24K-Production

Introduction

In this article, we share our bearish thesis against Datadog (NASDAQ:NASDAQ:DDOG). We think in today’s rate normalizing environment, Datadog is a sell at its 20x TTM EV/sales valuation due to three reasons:

- Datadog’s profitability is expected to worsen due to management’s commitment to invest, among other factors.

- Being currently valued at one of market’s most expensive multiples leaves little room for error.

- Convergence of product offerings between Datadog and its competitors, puts risk to its valuations.

What Does Datadog Do?

Datadog is a monitoring and security platform for cloud-based applications. Founded in 2010, Datadog’s mission is to break down the traditional DevOps silos. Its SaaS-based platform automates and integrates five complementary applications in infrastructure monitoring, application performance monitoring (“APM”), log management, UX monitoring, and network performance monitoring to provide unified and real-time observability to its customers. Datadog recently expanded its offering into the application-security segment following the acquisition of Sqreen.

Datadog generates revenue from sales of

- Monthly or annual subscription to customers using its platform;

- Usage-based products such as log management and APM;

- And additional add-on products such as custom metric packages, anomaly detection, and more.

Datadog’s products are mostly self-served and does not require on-premises installation.

Professional services are usually not required for the implementation of our products and revenue.

Datadog employs a land-and-expand sales strategy. The company first sells easy-to-adopt and short-time-to-value products to customers. Then, it cross sells other observability products within its portfolio of offering either through its sales team or on a self-serving basis. Datadog has been very successful with its land-and-expand strategy as its revenue consistently grow at a robust rate. Datadog’s revenue growth, on year-on-year basis, for the last four quarters were 74.88%, 83.74%, 82.84%, and 73.9%, for Q3’21, Q4’21, Q1’22, and Q2’22, respectively. Below is an example of an 8-figure upsell enabled by Datadog’s land-and-expand strategy shared by CEO Olivier Pomel during the Q2’22 earnings call:

[We] signed an 8-figure upsell with a next-gen fintech company which was our largest ever deal on an ARR basis. This customer is experiencing explosive growth in demand for its products, and availability and performance of their system is critical to avoid loss of revenue. These customers started with us 3 years ago with just infrastructure monitoring, and its expansion now includes 6 of our products.

DDOG Stock Recent Performance

Similar to most tech names, Datadog has been in a steep decline since the beginning of 2022. YTD, Datadog has lost approximately -45% of its market capitalization, with its share price declining from $160 in January 2022 to $88 on September 30th, 2022. However, despite losing close to half of its market capitalization, Datadog continues to be one of the most expensive stocks in the market, trading at approximately 20x TTM EV/sales.

TTM EV/Sales Multiples (Seeking Alpha )

Investment Summary

Below, we share 3 reasons why, in our opinion, investors have continued to support Datadog at one of the loftiest valuations in the market.

1. Recession-proof (so far); consistent and robust revenue growth despite macro headwinds in Q2’22

Inflation is at its 40-year high. The Federal Reserve is catching up to the curve and is raising interest rates at its fastest pace in more than a decade. Yet, Datadog is experiencing close to no impact on its operations from these macro-headwinds.

In Q2’22, Datadog revenue outperformed the higher-end of its guidance by 7% (actual: $406mm vs. higher-end guidance: $380mm). And this outperformance isn’t the result of conservative guidance; management previously guided a 62% (Q2’21 actual $234mm; Q2’22 guidance $380mm) year-over-year improvement from Q2’21.

In terms of customer acquisitions, Datadog added an additional 850 customers with over $100,000 ARR, which represents a 54% improvement compared to Q2’21. And its net-dollar-based retention rate for the latest quarter was over 130% as “customers continue to increase usage” and adopt more products.

As of the end of Q2, 79% of customers were using two or more products, up from 75% a year ago. 37% of customers were using four or more products, up from 28% a year ago and 14% of our customers were using six or more products, up from 6% a year ago.

While Datadog’s latest operating performance has been unaffected by recent macro headwinds, management mentioned during the earnings call that they’re observing some “variability” in growth and usage among its customers, in particular customers within the consumer discretionary segment. This impact is evident in the sales mix that’s not disclosed to investors, embedded in the volume-based usage product offering such as log management and APM suite.

And we saw lower expansion rate weighted towards areas of our platform that have volume-based components like certain aspects of log management and APM. Infrastructure monitoring ARR growth was relatively steady year-over-year.

2. FedRAMP Moderate Status; new market opportunity (public sector)

In Q4’22, Datadog announced it has received the FedRAMP Moderate Authorization status. FedRAMP stands for Federal Risk and Authorization Management Program, which is a federal program to assure that cloud service providers are employing a proper level of information and data security when providing services to the US government. The US FedRAMP Moderate status means there’s now a new revenue opportunity for the company, the public sector market.

After receiving the FedRAMP status in Q4’21, Datadog was able to immediately upsell a 7-figure contract with a US federal entity in Q1’22.

We had a 7-figure upsell with a U.S. federal entity. We were able to deepen our relationship with this customer after we achieved FedRAMP Moderate status. Before Datadog, this customer had siloed infrastructures, applications, networks, database, and customer experience monitoring, this caused blind spots and long times to resolution. With this expansion, they are replacing both homegrown and commercial observability tools and are enabling Dev-Sec-Ops cultures with a visibility across the full stack and a single source of truth.

3. Early stage of observability industry; market leader

Observability describes the capability or technology that enables the discovery process of what went wrong in applications and systems. As industries become increasingly digital and migrate onto clouds, applications and systems are becoming more complex. To figure out what went wrong in the event of a malfunction is often challenging and requires significant resources.

We’re at a very early stage of the observability industry, which is expected to grow into a $35bn market. It is viewed that there’re only a handful of ready competitors/vendors within the observability industry today. Datadog CEO Pomel has previously discussed that the company’s biggest competitor is usually customers’ self-built observability product utilizing open source. But these open-source products often require significant manpower to develop and maintain. And it usually isn’t compatible nor sustainable as customers grow and scale their operations.

The below quote is an example of multinational media adopting Datadog’s monitoring products in favor of its mix of internal open source and legacy solution:

We had a seven-figure land with a multinational media company. This customer has aggressive expansion plans for its streaming service, including in international markets. But they found that their current mix of open source and legacy solutions wasn’t meeting their needs. They calculated Datadog [indiscernible] simply by accelerating resolution of just one of their major incidents and avoiding loss of revenue. This customer started with infrastructure, APM and log management, with the opportunity to expand and to more usage in products as the company scales.

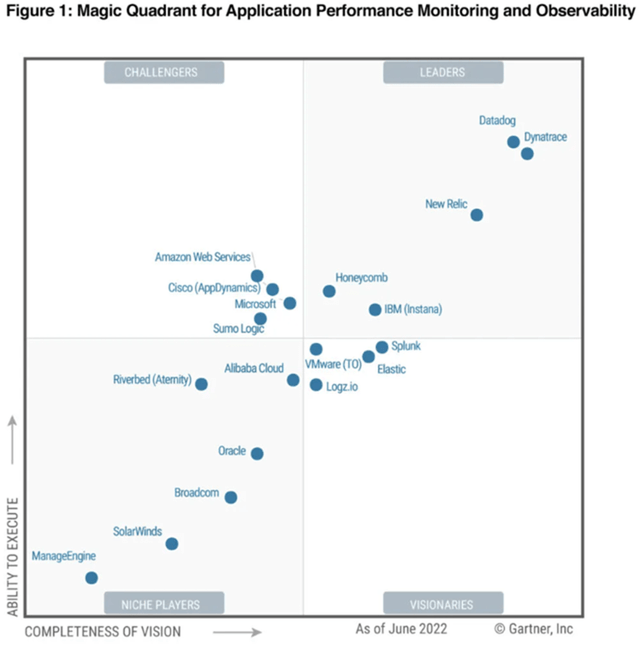

Datadog is viewed as an industry leader by investors. Below is a discussion of Datadog being able to influence market-pricing for observability products. Datadog product pricing is closely followed by its competitors such as New Relic and Dynatrace.

Datadog was also recently announced as the market leader in Gartner 2022 Magic Quadrant for Application performance monitoring and observability. Datadog was selected as a market leader for both its ability to execute and the completeness of its vision.

Gartner 2022 Magic Quadrant

Short Thesis

Despite the three long-term bullish investment points discussed, we think Datadog could work well as a short-term hedge against our long-concentrated, tech-focus portfolio. Below we discuss three reasons why a short-term, long-put-options trade against Datadog could yield outsized returns.

1. Datadog’s profitability is expected to worsen due to management’s commitment to invest. Worsening profit profile likely will be viewed unfavorably by investors during market downturn.

Datadog confirmed that it is not slowing its acquisition and R&D efforts.

We continue to feel very confident in our opportunities. We believe cloud migration and digital transformation are drivers of our long-term growth and our multiyear trends that are still early in their life cycle. And we believe it is increasingly critical for companies to embark on these journeys in order to move faster, serve their customers better and in times like these become more efficient with their infrastructure and engineering investments. So, we plan to continue to invest in our solid priorities to execute on these long-term opportunities.

Management expects Datadog to experience 400bps of margin impacts from peak gross margin of 80% in Q1’22 due to both the return to office mandate and in-person tech events.

First, gross margins have recently been at the top of our historical range. In operating expense, we have returned to in-office attendance, travel and events. We estimate that this was a 300 basis point sequential margin impact in Q2, and we expect an additional 100 basis point sequential margin impact in Q3.

And, hosting the Dash User and AWS conferences are expected to add another 400bps impact to its gross margins in Q3’22.

As Oli mentioned, in Q4, we will hold our Dash user conference and we will participate in the AWS re:Invent, our largest trade show at the end of the year. The cost of these events will be approximately 400 basis points of margin impact.

For operating income, Datadog reported GAAP-operating loss of -$9.9mm in contrast to the non-GAAP operating income of $85mm, or 21% operating margin, discussed by management during the Q2’22 earnings call.

While we agree that companies should invest for the future, doing so in a substantial manner while the world heads into a recession will add significant pressure on the company’s valuations. Margin pressure from investments on top of the expected -8% post-COVID impacts will worsen the already negative operating margin. Datadog’s worsening profit profile will likely be viewed unfavorably by investors in our opinion as macro headwinds continue to add pressure and cost of capital increases.

2. Being valued at one of market’s most expensive multiples leaves little room for error.

Datadog is one of the most expensive stocks in the market, valued at ~20x TTM EV/Sales. Its lofty valuation multiple has been resilient as the company consistently outperforms both management’s guidance and sell-side expectations. For example, as mentioned earlier, Datadog revenue grew 74% year-over-year in Q2’22, outperforming both management’s guidance (+62% y/y) and consensus (+64% y/y) from sell-side analysts.

Yet, despite its outperformance, Datadog’s share price remained unchanged; it didn’t trade higher from outperforming analysts’ consensus by 10%. To us, it seems that investors are expecting a lot from Datadog; to sustain its current 20x TTM EV/Sales multiple, Datadog needs to meaningfully outperform both guidance and consensus again. And if Datadog performs at or below guidance and consensus, it will likely lead to a significant valuation contraction.

Here are 2 reasons why we don’t think Datadog is likely going to generate as robust revenue growth as it did in Q2’22:

- Subscriptions are signed on a monthly and annual basis, which means customers can flexibly attempt to negotiate a more favorable rate. We believe most customers’ CFOs are becoming increasingly cost-sensitive with its back office spending during a global tightening environment.

- Some products such as log management and APM have a volume-based component. Management has already observed “noises” and “variability” during Q2’22. If the Federal Reserve continues to push the economy into a recession to contain the 40-year high inflation, we expect customers to be even more sensitive to the usage-based products, thereby affecting Datadog’s ability to grow revenue.

We want to make it clear that we don’t expect Datadog’s revenue to decline. We expect it to continue to grow at a significant pace still, but slower than it did previously as the macro operating environment becomes more challenging. And because investors have historically expected a lot from the company, we don’t think Datadog will deliver enough to sustain its lofty valuation.

3. Convergence in product offerings between Datadog and its competitors.

Having started in infrastructure monitoring, Datadog’s product offerings have quickly and successfully expanded into other adjacent areas such as APM, log management, UX monitoring, and security. As Datadog expands into its competitors’ area of specialties, its competitors are doing the same, which accordingly creates this convergence in product coverage. In the example of security, Datadog’s product differentiates from security-pureplays by having its product focus more on monitoring for operation teams instead of for security teams. We think this distinguishment is less rigid than its previous products and therefore, offers less moat. We don’t think it would be particularly difficult for other companies to step over and offer similar products, putting Datadog’s market share at risk. Again, any slowdown in Datadog’s revenue growth will be magnified as it is trading at one of market’s most expensive valuations.

Risks to Shorting Datadog

Below are two risks we’ve identified in shorting Datadog:

- Datadog has historically surprised investors and outperformed consensus. There’s a chance that Datadog will return greater than expected topline growth thus offsetting the potential valuation multiple contraction we anticipate. From RBC notes with management, they’ve mentioned that the operating environment was “noisy” in beginning of Q3’22, but performance has improved since.

- A large part of our short thesis revolves around the anticipated increase in cost of capital which thereby exacerbates the anticipated decrease in return on capital (or reduced profit profile) for Datadog. However, macro is difficult to predict and there’s a chance that the macro environment and Fed’s decision will differ from what we are anticipating.

Conclusion

In conclusion, Datadog has, historically, outperformed market expectations and grown at a robust rate. And the company is well-positioned for sustained take-rates over the longer term within the observability industry as industries become increasingly digital and migrate to the cloud. However, in our opinion, in the short-term, due to 1) potential worsening of profitability due to management’s commitment to invest, among other factors; 2) potential slowdown in revenue growth due to macro headwinds; and 3) convergence in product offering between Datadog and its competitors, the company’s lofty ~20x TTM EV/Sales valuations could contract meaningfully, which offers a significant sell opportunity for investors.

Be the first to comment