MicroStockHub/iStock via Getty Images

In my monthly series, 10 Dividend Growth Stocks, I rank a selection of Dividend Radar stocks and present the ten top-ranked stocks for further research and possible investment. Dividend Radar is a weekly automatically generated spreadsheet of dividend growth [DG] stocks with dividend increase streaks of five or more years.

I use a ranking system based on DVK Quality Snapshots, which employs five widely used quality indicators from independent sources to assess the quality of DG stocks. I apply different screens every month to highlight different aspects of DG investing.

Last month, I experimented by replacing Value Line’s Safety Rank in DVK Quality Snapshots with a ranking based on JUST Capital’s Overall Rankings of America’s largest publicly traded companies. In contrast to Value Line’s coverage of 90%, JUST Capital provides rankings for only 50% of Dividend Radar stocks, which is insufficient for my purposes.

Nevertheless, I think JUST Capital’s rankings are worth exploring further, so I’m revisiting it as a way of screening Dividend Radar stocks.

Specifically, I considered only Dividend Radar stocks with JUST Capital rankings of 1-100 and only stocks with quality scores of 19-25. Furthermore, I screened stocks by their GICS sector, so this month’s picks have one representative in ten of the eleven GICS sectors.

About JUST Capital

JUST Capital was founded in 2013 as an independent non-profit 501(C)(3) organization with the long-term goal of bringing about a more just and balanced economy, as expressed in JUST Capital’s mission statement:

“The mission of JUST Capital is to build an economy that works for all Americans by helping companies improve how they serve all their stakeholders – workers, customers, communities, the environment, and shareholders. We believe that business and markets can and must be a greater force for good, and that by shifting the resources of the $19 trillion private sector, we can address systemic issues at scale, including income inequality and lack of opportunity. Guided by the priorities of the public, our research, rankings, indexes, and data-driven tools help measure and improve corporate performance in the stakeholder economy. is “to build an economy that works for all Americans by helping companies improve how they serve all their stakeholders – workers, customers, communities, the environment, and shareholders.”

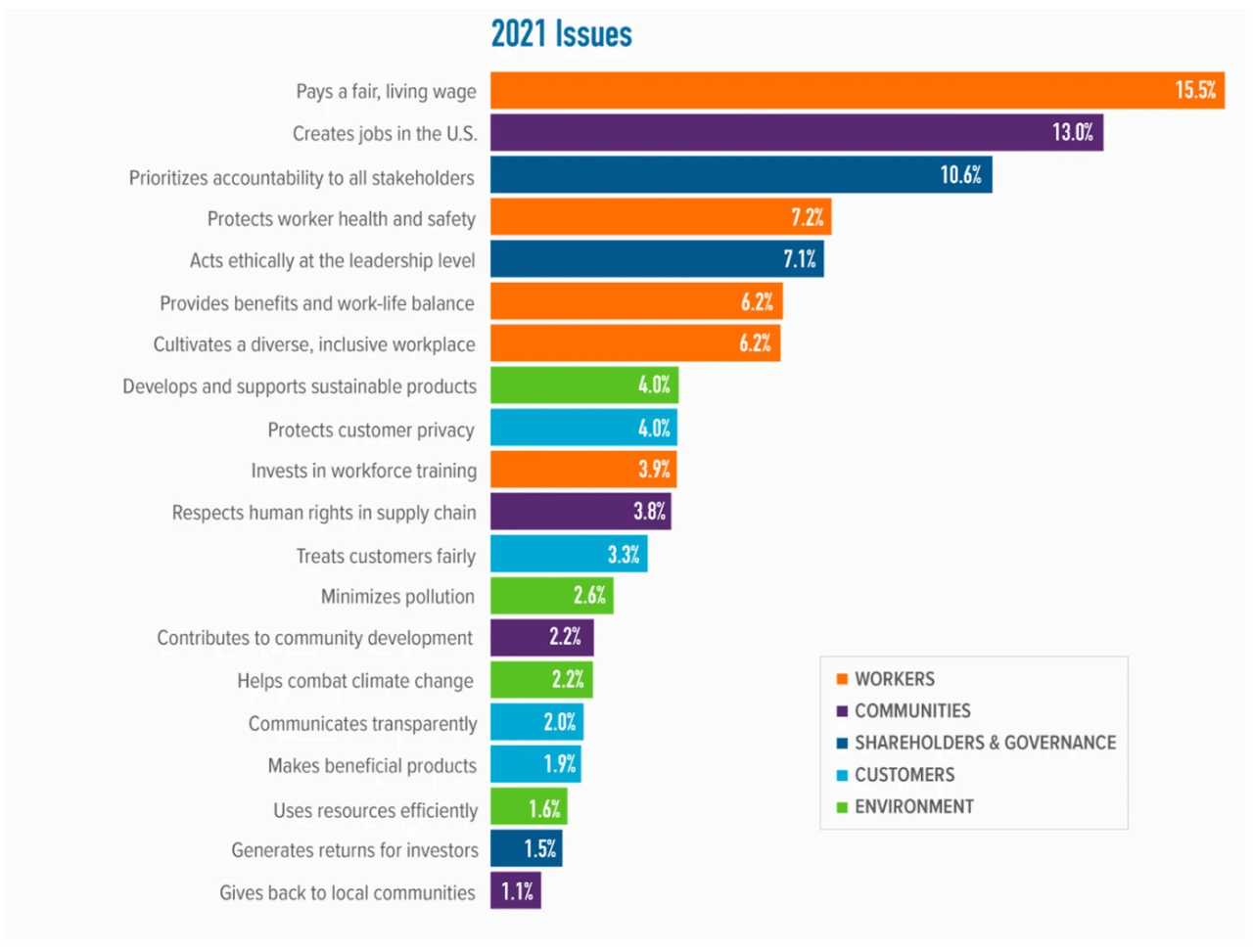

JUST Capital surveys Americans annually to identify the issues that matter most to them in defining just business behavior. It then establishes representative metrics and measures the largest publicly traded U.S. companies to reach an overall ranking for each company.

In the 2021 survey, the public identified 20 issues essential to just businesses, color-coded below by the stakeholder it most impacts:

JUST Capital

To produce the 2022 Rankings, JUST Capital tracked, analyzed, and ranked 954 companies across five stakeholder groups, 20 issues, 66 metrics, and 241 data points (as determined in the 2021 survey).

Screening and Ranking

The latest Dividend Radar (dated November 18, 2022) contains 722 stocks. Of these, only 56 stocks have JUST Capital rankings in the range of 1-100, and 38 stocks have quality scores of at least 19 points based on DVK Quality Snapshots.

To promote diversity, I looked for one stock from each GICS sector.

Here are this month’s screens:

- Dividend Radar stocks

- Stocks with JUST Capital rankings of 1-100

- High-quality stocks with DVK Quality Snapshots quality scores of 19-25

- If feasible, one stock from each GICS sector

There is at least one candidate for every GICS sector except for the Real Estate sector. The top Real Estate sector stock has a quality score of 17 points, so it does not qualify.

I ranked the ten candidates that pass all my screens and present them below for your consideration. To break ties, I used my usual tie-breakers. Each stock’s Rank is shown in the tables below.

The 10 Dividend Growth Stocks for November

Here are this month’s ten top-ranked DG stocks in rank order:

The seven stocks I own in my DivGro portfolio are highlighted.

| Rank | Company (Ticker) | Sector | Supersector | JUST CapitalRanking |

| 1 | Merck (MRK) | Health Care | Defensive | 26 |

| 2 | PepsiCo (PEP) | Consumer Staples | Defensive | 12 |

| 3 | Ecolab (ECL) | Materials | Cyclical | 90 |

| 4 | Lowe’s (LOW) | Consumer Discretionary | Cyclical | 70 |

| 5 | Verizon Communications (VZ) | Communication Services | Sensitive | 9 |

| 6 | American Electric Power (AEP) | Utilities | Defensive | 31 |

| 7 | Intel (INTC) | Information Technology | Sensitive | 2 |

| 8 | United Parcel Service (UPS) | Industrials | Sensitive | 42 |

| 9 | JPMorgan Chase (JPM) | Financials | Cyclical | 28 |

| 10 | Exxon Mobil (XOM) | Energy | Sensitive | 89 |

The following company descriptions are my summary of company descriptions sourced from Finviz.

1. Merck

Founded in 1891 and headquartered in Kenilworth, New Jersey, MRK is a global healthcare company that offers health solutions through prescription medicines, vaccines, biologic therapies, and animal health products. MRK markets its products to drug wholesalers and retailers, hospitals, government entities and agencies, physicians, physician distributors, veterinarians, distributors, animal producers, and managed health care providers.

2. PepsiCo

PEP is a global beverage and food company. The company distributes beverages under well-known brands such as Pepsi, Gatorade, Mountain Dew, 7UP, and Tropicana, and food and snacks under brands such as Quaker, Lay’s, Doritos, Cheetos, and Ruffles. PEP was founded in 1898 and is headquartered in Purchase, New York.

3. Ecolab

Founded in 1923 and headquartered in St. Paul, Minnesota, ECL provides water, hygiene, and infection prevention solutions and services worldwide. ECL’s cleaning and sanitizing products, pest elimination services, and equipment maintenance and repair services support customers in various sectors, including food service, food and beverage processing, hospitality, healthcare, retail, textile care, and commercial facilities management.

4. Lowe’s

LOW is a home improvement retailer. The company offers a complete line of products for maintenance, repair, remodeling, and home decorating. It also offers installation services through independent contractors, as well as extended protection plans and repair services. LOW was founded in 1946 and is based in Mooresville, North Carolina.

5. Verizon Communications

VZ provides communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide. Formerly known as Bell Atlantic Corporation, the company changed its name to Verizon Communications Inc in June 2000. VZ was founded in 1983 and is based in New York, New York.

6. American Electric Power

AEP is a public utility holding company that engages in the generation, transmission, and distribution of electricity to customers in the United States. The company generates electricity using coal and lignite, natural gas, nuclear, hydroelectric, and other energy sources. AEP was founded in 1906 and is headquartered in Columbus, Ohio.

7. Intel

INTC designs, manufactures, and sells computer, networking, and communications platforms worldwide. The company operates through the Client Computing Group, Data Center Group, Internet of Things Group, Non-Volatile Memory Solutions Group, Intel Security Group, Programmable Solutions Group, and All Other segments. INTC was founded in 1968 and is based in Santa Clara, California.

8. United Parcel Service

UPS is a global leader in logistics, offering a broad range of solutions, including the transportation of packages and freight, the facilitation of international trade, and the deployment of advanced technology to more efficiently manage the world of business. Headquartered in Atlanta, UPS serves more than 220 countries and territories worldwide.

9. JPMorgan Chase

JPM is a financial holding company providing investment banking, financial services, commercial banking, financial transaction processing, and asset management. With assets of about $2.6 trillion, the company serves many prominent corporate, institutional, and government clients worldwide. JPM was founded in 1799 and is headquartered in New York, New York.

10. Exxon Mobil

XOM is the world’s largest publicly traded international oil and gas company. Founded in 1882 and based in Irving, TX, the company is engaged in oil and natural gas exploration and production, petroleum products refining and marketing, chemicals manufacture, and other energy-related businesses. The majority of XOM’s earnings come from operations outside the United States.

Please note that the top ten DG stocks are candidates for further analysis, not recommendations.

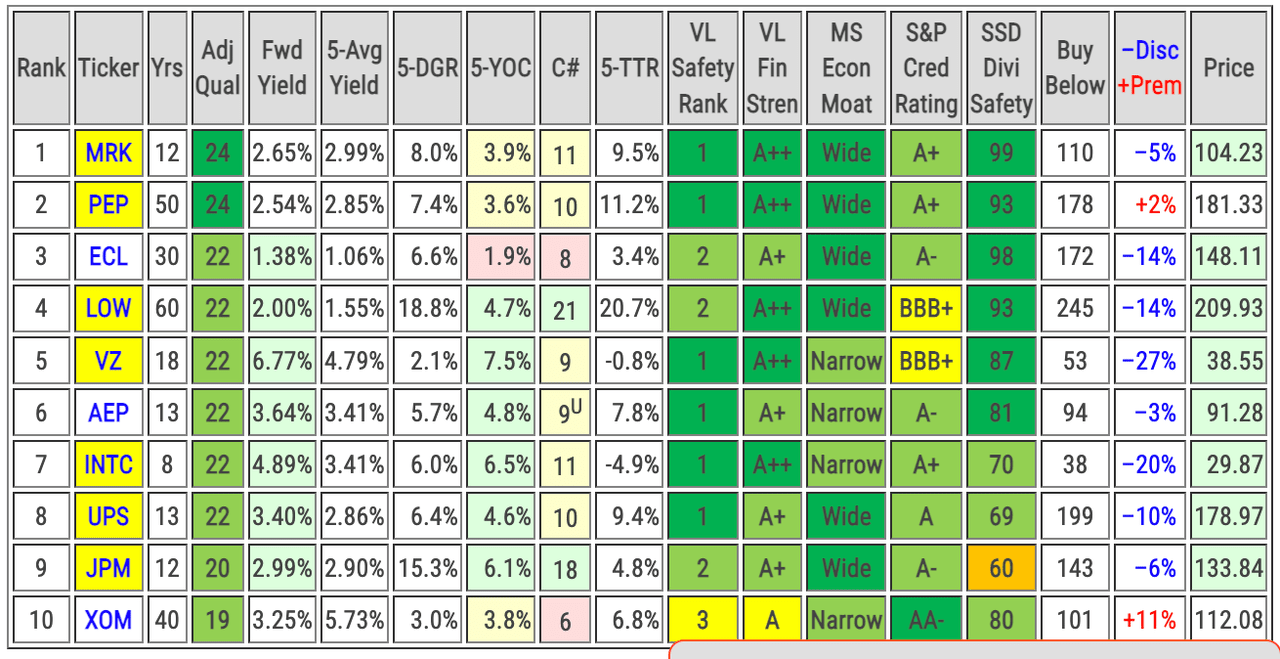

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to DG investors, along with quality indicators and fair value estimates:

-

Yrs: years of consecutive dividend increases

-

Adj Qual: DVK Quality Snapshots quality score.

-

Fwd Yield: forward dividend yield for a recent share Price

-

5-Avg Yield: 5-year average dividend yield

-

5-DGR: 5-year compound annual growth rate of the dividend

-

5-YOC: the projected yield on cost after five years of investment

-

C#: Chowder Number, a popular metric for screening DG stocks

-

5-TTR: 5-year compound trailing total returns

-

VL Fin Stren: Value Line’s Financial Strength ratings

-

MS Econ Moat: Morningstar’s Economic Moat

-

S&P Cred Rating: S&P Global’s Credit Ratings

-

SSD Divi Safety: Simply Safe Dividends’ Dividend Safety Scores

-

Buy Below: my risk-adjusted buy-below price (see below)

-

–Disc +Prem: discount or premium of the recent share Price to my Buy Below price

-

Price: recent share price

|

Color-coding

|

Created by the author from a personal spreadsheet

I use a survey approach to estimate fair value [FV], collecting fair value estimates and price targets from several online sources such as Morningstar, Finbox, and Portfolio Insight. Additionally, I estimate fair value using each stock’s five-year average dividend yield. With up to 11 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

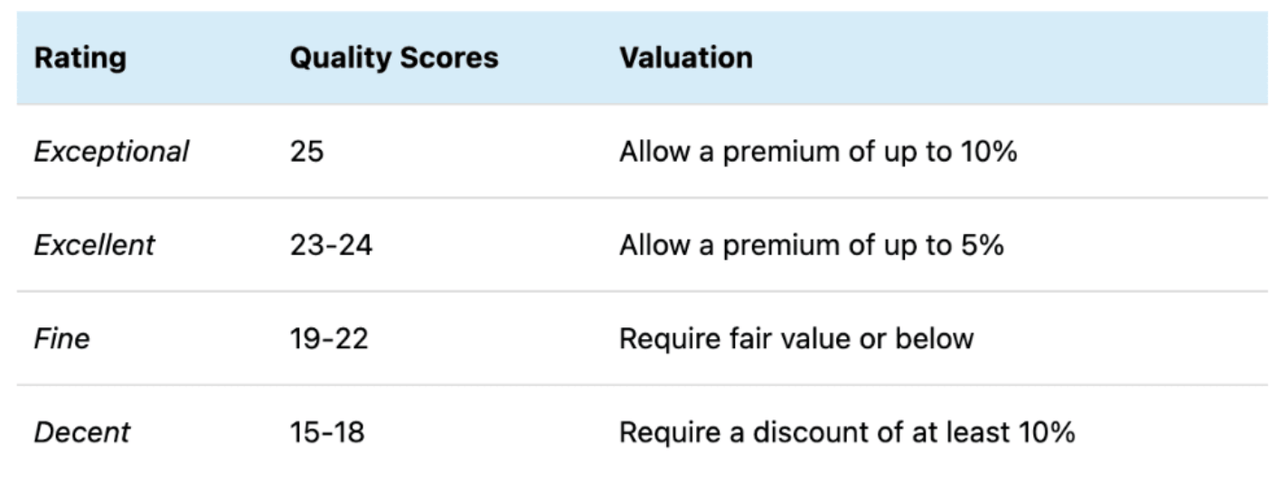

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

Created by the author

My Buy Below prices recognize that the highest-quality stocks rarely trade at discounted valuations. As a dividend growth investor with a long-term investment horizon, I’m more interested in owning quality stocks than getting a bargain on lower-quality stocks.

Commentary

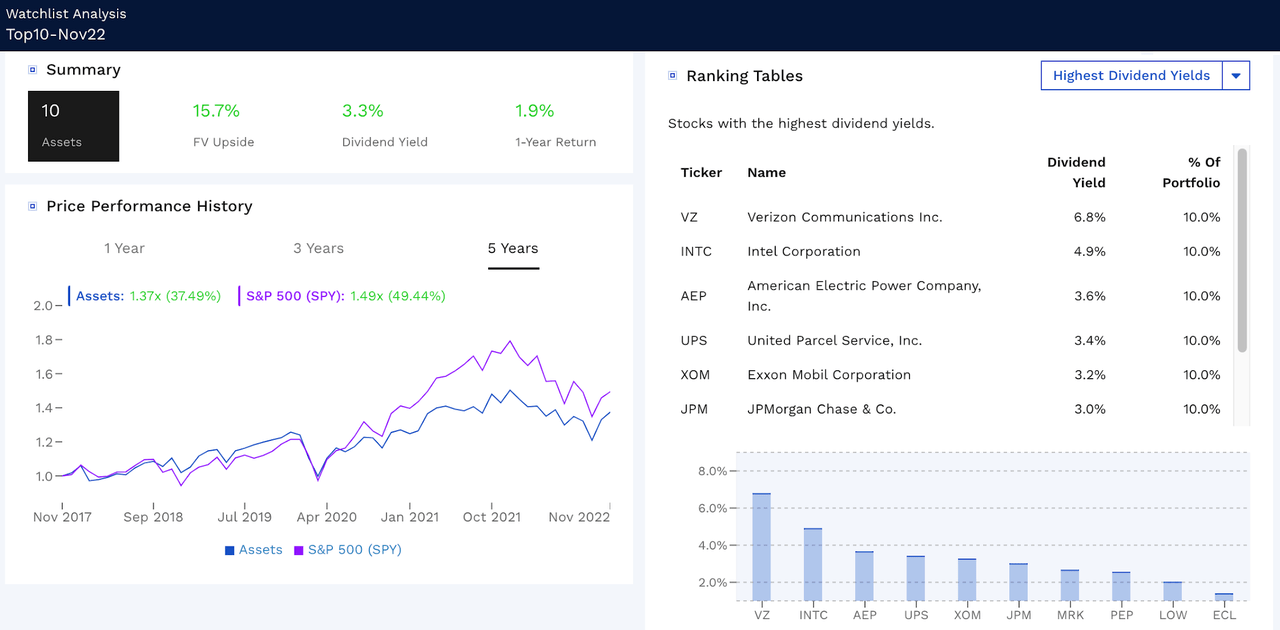

Here’s a comparative analysis of an equal-weighted portfolio of this month’s top ten DG stocks, courtesy of Finbox.com:

Finbox.com

From a price-performance perspective, the portfolio would have underperformed the S&P 500 (as represented by the SPDR S&P 500 Trust ETF (SPY)) over the last five years, returning 37% versus SPY’s 48%.

The stocks offer a wide variety of yields, with VZ the highest at 6.8% to ECL the lowest at 1.4%.

VZ (6.8%), INTC (4.9%), and AEP (3.6%) offer the highest yields and are suitable for income investors.

LOW (18.8%) and JPM (15.3%) have the highest 5-year dividend growth rates and are strong candidates for growth-oriented investors.

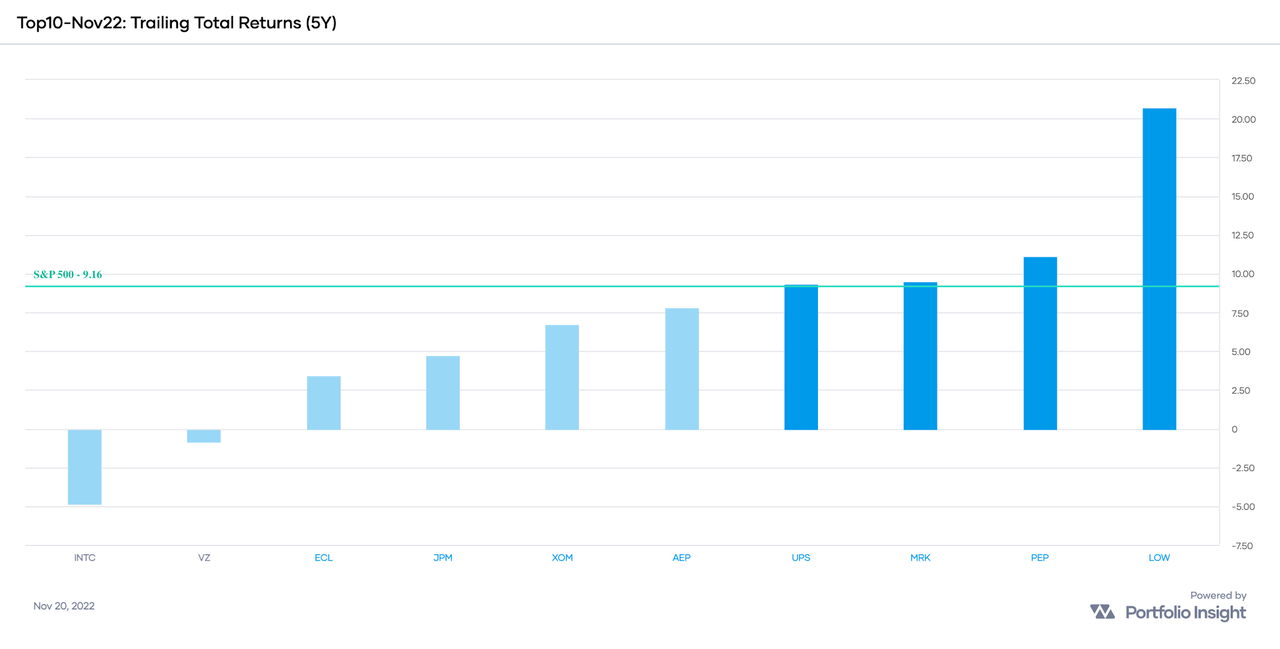

LOW, PEP, MRK, and UPS have the highest 5-year TTRs and are the only stocks in this month’s list that outperformed SPY over the 5-year period:

Portfolio Insight

As for valuations, VZ (-27%) and INTC (-20%) are discounted most relative to my Buy Below prices and are strong candidates for value investors.

Of the stocks I don’t own, AEP is the only candidate that somewhat interests me. AEP is a Utilities sector stock with a forward yield of 3.64%. For Utilities, I prefer yields above 4%. This means AEP would need to trade at least 9% lower than its current price of $91.28 per share, or below $83 per share.

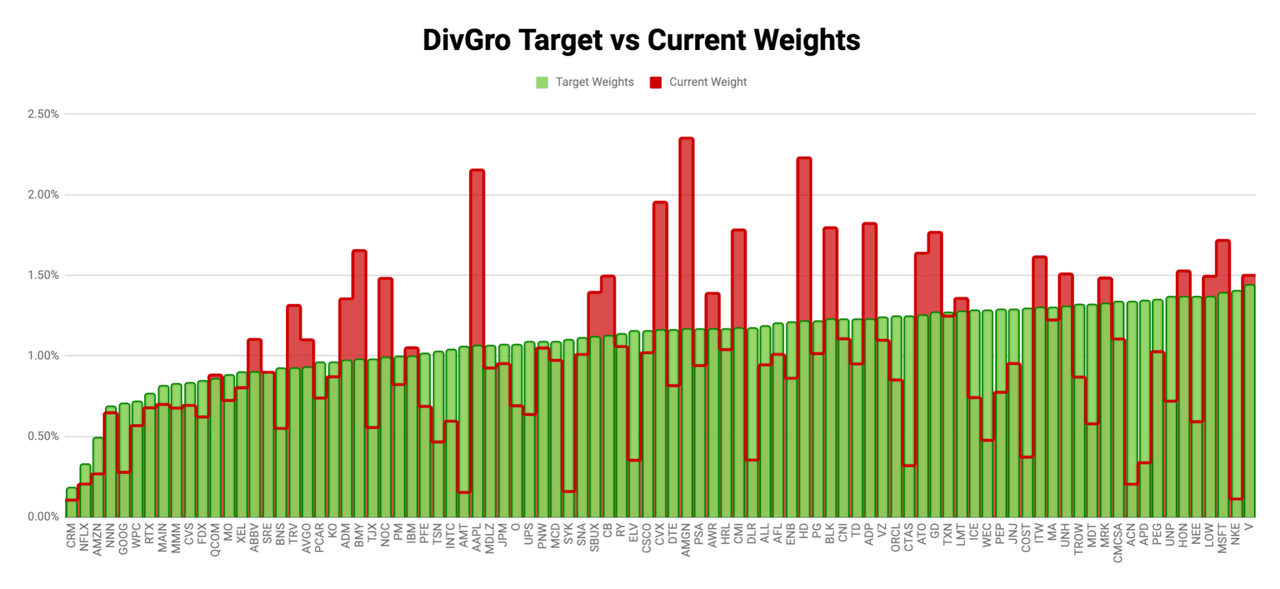

I use a dynamic and flexible system for determining target weights for my DivGro portfolio. Here is a chart showing the current and target weights of dividend-paying stocks in DivGro:

Created by the Author

Of this month’s candidate stocks in my portfolio, LOW and MRK are somewhat overweight. JPM and VZ are somewhat underweight, whereas INTC, PEP, and UPS are significantly underweight. Based on my calculations, I’d need to buy 207 shares of INTC, 40 shares of PEP, and 35 shares of UPS to match my target weights.

The main reason I’m so underweight in my INTC position is that INTC’s stock price is down about 47% from its 52-week high of $56.28. The company is struggling in a tough environment. According to Gartner, worldwide PC shipments declined about 20% in the third quarter of 2022, the fourth consecutive quarter of year-over-year decline. The earnings outlook is grim, but INTC’s dividend is deemed to be safe for now.

I’ll likely write two put options on INTC rather than buy 200 shares.

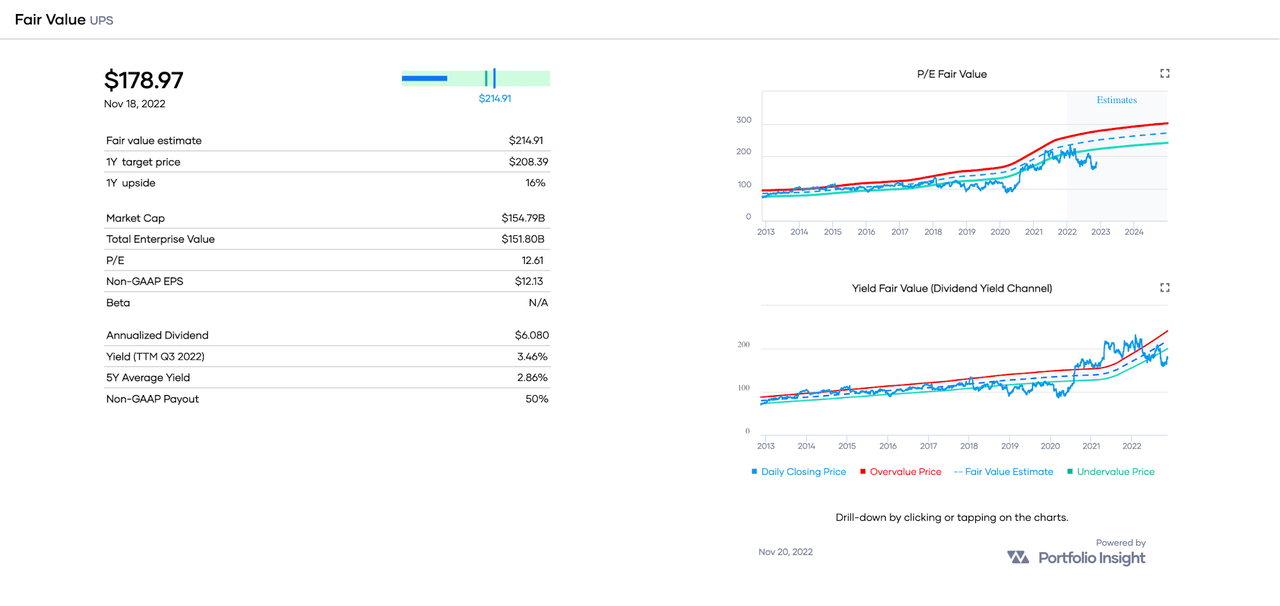

Between PEP and UPS, I’d lean towards UPS as PEP is trading above my Buy Below price. In contrast, UPS is trading at a discount of 10% to my Buy Below price, and the stock offers a solid dividend yield of 3.40%.

Portfolio Insight

According to Portfolio Insight, UPS has a 1-year upside of 16%.

With a Non-GAAP payout ratio of 50%, UPS has plenty of room to continue paying and raising its dividend. UPS’s dividend is deemed Safe with a Dividend Safety Score of 69, according to Simply Safe Dividends.

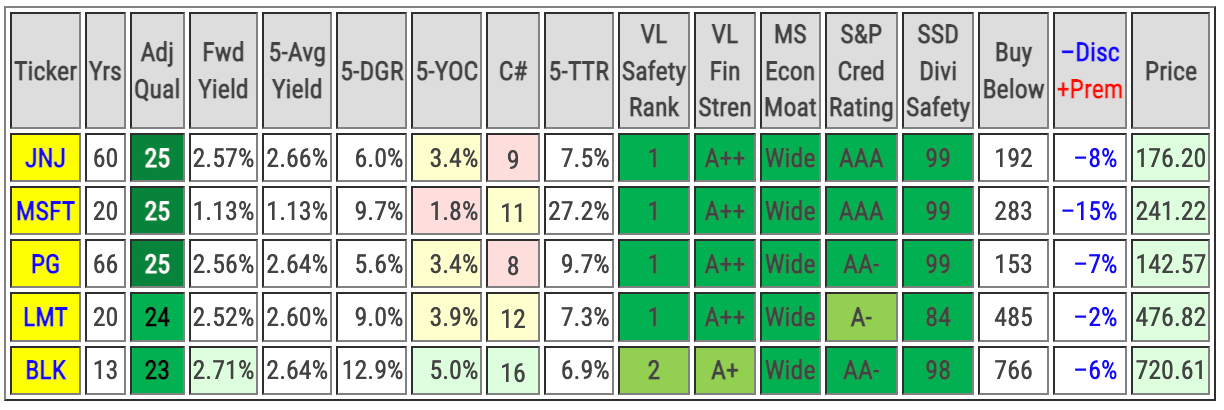

Bonus Section

For this month’s picks, I selected the top-ranked stock in each GICS sector based on JUST Capital’s rankings, provided each stock’s DVK Quality Snapshot quality score was at least 19. In five sectors, there actually are stocks with higher quality scores but lower JUST Capital rankings. I include these stocks below as a bonus:

Created by the author from a personal spreadsheet

| Company (Ticker) | Sector | Supersector | JUST CapitalRanking |

| Johnson & Johnson (JNJ) | Health Care | Defensive | 49 |

| Microsoft (MSFT) | Information Technology | Sensitive | 3 |

| Procter & Gamble (PG) | Consumer Staples | Defensive | 59 |

| Lockheed Martin (LMT) | Industrials | Sensitive | 44 |

| BlackRock (BLK) | Financials | Cyclical | 45 |

Of these bonus stocks, BLK looks most interesting to me, mostly based on its very favorable Chowder Number of 16.

Concluding Remarks

In this article, I ranked a selection of Dividend Radar stocks using DVK Quality Snapshots. I considered Dividend Radar stocks with JUST Capital rankings of 1-100 and only stocks with quality scores of 19-25 and selected one stock from each GICS sector for diversification purposes.

As always, I encourage readers to do their due diligence before buying any stocks I cover

Thanks for reading, and take care, everybody!

Be the first to comment