edwardolive

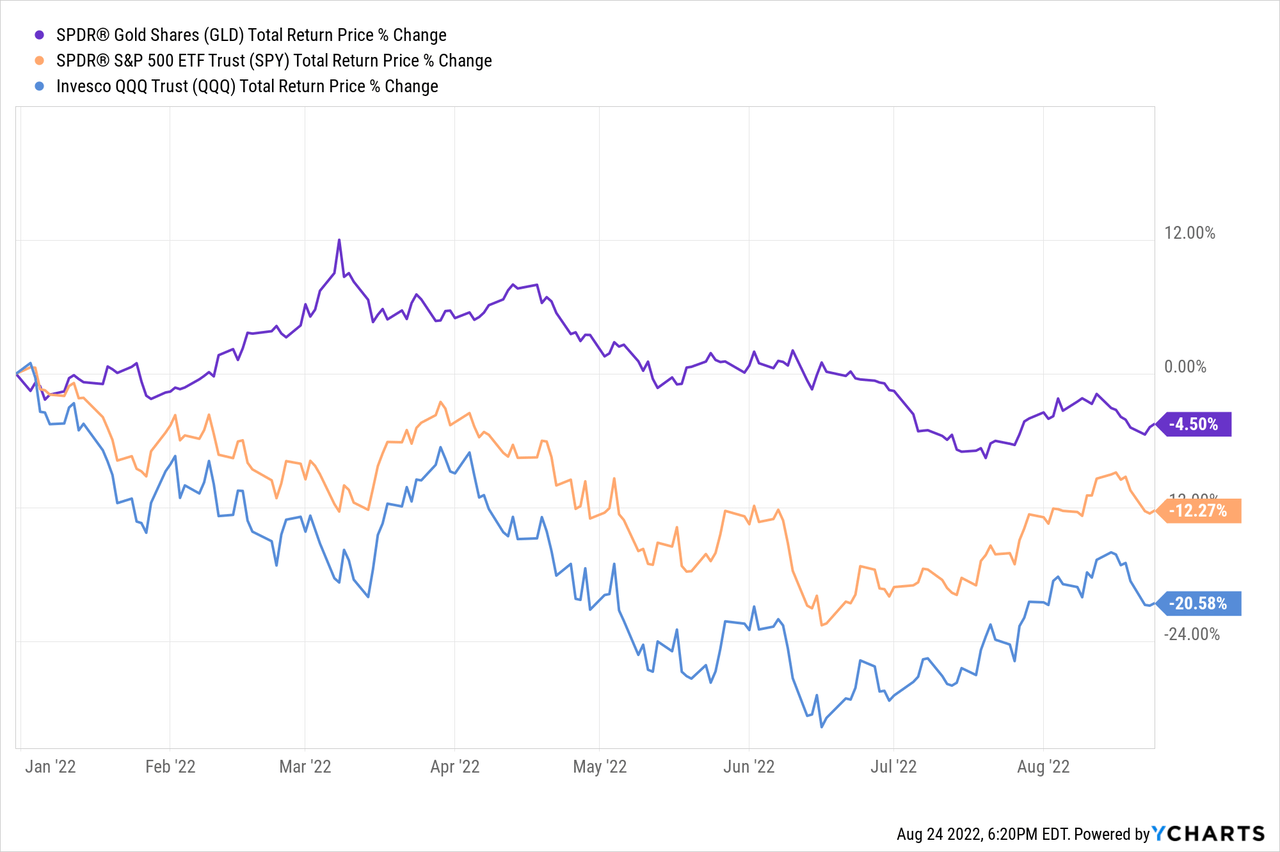

If you were only privy to the news headlines of 2022 and were not allowed to check market prices, I would imagine that most investors would guess that Gold-linked investments like the SPDR Gold Trust ETF (NYSEARCA:GLD) was having a banner year. However, in reality it is having a pretty unimpressive year. While it is clearly outperforming the S&P 500 (SPY) and Nasdaq (QQQ), it has still generated a negative return year-to-date:

In some ways this is shocking given that inflation has significantly eroded the purchasing power of the U.S. Dollar this year. On the other hand, despite the Dollar’s value declining, on a relative basis to other currencies, the U.S. Dollar is actually holding up incredibly well. As a result, demand for Dollars remains very high, in our view inexplicably so. For whatever reason, thus far, the demand for a safe haven from inflation has not sufficiently reached gold to drive its price higher and for now at least, global markets favor the U.S. Dollar to gold as that safe haven.

However, we believe that sooner or later, the laws of economics will prevail and gold instruments like GLD will soar higher. Here are two reasons why.

#1. The Evolving Geopolitical Landscape Is Bullish For Gold

Between the growing threat of major war – potentially even World War 3 or God-forbid a nuclear exchange – and the increasing polarization of the great military and economic powers of the world, gold appears to have a shiny future in store for it.

In today’s world, the U.S. Dollar is still viewed as the ultimate store of wealth given its global acceptance, the strength and resilience of its economy, and its perceived political stability.

However, the global acceptance of the Dollar is beginning to fray. Thanks to the U.S.-led alliance of Western nations effectively freezing Russia’s U.S. Dollar and Euro-denominated reserves, Russia is increasingly operating off of any U.S. Dollar dominated economic system. While China continues to deal in the Dollar-dominated system of global trade, it too may decide to leave if/when it comes into direct military conflict with the U.S. At the very least, China is beginning to wean itself off of the U.S. Dollar by gradually reducing its U.S. debt holdings and boosting its holdings of gold.

Furthermore, it is working aggressively to increase its natural resource independence from U.S. allies by working tirelessly to forge strong economic bonds in resource-rich African nations and also by building a special partnership with “no limits” with energy-rich Russia. If/when China leaves the Dollar system and economic relations between China and the United States become fractured, it will likely deal a major blow to the value of the U.S. Dollar and significantly increase demand for gold, which has been widely accepted for practically all of human history and is fully fungible across geopolitical barriers.

On top of that, if a nuclear exchange were to take place in Asia over Taiwan, in Europe over an expanding Ukrainian conflict, or even in the Middle East between Iran and Israel, it could send gold soaring. Fears over such horrific means of warfare expanding into major economic centers and eventually involving the United States or other major powers in Western Europe or East Asia could send investors running for cover.

Last, but not least, the United States itself is no longer as politically stable as it once was (and is still widely perceived as being). Americans are increasingly warming to the idea of using violence to resolve political differences, there is a growing loss of confidence in the security and fairness of U.S. elections and the political process in general, and the schism in worldview between the left and right continues to grow wider. Additionally, the wealth gap continues to widen, America continues to become increasingly multicultural, and religious diversity continues to accelerate. All of this generally leads to a less cohesive society and could eventually lead to violent unrest and even potentially another civil war. In fact, an increasingly large number of Americans seem to think that a second civil war is likely in the near future. It goes without saying that major political unrest in the United States would be a very bearish event for the Dollar and a very bullish one for GLD.

#2. Real Interest Rates Are Likely To Remain Negative For The Foreseeable Future

The other main reason why we believe that now is a great time to buy GLD is that real interest rates are likely to remain negative for the foreseeable future. This is bullish for GLD because when real interest rates are negative it means that cash – even when invested in long-term savings bonds – is a losing investment when it comes to preservation of purchasing power. As a result, inflation-resistant investments like GLD become more attractive safe haven/store of wealth investments on a relative basis.

The reasons why we expect real interest rates to remain negative for the foreseeable future are:

(1) Given how high government debt levels are as a percentage of GDP in major economies like the United States and Japan, their budgets can simply not bear to service so much debt at high interest rates. If such a scenario were to unfold, these governments would either have to default on their debts (which would cause a cratering in the value of their currencies and gold prices to soar), raise taxes, or they would have to cut back massively on wildly popular social safety net programs as well as national defense spending, none of which would be tenable, especially in countries with democratically elected leadership. Instead, we expect policymakers to err on the side of lower interest rates and higher inflation, as this not only makes the debt more serviceable from an interest payment perspective, but it also inflates away the real value of the outstanding debt. Besides, even if the market no longer desires U.S. debt at interest rates well below the inflation rate, the Federal Reserve can always print money and buy U.S. debt to keep interest rates low.

(2) The other reason is simply that if the government were to allow interest rates to rise in response to inflation with the plan to raise taxes as well to help service the increased interest expense that comes along with it, the economy would be absolutely crushed. This is because higher interest rates would deal a heavy blow to equity valuations and corporate cost of capital, causing growth investments to rapidly decline and the heavy tax burden would likely result in layoffs and ultimately send the economy into a downward spiral. Again, lower interest rates and higher inflation – especially if the inflation can still be kept at a single digit level – seems like the only tenable long-term solution here.

History has shown that when real interest rates are negative, gold prices almost always outperform. We expect this trend to continue over the long-term.

Investor Takeaway

It looks like it is a great time to buy GLD hand-over-fist, thanks to a geopolitical and macroeconomic backdrop that is shaping up perfectly for the yellow metal. Between soaring geopolitical tensions and conflict domestically and internationally, raging high inflation, and a strong incentive to keep interest rates low, it is very difficult to imagine gold prices not rising materially over the long-term.

Right now GLD is an attractive way to play gold if you want to be conservative and also enjoy significantly liquidity. However, we also think that attractive risk-reward can be found in blue chip miners trading at steep discounts and paying out very attractive dividend yields like Barrick Gold (GOLD) and Newmont Corporation (NEM).

Be the first to comment