US DOLLAR FORECAST: FEDERAL RESERVE ANNOUNCES SURPRISE RATE CUT, USD PRICE ACTION SPIRALS LOWER – WHERE TO NEXT?

- The US Dollar took a nosedive on Tuesday owing to an emergency Fed rate cut

- USD price action now hinges largely on upcoming ISM Services PMI and nonfarm payrolls data slated for release

- AUD/USD and USD/JPY are expected to be the most active major currency pairs while USD/CAD overnight implied volatility presses extremes

The US Dollar has crumbled a confounding 2.75% over the last two weeks on balance. A shock 50bps rate cut delivered by the Federal Reserve earlier today overwhelmingly explains the latest drop in the US Dollar.

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (OCTOBER 2019 TO MARCH 2020)

Chart created by @RichDvorakFX with TradingView

USD price action has gravitated lower on the back of recently rekindled recession odds, which stems largely from the novel coronavirus outbreak and its destabilizing impact on global economic activity.

Downside in the US Dollar since mid-February has overwhelmingly erased the monumental rally recorded by the broader DXY Index and pushed the benchmark of major currency pairs back toward year-to-date lows.

The US Dollar Index is now hovering around a critical level of confluent support underpinned by the 78.6% Fibonacci retracement of its most recent bullish leg.

If this technical barrier fails to keep USD price action afloat, the US Dollar could continue sliding toward its December 31 swing low.

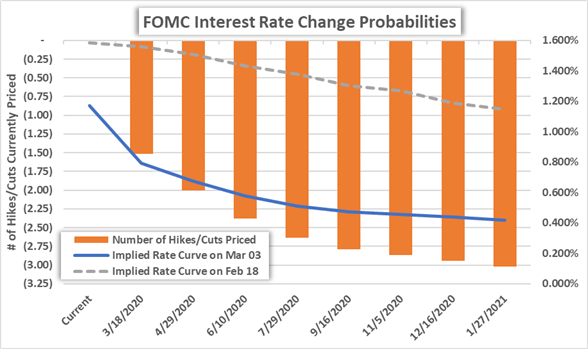

FED INTEREST RATE CUT EXPECTATIONS (FUTURES-IMPLIED)

There has been an unprecedented downshift in the futures-implied Federal funds rate (FFR) curve over the last several trading sessions.

Trader angst around the coronavirus has prompted market participants to ramp up Fed rate cut expectations, which now stand at a staggering 70-basis points by the December FOMC decision. This is on top of the 0.5% emergency rate cut delivered on Tuesday.

As such, the direction of the US Dollar will likely respond predominantly to the convergence between current market expectations and guidance from FOMC officials.

The Fed may capitulate as it has over recent history to match futures-implied probabilities of anticipated FOMC rate changes, which could be further encouraged by disappointing economic data expected this week like the ISM Services PMI or nonfarm payrolls (NFPs).

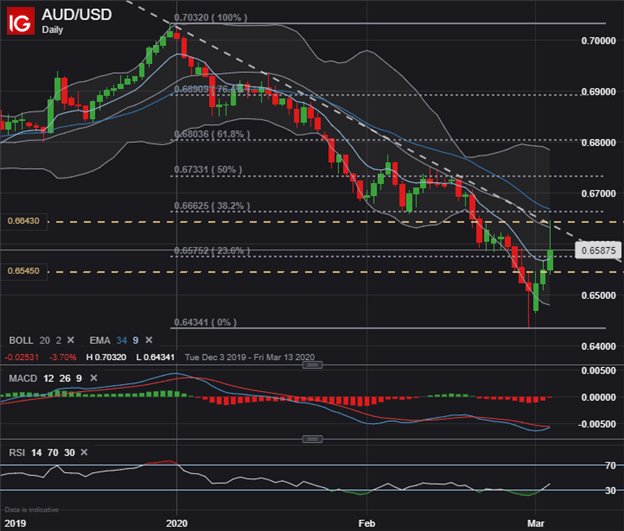

AUD/USD PRICE CHART: DAILY TIME FRAME (DECEMBER 2019 TO MARCH 2020)

That said, AUD/USD price action could be crucial for forex traders to watch considering Australia GDP data is also due for release.

Spot AUD/USD briefly pierced the downward-sloping trendline of resistance that connects the series of lower-highs printed throughout the year, but quickly reversed back lower toward its 9-day exponential moving average.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -16% | -4% |

| Weekly | -22% | 0% | -18% |

AUD/USD overnight implied volatility of 14.3% highlights the potential for outsized moves in spot prices as expected currency volatility continues to creep higher.

Judging by its overnight implied volatility reading of 14.3%, spot AUD/USD is estimated to trade between 0.6545-0.6643 with a 68% statistical probability over the next 24-hours.

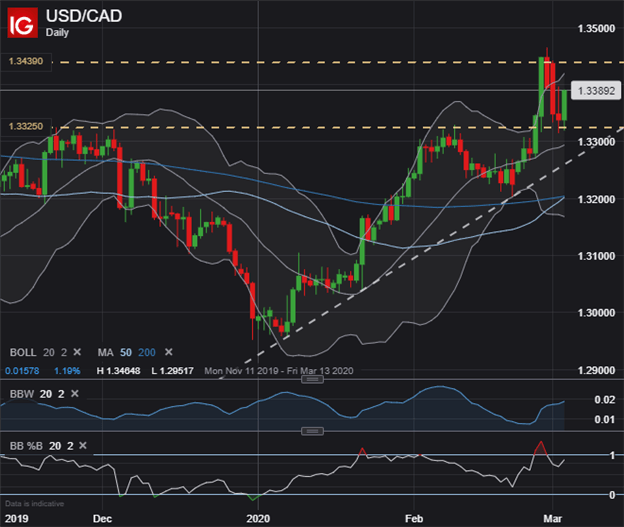

USD/CAD PRICE CHART: DAILY TIME FRAME (NOVEMBER 2019 TO MARCH 2020)

USD/CAD might be gearing up for a topside breakout despite the latest FOMC interest rate cut. Spot USD/CAD price action could eclipse technical resistance presented by the 1.34 handle if the Bank of Canada (BOC) decides to join other dovish central banks slashing their benchmark interest rates.

| Change in | Longs | Shorts | OI |

| Daily | 14% | 10% | 11% |

| Weekly | -19% | -18% | -19% |

On the other hand, the BOC could reiterate its neutral monetary policy, which might send spot USD/CAD prices spiking lower. The BOC is due to release its upcoming interest rate decision on Wednesday, March 04 at 15:00 GMT.

USD/CAD overnight implied volatility of 8.2% is also at extremes seeing that the measurement ranks in the top 99th percentile of readings taken over the last 12-months. Spot USD/CAD is estimated to trade between 1.3325-1.3439 with a 68% statistical probability if implied volatility readings are believed to be true.

— Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment