Mgov

Investment thesis

I believe Vimeo, Inc. (NASDAQ:VMEO) is undervalued. More and more companies are incorporating video into their communication strategies because it is a powerful tool for capturing the attention of target audiences and increasing actionable metrics like click-through and conversion rates. Vimeo is unique in the market because it provides a consolidated hub for the entire video production process and facilitates cross-platform distribution of user-created content.

Business overview

Vimeo develops video editing software that facilitates sharing, syncing, and collaborating on video content on a single, turnkey platform

More businesses are using video as an integral part of their communication strategy

As far as I’m concerned, video is quickly becoming an integral part of every facet of business communication, and that trend will only accelerate in the years to come.

Customers have grown accustomed to instantaneous, entertaining video content from businesses. I expect that the dramatic increase in user-generated content on social media will increase the pressure on companies to create high-quality videos for these platforms. It’s a proven fact that videos do better than images and text, and studies have shown that including them on landing pages boosts key metrics (click-through, conversion, etc.). As such, I believe businesses cannot afford to ignore this trend. Moreover, the uptick in these metrics will aid in both traffic generation and search engine optimization, the latter of which is frequently cited as a primary traffic generator for websites and businesses.

Direct-to-consumer streaming is another indicator of the growing popularity of watching videos online. Creators are increasingly going straight to their target demographics instead of going through more intermediary outlets like television networks. Look around: today, subscribers can choose from a wide variety of streaming services, including Netflix (NFLX), Amazon Prime Video (AMZN), Disney + (DIS), and many others. The average American family subscribes to 4.7 different services. This is unequivocal proof that customers want this. I expect many of the current content creators want to launch their own D2C offerings in the future to capture more of the profit economics.

In my opinion, widespread access to fast internet is what really stokes the fire of all these shifts. In the past, people watched videos online mostly on PC that required a constant, constant connection to a fast Internet service. These days, many people have connected TVs in their homes, and smartphones and tablets can play HD video. Additionally, 5G network coverage is growing. Viewing devices like AR/VR goggles, and autonomous vehicles will likely proliferate in the near future. Businesses will need a consolidated system to distribute video across platforms as their audiences spread across more and more devices.

Not only are consumers’ preferences shifting, but how work is done is also evolving, necessitating changes in how businesses operate. Video has emerged as a crucial tool for improving staff interaction, efficiency, and retainment as businesses increasingly rely on remote workers and software for team communication. The pandemic has likely sparked an irreversible trend toward flexible schedules, and it goes beyond distributed teams. Employees no longer need to conduct face-to-face meetings in the office; instead, they can hold their meetings via video conferencing.

Vimeo supplies a unified platform for all stages of video production

In my opinion, VMEO stands out from the crowd because it provides a unified platform for all stages of the video production life cycle, from concept to consumption, with a single login and set of fees. VMEO is able to provide more value to more customers at a lower cost by offering a wider variety of tools for more scenarios. With VMEO, users only need to learn and manage one platform, rather than juggling a variety of point solutions that may or may not work together.

I think the ability for customers to share videos on different platforms is a competitive advantage for VMEO. Most social media sites are trying to attract more users so that they can charge more for advertising space on their sites. Most companies, however, need and want to share their videos across various online channels to reach the widest possible audience. VMEO is a provider that isn’t tied to any particular platform, so they can assist with marketing and sales across multiple channels. VMEO is able to take advantage of this by aligning its business model with users’ requirements to distribute videos across multiple platforms, allowing it to provide more distribution opportunities than other isolated social media platforms. This is a smart move because instead of competing with social media platforms, VMEO can now “work” with them, thereby boosting the value chain as a whole.

More importantly, VMEO’s size allows for in-depth analysis of video interaction and performance across channels. Over time, I expect VMEO utilizing this information to furnish individualized knowledge and insight, adaptively fine tune content, enhance video quality, and make recommendations regarding when, what, and where to create videos. Take note that as VMEO’s user base grows, so does the amount of data it collects, allowing it to better tailor its offerings to each individual.

VMEO product has no ads

On the surface, this doesn’t seem like a good move because VMEO is giving up potential revenue streams; NFLX, after the fact, expressed regret that it hadn’t done the same. As a customer, though, I think this is a fantastic selling point over competitors like YouTube. Unlike social media sites, VMEO gives its free users access to an ad-free video player and gives its paying customers full control over their videos and how they’re presented. VMEO will never intentionally send visitors away from a user’s content or website as they do not use advertising to monetize their audience. Because of this, content producers can rest assured that their hard-won audience will not be competed away by other ads.

Vimeo enjoys a low-cost method of customer acquisition and advertising

Sharing and collaborating on videos amongst users expands the VMEO community, which in turn attracts more users who may become paying subscribers. Anyone who watches a video uploaded by a free user and enjoys it will get a taste of what the VMEO platform has to offer. As a result, the number of people who can be targeted by VMEO grows every time a user shares a video publicly, sends a Vimeo link to a friend privately, or works on a video project with a group of people. This kind of behavior piques the interest of viewers, who may then sign up as users. This is essentially a low-cost method of advertising and customer acquisition for VMEO, and the best part is that it will only get better as the company expands.

Scale drives high margins

Just like with more conventional industries like manufacturing, VMEO thrives when it has a larger customer base. The company’s variable expenses decline as it stores and transmits more video. The growth in VMEO gross margin from 60% in FY19 to 75% in LTM 3Q22 demonstrates how a large scale of operations has allowed them to increase margins without increasing prices. As a result of the rise in gross margin, VMEO is now able to offer competitive pricing in formerly unreachable regions. In my opinion, VMEO will be able to achieve higher margins as it grows in size, which will translate to substantial profits once the company stops investing in its expansion (i.e., maturity).

Valuation

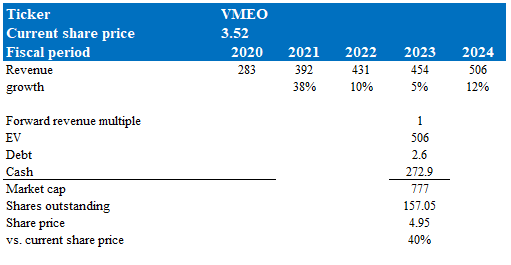

Based on the long-term trend in video consumption, I believe VMEO has a long, albeit slow, growth runway ahead of it. My model suggests VMEO could be easily worth more than 40% from its share price today if multiples were to revert to 1x (or more) from the 0.6x today. I believe this is likely to happen once we see VMEO print better profitability and growth to revert post FY23.

Model walkthrough:

- Revenue is expected to continue growing at ~10+%, but will face a slowdown in FY23 due to bad macro-economics.

- VMEO should at least trade back to 1x revenue multiple as we see growth reaccelerate in FY24.

Own calculations

Risks

Competition

Vimeo is in the video solutions industry, which is crowded with heavy hitters like Adobe (ADBE), Microsoft (MSFT), and Zoom (ZM). One day, these competitors could simply turn on a switch and start copying VMEO, turning its competitive advantage into a commodity and thereby reducing VMEO’s advantage.

Post-pandemic consumer habit reversion

Vimeo’s growth may slow more than expected as people move away from online and toward in-person activities in the wake of the pandemic. Even though this is already factored into consensus estimates, if the reversion is significantly larger than expected, it could slow VMEO’s growth in the near term.

Conclusion

To conclude, I believe VMEO is significantly undervalued. Vimeo is a video editing software company that offers a turn-key platform for sharing, syncing, and collaborating on video content. Businesses are increasingly using video as part of their communication strategy because it is an effective way to engage audiences and can improve key metrics such as click-through and conversion rates. The growing trend of direct-to-consumer streaming and the proliferation of devices that can play video, such as smartphones and connected TVs, also highlight the increasing popularity of watching videos online. Vimeo stands out in the market because it offers a unified platform for all stages of the video production process and allows customers to share their videos across multiple online channels.

Be the first to comment