Investment Thesis

British Land (OTCPK:BTLCY) currently trades at a massive 45.3% discount to NAV following weakness in GBP and global market concerns following coronavirus outbreak. This discount will not last. It’s impossible to say when it will close, but BTLCY’s 6.5% dividend makes it well worth the wait.

It usually pays to be skeptical of companies with a high dividend yield as a cut is likely, but BTLCY’s yield seems safe. Rents in London are expected to increase by 15.9% by 2023, which means more cash for British Land to pay out and increase its dividend. Also, the company’s shift to larger London campuses will mean longer lease agreements. This gives BTLCY increased insight into its future cash flows and makes dividend planning much easier.

The Company

As the name suggests, British Land owns almost 24 million square feet of land in Great Britain. Their business model doesn’t follow the traditional management model of buying land, leasing it, and then never thinking about it. The company considers themselves community developers, which simply means they are attempting to create properties that help improve the daily lives of the people within that community and make people want to spend time there.

British Land’s current portfolio consists of three types of properties: London campuses, residential, and single-use retail. The company is focused on growing their ownership in the first two categories, while moving away from single-use retail. Traditional retail currently accounts for about 45% of the company’s portfolio. The goal is to shrink it down to 30%-35% over the next five years.

(Source)

This pivot away from single-use retail will allow the company to focus more on their larger London campuses. The company currently operates three of these properties: Broadgate, Regent’s Place, and Paddington Central. Combined, these properties cover over 50 acres of prime central London real estate.

The company is smartly treating these as more than just a collection of buildings and is creating mixed use spaces. They’re filled with open space, vegetation, and places to sit. They’re places people want to be in one of the busiest cities in the world, and the financials reflect that. If you take a look at the Broadgate campus (picture below) numbers, you’ll see a 97% occupancy rate, 5.5 year average lease, and $175 million in annual rent. All terrific numbers, and that’s just one of its three campuses.

I could continue to stress the importance of these campuses, but I’ll let the company explain their strategy. From their website,

“our campuses are a unique competitive advantage for us; here we control not just the buildings but the spaces between them, allowing us to deliver environments that reflect the evolving needs of modern, London lifestyles. Today’s businesses are focused on operating in buildings and locations which enable them to attract and retain the best talent.”

These real estate holdings should continue to increase in value, but there are three current profit drivers that should drive more immediate returns for British Land shareholders.

Profit Driver 1: Closing the Discount to NAV

British Land’s net asset value (NAV) is currently around $11 billion. This is calculated by taking the $15 billion in property owned by British Land and subtracting their $4 billion in debt. If you divide the net asset value of $11 billion by the current shares outstanding, you get a net asset value for the company of about $11.50 per share.

As of writing this, the stock currently trades at $6.29, which is an absurd 45.3% discount to NAV. This is an incredible value. Put another way, NAV is often used as an estimate for liquidation value, so if British Land was liquidated tomorrow at its NAV you would make an immediate 45.3% on your investment.

Unfortunately, for us, British Land won’t be liquidated at NAV tomorrow, so you’ll have to wait for this discount to close organically over time. In the meantime, enjoy the 6.5% annual dividend!

Profit Driver 2: Dividends

As mentioned earlier, British Land’s collection of London properties demands high levels of rents. A portion of these rents are then returned to investors in the form of dividends. The rents are so high that the stock is currently paying a dividend in excess of 6.5% a year. And as London rents are expected to continue to rise, so is British Land’s dividend. While we wait for profit drivers 2 and 3 to play out, you’ll collect 6.5% a year or more. Not bad in the 0% interest world we currently live in.

British Land maintaining its current high dividend level seems like a safe bet for a few reasons. First, the company generates massive amounts of cash from rent, and this number is only expected to increase in the future. Second, their pivot to massive London campuses will mean longer leases and more insight into future cash flows. Finally, given the greater insight and the aforementioned 0% interest world, if BTLCY ever ran into short-term issues, it would be easy for the company to borrow money for almost nothing to continue to paying its dividend.

Profit Driver 3: Appreciation of the British Pound

When investing in foreign companies, a lot of American investors will overlook the foreign currency aspect of their investment, but it can play a huge role in your returns. About a decade ago, the British Pound (GBP) was extremely strong, trading at about $2 each. Today, it is a much different picture. Currently, the GBP trades for about $1.29 each.

Having your USD in British properties during this large decline would have been disastrous for your investment returns. Any gains made would have been mostly wiped up by the GBP’s collapse. The exact reverse of this situation is what could potentially drive our returns in British Land even higher than expected.

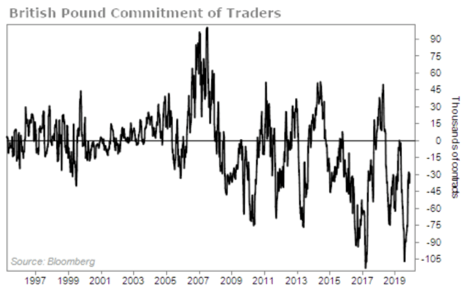

The fall in GBP has been traumatic, but the current negative sentiment makes it likely the currency has bottomed, and that right now is a great time to bet on the British Pound. The uncertainty surrounding Brexit, the long-term effects of which are still largely unknown, is the main culprit that has sent investors running to the hills for the past five years. Despite the large drop that’s already occurred, futures traders are still betting heavily that GPB’s fall will continue.

An easy view of this negative sentiment is to look at the Commitment of Traders (COT) report for the British Pound. We’ve only seen this level of bearishness from futures traders a few times in the past decade, and all of them have been tremendous contrarian indicators.

GBP is historically cheap and hated, which makes this a perfect time to make this investment in British Land. Our exposure to the British Pound could easily add another 10%-15% to our investment returns if we were to get a rally.

Risks

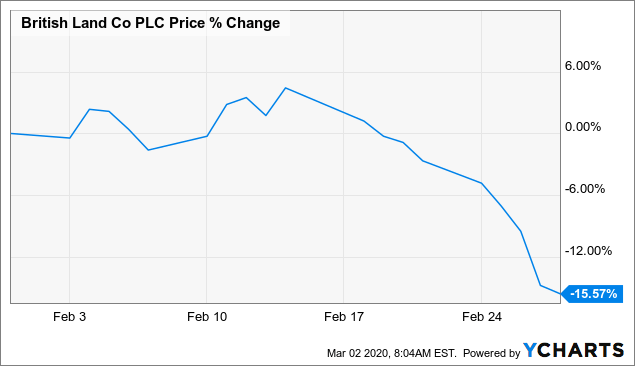

There are a few main risks that could cause British Land’s discount to NAV to persist, or even increase. It’s no surprise that British Land has come under pressure recently due to the coronavirus outbreak.

Data by YCharts

Data by YCharts

People are currently afraid to congregate in large spaces, which means foot traffic on their large London campuses will be down. If the virus is a short-term issue, BTLCY will be largely unaffected as their leases have already been negotiated. If the concern stretches over multiple years and people continue staying inside, then British Land could struggle to keep their occupancy rates high without lowering leasing costs.

Brexit uncertainty remains a risk for any investment in the UK. A lot remains to be seen how a post-Eurozone UK will fit into the global sphere, but their new immigration policy is an example of the potential risks to British Land. Under this new policy, which you can read about here, it will become harder for most people to immigrate to the UK. A decreased population and a decreased diversity of population could make the area less attractive for tourists. Both of these things would be downward pressures on rent and lease levels in the UK.

Conclusion

It’s rare to find an investment opportunity with such straight-forward profit drivers. I haven’t found many investments that will pay you 6.5% a year to wait for a 45.3% discount to NAV to close while also having a massive potential tailwind such as a long overdue rally in the British Pound.

Disclosure: I am/we are long BTLCY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment