lithiumcloud/iStock via Getty Images

Benjamin Graham once wrote,

“Diversification is an established tenet of conservative investment. By accepting it so universally, investors are really demonstrating their acceptance of the margin-of-safety principle, to which diversification is the companion.”

In other words, the legendary value investor believed that diversification is perhaps the simplest and cheapest form of utilizing the margin of safety. It’s the reason that the catchphrase “don’t pull all of your eggs in one basket” was coined.

Another well-known value investor, Sir John Templeton, said it like this,

“The only investors who shouldn’t diversify are those who are right 100 percent of the time.”

Sir John coined “the world’s greatest stock picker of the century” by Money magazine was only right 66% of the time.

So, if the greatest stock picker in the world needs to be diversified to protect against losses, the average investor can surely benefit from the practice of diversification too. As a huge proponent of diversification, as he explained (in July 1949):

“Diversification should be the cornerstone of your investment program. If you have your wealth in one company, unexpected troubles may cause a serious loss; but if you own the stocks of 12 companies in different industries, the one which turns out badly will probably be offset by some other which turns out better than expected.”

I have now been a real estate investor for over 30 years. I started out as a small real estate developer in which I constructed and leased back buildings to companies like Advance Auto Parts and Blockbuster Video. Later I developed shopping centers for chains like Walmart and Ahold.

During my time as a developer, I did have to navigate a few tenant bankruptcies; however, I was diversified enough such that one torpedo did not sink the ship.

That’s precisely what happened almost a century ago, May 7, 1915, when the RMS Lusitania (a UK-registered ocean liner) was torpedoed by an Imperial German Navy U-boat. The passengers aboard the ocean liner had been warned before departing New York of the danger of voyaging into the area in a British ship.

One single torpedo struck the boat, and it took just 18 minutes for it to sink. This turned public opinion in many countries against Germany and was a contributor for the U.S. to enter World War I two years later.

That’s a harsh example, but it’s true that owning one individual stock can be extremely risky, and the purpose for my Easter-inspired article is to make the case for maintaining a diversified stock portfolio.

Every investor has his or her own risk tolerance limitations, and it’s important to consider both systematic risk (market risk) and unsystematic risk (asset specific).

How many eggs to put in your basket depends on you, as you seek to balance these risks versus the potential rewards.

One thing I always like to ask myself is whether “the thrill of victory is worth the agony of defeat”.

In The Intelligent Investor, Ben Graham talks about this idea of the roulette table and how it can relate to both the margin of safety and diversification.

He pointed out, you have a bunch of stocks with a margin of safety, and if you’re making mathematical decisions, that margin of safety will be based on cold, hard facts.

He said that when you throw diversification into the mix, you’re essentially helping these stocks have higher mathematical odds of doing well. The result is that you either have your cushion absorbed so you can keep having great returns regardless… or you get superb returns.

By spreading your risk out, you’re improving the chances.

And over the long term, your chances are just going to be better than an investor who is speculating. And by “speculating,” he meant somebody working off of emotions.

Remember that, when you play roulette, the odds are in the house’s favor. They aren’t 50-50 (black and red).

REIT Roulette

Today, I’m providing you with a sweet REIT treat, in that I will be providing you with a few Strong Buys to add to your dividend basket. If you don’t own any of these REITs, I encourage you to do so, as they represent a few of my highest conviction picks.

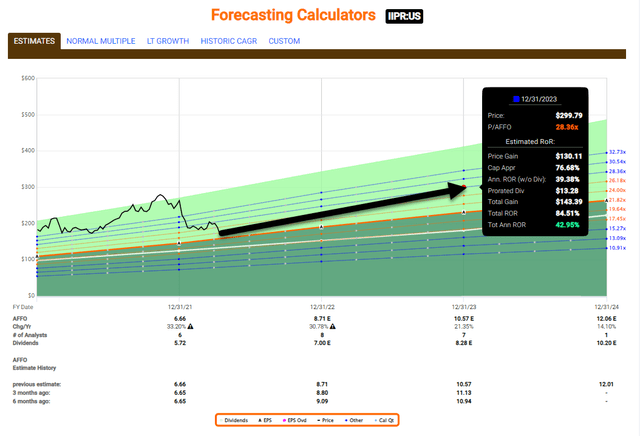

Innovative Industrial (IIPR) is a cannabis REIT that owns 105 properties (as of Q4-21) in 19 states and has one of the strongest balance sheets (with no secured debt and no debt maturities this year or next year) in the REIT sector.

IIPR recently announced a dividend increase of almost 17%, boosting its quarterly payment from $1.50 per share to $1.75 per share (we suspect the company will grow the dividend to $2.00 in 2022).

Recently IIPR issued 1.5 million shares at $190/share, and as I informed iREIT on Alpha members, “IIPR priced the offering as aggressively as it could, in order to continue to fund the acquisition of properties in the pipeline. IIPR was also able to upsize the transaction by more than 50% from the original launch, which is reflective of the strong level of investor interest in this offering.”

The bigger news recently was the short attack from Blue Orca Capital, and my subsequent reply,

“I truly believe that Blue Orca is confused with the sale/leaseback mechanism in which a property seller (and new lessee) can convert an illiquid fixed asset into cash and increase its working capital.

This concept is nothing new, as many REITs including W. P. Carey (WPC), Realty Income (O), STORE Capital (STOR), VICI Properties (VICI), and Medical Properties (MPW) use sale/leasebacks on a frequent basis.”

IIPR remains a top conviction at iREIT on Alpha and we strongly suggest holding a position. As most know, shares are now trading at an extreme discount – 23.4x P/AFFO and dividend yield of 4.1%. Shares have not traded this low since 2020.

Meanwhile, the growth engine is intact, as analysts expect AFFO per share to grow by another 20% in 2022. My conservative model has IIP returning 40% annually:

As I referenced in the previous article, “one way for IIPR to climb is to split the stock (4:1) which will open up the floodgates for retail investors. In addition, a monthly dividend would be nice.”

richard johnson/iStock via Getty Images

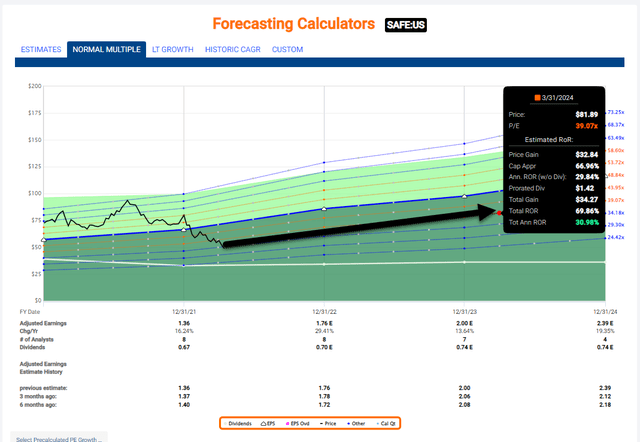

Safehold (SAFE) is a unique net lease REIT that focuses exclusively on ground leases, that is, the land underlying the types of buildings. SAFE’s ground leases can be part of the capital structure of almost any property within the $7 trillion+ commercial real estate industry.

In 2021, SAFE closed over $1.5 billion of ground leases and broke into several new markets, the company originated a record 17 ground lease transactions for $777 million in Q4-21, representing the second best quarter-by-dollar amount ever and the best quarter since the beginning of the pandemic. Since its IPO (6-22-17) SAFE has grown 14x – from $.3 billion to $4.8 billion.

At the end of Q4-21, SAFE had $3 billion of debt, comprised of approximately $1.5 billion of nonrecourse secured debt, $750 million of unsecured notes, and $272 million of debt on ground leases (own in partnership). The weighted average debt maturity is 23 years.

SAFE has $490 million drawn on its unsecured revolver, and so combined with cash on hand, we has approximately $900 million of liquidity at the end of the year. On a recent Ground Up podcast (iREIT on Alpha members) SAFE’s CEO, Jay Sugarman told me,

“…we want to be the low-cost provider for our customers. So we’re trying to drive our cost of capital down and then pass that along to our customers.”

More recently SAFE announced this so-called Caret transaction that allows investors to tap into the UCA (unrealized capital gains) value with a small group of sophisticated investors.

Granted this is a small deal – SAFE sold and received commitments to purchase 1.37% of Caret units for $24 million (at a value of $1.75 billion) – but it’s a path to creating liquidity that could provide a public market listing for Caret units.

Like IIPR, SAFE has also sold off quite a bit – over 39% YTD – and shares are now trading at $167.30 with a dividend yield of 1.4%. We believe SAFE is edging closer to internalizing with iStar (STAR) and we believe this could serve as a catalyst that provides more transparency (and value) to the combined companies.

Similar to IIPR, SAFE’s growth engine is intact, as analysts are forecasting EPS growth of 29% in 2022. The Carat concept is hard to grasp, it seems almost like investing in NFTs, but if SAFE can create a sustainable market for monetizing its unrealized gains, SAFE’s cost of capital will be super-charged.

Again, don’t put all of your eggs in one basket, but SAFE could be an interesting chip to have on the table.

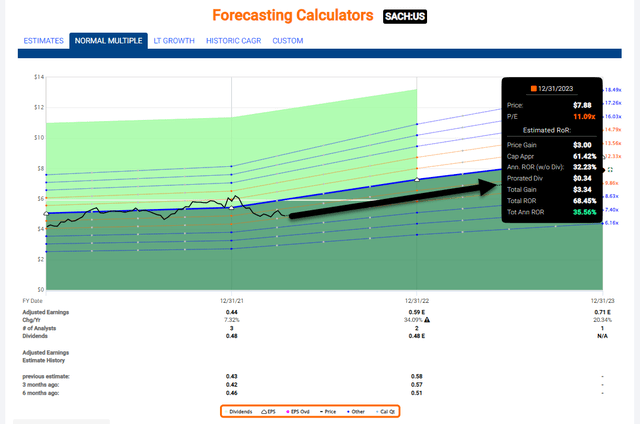

Finally, we’re betting on Sachem Capital (SACH), a commercial mortgage REIT that could become the quintessential diamond in the rough. The Connecticut-based mREIT specializes in originating short-term, high-yielding real estate loans, historically targeting the “fix-and-flip” and real estate development markets.

All loans secured by first lien mortgages with conservative maximum 70% loan-to-value ratio; all loans require personal guarantee by the principals of the borrowers.

One key differentiator for SACH is its nimble approach to origination, the company can close a loan in as quickly as 5 days, whereas the competitors can take 3-6+ months. Due diligence is more centered around the value of the collateral rather than the property cash flows or borrower’s credit.

The company continues to diversify holdings, including larger loans with established developers, and it’s also expanding lending operations across the U.S. with a presence in 14 states, with a strong core focus along the Eastern seaboard.

Total revenue in 2021 was approximately $30.4 million (compared to approximately $18.6 million in 2020), an increase of approximately $11.8 million, or 63.5%. The increase in revenue was due primarily to an increase in lending operations.

Net income for 2021 was approximately $11.5 million (compared to approximately $9.0 million for 2020), an increase of approximately $2.5 million or 27.5%. The net income per weighted average common share outstanding for 2021 was $0.44 compared to $0.41 for 2020.

The payout ratio was 109% in 2021 which means the dividend was not covered; however, the analyst forecast for 2022 looks solid, with 34% growth (keep in mind, there are just 2 analysts reporting to FAST Graphs).

Nonetheless, given the pipeline and modest default rate (of around 1.6%), we believe SACH could easily cover the dividend and provide shareholders with a meaningful boost in 2022.

We maintain a Strong Buy, although we must also acknowledge this small cap REIT ($176 mm market cap) can be extremely volatile. Shares are now trading at $4.88 with a P/E of 10.1 and dividend yield of 9.8%.

What’s in your REIT Basket?

I own all three of these REITs because I consider them cheap while they’re also likely to generate considerable growth in 2022:

- IIPR: +31% AFFO per Share

- SAFE: +29% EPS

- SACH: +34% EPS

Where else in the REIT sector are you going to find REITs that are growing at 30%?

Meanwhile all three are trading at a wider margin of safety.

“If I pay too much upfront, I’d better understand everything there is to know about the company since there is no margin of safety. If I invest when it’s undervalued, I can be wrong about a whole host of issues and still make a good return” – Guy Spier

Happy Easter and thanks for reading!

Be the first to comment