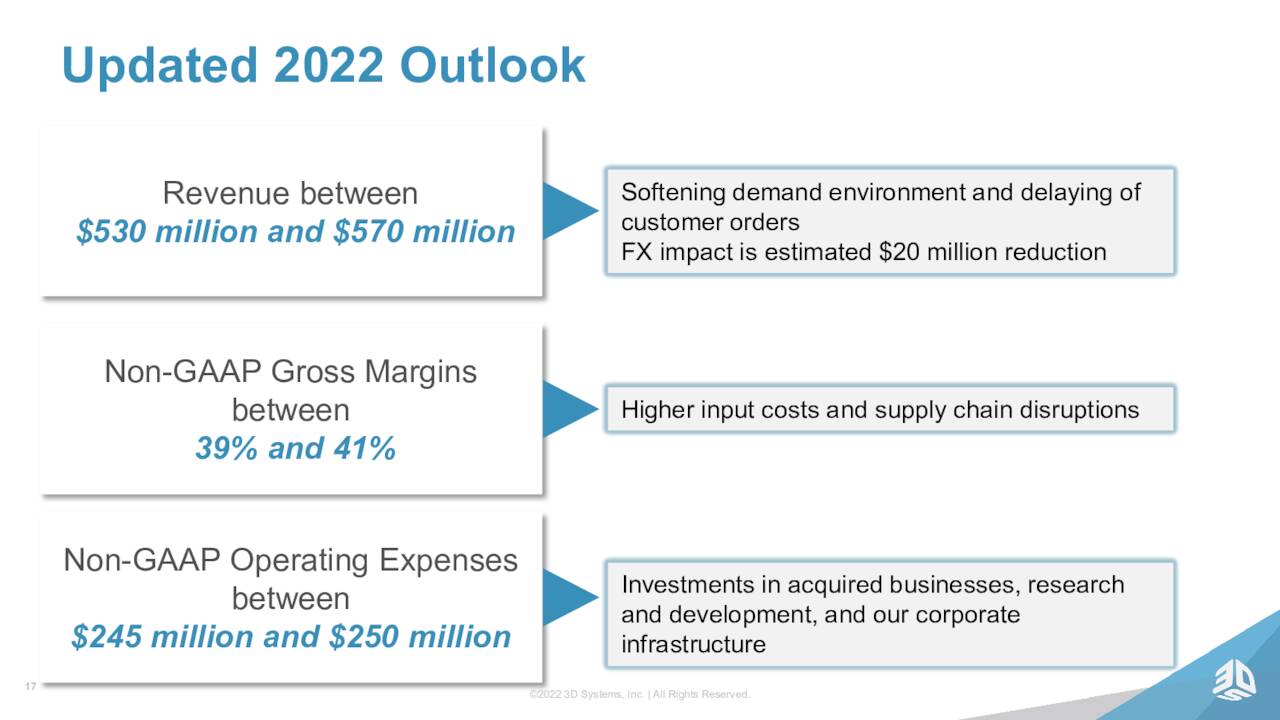

Management also ratcheted down full year sales guidance to a range of $530 million to $570 million from their previous range of $580 million to $625 million. It should be noted this is the second quarter in a row the company missed expectations and lowered forward guidance. Leadership cited many factors for the reduced guidance including the strong dollar, geopolitical tensions and macroeconomic factors such as the slowing global economy.

August Company Presentation

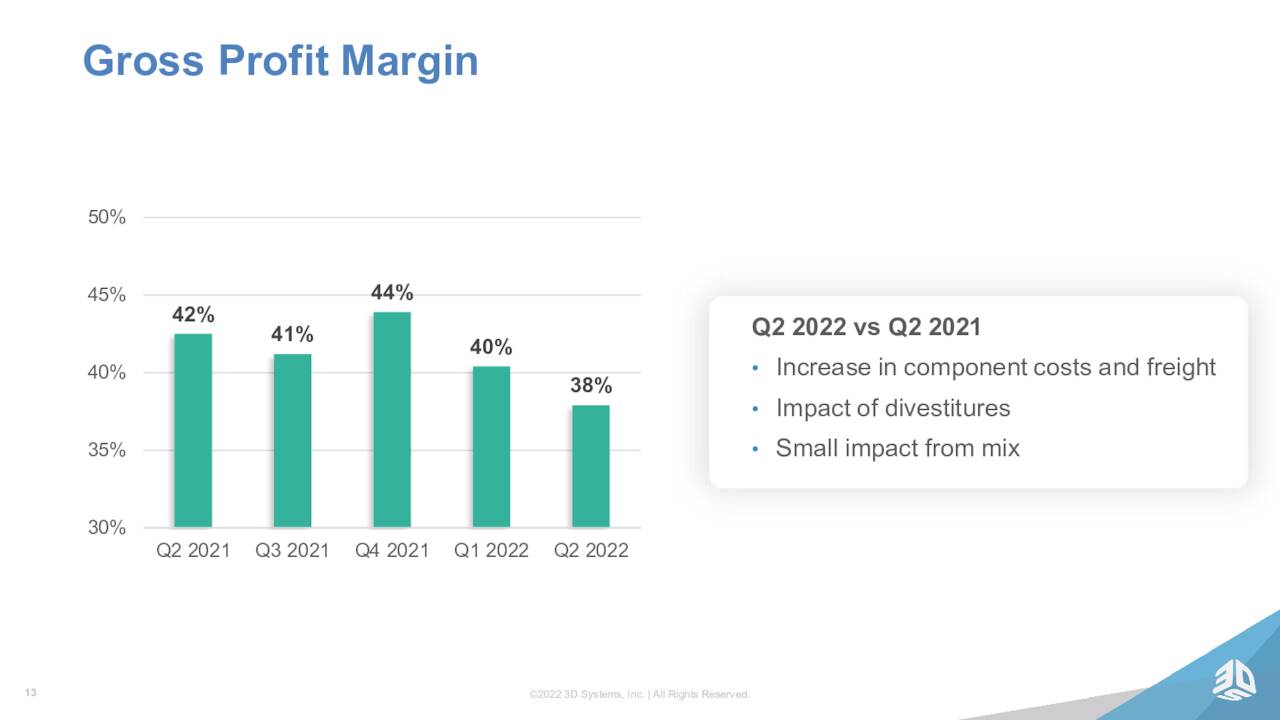

Margins were also impacted during the quarter by continued challenges within the global supply chain as well as higher input costs. Something that has become a theme in 2022 across so many sectors of the economy.

August Company Presentation

Analyst Commentary & Balance Sheet:

Since second quarter earnings came out, JP Morgan has reissued an Underweight rating and $9 price target on the stock. Credit Suisse initiated the shares as a Hold with a $8 price target. Needham maintained its own Hold rating on the shares.

August Company Presentation

Approximately nine percent of the outstanding float in the shares is currently held short. Since our last article on 3D Systems insiders have sold approximately $2 million worth of shares in aggregate. Two insiders including the CEO did buy just over $105,000 worth of shares apiece in May. The company ended the second quarter with nearly $640 million of cash and marketable securities on the balance sheet against just under $450 million in long term debt.

Verdict:

The current analyst firm consensus is that 3D Systems will lose a quarter a share in FY2022 as revenues shrink nearly 10% to $555 million. In FY2023, losses are projected to be cut to approximately a nickel a share as revenue growth rebounds to an eight percent rise to around $600 million.

Obviously, DDD is a much cheaper stock on a price to sales basis than it was in February as the stock has fallen over 50% since then. 3D Systems also has the balance sheet to get through the transition the company is currently undergoing. That said, the company has missed expectations and lowered guidance the past two quarters and the global economy looks heading for a recession.

I would also like to see a bit more traction from recent acquisitions before I hit the Buy button on DDD. At one point on the horizon, this name feels like it is going to be worthy of investment. However, I don’t think we are quite there yet.

You can’t regret the life you didn’t lead. ― Junot Díaz

Be the first to comment