Canadian Dollar Talking Points

USD/CAD consolidates ahead of the Bank of Canada (BoC) meeting as the central bank is anticipated to retain the current policy, but the exchange rate may continue to retrace the decline from the May high (1.3565) as a bull flag formation unfolds.

USD/CAD Rate Outlook Hinges on BoC Forward Guidance

USD/CADpulls back from the February high (1.3465) despite the limited reaction to Canada’s Gross Domestic Product (GDP), and little to no signs of a looming recession may keep the BoC on the sidelines as thecentral bank insists that “some of the slowdown in growth in late 2019 was related to special factors.”

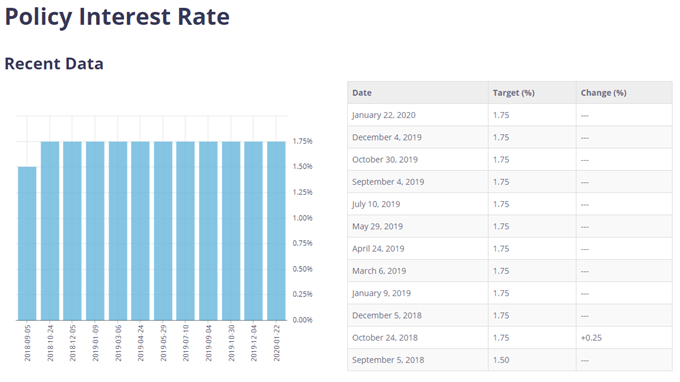

In turn, the BoC is expected to keep the benchmark interest rate 1.75% in March, and Governor Stephen Poloz and Co. may continue to endorse a wait-and-see approach in 2020 as the central bank “forecasts real GDP will grow by 1.6 percent this year and 2 percent in 2021, following 1.6 percent growth in 2019.”

More of the same from the BoC may generate a bullish reaction in the Canadian Dollar as market participants scale back bets for lower interest rates, and Governor Poloz may retain the status quo ahead of his departure in June as “the global economy is showing signs of stabilization.”

However, a material change in the forward guidance may fuel a further shift in USD/CAD behavior, and the exchange rate may continue to retrace the decline from the May high (1.3565) if the BoC shows a greater willingness to rollback the rate hikes from 2018.

With that said,the recent advance in USD/CAD may gather pace if the BoC prepares Canadian households and businesses for lower interest rates, and the exchange rate may continue to extend the advance from the 2020 low (1.2957) as a bull flag formation unfolds.

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

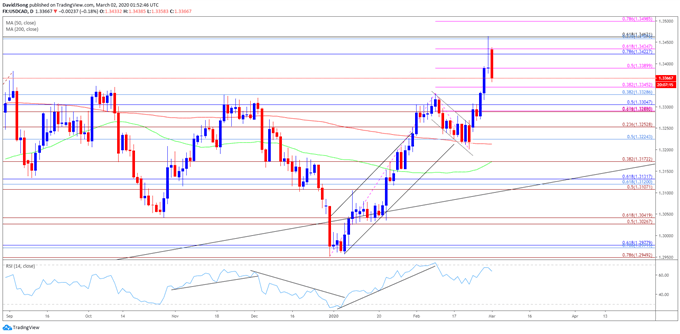

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the near-term strength in USD/CAD emerged following the failed attempt to break/close belowthe Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement), with the yearly opening range highlighting a similar dynamic as the exchange rate failed to test the 2019 low (1.2952) during the first full week of January.

- There appears to be shift in USD/CAD behavior as the exchange rate breaks out of the range from the fourth quarter of 2019 and clears the October high (1.3383).

- In turn, USD/CAD may continue to retrace the decline from the May high (1.3565) as the bull flag formation unfolds, but the bullish momentum appears to be abating as the Relative Strength Index (RSI) deviates with price and reverses course ahead of overbought territory.

- Lack of momentum to close above the Fibonacci overlap around 1.3420 (78.6% retracement) to 1.3430 (61.8% expansion) has pushed USD/CAD back below the 1.3390 (50% expansion) region, with the exchange rate quickly approaching the former resistance zone around 1.3330 (38.2% retracement) to 1.3350 (38.2% expansion).

- Next area of interest comes in around 1.3290 (61.8% expansion) to 1.3310 (50% retracement) followed by the Fibonacci overlap around 1.3220 (50% retracement) to 1.3250 (23.6% expansion).

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment