VioletaStoimenova/E+ via Getty Images

Capital Rotation

I am always looking for opportunities to rotate capital whenever the market presents an opportunity to do so. In the current environment, we have sold some of the high-cost energy investments and replenished cash holdings. It’s pretty uncommon that I liquidate a position altogether unless I believe the business model or potential investment thesis no longer makes sense.

Those who are interested can reference my previous article ‘3 Dividend Paying Industrials Near 52-Week-Lows’ which was well received and inspired me to look at other sectors for additional opportunities.

Consumer Goods Stocks On The Watchlist

The current environment has opened some doors for entry points in stocks that are near the 52-week-lows. In many cases, these stocks were near their 52-week-highs within the last six months.

The goal of this list is to have a brief review of the company and several of the metrics that we consider particularly important when investing in dividend-paying stocks.

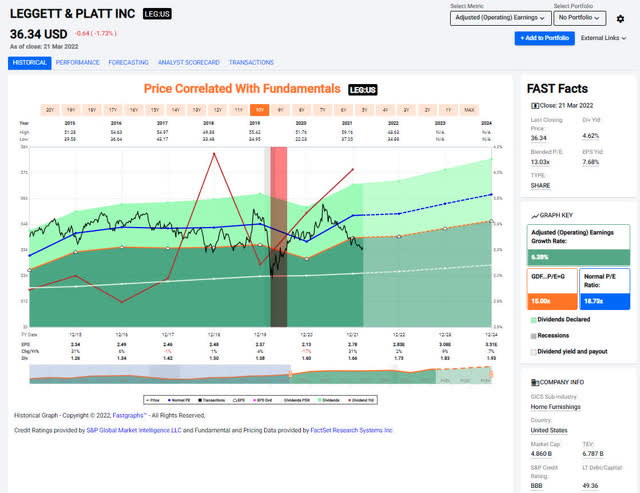

Leggett & Platt – We recently trimmed our retirees John and Jane’s exposure to LEG because we wanted to reduce the holding to the lowest cost basis possible (the remaining position is from when shares reached unheard-of lows in the $25/share range during the initial phases of the COVID outbreak and is indicated by the red highlighted area on the image below). Referencing the Fastgraphs image below we can see that the market is currently pricing in a rather bleak performance relative to the company’s historical P/E ratio of 18.7x.

LEG – FastGraphs – 2022-3 (FastGraphs)

From everything I can see, there is nothing in LEG’s guidance that would suggest the significant drop in share price. Here are the highlights of what LEG expects to see in 2022:

- Projected sales are expected to come in somewhere between 4%-10% (results in $5.3 billion-$5.6 billion in sales).

- EPS for 2022 are expected to be between $2.70-$3.00 per share.

If we use the low-end EPS guidance of $2.70/share and see that the dividend is more than covered (and this is already after LEG has increased the dividend by 5% to $.42/share per quarter or $1.68/share annually. This works out to be a dividend payout ratio between 56%-62% which is right in line with LEG’s historical payout ratio that falls between roughly 50%-60%.

Therefore investors who are seeing a warning on SeekingAlpha that “LEG is at a high risk of cutting its dividend” can rest assured that management has no intention of ruining their 51-year history of regular dividend increases.

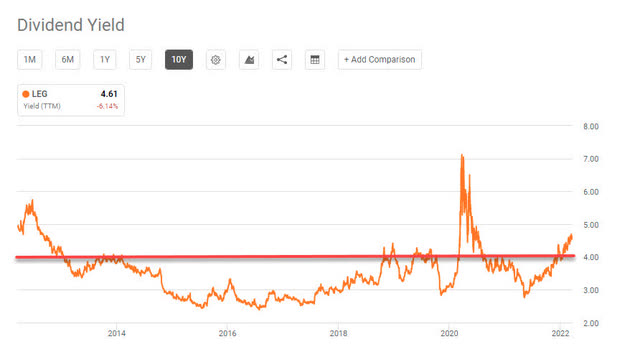

Leggett & Platt – Dividend Yield (Seeking Alpha)

One of the reasons why LEG made my shortlist is that the dividend potential is extremely compelling. The company has previously seen quite a bit of resistance at the 4% yield mark over the last 10 years the main notable exception was during the pandemic (again, this is when we really took advantage of the situation and built a low-cost position that hadn’t been seen for 8 years prior to the pandemic. Purchasing shares at these levels significantly increases the opportunity for investors to earn an outsized return on their investment.

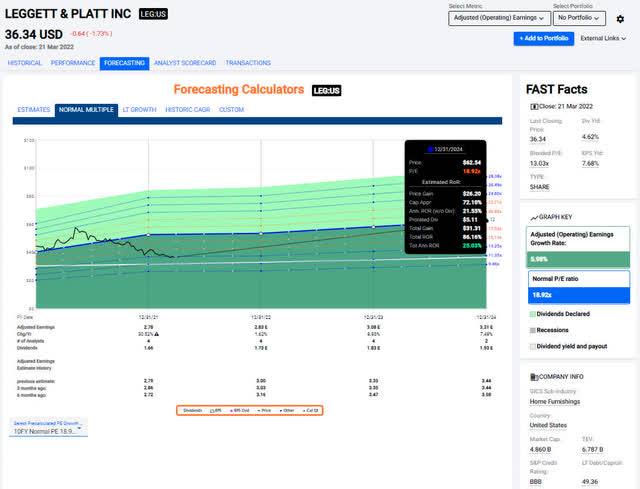

LEG – FastGraphs – Forecasting (FastGraphs)

The FastGraphs image above utilizes the 10-year P/E ratio of 18.9x to suggest that investors could see an annualized return of 25% through the end of 2024.

The dividend growth rate over the last 10 years comes in at 4.2% which isn’t the most compelling investment we have seen but when we look at the current dividend yield I am willing to accept a smaller annual dividend increase because we are earning a yield that higher growth stocks would take years to match.

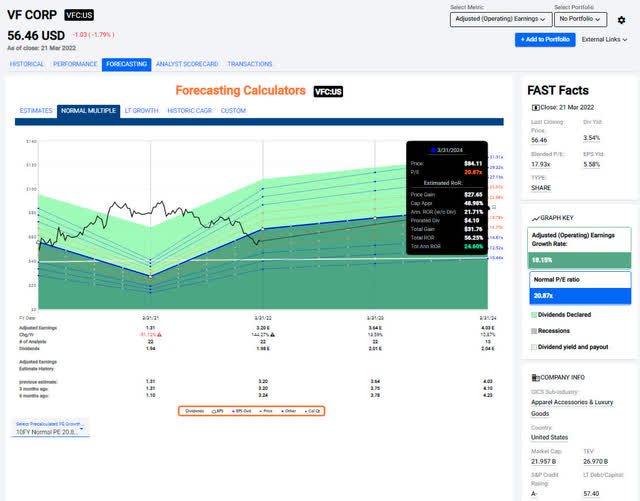

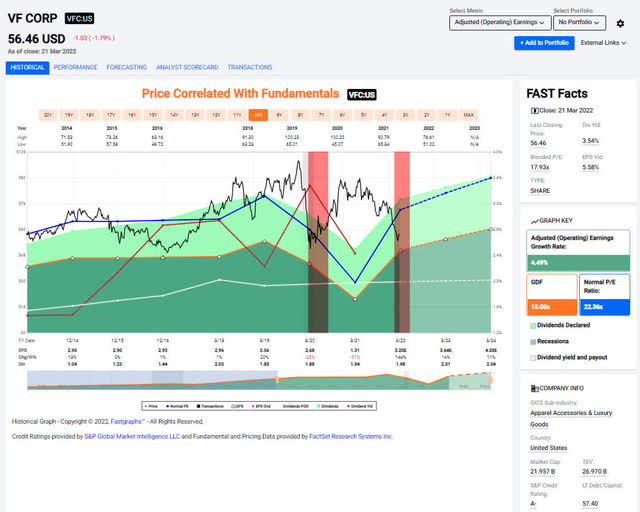

VF Corporation – Analysts didn’t seem too happy when VFC cut its full-year revenue outlook to $11.85 billion down from $12.0 billion. As if that wasn’t bad enough, VFC did not achieve the kind of margin expansion that analysts were hoping to see. The final straw for VFC’s share price was Russian invasion of Ukraine which added to the uncertainty when it comes to European sales.

I am personally long VFC stock alongside my clients John and Jane because they have great product lines (The North Face and Dickies are two of my favorites).

The first highlighted area of the image above represents the stock’s performance during the initial phases of the coronavirus pandemic. The second highlighted area is where we are today as the stock price dropped as a consequence of the events mentioned above.

This has led to a situation where the dividend yield is near its all-time high and is an extremely rare occurrence to see. Traditionally I would view VFC as a solid buy when the dividend yield is around 3%. Even then, there have only been a few time frames over the last five years where VFC was selling at a discount and offered a dividend yield at or above 3%.

VFC – Dividend Yield (FastGraphs)

VFC has a reasonably safe dividend (the payout ratio is currently higher than I would normally like to see at roughly 68%. We can see that EPS is set to improve and could potentially drop to 50% over the next two years. The main reason why am not concerned is that VFC boasts a dividend growth record of 48 consecutive years and according to Brad Thomas’s recent article ‘V.F. Corp Is High-Yield Dividend Aristocrat Bargain You Don’t Want To Miss’ he rightfully points out the kind of economic environments that VFC has been able to navigate through successfully.

VFC – Fundamentals – Brad Thomas (Seeking Alpha)

All of these factors contribute to a long-term bull thesis because honestly there is nowhere to go buy up from this point. The FastGraphs forecast using the 10-year average P/E ratio of 20.8x also indicates there is serious upside potential that is currently available in box LEG and VFC.

VFC – FastGraphs – Forecasting (FastGraphs)

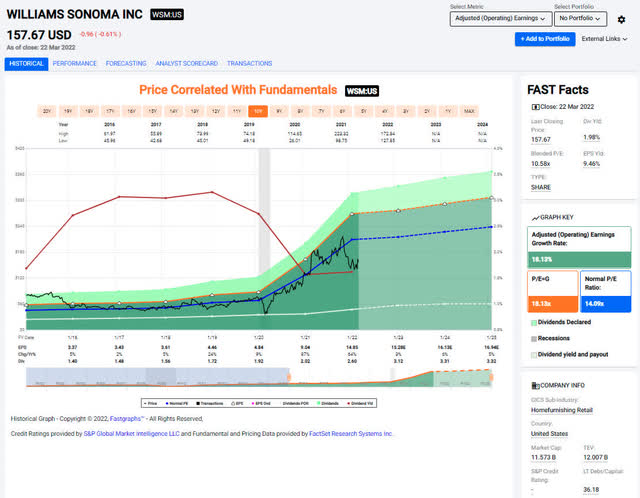

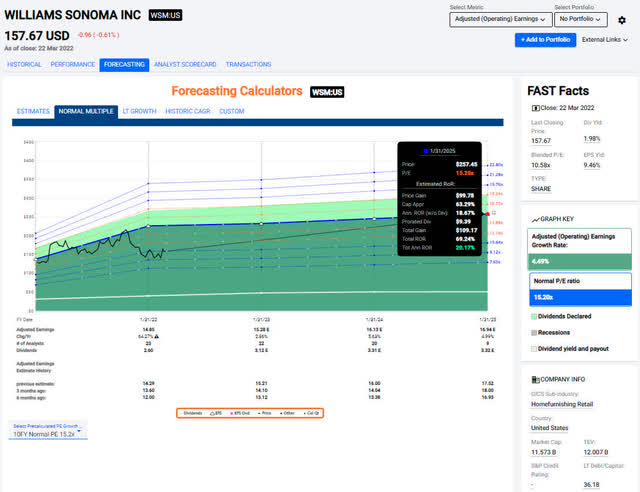

Williams-Sonoma – This is a company that neither my clients nor I hold but is worth considering even though it exhibits many of the traits seen by high-quality companies in this consumer goods sector. WSM doesn’t fit into the same box as LEG or VFC because it’s not offering an outside dividend yield and the company made a dramatic shift at demonstrated by FastGraphs.

Williams Sonoma – FastGraphs (FastGraphs)

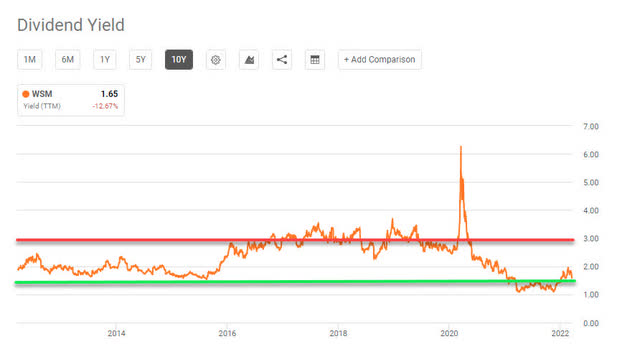

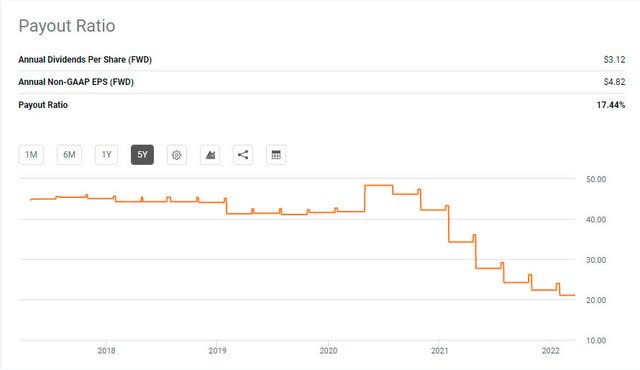

WSM is a name that thrived during COVID and presented the opportunity to bolster e-commerce sales further as remaining brick-and-mortar stores without an e-commerce strategy struggled to keep pace. WSM use this opportunity to deliver substantial dividend increases (considerably higher than ones in previous years) while also maintaining a payout ratio under 25%. For this reason, we can’t simply look at the dividend yield alone because by itself it would suggest that WSM is not a compelling value at this point in time. If we include the historical payout ratio along with the dividend yield we can see that as the dividend yield got lower the payout ratio also got lower as well.

Williams Sonoma – Dividend Yield (Seeking Alpha)

- The red line in the first image suggests the dividend yield baseline where we wouldn’t want to purchase shares for less than a 3% yield since this presented the strongest upside opportunity.

- The green line represents the new baseline that we would target for purchasing shares (estimated dividend yield of 1.50%).

The current yield with the most recent raise payable in May puts the yield at 1.98%.

Williams Sonoma – Dividend Payout Ratio (Seeking Alpha)

What makes the situation unique for WSM is that the dividend yield has dropped and the payout ratio has dropped from nearly 50% down to less than 20% during the same timeframe. Normally, this would lead one to believe the dividend was cut since a decreasing dividend yield and a decreasing payout ratio point towards something drastic like this.

WSM has 12 straight years of continuous dividend increases and offers a average five-year dividend growth rate of nearly 12%. In other words, WSM stands out is the exception to what we see with most dividend paying stocks and looks a lot more like what we saw with Parker-Hannifin (PH) in the last write-up on undervalued industrial stocks (PH sots payout ratio dropped from the mid-40% range down to the low 20% range and boasts a similar dividend growth profile with the five-year average dividend growth rate coming in at 10%).

Williams Sonoma – FastGraphs – Forecasting (FastGraphs)

Using the 10-year P/E ratio average of 15.2x we can see that WSM is targeting approximately 20% annualized returns over the next three years. For investors who are more interested in the short term, the stock could achieve a nearly 60% annualized return if the stock price moves back into the range of its 15.2x multiple.

Current analyst price targets:

- RBC Capital Markets – $220/share – Outperform

- Cowen – Reduced price target from $245/share down to $225/share.

Both of these estimates would be right in the expected P/E ratio range of 15.2x.

Conclusion

There are several interesting buying opportunities out there and this article highlights three among the consumer goods sector. While all three stocks look attractive I must admit that WSM looks like the most compelling play and is the only stock that neither my clients nor I own. Although it has the lowest yield it also has the lowest payout ratio by a long shot.

As always, you should always do your own due diligence because there are often external factors that could have a major impact on the information discussed in this article. For example, I have a couple of holdings that are already priced to perfection because they are in the process of a merger and/or acquisition.

My clients John and Jane are long LEG, PH, VFC.

Be the first to comment