LilliDay/iStock via Getty Images

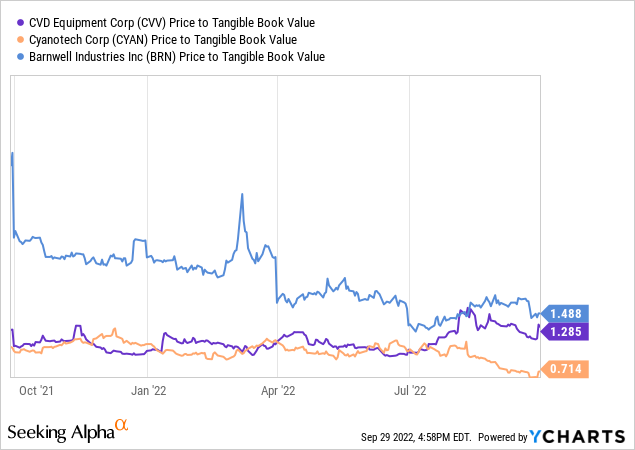

I have purchased shares in three micro-caps over the last week, each previously identified by my Volume Breakout Report series since late June. One just entered an important sale-leaseback agreement, one keeps declining well under tangible book value, and another is witnessing free cash flow explode. The names are CVD Equipment Corporation (CVV), Cyanotech Corporation (CYAN), and Barnwell Industries, Inc. (BRN). All are trading close to underlying tangible book value (going-out-of-business liquidation numbers) despite bright operating futures. And, if earnings turn higher next year, already low EV to EBITDA ratios could be close to business “giveaways” for today’s buyers.

YCharts – CVV, CYAN, BRN – Price to Tangible Book Value YCharts – CVV, CYAN, BRN – EV to trailing EBIDTA

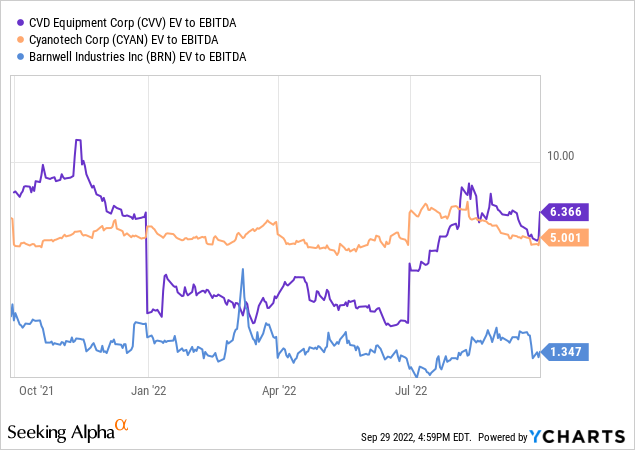

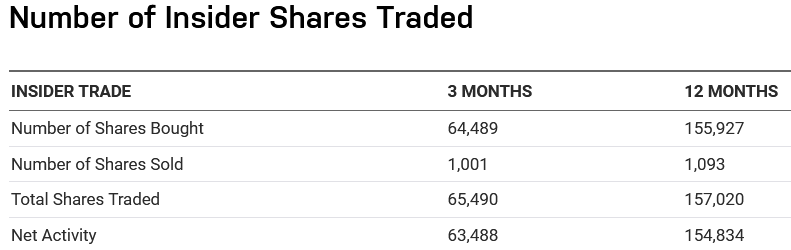

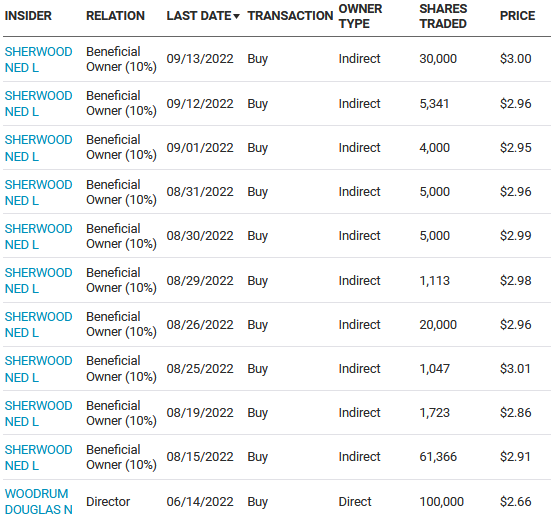

On top of this bullish valuation setup, insiders and management have been steady-to-aggressive buyers during the summer. If this knowledgeable group is optimistic on the direction of each business, why not take a serious look for your portfolio?

I thought I would quickly update my analysis of these potential multi-bag winners. For sure, the weakness in 2022’s U.S equity market is starting to open some real bargain opportunities, the kind you only find for your investment dollar once every 5 to 7 years. All three could easily double or triple in price over the next 12-18 months, if business growth continues (resumes for Cyanotech).

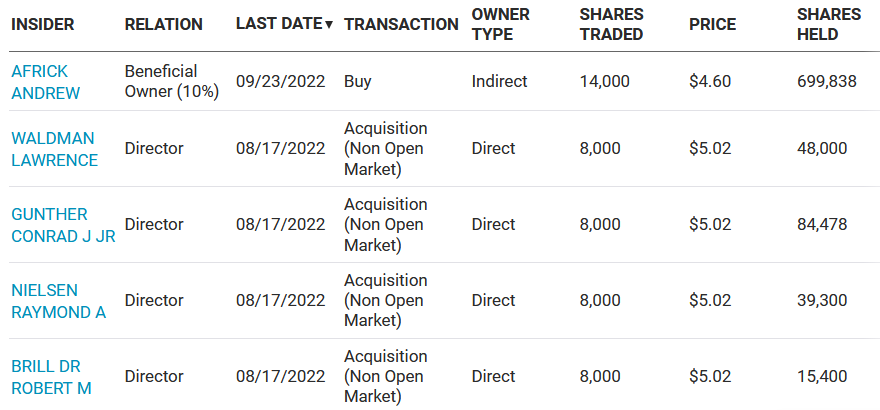

CVD Equipment

CVD just sold its main manufacturing building in a sale-leaseback deal that will add an estimated (by the company) $20 million in net cash after taxes and transaction fees. The entire equity market cap before the announcement was just $30 million, so this is a very important news headline for owners. At the end of June, CVD already held $12 million in cash and $20 million in current assets vs. just $7 million in total liabilities. So, EFFECTIVELY (assuming the real estate deal closes) investors in the low $5 area are getting the operating business for FREE right now.

I mentioned the company in early August here, at about the same price level. The good news is sales growth is expected to be in the 50% to 100% range in 2023, based on mushrooming orders and backlog. Manufacturing equipment that helps speed electric vehicle [EV] charging times seems like a good place to park your money for the future, at least to me. If management can deliver earnings next year and growth in orders continues, buying around $5 will be viewed as an incredible opportunity (hopefully not missed).

Insider buying has been concentrated in the stock since August. There have been no sells reported to the SEC this year. Most of the trades have to do with stock options and compensation for directors, although this activity appears to be abnormal for the company vs. its recent past.

Nasdaq.com – CVD Equipment, Insider Buys StockCharts.com – CVD Equipment, 1-Year Chart of Daily Changes

Cyanotech

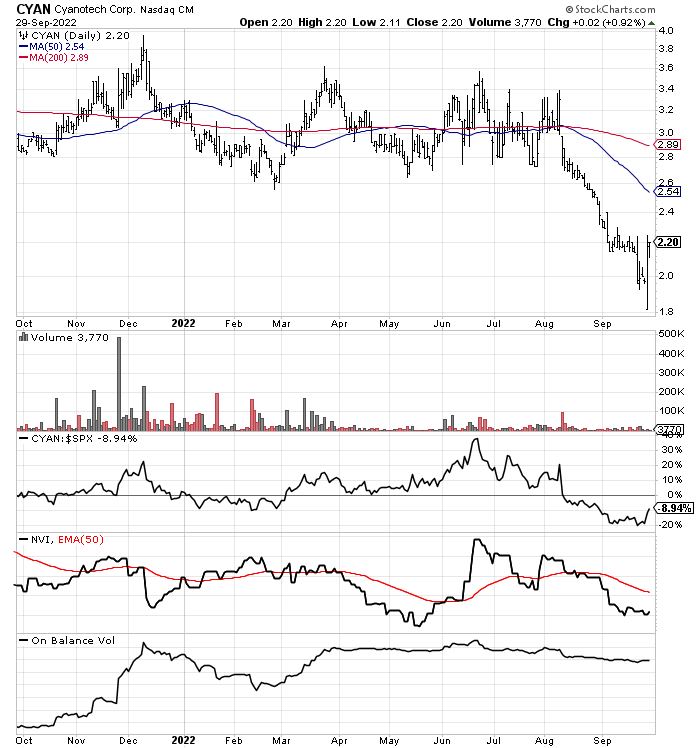

Cyanotech was mentioned in March here, as a unique enterprise growing algae proteins in Hawaii. The company has real expertise that could be utilized to expand the company faster into new bulk algae areas of the plant-based food marketplace. However, sales in 2022 have disappointed, and the stock quote has struggled.

The good news is its self-contained operations use seawater from the Pacific, energy from owned solar panels on the property, and proprietary health supplement production in-house. In mind, the company’s fixed costs give it a real operating advantage if inflation continues at high rates.

At $2 a share, the market cap is a minor $12 million vs. a tangible book value of $19 million (mostly equipment and inventory on its single property). Cyanotech is selling for 10x earnings, which could be the low point for many years. $15 million in current assets stacks up well vs. $12 million in total liabilities and $33 million in annual trailing sales.

Insiders including management have received plenty of stock-based compensation the last three months as incentive to keep operating costs low and smartly move into incremental expansion ideas.

Nasdaq.com – Cyanotech, Insider Buys

Investor confidence has been crushed in August-September. The company is basically selling at a 13-year low price and super-cheap valuation if business trends turn higher. Assuming supplement sales rebound next year, I figure the stock could trade above $6, with EPS in the $0.50 range.

StockCharts.com – Cyanotech, 1-Year Chart of Daily Changes

Barnwell Industries

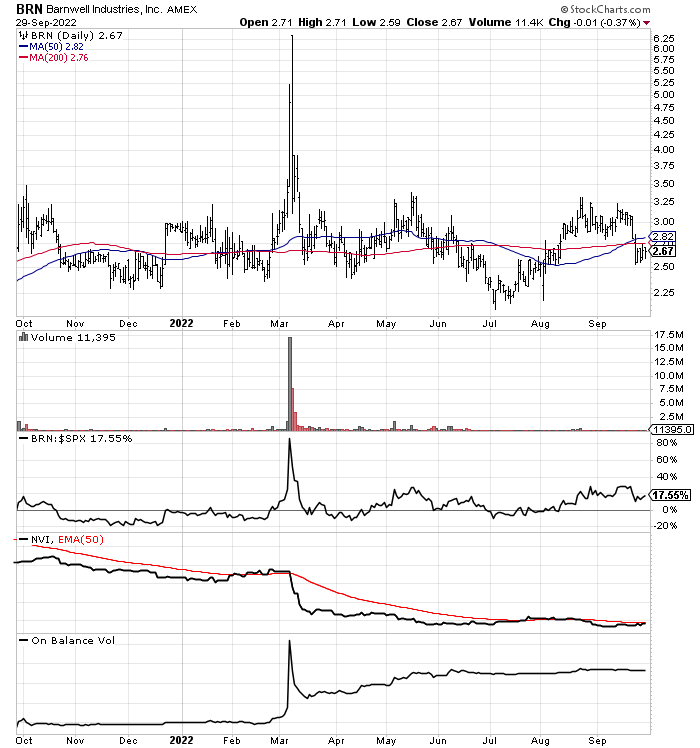

Barnwell is also based in Hawaii, but with 80% of revenue now being generated by oil/gas production and ownership in Canada. It’s a backdoor play on one more spike in global petroleum prices this winter from supply problems in Europe (caused by Russia withholding supplies). In June, the company held $20 million in current assets vs. $18 million in total liabilities. I am coming up with an estimated tangible book value at the end of this month of approximately $2 per share. Management started a dividend, and appears to be very confident on future free cash flow generation from high oil/gas prices.

I talked about Barnwell in a VBR article five weeks ago here. Since then, the price has declined about 10% with weaker crude oil quotes. The overall investment picture at $2.67 per share looks quite positive, especially if crude oil and natural gas prices rise from today. The valuation of this oil business is between a 50% to 70% discount to the regular oil companies traded on Wall Street, from its lack of analyst coverage and investor following. $150 per barrel crude oil and $10+ MMbtu for natural gas could allow for earnings in the $1.50 to $2.00 share range annually, about the same as its current share quote.

A member of the board of directors and a 10% owner have been aggressive buyers since June. Together they have “added” better than 2% of outstanding ownership interests to their accounts.

Nasdaq.com – Barnwell Industries, Insider Buys StockCharts.com – Barnwell Industries, 1-Year Chart of Daily Changes

Final Thoughts

As I explained weeks ago, Volume Breakout Report selections will only come in numbers once Wall Street bottoms from the wicked bear market selloff playing out. Until then, investors should concentrate on keeping losses to a minimum with extra cash holdings and diversification into assets outside of regular stocks. Please consider hedges like short selling individual names and buying inverse exchange-traded funds (“ETFs”), alongside investments in gold/silver. Both angles should help you sleep better at night. One bullish take on the current market decline is solid bargains are beginning to show up. Focusing on turnaround situations and underlying net asset plays often creates awesome gains eventually, when a new bull phase takes shape.

A diversified basket of selections (at least 20-30 names) is the smartest way to reduce risk in smaller companies. I do not recommend exaggerated exposure in any one name, as each can experience wild price swings, with minor dollar amounts able to move marketplace supply/demand equilibrium. Please consider using preset stop-loss sell orders to reduce downside potential in individual names. Depending on your risk tolerance, 20% to 30% stop levels are recommended. Cutting your losses quickly is an important part of the investing process, while winners should be allowed to run for a spell.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment