Lari Bat/iStock via Getty Images

Top Industrial Stocks To Buy

Stocks rallied this week amid news that protests in China may be cooling, as Chinese authorities agree to bolster vaccinations to ease fears of more lockdowns that would further set back the nation’s economic growth. The news prompted a fall in the U.S. dollar, which could serve as a tailwind for industrial companies. A declining dollar could mean more sales outside of the US and, perhaps in the second half of next year – an increased opportunity for revenues generated abroad by industrials.

The Industrial Revolution built the foundation of the U.S. economy, and the industrial sector continues to be poised for growth. As America’s backbone, companies that use or focus on machinery, manufacturing, construction, health care, defense, and aerospace have experienced benefits. The sector offers a long history and is known for offering many dividend-paying stocks, including the two dividend aristocrats I’ve picked for this article, Caterpillar Inc. (NYSE:CAT) and PACCAR Inc (NASDAQ:PCAR). While headwinds that riddle the sector include supply chain constraints and inflationary pressures that affect costs, CAT and PCAR maintain strong demand, resulting in bullish momentum for price gain. Both companies are strategic, with great leadership that has enabled operational efficiencies to withstand the headwinds of the industry’s cyclical nature. And with a split House, potential cuts in fiscal spending, and a slowdown in demand, CAT, and PCAR have attractive margins to help withstand potential decreases in revenue.

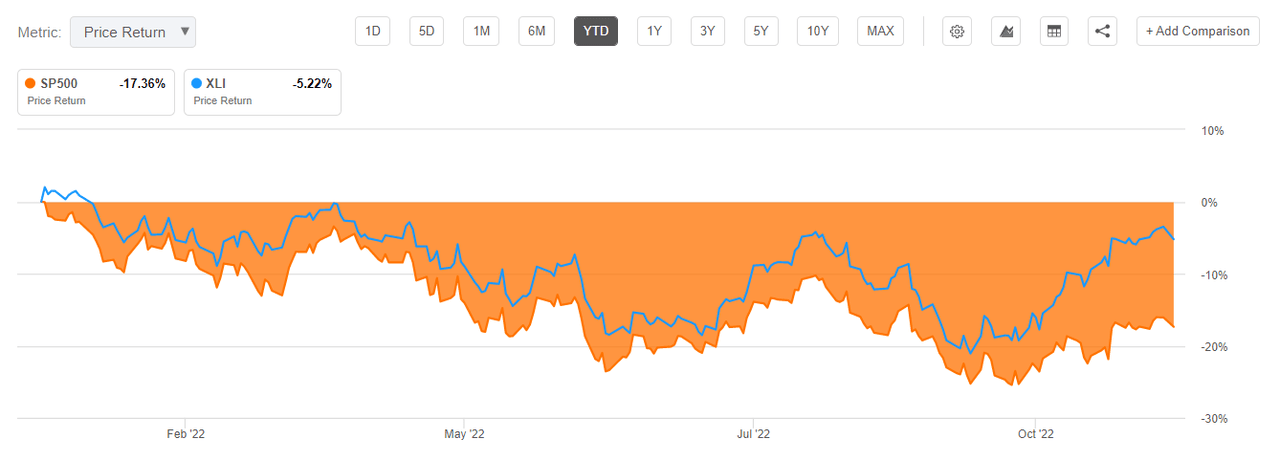

Demand for trucks and heavy truck parts is high. As recessionary concerns and overall fear continue to create chaos in the markets, the Industrial sector remains resilient. Compared to the S&P 500, which is down more than 17% YTD, the Industrial Select Sector SPDR ETF (XLI) is -5.22% YTD.

S&P 500 vs. XLI Year-to-Date Price Return

S&P 500 vs. XLI year-to-date Price Return (Seeking Alpha Premium)

Geopolitical concerns are affecting sectors everywhere, yet Caterpillar and PACCAR have experienced substantial gains and should remain bullish going forward, given their narrow moat that includes strong freight demand, new truck orders with fuel efficiency, and their brand reputations. Quant-rated the top two companies in their industry, both stocks have a strong competitive position in construction machinery and heavy trucking, which is why they are rated Best Industrial Stocks to invest in for the winter.

Buying Construction Stocks This Winter

Construction has experienced a slowdown. And while geopolitics and volatility in the markets are a test for investors on whether to buy the dip or get defensive, some sectors have been more resilient as fear has moved the markets. In fact, some sectors provide some form of inflation protection in the form of revenue security.

S&P 500 Sectors Performance (Standard & Poor’s, Yardeni)

One of the top performing sectors is industrials. Although it’s cyclical and facing headwinds, the global stocks I’ve selected are passing rising costs directly to the consumers and continue to experience record sales, demand, and record results. As you can see in the chart above, the industrial sector was one of the best performers, down only 6.2% YTD compared to its peers. Many industrials also tend to be dividend-paying stocks, and given their history of payments, especially in this environment, I’m highlighting 2 top industrial stocks, which are also dividend aristocrats.

1. Caterpillar Inc. (CAT)

-

Market Capitalization: $122.66B

-

Quant Rating: Strong Buy

-

Dividend Safety B+

-

Quant Sector Ranking (as of 11/28): 4 out of 627

-

Quant Industry Ranking (as of 11/28): 1 out of 41

As the world’s largest construction equipment and manufacturing company, Caterpillar has been a global leader for nearly 100 years. Its brand and vast network helped 2021 sales and revenues exceed $51B. A Fortune 500 company, CAT offers a diversified portfolio including energy & transportation, mining, financial products, and a division responsible for machinery and heavy truck maintenance, parts, and logistics solutions.

Consistently evolving, Caterpillar is well known for releasing new product models for machine and operational efficiency. Passage of the $1.2T Infrastructure Bill should offer major tailwinds for the company, which has been responding to pent-up demand for U.S. road construction. The Infrastructure package includes a $550B investment in bridges, airports, waterways, and public transit, with approximately $110B dedicated to U.S. roads and bridges. As energy, oil, and gas prices fall, price improvements should allow for more exploration and production, resulting in an increased need for Caterpillar’s equipment and products to help boost sales growth.

Caterpillar Stock Growth and Profitability

Despite weakening economies worldwide, Caterpillar’s pricing power has allowed it to offset higher costs while maintaining strong financials. Consistently showcasing strong earnings, its strategic leadership and board have managed to plan for the future despite headwinds in many circumstances, including the pandemic. Using its pricing power and navigating supply chain constraints amid the pandemic, and after that, CAT has shown incredible resilience and growth. With a 2.07% forward dividend growth and 33 years of consecutive dividend payments, the dividend aristocrat offers shareholders a steady stream of income and an excellent dividend scorecard.

Caterpillar Stock Dividend Scorecard

Caterpillar Stock Dividend Scorecard (Seeking Alpha Premium)

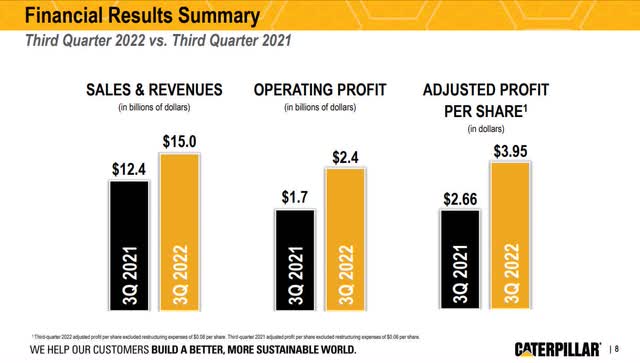

Amid higher volumes and prices, Caterpillar’s Q3 Earnings results were stellar, allowing them to declare a $1.20 dividend in line with its previous. CAT’s EPS of $3.95 beat by $0.78, and revenue of $14.99B beat by $619.93M, a nearly 21% year-over-year increase, their best results ever.

CAT Stock Q3 2021 vs Q3 2022 Financial Results (Caterpillar Q3 2022 Investor Presentation)

With a cash hoard of $6.44B and benefitting from $1B in positive dealer inventory changes, fading supply chain constraints are increasing demand for CAT’s equipment.

“Because of higher demand, the company is getting new orders faster than its ability to work on the existing backlog. This is resulting in a $1.6 billion increase in the backlog to a total value of $30 billion. That’s great news as it will keep the company busy going forward,” writes Seeking Alpha Contributor Leo Nelissen.

With three consecutive quarters of positive sales growth and a 7% increase in Machines and E&T combined, Caterpillar has managed to shake off headwinds like inflation and commodity prices. Recently securing a $1.28B Defense Logistics contract, this big win for CAT in the current environment may offer protection if the markets experience further losses prompted by geopolitical uncertainty. A bit more icing on the cake is CAT’s announcement of the completed development of its first electric 793 prototypes and a demonstration of a battery-powered mining truck upgraded with renewable energy sources. “Our global team came together to develop this battery truck at an accelerated pace to help our customers meet their sustainability commitments,” said Denise Johnson, CAT President. With plans for the future and appealing to the ‘green movement,’ CAT’s higher margins, despite high inflation, showcase why their growth and profitability are consistent and why the company has been on an uptrend.

CAT Valuation & Momentum

Although Caterpillar’s valuation is stretched and appears to be trading at a relative premium, showcased by its D+ valuation grade, CAT’s trailing P/E ratio of 16.88x is a -12.24% difference to the sector. Additionally, its B- forward PEG of 1.29x is a -13.30% difference to the sector.

CAT Stock Momentum (Seeking Alpha Premium)

On a longer-term bullish trend, CAT has been outperforming the S&P 500, with shares on an upward-sloping 200-day moving average. Year-to-date, the stock is +12.74%, and over the last year, it’s +19.11%. Although the stock’s overall valuation grade is a D+, its collective factor grades are favorable. Some prudence is required if purchasing this stock at its current price, but its quant strong buy rating results from solid metrics, highlighted by favorable mentions, similar to the next industrial pick.

2. PACCAR Inc (PCAR)

-

Market Capitalization: $36.53B

-

Quant Rating: Strong Buy

-

Dividend Safety B+

-

Quant Sector Ranking (as of 11/28): 10 out of 627

-

Quant Industry Ranking (as of 11/28): 2 out of 41

Another legacy Construction Machinery and Heavy Trucks company is PACCAR Inc, founded in 1905, and designs, manufactures, and distributes commercial trucks of all sizes globally. Like its competitor Caterpillar, PCAR offers a diversified portfolio and operates in three segments: Truck, Parts, and Financial Services.

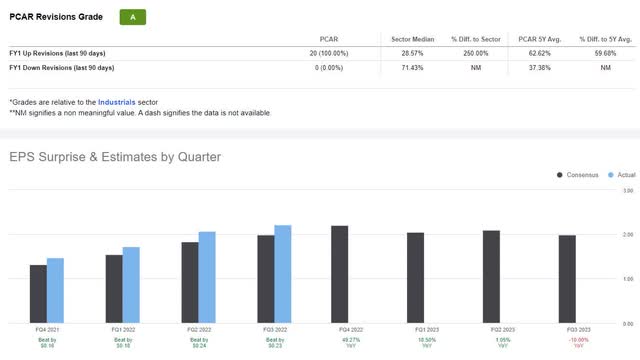

Despite economic uncertainty and the headwinds, which include inflation, increased fuel, and overall costs, PCAR has continued to profit amid strong demand for truck orders and is poised for growth, possessing an A profitability grade and strong Q3 earnings that resulted in 20 analyst FY1 Upward revisions.

PACCAR Stock EPS Revisions (Seeking Alpha Premium)

PCAR Stock Growth & Profitability

PCAR has a strong growth and profitability outlook. As oil and gas costs have skyrocketed this year, customers’ desire to replace old vehicles with newer fuel-efficient ones are helping drive demand. As PACCAR senior VP Mike Dozier said,

“Strong industry truck utilization and increased freight tonnage is good for truck demand…Customers are replacing older vehicles with the new fuel-efficient Kenworth and Peterbilt trucks. U.S. and Canada Class 8 truck industry retail sales are estimated to be in a range of 265,000-285,000 vehicles in 2022. Class 8 truck industry retail sales for 2023 are estimated to increase to a range of 260,000-300,000 vehicles.”

The high demand for trucks and parts drove PACCAR’s Q3 earnings, resulting in record revenues of $6.79B +25% year-over-year and an EPS of $2.07, beating by $0.24. PCAR beat consensus by $40M and generated cash from operations of $680.7M, while gross margins for Trucks, Parts and other divisions were nearly 15%. On the heels of these results, PACCAR raised its quarterly dividend by nearly 9% to $0.37.

PACCAR Dividends

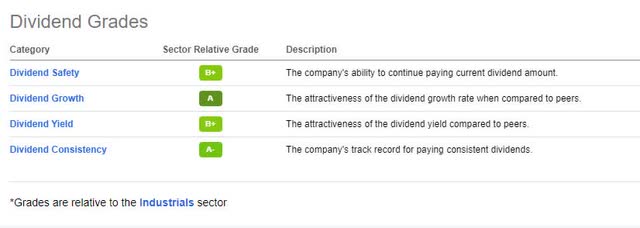

PCAR is also a dividend aristocrat, with an A+ grade for consecutive years of dividend payments. Paying its shareholders a dividend for 33 consecutive years, it’s no surprise that PCAR has a solid dividend scorecard. Showcasing that revenue growth is steady and demand is high, PCAR has also taken advantage of pricing competition, all of which have served as tailwinds to deliver increasing cash flows.

PACCAR Dividend Scorecard

PACCAR Stock Dividend Scorecard (Seeking Alpha Premium)

In volatile markets and given the industry’s cyclical nature, dividends can play an essential factor for investors, especially those looking for steady income. Although inflation is exceptionally high, PCAR’s modest 1.43% forward dividend yield and consistent history of growth, safety, and paying out a dividend to shareholders make the stock attractive and hopefully offset some of the inflation pains with income generated by these assets. Strong financials should help withstand future headwinds, but with the current momentum and the company trading at a relatively low valuation, this stock is primed for portfolios.

PCAR Valuation & Momentum

Industrials like PCAR are capitalizing on high inflation and supply chain constraints that have given them pricing power while passing costs onto consumers, making now a great time to purchase this strong buy-rated stock. Bullishly trending and trading nearly 30% below its sector with a forward P/E ratio of 12.77x, PCAR has an overall valuation grade of C-. In addition, PCAR has a forward PEG ratio of 1.23x, a -17.18% difference to the sector, and forward EV/Sales of 1.58x. Relatively undervalued, the stock’s share price is +17% YTD and +22% over the last year, with continued upward momentum.

PCAR Momentum Grade (Seeking Alpha Premium)

With an ‘A’ Momentum Grade, PCAR outperforms its sector peers quarterly, as evidenced above. Although interest rates are rising, with an undervalued stock outranking its industry peers despite global slowdowns, consider taking advantage of its tremendous sales and earnings now. PCAR and CAT are experiencing positive earnings and success amid geopolitical and macro constraints. Imagine holding these stocks on an upward trend as economies begin to experience a turnaround.

Conclusion

CAT and PCAR have strong balance sheets and profitability, and Top Industrial stocks are in high demand. Offering B+ dividend safety ratings and solid dividends, income-oriented investors looking for a steady stream of consistent payouts to help offset inflationary concerns should look no further! CAT and PCAR are quant-rated strong buys and have excellent fundamentals.

Despite headwinds that most other sectors face, capitalizing on companies like industrials with strong financials to withstand headwinds while still in high demand is an excellent opportunity for the future. As economies rebound and demand for infrastructure grow, construction could experience an uptick as investors look to companies that can weather increasing inflation, consider these two stock picks, or use Quant screeners to help you find superior stocks, including our selection of Top Dividend Stocks.

Be the first to comment