gorodenkoff

Investment Thesis

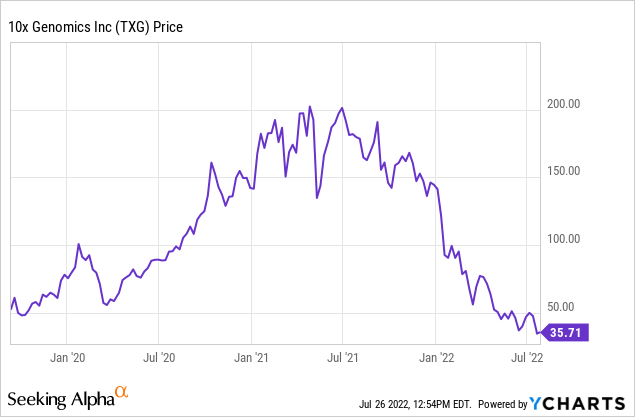

Despite falling ~82% from its peak in April 2021, 10x Genomics (NASDAQ:TXG) is still trading at high valuations, despite having a history of negative earnings that is expected to continue. Insiders have been consistently selling over the few years, unloading from $70 all the way up to $200 and back down to $50. The probability of multiple compression continuing and investors permanently losing their capital is still elevated and I would look elsewhere for sound investments.

Company Description

TXG is a $4B life sciences technology company that builds products and solutions to “interrogate, understand and master biological systems at resolution and scale that matches the complexity of biology”. In other words, they build products (instruments, software, consumables) to help analyze biological systems (e.g. the single cell level for millions of cells). The company relies largely on research activities in both academic institutions and government laboratories for revenue.

TXG’s commercial product portfolio comprises of:

-

Chromium: enable high throughput analysis of individual biological components (e.g. up to millions of single cells); this segment represents substantially all of TXG’s revenue

-

Visium: enable analysis of biological molecules within their spatial context, providing the locations of analytes that give insight into higher order biological structure and function

-

Xenium (forthcoming): enables scientists the ability to not only locate and type cells in their tissue context, but also to address a variety of specific questions based on previous knowledge of their samples

TXG’s main customers are academic institutions (~60-65% of sales), governments, biotech companies, and research institutions around the globe. No one customer represented more than 10% of their revenues. Since launching its first product in mid-2015, TXG has sold 3,511 instruments.

The company owns or exclusively in-licenses over 460 issued or allowed patents and over 830 pending patent applications as of December 31, 2021. According to the company, the market opportunity for its solutions and tools is ~$15B of the estimated $60B global life sciences research tools market in 2020.

The company was founded in 2012 and went public in 2019 (sold 11.5 million shares at $39 / share). It also completed a secondary offering in September 2020 (sold 4.6 million shares at $110).

Valuation Analysis

With ~113M diluted shares outstanding and a current price of $35, the market cap is ~$4B.

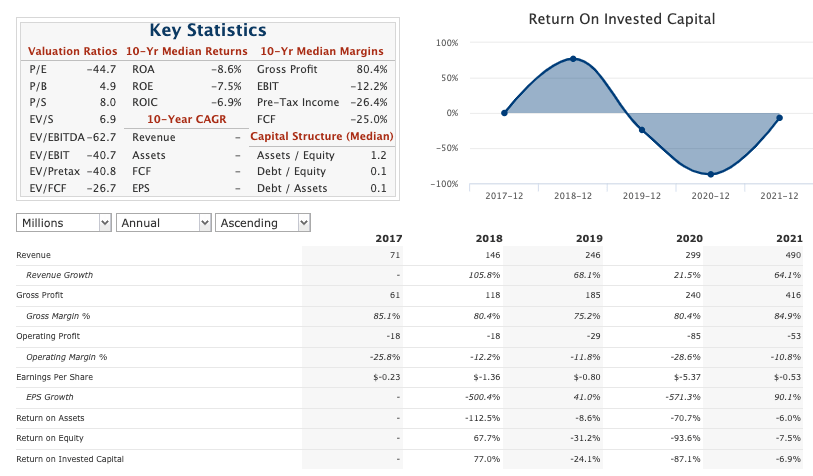

QuickFS

A quick glance at TXG’s valuation and financials:

-

P/S: 8.0x

-

P/B: 4.9x

-

EV/EBITDA: -62.7x

-

EV/FCF: -26.7x

-

ROA/ROE/ROIC: around -7%

-

Cash/Marketable Securities: ~$540M

-

Current Assets: $697M

-

Total Liabilities: $197M

Although the metrics are much lower than when I wrote up TXG back in March 2021 (Wouldn’t Touch This, Even With A 10×10 Foot Pole), when the P/S was 58x and P/B was 23x, it unfortunately doesn’t seem like the financials will be improving anytime soon (2021 10-K):

We have incurred significant losses since we were formed in 2012 and expect to incur losses in the future. We incurred net losses of $58.2 million and $542.7 million for the years ended December 31, 2021 and 2020, respectively.

We expect that our losses will continue in the near term as we continue to invest significantly in research and development and the commercialization of both new products and improved versions of existing products.

We may never be able to generate sufficient revenue to achieve or sustain profitability and our recent and historical growth should not be considered indicative of our future performance. Our failure to achieve or maintain growth or profitability could negatively impact the value of our Class A common stock.

Investors in TXG face the serious risk that the company will never be profitable and are therefore subjected to the risk of permanent loss of capital.

Another way to view the valuation is that Charles River Laboratories (CRL) (see my write-up here: High-Quality Company At A Fair Price), which is another company that operates in the life sciences space, trades at a P/S of 3x, a P/B of 3.9x, and has been consistently profitable for the past decade. If TXG’s P/S ratio were to just match CRL’s, then the ongoing multiple compression in TXG’s valuation still has a ways to go.

Insider Ownership & Transactions

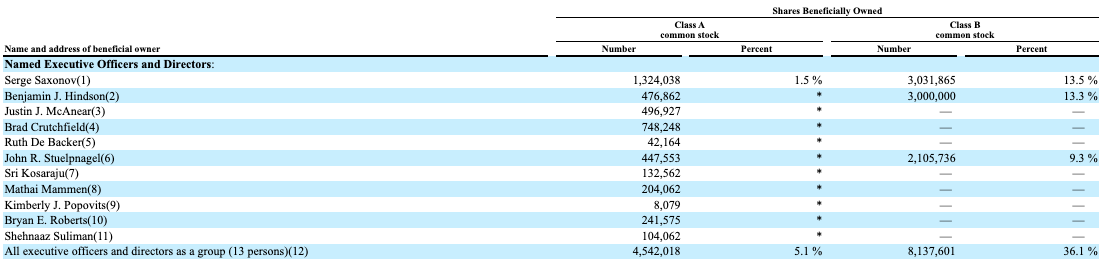

DEF 14A (2021)

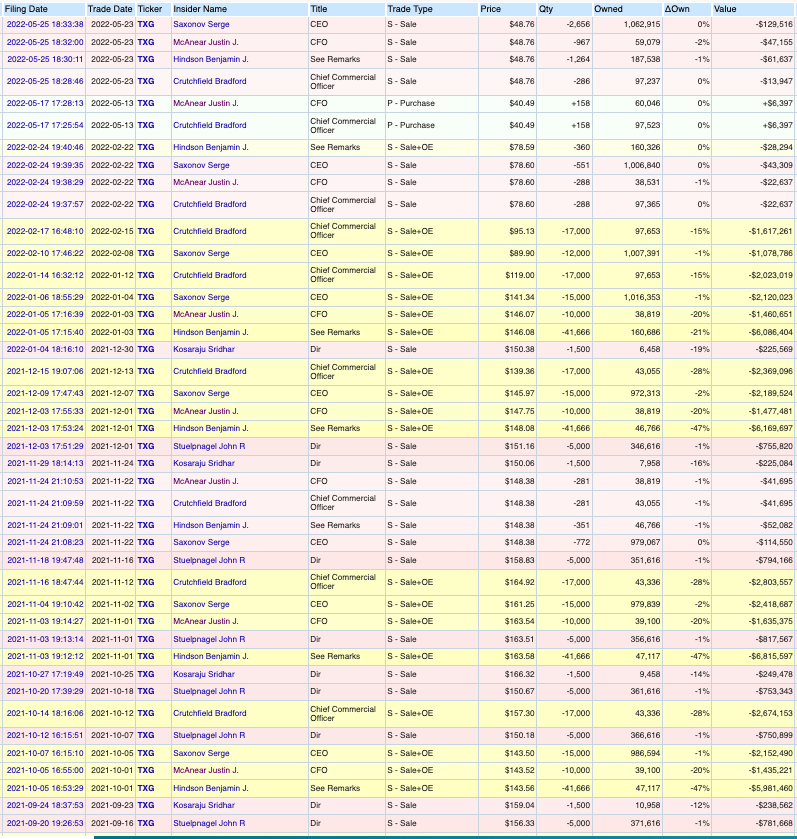

Insiders own ~4.5M of Class A shares and ~8.1M of Class B shares (Class B is convertible one-to-one into a Class A and has 10 votes per share), which sums to ~12.6M and comes out to ~11% of the company. Insiders have also been selling stock and sale prices have ranged from ~$200 to ~$50. According to Dataroma, TXG insiders have sold ~$331M in the last 2 years and bought ~$13K.

OpenInsider

Upside Risks

Continued Adoption

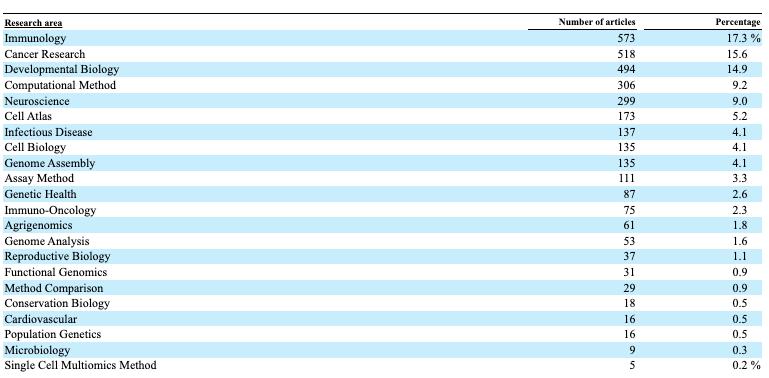

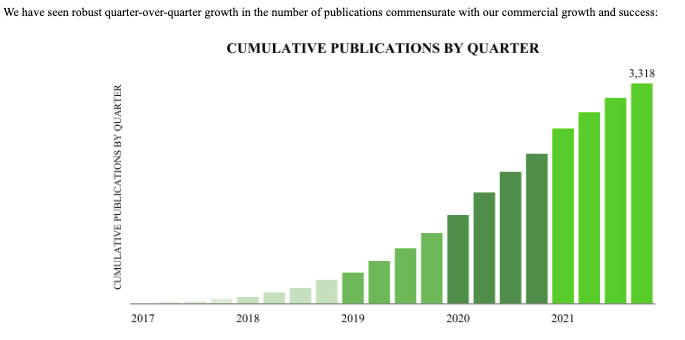

I did find the following data summarizing the number of peer-reviewed scientific publications that used TXG’s products pretty interesting (more than 390 of the articles were published in 3 highly regarded journals: Cell, Nature, and Science). It is possible that TXG’s product continues to be adopted and will eventually reach profitability, but as of now, it doesn’t seem like profitability will be on the horizon anytime soon.

2021 10-K 2021 10-K

Downside Risks

1. Continued Multiple Compression/High Valuation

In the last 18 months, TXG has gone from a P/S of 58x and a P/B of 23x to a P/S of 8x and a P/B of 4.9x; there is a serious risk of this continuing as TXG has yet to turn a profit and has warned that it expects to continually lose money in the future.

2. Continued Insider Selling

Insiders still own ~11% of the company and have been consistent sellers from $200 all the way down to $50 (most recent sale was in May 2022); if insiders continue to sell, it could continue to send the stock lower.

3. ARKK/ETF Reflexivity

ARK ETFs run by Cathie Wood hold ~$143M worth of TXG (ARKK holds ~3.3M shares and ARKG holds ~750K shares). Together, ARKK and ARKG hold ~4M shares. If ARK ever decides to sell its TXG position (or is forced to sell due to fund withdrawals), the price of TXG would fall. If TXG falls, ARK would also fall, which causes even more investors to pull their money; this would create a self-fulfilling cycle that will end poorly for TXG investors.

4. Litigation

One of the risks I mentioned in my last article was that TXG was involved in several lawsuits, such as the one with Bio-Rad Laboratories (BIO).

- In May 2020, 10x countersued Bio-Rad over a microfluidic chip patent infringement.

- In August 2020, the court ruled in favor of Bio-Rad and awarded them monetary damages of $23.9 million and a 15% royalty on past and future sales of a suite of 10x’s products.

This litigation ended on July 27, 2021 when the two parties settled on a global patent cross-license for patents held by both parties and, in addition to past and future royalties, Bio-Rad receives broad “freedom-to-operate in the single-cell market and maintains exclusivity to its microwell single-cell intellectual property.”

Maintaining intellectual property is critical if TXG is to even have a chance at success, since if any company can just create the same products TXG can, the company’s competitive advantage would be nonexistent. As a result, the company will most likely be involved in many litigations moving forward, which are both costly, time-consuming and risk serious damage to the company’s portfolio of patents and licenses.

Investment Summary

Charlie Munger has said, “All I want to know is where I’m going to die, so I’ll never go there.”

As much as investing is about knowing what to invest in, it is also about knowing what not to invest in. Despite falling ~82% from its peak in April 2021, TXG is still trading at high valuations, has yet to turn a profit, and expects to be losing money in the future. On top of that, insiders have been consistent sellers since $200 all the way down to $50 (and they still own 11%). The probability of investors permanently losing their capital is still elevated and I would look elsewhere for sound investments.

Based on the analysis above, I do not recommend taking a long position in TXG.

Be the first to comment