ugurhan

Earnings of 1st Source Corp. (NASDAQ:SRCE) will likely dip this year mostly on the back of provision normalization. On the other hand, moderate loan growth will likely support the bottom line. Further, some margin expansion will support earnings. Overall, I’m expecting 1st Source Corporation to report earnings of $4.58 per share for 2022, down 3% year-over-year. Compared to my last report on the company, I’ve revised upwards my earnings estimate as I’ve increased both my loan and margin estimates following the second quarter’s extraordinary performance. For 2023, I’m expecting 1st Source to report earnings of $4.68 per share, up 2% year-over-year. The year-end target price suggests a moderately high upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on 1st Source Corporation.

Loan Growth Deceleration Likely

1st Source Corporation’s loan book grew by a strong 2.9% in the second quarter of 2022, or 11.7% annualized, which beat my expectations. Given the company’s historical trend, the second quarter’s growth was extraordinarily high.

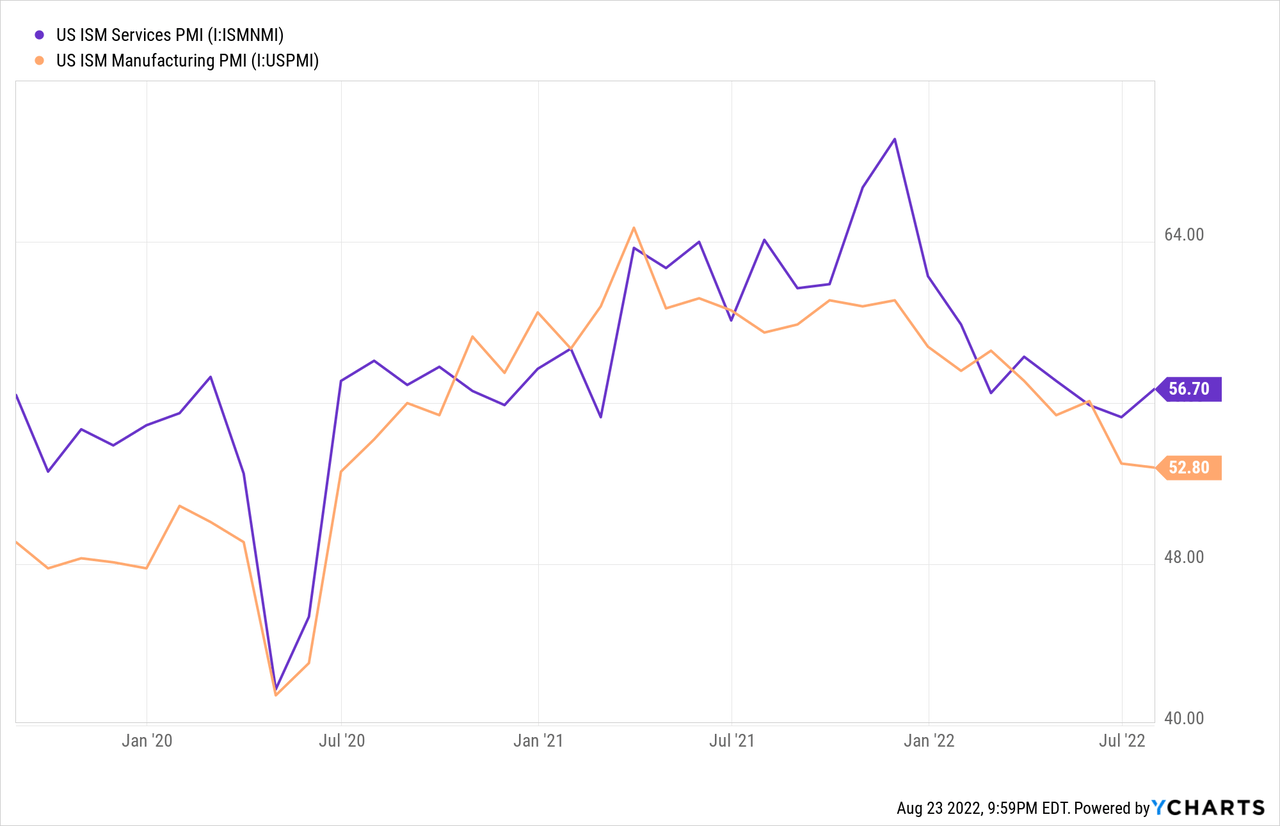

Half of 1st Source Corporation’s loans belong to the specialty finance segment (aircraft, trucks, construction equipment) while the other half belongs to the community banking segment (mostly small business loans). Therefore, the purchasing managers’ index is a good gauge of product demand. Although it has been on a downtrend so far this year, it is still indicating expansion in manufacturing and services segments.

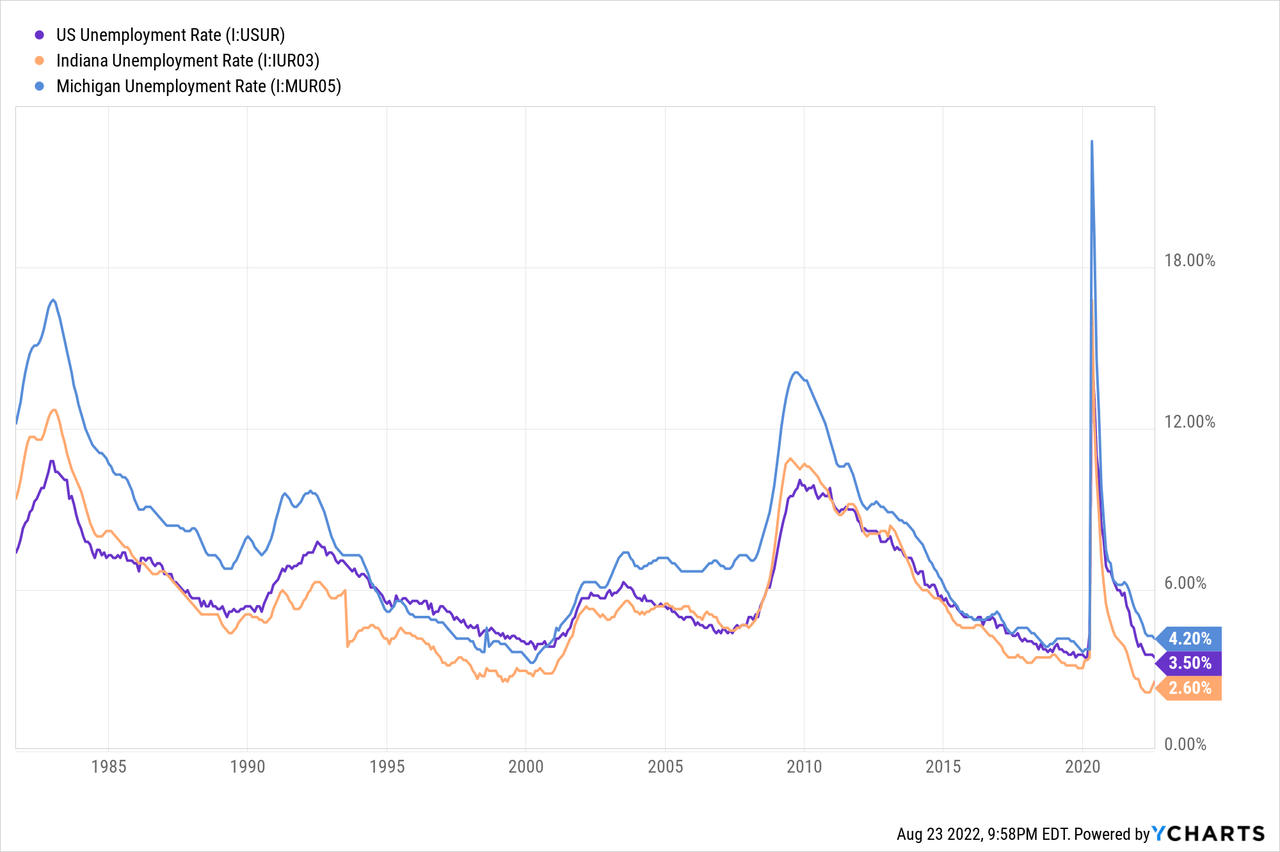

The unemployment rate is another appropriate indicator for credit demand. The company mostly operates in northern Indiana and southwest Michigan. While Indiana has a hot labor market with a very low unemployment rate, Michigan’s unemployment rate is trailing the national average. Nevertheless, both states have unemployment rates that are near record lows from a historical perspective.

However, some of 1st Source Corporation’s business sub-segments, especially renewable energy financing, are nationwide. Therefore, the U.S. unemployment rate is also an important metric to determine future credit demand.

Considering the mixed economic review, I’m expecting loan growth to decline from the second quarter’s level and remain slightly below the historical mean through the end of 2023. I’m expecting the loan book to grow by 1% every quarter (4% annualized) till the end of next year. Compared to my last report on the company, I’ve maintained my loan growth estimate for the second half of 2022 and full-year 2023. However, as loan growth surpassed my expectation in the second quarter of 2022, I’ve revised upward the full-year estimate for this year.

Meanwhile, I’m expecting other balance sheet items to grow mostly in line with loans. However, I’m expecting the equity book value to dip this year despite my expectations of positive retained earnings as discussed below. I’m expecting equity book value to dip because the rise in interest rates will build up unrealized losses on the available-for-sale debt securities portfolio. These losses will bypass the income statement and flow directly to the equity account through other comprehensive income.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 4,735 | 4,974 | 5,349 | 5,219 | 5,527 | 5,752 | ||||

| Growth of Net Loans | 6.8% | 5.1% | 7.5% | (2.4)% | 5.9% | 4.1% | ||||

| Other Earning Assets | 1,034 | 1,105 | 1,394 | 2,374 | 2,073 | 2,157 | ||||

| Deposits | 5,122 | 5,357 | 5,946 | 6,679 | 6,880 | 7,160 | ||||

| Borrowings and Sub-Debt | 329 | 276 | 291 | 330 | 281 | 292 | ||||

| Common equity | 762 | 828 | 887 | 916 | 897 | 980 | ||||

| Book Value Per Share ($) | 29.4 | 32.4 | 34.7 | 37.0 | 36.3 | 39.7 | ||||

| Tangible BVPS ($) | 26.1 | 29.1 | 31.5 | 33.6 | 32.9 | 36.3 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Combination of Loan and Deposit Mixes Leads to Low Asset Sensitivity

Around 63% of the loan portfolio is based on fixed rates, while 37% of the portfolio is based on variable rates, as mentioned in the earnings presentation. Therefore, the average earning-asset yield is not very responsive to interest rate hikes.

Meanwhile, the liability side is somewhat mixed in its response to interest rate changes. Savings and interest-bearing demand accounts face the biggest and most urgent repricing pressure in a rising rate environment compared to other types of deposits. These deposits made up 57% of total deposits at the end of June 2022, which is not too high but high enough to have a material impact on average deposit cost as rates rise.

The results of the management’s interest-rate sensitivity analysis given in the presentation showed that a 100-basis points hike in interest rates can boost the net interest income by only 2.92% over twelve months. Considering these factors, I’m expecting the margin to grow by 15 basis points in the second half of 2022 before stabilizing in 2023. Compared to my last report, I’ve revised upwards my margin estimate because of the second quarter’s performance as well as the greater-than-expected Fed Funds rate hike so far this year.

Contradictory Factors to Keep Provisioning Near the Historical Mean

Loan additions, high interest rates, inflation, and the possibility of a recession will likely keep provisioning elevated for the next few quarters. On the other hand, high reserves for loan losses will keep further provisioning subdued. Allowances were 2.4% of loans and leases, while nonperforming assets were just 0.6% of loans and leases at the end of June 2022.

As a result, I’m expecting provisioning to revert to the historical average in the second half of 2022 and full-year 2023. However, due to the below-normal provisioning reported in the first half of this year, the full-year provisioning for 2022 would be below the historical mean. Overall, I’m expecting the net provision expense to make up 0.30% of total loans (annualized) in every quarter till the end of 2023, which is the same as the average for the last five years.

Expecting Earnings to Dip by 3%

Provisioning normalization will likely be the chief contributor to an earnings decline this year. Further, non-interest income will be lower this year as higher interest rates will curtail income from mortgage refinancing. On the other hand, moderate loan growth and significant margin expansion will likely support the bottom line. Overall, I’m expecting 1st Source Corporation to report earnings of around $4.58 per share for 2022, down 3% year-over-year. For 2023, I’m expecting the company to report earnings of $4.68 per share, up 2% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 214 | 224 | 226 | 237 | 257 | 276 | ||||

| Provision for loan losses | 19 | 16 | 36 | (4) | 13 | 17 | ||||

| Non-interest income | 97 | 101 | 104 | 100 | 92 | 93 | ||||

| Non-interest expense | 186 | 189 | 187 | 186 | 188 | 201 | ||||

| Net income – Common Sh. | 82 | 92 | 81 | 118 | 113 | 116 | ||||

| EPS – Diluted ($) | 3.16 | 3.57 | 3.17 | 4.70 | 4.58 | 4.68 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on 1st Source Corporation, I projected earnings of $4.19 per share for 2022. I’ve revised upwards my earnings estimate because I’ve tweaked upwards both my loan and margin estimates following the second quarter’s performance.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Buy Rating

1st Source Corporation has a 34-year long history of annual dividend increases. Therefore, it’s very likely that the company will increase its dividend in early 2023. I’m expecting a $0.02 per share hike in the dividend level in the third quarter of 2023, which will bring total dividends to $1.32 per share for the full year. My dividend and earnings estimates suggest a payout ratio of 28% for 2023, which is in line with the last five-year average of 30%. My dividend estimate suggests a dividend yield of 2.7%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value 1st Source Corporation. The stock has traded at an average P/TB ratio of 1.54 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 26.1 | 29.1 | 31.5 | 33.6 | ||

| Average Market Price ($) | 51.8 | 46.7 | 36.6 | 46.7 | ||

| Historical P/TB | 1.98x | 1.61x | 1.16x | 1.39x | 1.54x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $32.9 gives a target price of $50.6 for the end of 2022. This price target implies a 2.6% upside from the August 23 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.34x | 1.44x | 1.54x | 1.64x | 1.74x |

| TBVPS – Dec 2022 ($) | 32.9 | 32.9 | 32.9 | 32.9 | 32.9 |

| Target Price ($) | 44.0 | 47.3 | 50.6 | 53.9 | 57.2 |

| Market Price ($) | 49.3 | 49.3 | 49.3 | 49.3 | 49.3 |

| Upside/(Downside) | (10.7)% | (4.0)% | 2.6% | 9.3% | 16.0% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.2 | 3.6 | 3.2 | 4.7 | ||

| Average Market Price ($) | 51.8 | 46.7 | 36.6 | 46.7 | ||

| Historical P/E | 16.4x | 13.1x | 11.5x | 9.9x | 12.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.58 gives a target price of $58.3 for the end of 2022. This price target implies an 18.3% upside from the August 23 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.7x | 11.7x | 12.7x | 13.7x | 14.7x |

| EPS 2022 ($) | 4.58 | 4.58 | 4.58 | 4.58 | 4.58 |

| Target Price ($) | 49.1 | 53.7 | 58.3 | 62.9 | 67.4 |

| Market Price ($) | 49.3 | 49.3 | 49.3 | 49.3 | 49.3 |

| Upside/(Downside) | (0.2)% | 9.1% | 18.3% | 27.6% | 36.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $54.4, which implies a 10.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 13.1%. Hence, I’m maintaining a buy rating on 1st Source Corporation.

Be the first to comment