Jennifer Miranda/iStock via Getty Images

In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of January 2nd, 2023 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $197,155.42

- Dividends paid: $4,512.96 (TTM)

- Average yield: 2.29%

- 2022 performance: -12.08%

- SPY = -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-Dec 2022): 81.28%

Annualized return (since September 2017 – 64 months): 11.80%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 10.44% (total return 69.86%)

iShares S&P/TSX 60 ETF (XIU.TO) (XIU:CA) annualized return (since Sept 2017): 8.45% (total return 54.16%)

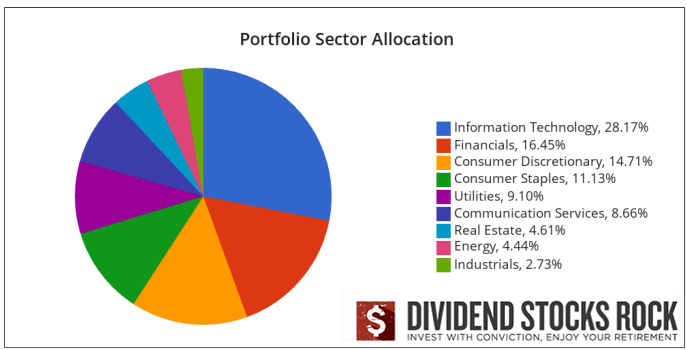

Dynamic sector allocation calculated by DSR PRO as of January 2nd.

Two Additions

I sold Sylogist (SYZ:CA) (OTCPK:SYZLF) after the dividend cut announcement last November, and I had a few thousand dollars in my account. It was almost a good thing to sell SYZ.TO as I was overexposed to the information technology sector. I used the proceeds and dividend payments recently received to complete my position in Brookfield Renewable (BEPC) (BEPC:CA).

Bought 85 BEPC.TO at $42.23

By adding 85 shares of BEPC.TO, I brought my total holding to $8,400 or 4.3% of my portfolio. Since I want to hold about 20 positions in this portfolio, the ideal weight of each position would be around 5%. I started a position in BEPC.TO with a couple of thousand dollars in dividends paid and increased my position each time I had a chance. I like the dividend growth perspective and the diversification (geographic and energy source) offered by this Brookfield asset.

Bought 22 HD at $324.28

It’s not a big surprise, but I finally sold my 235 shares of Gentex (GNTX) at $28.58 following the recent confirmation that GNTX would stick to the same dividend payment and therefore will not have increased its payout since April 2020. I still love Gentex’s business model and its lack of debt. Still, I’ve learned that sticking to my investing strategy (focusing on dividend growers) is more important than anything else. My total return on GNTX is above 50% in a little over 5 years, so I can’t complain!

I decided to go with Home Depot (HD) for the reasons I’ve discussed in my Top stock ideas:

I know; why would I pick Home Depot as a buy when the housing market is under such pressure? It’s counterintuitive, but I have a very good reason to think that Home Depot is a great buy right now. I can’t tell if it will take more than a year to reward shareholders. HD may continue to struggle in 2023, but the stock trades at its lowest valuation in the past 10 years (it reached a P/E ratio of 19 during the bear market in 2018 and the 2020 crash). Indeed, HD’s numbers are somewhat tied to the housing market. However, now that millions of Americans are locked into 30-year mortgages at incredibly low rates, what do you think will happen? They won’t want to sell their house and pay a 6%+ mortgage on the new one unless they have to. It means they will likely renovate their current home. This should support organic growth for a while.

HD shows a perfect dividend triangle, but I expect sales and earnings to slow down in 2023. It will create more uncertainty which is always good for the stock price if you are a long-term investor. HD has built a strong relationship with PRO contractors by being their “convenience store for all products”. Whenever a PRO misses something on a job, he can quickly grab everything he needs in a Home Depot and won’t have to delay the job. HD is the largest home improvement retailer and there is a Home Depot close to 90% of the U.S. population.

2022 Performance Review

I don’t pay much attention to short-term performance as it is mostly driven by luck (e.g., where the market goes). Long-term performance (more than 5 years) speaks louder, but it’s important to understand what happens yearly to know if I am still on the right path. There are two numbers to remember from last year: -12% and +11%. Let’s start with the bad one:

Portfolio down 12%

As you know very well, I’m “mortal” too! It hasn’t been an easy year for my portfolio either and I feel your pain. When I look at my performance, I’m still happy. I’m happy because I beat the market even though I’m showing a loss. While the Canadian market was only down 6% (thanks to the energy sector), the S&P 500 was down 18% (and I will spare you the NASDAQ performance). With a 50-50 allocation, my benchmark is down 12.26% while my portfolio is down 12.08%. If I want to “geek in” and use my January 2022 CAD-USD allocation, I should compare myself to a benchmark at 58.67% US and 41.33% CAD. That benchmark would be -13.29%. In all cases, I have done okay vs. a bad year on the market.

I would have done a lot better if I didn’t keep riskier investments like Sylogist and Algonquin (AQN) in my portfolio. Both came with risks I highlighted many times in my stock review and at DSR, but I liked the reward potential.

My exposure to tech stocks also hurt my overall performance. It’s good that I trimmed a bit at the end of 2021 to invest in Activision Blizzard (ATVI) and boosted my exposure to National Bank (OTCPK:NTIOF).

Couche-Tard, Activision Blizzard (OTCPK:ANCUF, OTCPK:ANCTF), and Intertape Polymer (acquired throughout the year) were my top performers for 2022.

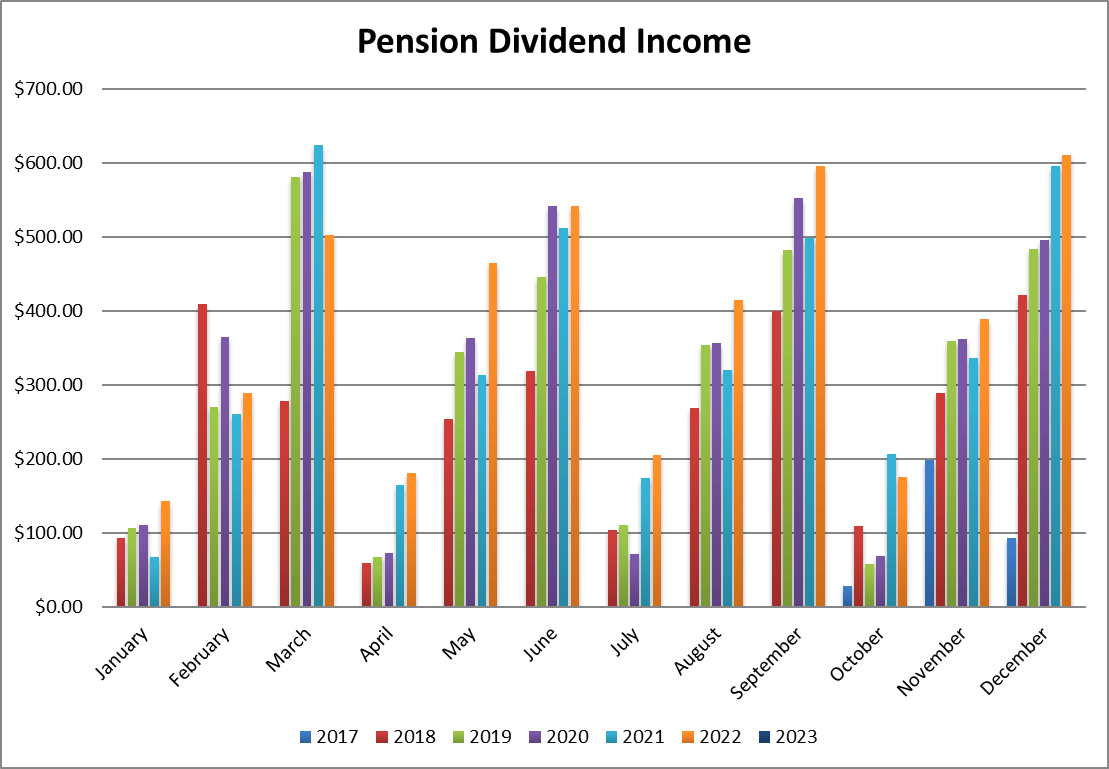

Dividend up 11%

It’s no surprise, but the increase in dividends is worth a lot more to me than how my portfolio did in 2022. Over the past twelve months, I generated $4,500 in dividends. That’s 50% better than what I generated in 2018 ($3,000). The increase comes mostly from dividend increases by companies and from reallocation towards higher-yielding companies (e.g., selling shares of Apple (AAPL) and Microsoft (MSFT) and buying shares of Brookfield and National Bank, for example).

My current yield is 2.30% and my yield on cost is 4.15%. While the yield on cost is a “feel good metric”, we need some light to go through the bear market tunnel. The yield on cost also proves that focusing on dividend growers works over the long haul. That portfolio alone will likely generate over $30,000/year of income at retirement without touching the capital. Considering I also have a RRSP (retirement account) + my business, I can sleep well thinking of how much income I’ll be generating at my retirement!

Smith Manoeuvre Update

So far, I’m almost breaking even with my strategy. I must admit that I didn’t expect much from this portfolio over the first few months. I still need to give it some time to perform especially considering this crazy market.

I previously initiated a pause in my SM contributions. I will maintain my investment update in the coming months, but I will not add another $500 monthly for a while. My trip to Africa got out of control and I must take a few months to recover financially. When you do a leveraged strategy, you should never invest money you don’t have. I’m following my own advice, so I’ll resume my monthly investments shortly, but I would rather play it safe for the time being.

Fortunately, my investments are doing well, and my finances are slowly but surely getting back under control, so I expect to resume my strategy in the second quarter of 2023.

Here’s my portfolio as of January 2nd, 2022 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Canadian Net REIT | NET.UN:CA | Real Estate | $384.40 |

| National Bank | NA:CA | Financials | $547.38 |

| Exchange Income | EIF:CA | Industrials | $578.93 |

| Brookfield Infrastructure | BIPC:CA | Utilities | $474.03 |

| Great-West Lifeco | GWO:CA | Financials | $532.10 |

| Cash (Margin) | $22.82 | ||

| Total | $2,539.66 | ||

| Amount borrowed | -$2,500.00 |

Let’s look at my CDN portfolio. Numbers are as of January 2nd, 2022 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Algonquin Power & Utilities | AQN:CA | Utilities | $3,677.94 |

| Alimentation Couche-Tard | ATD:CA | Cons. Staples | $21,360.50 |

| Brookfield Renewable | BEPC:CA | Utilities | $8,423.02 |

| CAE | CAE:CA | Industrials | $5,238.00 |

| Enbridge | ENB:CA | Energy | $8,520.12 |

| Fortis | FTS:CA | Utilities | $5,363.82 |

| Granite REIT | GRT.UN:CA | Real Estate | $8,842.24 |

| Magna International | MG:CA | Cons. Discre. | $5,324.20 |

| National Bank | NA:CA | Financials | $11,038.83 |

| Royal Bank | RY:CA | Financial | $7,638.00 |

| Cash | 95.71 | ||

| Total | $85,522.38 |

My account shows a variation of -$6,282.77 (-6.84%) since the last income report on December 2nd. My focus this year for the Canadian segment will be directed toward Algonquin and CAE (CAE). I’m waiting to know how management will allocate capital for both companies. If CAE doesn’t open the door to paying dividends this year, I’ll have no other choice but to get rid of it even if it is the dominant player in the aviation training market.

Here’s my US portfolio now. Numbers are as of January 2nd, 2022 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Activision Blizzard | ATVI | Communications | $8,879.80 |

| Apple | AAPL | Inf. Technology | $9,795.55 |

| BlackRock | BLK | Financials | $9,920.82 |

| Disney | DIS | Communications | $3,909.60 |

| Home Depot | HD | Cons. Discret. | $6,948.92 |

| Microsoft | MSFT | Inf. Technology | $13,190.10 |

| Starbucks | SBUX | Cons. Discret. | $8,432.00 |

| Texas Instruments | TXN | Inf. Technology | $8,261.00 |

| V.F. Corporation | VFC | Cons. Discret. | $2,236.41 |

| Visa | V | Inf. Technology | $10,388.00 |

| Cash | $323.77 | ||

| Total | $82,235.17 |

The US total value account shows a variation of -$4,816.93, (-5.53%) since the last income report on December 2nd. For the US segment, my attention will be focused on Activision Blizzard, Disney, and V.F. Corporation. I hope the deal between Microsoft and ATVI will close, but if it does not, ATVI will still get between $2B and $3B in cash as a termination fee. For Disney, I expect Bob Iger’s return and more blockbuster movies to support stronger performance. As for V.F. Corp, it will be a tough year, but I will not tolerate an absence of dividend growth.

My Entire Portfolio Updated for Q4 2022

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 2nd, 2022.

Dividend Income: $610.65 CAD (+2.6% vs December 2021)

There were a lot of different factors affecting this month vs. last year. In 2021, I had Intertape Polymer and Sylogist payments. This year, I increased my position in Brookfield Renewable, I benefited from many dividend increases and a jump of 8.8% of the USD vs. CAD.

I can now also count on a $33 distribution coming monthly from Granite!

Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- Fortis: +5.6%

- Enbridge: +3%

- Magna: +10%

- Granite: (new)

- Alimentation Couche-Tard: +27.3%

- Brookfield Renewable: +273% (more shares)

- Visa: +20%

- Microsoft: 0% (I sold shares)

- V.F. Corp: +2%

- BlackRock: +18%

- Currency factor: +8.8%

Canadian Holding payouts: $380.51 CAD

- Fortis: $55.94

- Enbridge: $138.46

- Magna: $41.84

- Granite: $33.06

- Alimentation Couche-Tard: $50.26

- Brookfield Renewable: $60.95

U.S. Holding payouts: $169.53 USD

- Visa: $22.50

- Microsoft: $37.40

- V.F. Corp: $41.31

- BlackRock: $68.32

Total payouts: $610.65 CAD

*I used a USD/CAD conversion rate of 1.3575

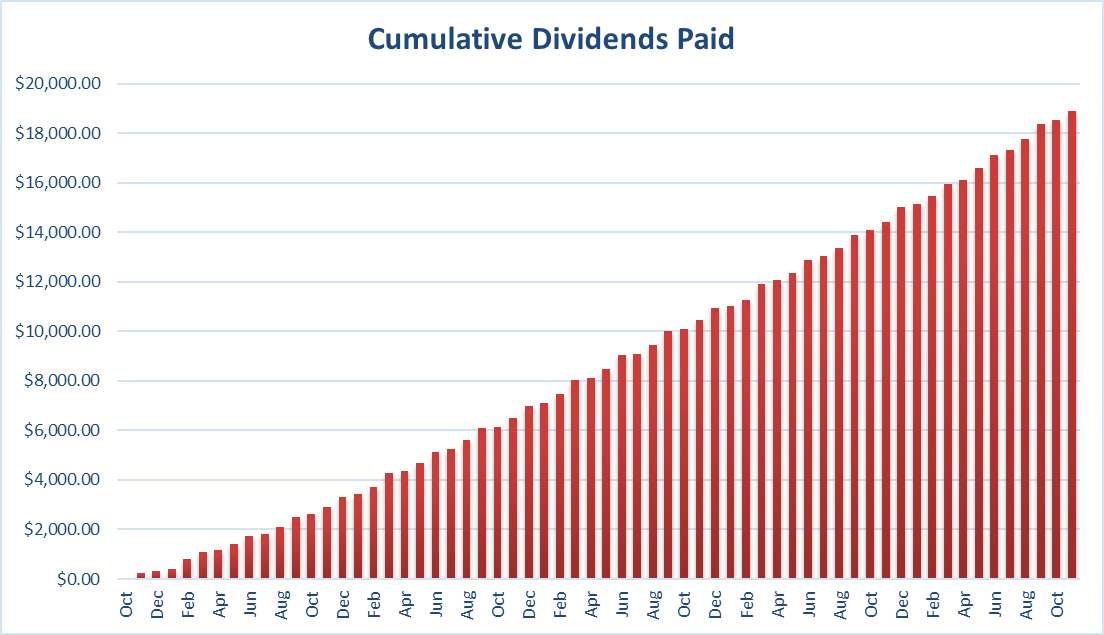

Since I started this portfolio in September 2017, I have received a total of $19,522.09 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

It’s very motivating to see my total dividends received since I created this account getting close to $20,000. I can see the snowball getting bigger and bigger. I will consider selling a few more tech stocks throughout the year to reduce my exposure to this sector.

As you can see, following a portfolio is an ever-evolving journey!

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment