elise_kurenbina/iStock via Getty Images

Companies that grow dividends over time have been shown to beat the broader market. Management’s dividend increases are an important signal that the business is performing well and the company can and wants to reward shareholders. I track upcoming dividend increases from companies with a history of increasing them. The lists below contain different data points for the stocks increasing their dividends next week. This is especially important during these inflationary times.

This list is a trimmed-down version, only covering dividend increases. A full upcoming dividend calendar is always available here.

How I Created The Lists

I created the information below by combining the “U.S. Dividend Champions” spreadsheet hosted here with upcoming dividend information from NASDAQ. This meshes metrics about companies with dividend growth history with upcoming dividend payments. These companies all have a minimum five-year dividend growth history.

Companies are required to have higher total dividends paid out each year. Therefore, a company may not raise its dividend each calendar year, but the total annual dividend can still increase.

What Is The Ex-Dividend Date?

The “ex-dividend” date is when you are no longer entitled to the dividend or distribution. You need to have made your purchase by the preceding business day. For example, if the date is a Tuesday, you need to have purchased (or already owned) shares by the market close on Monday. Be aware that for any stock going ex-dividend on a Monday (or Tuesday if Monday is a holiday), you must own it by the prior Friday.

Dividend Streak Categories

Here are the definitions of the streak categories, as I’ll use them throughout the piece.

- King: 50+ years

- Champion/Aristocrat: 25+ years

- Contender: 10-24 years

- Challenger: 5+ years

| Category | Count |

| King | 0 |

| Champion | 6 |

| Contender | 14 |

| Challenger | 5 |

The Dividend Increasers List

Data has been sorted by the ex-dividend day (ascending) and then by the streak (descending):

| Name | Ticker | Streak | Forward Yield | Ex-Div Date | Increase Percent | Streak Category |

| Balchem Corporation | (BCPC) | 11 | 0.58 | 23-Dec-22 | 10.94% | Contender |

| Toro Company | (TTC) | 18 | 1.2 | 27-Dec-22 | 13.33% | Contender |

| American Tower Corporation | (AMT) | 11 | 2.96 | 27-Dec-22 | 6.12% | Contender |

| Nucor Corporation | (NUE) | 48 | 1.48 | 29-Dec-22 | 2.00% | Champion |

| Franklin Resources, Inc. | (BEN) | 41 | 4.46 | 29-Dec-22 | 3.45% | Champion |

| McCormick & Company, Incorporated | (MKC) | 35 | 1.8 | 29-Dec-22 | 5.41% | Champion |

| Stryker Corporation | (SYK) | 28 | 1.24 | 29-Dec-22 | 7.91% | Champion |

| Lincoln Electric Holdings, Inc. – Common Shares | (LECO) | 26 | 1.77 | 29-Dec-22 | 14.29% | Champion |

| W. P. Carey Inc. REIT | (WPC) | 24 | 5.35 | 29-Dec-22 | 0.38% | Contender |

| The York Water Company | (YORW) | 24 | 1.77 | 29-Dec-22 | 4.10% | Contender |

| Edison International | (EIX) | 18 | 4.52 | 29-Dec-22 | 5.43% | Contender |

| Axis Capital Holdings Limited | (AXS) | 18 | 3.15 | 29-Dec-22 | 2.33% | Contender |

| The Ensign Group, Inc. | (ENSG) | 14 | 0.24 | 29-Dec-22 | 5.45% | Contender |

| Hingham Institution for Savings | (HIFS) | 13 | 0.89 | 29-Dec-22 | 3.30% | Contender |

| Alexandria Real Estate Equities, Inc. | (ARE) | 11 | 3.3 | 29-Dec-22 | 2.54% | Contender |

| Ares Commercial Real Estate Corporation | (ACRE) | 6 | 12.02 | 29-Dec-22 | 6.06% | Challenger |

| TFI International Inc. Common Shares | (TFII) | 6 | 1.36 | 29-Dec-22 | 29.63% | Challenger |

| Four Corners Property Trust, Inc. | (FCPT) | 6 | 5.11 | 29-Dec-22 | 2.10% | Challenger |

| Realty Income Corporation | (O) | 28 | 4.64 | 30-Dec-22 | 0.40% | Champion |

| The Andersons, Inc. | (ANDE) | 24 | 2.11 | 30-Dec-22 | 2.78% | Contender |

| CubeSmart Common Shares | (CUBE) | 12 | 4.89 | 30-Dec-22 | 13.95% | Contender |

| Washington Trust Bancorp, Inc. | (WASH) | 11 | 4.69 | 30-Dec-22 | 3.70% | Contender |

| Agilent Technologies, Inc. | (A) | 10 | 0.6 | 30-Dec-22 | 7.14% | Contender |

| Raymond James Financial, Inc. | (RJF) | 9 | 1.57 | 30-Dec-22 | 23.53% | Challenger |

| ServisFirst Bancshares, Inc. | (SFBS) | 7 | 1.63 | 30-Dec-22 | 21.74% | Challenger |

Field Definitions

Streak: Years of dividend growth history are sourced from the U.S. Dividend Champions spreadsheet.

Forward Yield: The new payout rate is divided by the current share price.

Ex-Dividend Date: This is the date you need to own the stock.

Increase Percent: The percent increase.

Streak Category: This is the overall dividend history classification of the company.

Show Me The Money

Here’s a table mapping the new rates versus the old rates. It also reiterates the percentage increase. This table is sorted the same way as the first table (ex-dividend day ascending, dividend streak descending).

| Ticker | Old Rate | New Rate | Increase Percent |

| BCPC | 0.64 | 0.71 | 10.94% |

| TTC | 0.3 | 0.34 | 13.33% |

| AMT | 1.47 | 1.56 | 6.12% |

| NUE | 0.5 | 0.51 | 2.00% |

| BEN | 0.29 | 0.3 | 3.45% |

| SYK | 0.695 | 0.75 | 7.91% |

| LECO | 0.56 | 0.64 | 14.29% |

| WPC | 1.061 | 1.065 | 0.38% |

| YORW | 0.195 | 0.203 | 4.10% |

| MKC | 0.37 | 0.39 | 5.41% |

| EIX | 0.7 | 0.738 | 5.43% |

| AXS | 0.43 | 0.44 | 2.33% |

| ENSG | 0.055 | 0.058 | 5.45% |

| HIFS | 0.61 | 0.63 | 3.30% |

| ARE | 1.18 | 1.21 | 2.54% |

| FCPT | 0.333 | 0.34 | 2.10% |

| TFII | 0.27 | 0.35 | 29.63% |

| ACRE | 0.33 | 0.35 | 6.06% |

| O | 0.248 | 0.249 | 0.40% |

| ANDE | 0.18 | 0.185 | 2.78% |

| CUBE | 0.43 | 0.49 | 13.95% |

| WASH | 0.54 | 0.56 | 3.70% |

| A | 0.21 | 0.225 | 7.14% |

| RJF | 0.34 | 0.42 | 23.53% |

| SFBS | 0.23 | 0.28 | 21.74% |

Additional Metrics

Some different metrics related to these companies include yearly pricing action and the P/E ratio. The table is sorted the same way as the table above. A value investor may find stock ideas with those companies near their 52-week lows, as they could provide more margin of safety and inflated yield.

| Ticker | Current Price | 52 Week Low | 52 Week High | PE Ratio | % Off Low | % Off High |

| BCPC | 122.6 | 110.15 | 173.8 | 41.24 | 11% Off Low | 29% Off High |

| TTC | 112.88 | 71.62 | 115.57 | 32.72 | 58% Off Low | 2% Off High |

| AMT | 210.58 | 178.17 | 288.99 | 52.97 | 18% Off Low | 27% Off High |

| NUE | 137.46 | 87.39 | 186.16 | 39.74 | 57% Off Low | 26% Off High |

| BEN | 26.91 | 20.24 | 35.21 | 14.81 | 33% Off Low | 24% Off High |

| SYK | 241.52 | 188.2 | 277.79 | 51.28 | 28% Off Low | 13% Off High |

| LECO | 144.3 | 117.65 | 150.68 | 34.45 | 23% Off Low | 4% Off High |

| YORW | 45.7 | 36.85 | 49.18 | 37.27 | 24% Off Low | 7% Off High |

| WPC | 79.56 | 67.77 | 88.33 | 26.9 | 17% Off Low | 10% Off High |

| MKC | 84.24 | 70.83 | 105.94 | 32.77 | 19% Off Low | 20% Off High |

| EIX | 65.21 | 54.45 | 71.74 | 63.03 | 20% Off Low | 9% Off High |

| AXS | 54.88 | 48.18 | 60.41 | 0 | 14% Off Low | 9% Off High |

| ENSG | 96.79 | 70.19 | 97.48 | 25.55 | 38% Off Low | 1% Off High |

| HIFS | 283.27 | 242.39 | 429.51 | 10.98 | 17% Off Low | 34% Off High |

| ARE | 146.82 | 126.74 | 219.99 | 39.54 | 16% Off Low | 33% Off High |

| FCPT | 26.64 | 22.67 | 29.36 | 26.97 | 18% Off Low | 9% Off High |

| ACRE | 10.98 | 9.99 | 15.97 | 22.39 | 10% Off Low | 31% Off High |

| TFII | 103.02 | 71.18 | 112.38 | 18.18 | 45% Off Low | 8% Off High |

| O | 64.24 | 55.06 | 73.93 | 50.39 | 17% Off Low | 13% Off High |

| ANDE | 35 | 29.18 | 58.33 | 0 | 20% Off Low | 40% Off High |

| CUBE | 40.08 | 36.82 | 55.7 | 39.74 | 9% Off Low | 28% Off High |

| WASH | 47.75 | 44.58 | 59 | 11.34 | 7% Off Low | 19% Off High |

| A | 150.09 | 112.13 | 161.59 | 49.74 | 34% Off Low | 7% Off High |

| RJF | 106.74 | 84.25 | 126 | 16.22 | 27% Off Low | 15% Off High |

| SFBS | 68.8 | 63.54 | 96.69 | 13.43 | 8% Off Low | 29% Off High |

Tickers By Yield And Growth Rates

Some investors are more interested in the current yield, so I sorted this table descending by yield. The table also includes some historical dividend growth rates as a bonus. Additionally, the “Chowder Rule” has been included, the current yield + five-year dividend growth rate.

| Ticker | Yield | 1 Yr DG | 3 Yr DG | 5 Yr DG | 10 Yr DG | Chowder Rule |

| WPC | 5.35 | 0.8 | 1.1 | 1.6 | 7.3 | 7 |

| FCPT | 5.11 | 4.6 | 5.6 | 12.9 | 18 | |

| CUBE | 4.89 | 3.1 | 4.9 | 11.3 | 21.7 | 16.3 |

| WASH | 4.69 | 1.5 | 8.1 | 8.1 | 9.2 | 12.8 |

| O | 4.64 | 2 | 2.8 | 3.8 | 5 | 8.5 |

| EIX | 4.52 | 4 | 3.3 | 7 | 7.4 | 11.6 |

| BEN | 4.46 | 72.5 | 15.8 | 14.9 | 15.6 | 19.5 |

| ARE | 3.3 | 5.8 | 6.7 | 6.8 | 9.9 | 10.1 |

| AXS | 3.15 | 2.5 | 2.5 | 4.5 | 6.4 | 7.7 |

| AMT | 2.96 | 17.4 | 19.1 | 19.6 | 22.6 | |

| ANDE | 2.11 | 34.6 | 2.2 | 3 | 9.6 | 5.1 |

| MKC | 1.85 | 9.3 | 9.5 | 9.4 | 9.2 | 11.3 |

| YORW | 1.77 | 4 | 4 | 3.8 | 3.6 | 5.6 |

| LECO | 1.77 | 4.1 | 10 | 10.1 | 12.8 | 11.9 |

| SFBS | 1.63 | 14.8 | 34.3 | 42.9 | 44.2 | |

| RJF | 1.57 | 6.2 | 14.7 | 14.6 | 11.9 | 16.2 |

| NUE | 1.48 | 0.6 | 2.2 | 1.6 | 1.1 | 3.1 |

| TFII | 1.36 | 16.9 | 11.2 | 11.6 | 13 | |

| SYK | 1.24 | 9.8 | 10.3 | 10.7 | 13.6 | 12 |

| ACRE | 12.02 | 0 | 6.3 | 5.3 | 17.6 | |

| TTC | 1.2 | 6.4 | 10.2 | 12.5 | 18.2 | 13.7 |

| HIFS | 0.89 | 13.6 | 11.2 | 9.3 | 6.8 | 10.2 |

| A | 0.6 | -34.6 | 9.7 | 5 | 5.6 | |

| BCPC | 0.58 | 11.5 | 11.4 | 11.3 | 14.5 | 11.9 |

| ENSG | 0.24 | 5.1 | 5.4 | 5.7 | 6.8 | 5.9 |

Historical Returns

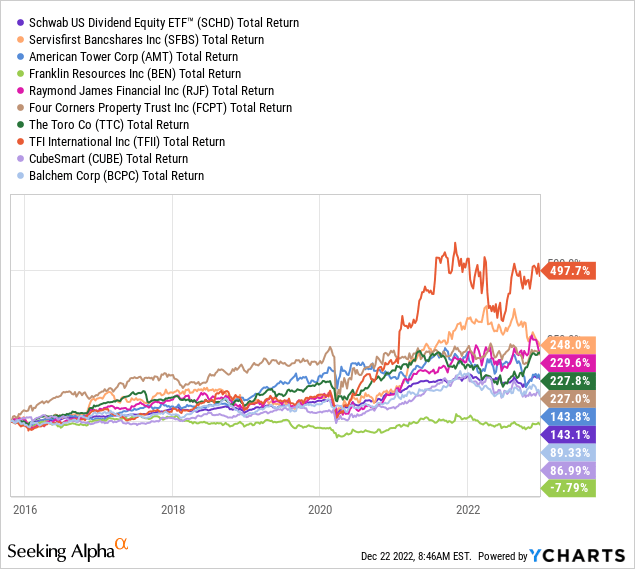

I’m always searching for dividend-growth stocks with a history of beating a market benchmark. I use the Schwab U.S. Dividend Equity ETF (SCHD) as my benchmark. The short version is that the ETF has a long history of outstanding performance, higher yield than the S&P, and growing dividends.

Here’s the six-year total return chart for SCHD versus the top nine companies with the highest five-year dividend growth rate. It’s six years this time because of comparison data for other companies. I use this data as a starting point for more research.

Over the six years, TFII, SFBS, RJF, TCC, and FCPT all handily beat SCHD. Perhaps surprisingly, BEN is actually down over the past six years on a total return basis.

Please do your due diligence before investing, and thanks for reading.

Be the first to comment