tolgart

Published on the Value Lab 3/8/22

TeamViewer (OTCPK:TMVWF) (OTCPK:TMVWY) is a stealth play on AR with great value and persisting growth in Q2, ahead of expectations of falling demand. However, we think there is a clear latent risk-on sentiment in corporate tech. As one of our worse performing positions, it has been sold after a recovery from the panic in order to reallocate funds in less risky corners of the market, even though we think substantial capital appreciation would eventually come from these levels. We are concerned that a wave of declines as per the market’s June recession concerns are going to hit next quarter.

TeamViewer Q2

The Q2 was actually better than expected. We thought there’d be some softening, but actually large-scale enterprise sales contracts, likely driven by liquidating backlog in the AR segment, but also probably decent performance in the flagship product evidenced by SMB growth, which was not expected, netted a pretty good quarter.

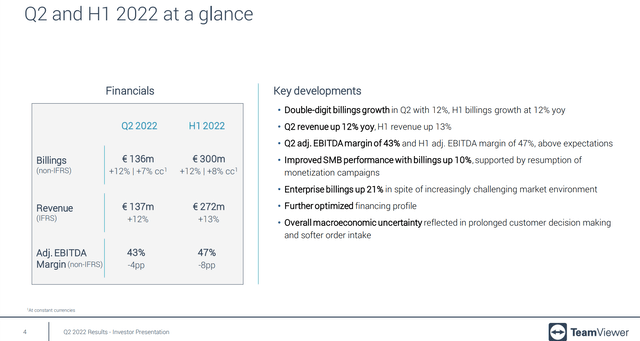

On a constant currency basis, the billings were up 7%, which means sales growth on those new billings are not too far behind. Indeed, previous quarters of billings growth sequentially have also contributed to the rising revenue figure this year as unearned revenue gets settled with growth of 13% in H1. The very narrow difference between H1 and Q2 revenue growth figures indicates that there is still momentum in sales and billings as of now.

TeamViewer Highlights (Q2 Pres 2022)

The AR partnerships are continuing, and they are by no means scraping the bottom of the barrel in terms of brands – Siemens (OTCPK:SIEGY) and also Wendy’s (WEN) in the US. The appeal continues to be broad-based across marquis brands both in Europe and the US.

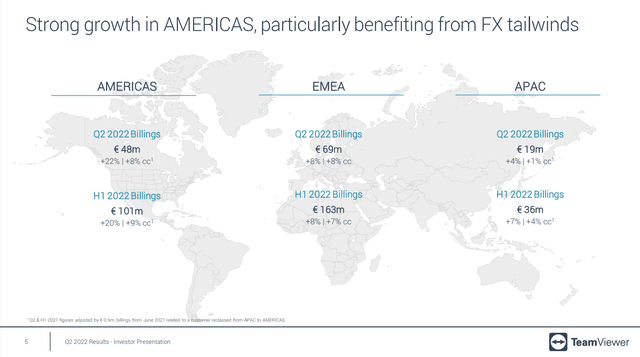

Another note on geographic results, while still narrow, there is actually upward momentum in the US versus downward momentum in Europe. It is slight but still notable given how much more aggressive the US has been with rate hiking. Naturally, these figures partial out the effect of a rising dollar.

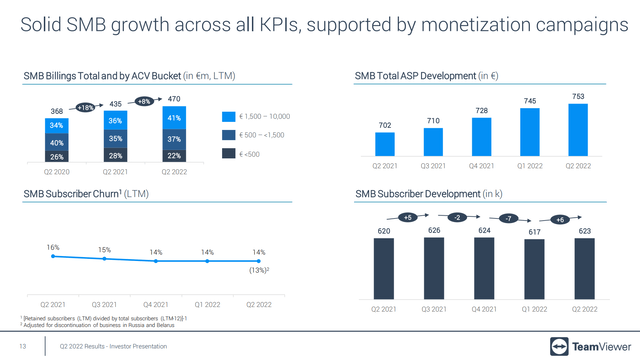

SMB results were also surprisingly good, showing 10% billings growth. We are seeing that the smallest businesses are beginning to churn, but the overall churn figure is staying the same.

Conclusions

The company has definitively announced that it won’t continue its Manchester United (MANU) partnership once the rest of the four years are up. That is going to be another 570 million EUR in discounted value returned to the company when that marketing spend reverses. If you adjust the equity bridge with that and look at the multiple, that puts TeamViewer at less than a 6x multiple if you annualise H1 figures. If you assume a 10% broad-based decline in headcounts across clients, suppose that with operating leverage that hits EBITDA by about 30% with a decrease. You would still be investing in an 8.5x tech business with a secular AR thesis at the current prices. That’s clearly good value in our eyes.

However, we recognise two concrete concerns that have led us to rotate out of the position. First of all, the MANU partnership, while alright in principle, does introduce a new source of operating leverage in a risky period for the markets. This was perhaps the biggest mistake with respect to that partnership. The other issue is that we have seen the tech earnings for Q2, and there are weak spots that make us worry. The earnings were characterised by consumer-facing companies seeing sharp declines as consumer confidence fell, while enterprise-facing businesses still grew on corporate optimism. We think it is almost assured that if rate hikes continue, which they likely will, that consumer pessimism will change corporate tunes too, to the detriment of companies exactly like TeamViewer. We think the current results are going to be a local maximum. Respecting the power of sentiment, we are simply walking away from it now in hopes of getting it at a better price. There are other interesting opportunities on the market to scout that we could maybe put more confidence in.

Be the first to comment