mikeinlondon/iStock via Getty Images

As many of my readers and followers know, I’m a huge Willy Wonka fan and that means I make frequent references to Willy Wonka and the Chocolate Factory.

As such, you may have heard about the Everlasting Gobstopper, a candy that not only changes colors and flavors when sucked on, but also never gets any smaller or disappears.

In fact, the name of that fictional candy was used for a product similar to a normal gobstopper, or jawbreaker, and the layer of the candy allows for the color and flavor changing effects described in the book (and the movie).

Anyway, today I will be writing on three of my favorite REITs that I consider to be Everlasting Gobstoppers, which means they are safe and reliable dividend growers that are expected to see steady and predictable growth.

So in this article, we’ll focus on what we view as the currently, best, undervalued REITs from a quality and upside perspective when accounting for yield/payout coverage.

These are certainly not the only options that can be looked at or invested in, but these companies are excellent overall options for you to invest your capital into.

At iREIT on Alpha we focus on a few qualitative indicators that imply that a company is of high quality, with a safe payout, and strong fundamentals.

We look at things like dividend coverage, dividend history, safety margins, quality, valuation targets, payout ratios, market caps, earnings forecast, expected FFO growth, total return numbers – a whole host of data that comes together into a qualitative thesis that we can offer you, our readers and subscribers, to make sure that your investments are as aligned as possible with what we feel is the best quality.

The combined experience we offer, along with how we have been burned over time by not following common-sense advice, ensures that we’re unlikely to lead you astray into risky investments – at least not without us clearly saying that this is the case.

In this case and in this article, we’re going to focus on what we view as some of the safest investments in the REIT space that we consider available today.

These investments are going to be from different sectors, and they’re from a variety of yields – both high and lower – but what they have in common is quality and safety.

None of them are overleveraged.

None of them are overly concentrated on single assets.

The market has over 200 REITs that trade at a combined market capitalization of more than $1 trillion dollars, invested into by both individual investors as well as mutual funds and ETFs.

Here, we’re going to pick the best of them for you. Now, we’re going to exclude Simon Property Group (SPG) here, for the simple reason that we recently wrote a piece on it, and this company is among the highest on our “BUY” list.

This article is about the other companies aside from Simon, which are also well worth investing in.

Here are three.

1. Spirit Realty Capital (SRC): 6.5% Yield

Spirit Realty shares a few similarities with Simon – it’s a REIT, it’s investment-grade rated, it has a great yield (over 6.5%, well-covered at an FFO payout ratio of 2022E of below 71%) and, more importantly, it has a great valuation.

A lot of investors are looking at Realty Income (O) and while no one can be faulted for looking at the “king” of monthly dividend payors, you should be looking at SRC as well.

SRC trades at an FFO multiple of less than 12X, an EBITDA multiple of less than 14X, a NAV multiple of below 0.85X (O is still above 1X), showcasing metrics that aren’t even in the same zip code in terms of how valued they are.

The market is pricing SRC as though it’s about to be externally managed, or about to cut its dividend, as opposed to a class-A retail REIT with a well-covered 6.5%+ yield.

It’s important to us at iREIT to focus on REITs that can withstand the troubles and turmoils of a downturn or/and a recession. While SRC can certainly fall more, that does not mean that it’s in danger of cutting the dividend or becoming fundamentally unsafe.

SRC has a well-diversified portfolio filled with top-class tenants. Like Simon, as of 1Q22, the company is showing nothing but good numbers. Its rigorous underwriting standards have resulted in one of the more appealing performances in the entire market and is currently forecasting a 2022E AFFO growth of 10.2% on the high end.

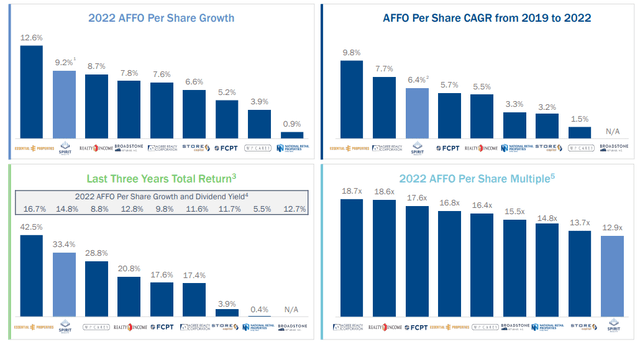

Its growth, in terms of AFFO, in terms of total returns, and in terms of multiples, shows exactly what we want to be seeing. By that, we mean that the growth ratios and CAGR numbers are among the higher percentiles, while the current multiples are significantly below, or in the lower percentiles. Take a look as of 1Q22.

SRC Investor Deck

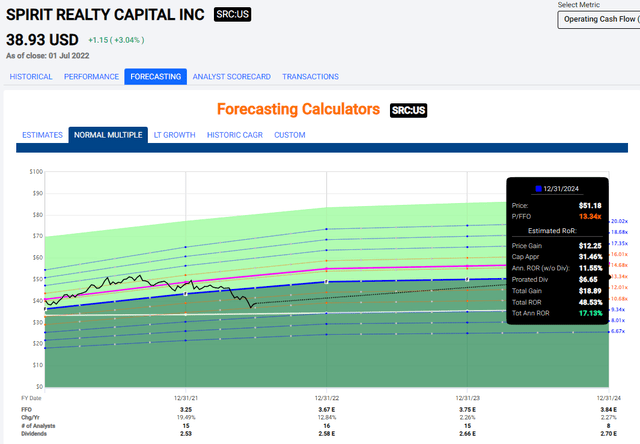

We consider Spirit Realty having a potential annualized RoR of no less than 17% here, with a total potential RoR of close to 50% in less than 3 years, if the company only moves back to a 13.5X P/FFO multiple. Based on average forecasted FFO growth of around 6% CAGR until 2024, that does not seem unlikely in the least.

FAST Graphs

Based on this, the company is a “BUY” for us – and we at iREIT see a margin of safety here of no less than 30%.

2. Federal Realty (FRT): 4.4% Yield

At iREIT, we’re very big on safety.

Fundamentals need be strong, and safeties need to be high when we talk about our “top buys”. While FRT might not be the most undervalued REIT, or the one with the highest possible upside (that honor goes to REITs with a bit less overall safety), it’s fair to say that FRT has one of the safest upsides on the entire market.

FRT is one of the extremely few REIT Dividend Kings – meaning it’s paid an uninterrupted, uncut dividend of 50 years or longer.

This means that the company commands a considerable premium to its peers – around 22X P/FFO on a 5-year average historical. Saying that FRT isn’t undervalued here would mean completely ignoring anything having to do with this company’s fundamentals.

That’s not something we do at iREIT on Alpha. Certain companies deserve their premiums, even if the market is currently screaming at us that this is not the case.

Still, FRT has a lot of upsides.

What?

FRT Investor Presentation

The assets and the dividend record, for one. There is not a single indication anywhere that the ~4.4% yield is anything but “well-covered” at this point, despite the current turmoil in the market.

The REIT has also reported a 28% 1Q22 YoY FFO increase, and 14.5% increase in POI, and has increased its guidance. Like Simon Property group, FRT is seeing continued levels of record leasing, with 50% more comparable lease than the average 1QXX since the financial recession.

FRT has over $800M worth of redevelopments and expansions in the pipeline for the next 36 months.

Investors like talking about potential downturns – but they forget that FRT is not only time-tested but time-proven.

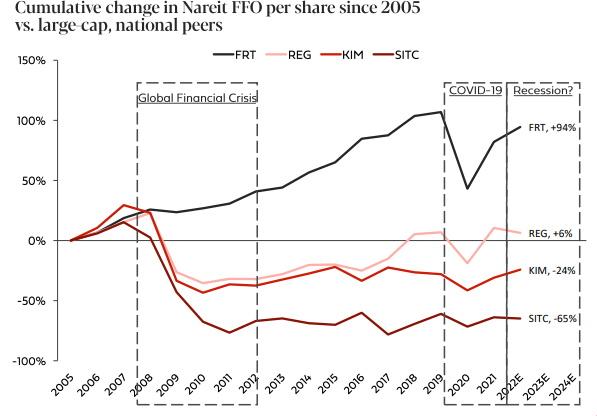

Proof? It’s in the pudding.

FRT Investor Presentation

Oh, you can argue that “this time it’s different”, except…no, we don’t believe that it is. FRT will continue to perform well, indeed potentially outperform. FRT has historically held lease rates of up to 2-4% above peers during difficult times and delivered flat or low growth rates even during recession times.

FRT has best-in-class demographic fundamentals when looking at the 3-mile population and the household income in that population range. These are high-barrier markets to enter, and these are not going anywhere. The company’s income stream is extremely diversified and contains some of the best tenants out there.

FRT Investor Presentation

Like SPG, FRT is focusing in the future on so-called mixed-use properties, including office space, residential units, technology centers, government buildings, pharma, and many other sectors.

FRT continues to have a BBB+ credit rating, over $1.3B in available liquidity, and a fixed charge coverage of over 4X, with 93% of total company debt at fixed, not floating rates. FCF is expected to revert to pre-COVID in 2023E.

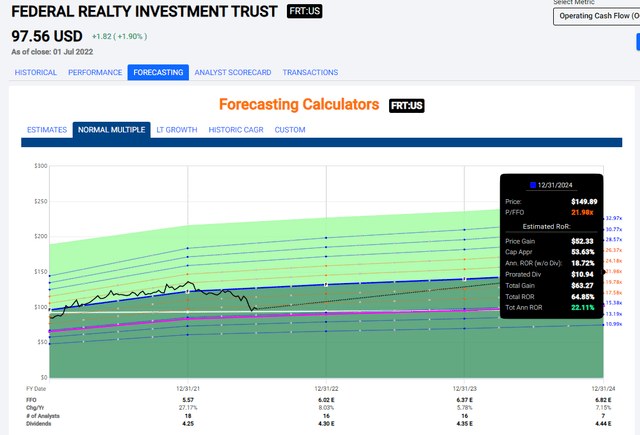

Based on these current trends, we consider the company justified at a premium, which means that 16.8x P/FFO is too cheap for FRT. At current levels, it’s not just a dividend king that pays over 4% yield with a BBB+ credit, the company is also an investment with a 22% annualized upside to its justified premium based on a continued 7% FFO growth rate, dividend history, and upside to 22X.

FAST Graphs

“The King” is actually cheap here.

And whenever a dividend King is cheap like this, and there are no real indications of fundamental, long-term thesis-breaking issues in the near term, it’s time to load up.

That’s why we have a “BUY” stance and consider this business attractive here. It’s the second of our “BUYS” here.

3. STORE Capital (STOR): 5.7% Yield

The third spot was a bit of a toss-up. It could have been one of several potentials – because there are a lot of attractive upsides in the market and in REITS here at this time.

However, in the end, we chose to go with STOR over some of the other possibilities. Why is that? There are plenty of high yielders here that would qualify as comparatively safe investments given coverage and fundamentals.

However, unlike many of the options, STOR is investment-grade rated. That means a few things, but in this climate, it means safety and an easier time refinancing debt at lower rates than a company with junk-rated credit.

Furthermore, STOR has fallen from grace quite a bit. The previous close to 19X P/FFO, implying a strong premium, is down to a 12.6X average weighted multiple to FFO and similar to AFFO, which would imply a strong increased risk to the company.

Is there such risk?

No, not really.

Well, you could argue the former CEO’s departure (very sudden) to be a risk here, and you’d be right. But I don’t see it as a fundamental one.

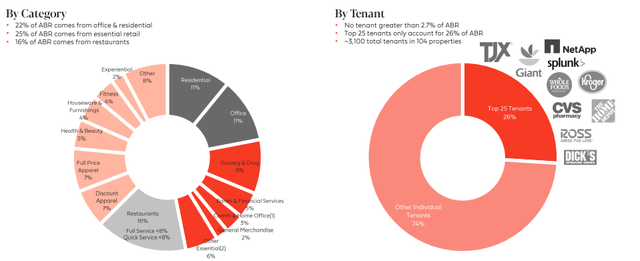

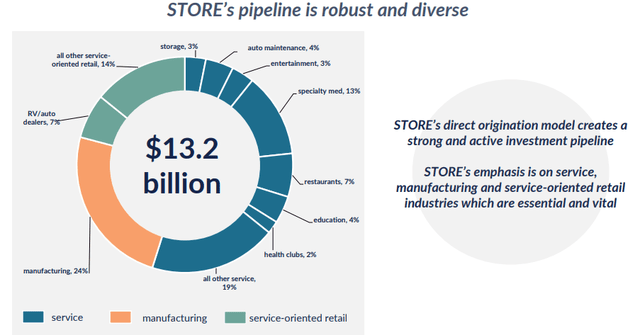

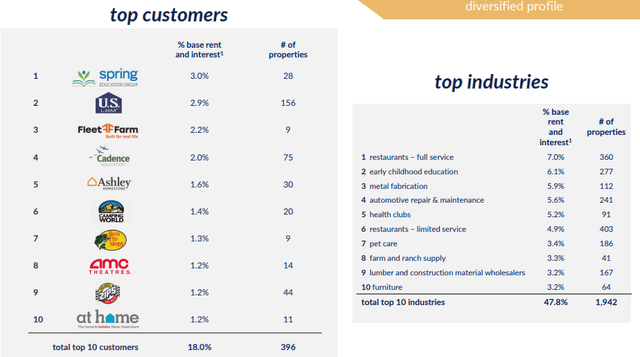

STOR is a REIT with a laser focus on unit-level profitability and being active in expansive areas. The company has 573 customers, with no single tenant at more than 3% of ABR, and the top ten at 18% in 121 different industries. The company’s historicals are convincing, with a 5.7% AFFO CAGR since IPO, as well as a 6.1% average dividend yield since IPO.

The current company guidance calls for continued near 9% AFFO growth in 2022. A company with a focus on profitability, and unit-level profitability is what we want to see here. The company’s record is superb, and it has a massive pipeline.

STOR Investor Presentation

If you’ve done your research on REITs, you know that the crucial part is operating at an attractive spread between acquisition cap rates and company cost of debt. STOR continues to do so and has done so for a long time. While the spread is currently narrowing, it’s still attractive at this time, at well over 3%.

The company operates with a portfolio of around $11.2B, with average leases of 13.3 years in 49 states in the US. The company has properties at 2,965 locations, and 94% of the leases are subject to so-called master leases.

What is a master lease?

A master lease means that STOR rents out a property to a single tenant, and then sublease it to occupant tenants to get rental income. Under this operating model/leasing model, STOR has zero responsibilities for the property.

The lessee is given a so-called “equitable title”, meaning that even though the owner still technically owns the property, you have the permission and right to modify and manage it however you wish for a period of time.

In short, STOR allows its leases to improve its properties and charge higher rents due to the space/quality premium. Then there are sub-types of master lease (performance and fixed), but we won’t go into them here.

Let’s stick with the fact that STOR is a very active user of master leasing models, and as an investor, we want this.

The company leases come with average annual lease escalations of close to 2%. Not really close to inflation, but still an alright performance.

Occupancy?

Simple – 99.5%. STOR also gets Unit-level financial reporting from 99% of its locations, meaning the company knows exactly how well, or how poor a location is doing.

Diversification here is extremely appealing, as we see it. Take a look.

STOR Investor Presentation

All of these factors mean that STOR, despite having lost its CEO and crashed significantly over the past few months, is in a superb position for loading up more here.

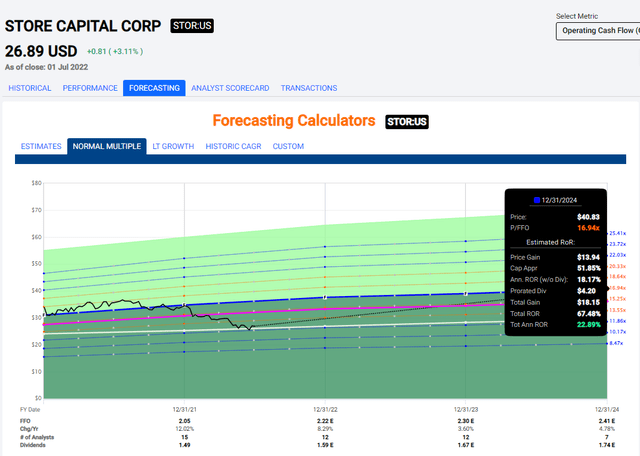

The company yields close to 5.75% here, and at a FFO payout rate for 2022E of around 71.6%, all of these companies come in at extremely well-covered and attractive payout coverages.

Upside?

There’s plenty.

Consider a reversal to standard 15-17X P/FFO, and this would generate annual RoR of close to 23% to a total of 67.5% until 2024E. We consider such performance to be likely here.

FAST Graphs

But even if the company were to perform at “only” 11.5-13X P/FFO, that’s still a market-beating high-end RoR of 13.5% per year or 37% in 3 years. There is a lot to like about STOR here, and that’s why we consider the company a “BUY”.

And remember. STOR very rarely misses these estimates.

FAST Graphs

This is why we, including several of our contributors on iREIT, are LONG STOR – and why we will be buying more.

In Closing

I hope you enjoyed this Wonka-inspired article – 3 Sweet REITs – that offer investors quality portfolios at attractive prices, with upsides of well above 15% per year for the next 3 years or more.

At iREIT on Alpha we’ve long since learned the difference between “investing” and “speculating”. We believe that investing is, to us, synonymous with taking strong stances on quality businesses.

We’ve grasped the danger of risking the principal or capital and we believe everyone should be very careful of this.

Respect every cent you’ve made, because it’s a representation of the hard work you’ve put in. Don’t throw it away on casino-like or gamble-type speculation.

We believe that none of these companies are speculative, but in fact are three of the best opportunities available on the market today. As always, thank you for the opportunity to be of service. Now let’s enjoy some everlasting gobstoppers!

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment