FEDERAL RESERVE CUTS INTEREST RATES BY 50-BPS UNEXPECTEDLY TO COUNTER CORONAVIRUS OUTBREAK; DOW JONES & GOLD PRICES SURGE AS US DOLLAR PLUNGES

- The Federal Reserve (Fed) just announced an unprecedented inter-meeting rate cut

- A unanimous FOMC lowered the benchmark Federal Funds rate (FFR) by 0.5%

- The US Dollar (USD) crumbled in response to the news while spot gold prices (XAU/USD) and the Dow Jones Industrial Average (DJIA) surged

The Fed has your back – at least that is what the US central bank wants markets to think. FOMC officials just unanimously announced a 0.5% interest rate cut (i.e. 50-bps) to shore up market confidence and keep financial conditions accommodative.

The decision to lower rates came unexpectedly and outside of routine Federal Reserve meetings scheduled for this year. The last time the Fed delivered an emergency rate cut was in August 2008 amid the global financial crisis and collapse of Lehman Brothers, but follows the coordinated G7 meeting of global finance ministers earlier today.

Recommended by Rich Dvorak

Trading Forex News: The Strategy

Although market participants have increasingly priced in dovish FOMC action over recent trading sessions, which comes in response to mounting coronavirus concerns, traders were likely caught off-guard by the latest inter-meeting Fed interest rate cut.

This is being reflected by the violent reaction in assets across the risk-spectrum such as the US Dollar, Dow Jones and gold.

DXY – US DOLLAR INDEX PRICE CHART: 1-MINUTE TIME FRAME (MARCH 03, 2020 INTRADAY)

Chart created by @RichDvorakFX with TradingView

USD price action quickly cratered to session lows and pushed the US Dollar Index (DXY) down to the 97.00 handle before the shock Fed rate cut induced selloff stabilized.

Tuesday’s sharp drop in the US Dollar relative to major currency pairs is exacerbating recent downside recorded by the Greenback.

Recommended by Rich Dvorak

Forex for Beginners

After notching its strongest reading in roughly three years, the broader US Dollar is now trading at its weakest level since early January after its 2.9% drop over the last eight sessions.

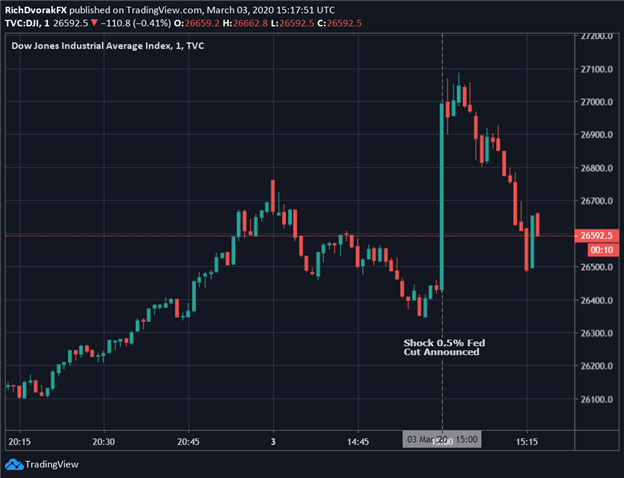

DJIA – DOW JONES INDUSTRIAL AVERAGE PRICE CHART: 1-MINUTE TIME FRAME (MARCH 03, 2020 INTRADAY)

Chart created by @RichDvorakFX with TradingView

The US stock market – measured via the Dow Jones Index – welcomed news of the surprise FOMC rate cut. The DJIA popped about 2.5% off of session lows to the 27,000 price level subsequent to the unforeseen interest rate cut from the Fed.

| Change in | Longs | Shorts | OI |

| Daily | -11% | 27% | 5% |

| Weekly | -15% | 0% | -8% |

Although major equity indices initially jumped back into the green, stocks have since edged back lower as traders digest the news.

The move back lower might be explained by overarching cynicism amongst investors who are likely questioning the motivation behind the Federal Reserve’s decision.

For example, how bad is the economy if a surprise 0.5% rate cut is truly warranted – particularly after already slashing the target Federal funds rate by 0.75% since last July.

XAU/USD – SPOT GOLD PRICE CHART: 1-MINUTE TIME FRAME (MARCH 03, 2020 INTRADAY)

Chart created by @RichDvorakFX with TradingView

The reaction in spot gold price action to the surprise Fed rate cut was quite notable as well. Bullion bounced in excess of 2% after news of the shock interest rate cut crossed the wires.

The precious metal is now trading comfortably back above the $1,600 per ounce price level following the bullish fundamental development. Gold prices tend to rise as interest rates fall.

Recommended by Rich Dvorak

Get Your Free Top Trading Opportunities Forecast

Market participants now turn to an upcoming press conference from Fed Chair Jerome Powell, who will be speaking live on the subject at 1600 GMT.

Keep Reading: US Recession Watch – Recession Odds Rekindled as Coronavirus Festers

— Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment