baona

Suncor Energy Inc. (NYSE:SU) reported a solid third quarter performance when it released numbers last week. This was on the back of a strong showing in its refining segment as the company hit the third highest crude refining throughput levels in its history. And while the company had to contend with wider heavy-crude differentials, production came in at expected levels and distillate demand was very strong.

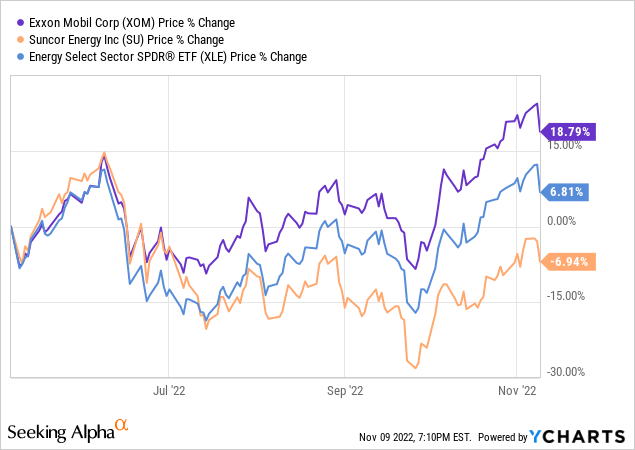

But what’s really interesting about Suncor are the steps that management is taking to implement a more focused business strategy. The sale of noncore renewable energy assets coupled with the purchase of Teck Resources Limited’s (TECK) stake in the Fort Hills oil sands project shows that management is serious about implementing changes that will drive the share price higher. This article will discuss those changes and their potential impact on the company’s discount relative to other industry players.

Note: Unless otherwise stated, all references to dollars ($) are to the Canadian currency.

Backgrounder

On their surface, Suncor’s Q3 results looked rather disappointing as the company booked a $609 million net loss; this was mostly on the back of a $3.4 billion write-down against its share of the Fort Hills project. But when we dig a little deeper, we quickly see a much brighter picture. During the quarter, Suncor’s adjusted operating earnings increased to $2.6 billion from the $1 billion level in the corresponding quarter last year. That comes to $1.88 versus $0.71 on a per share basis respectively. Adjusted funds from operations also improved substantially to $4.5 billion ($3.28/share) relative to $2.6 billion ($1.79/share) in Q3 of last year.

In recent weeks, Suncor also made some moves to reduce the long-term liabilities side of its ledger. In early October, it executed a debt tender offer that allowed it to repay about $3.6 billion of various note issuances. This is significant because it will keep the company on track to meet its net debt reduction targets which will help lessen its dependence on commodity pricing. The company’s long-term debt stood at about $13.5 billion at the end of Q3 before the $3.6 billion reduction. After October’s payment is factored in, the total is well below the $14.3 billion debt level at the beginning of the year.

But even more importantly, the debt reduction will allow for greater share buybacks. Kris Smith, Suncor’s Interim CEO, discussed the issue during the Q3 call and said that the debt reduction will help in, “increasing capital allocation to share buybacks to 75% by the end of Q1 2023.”

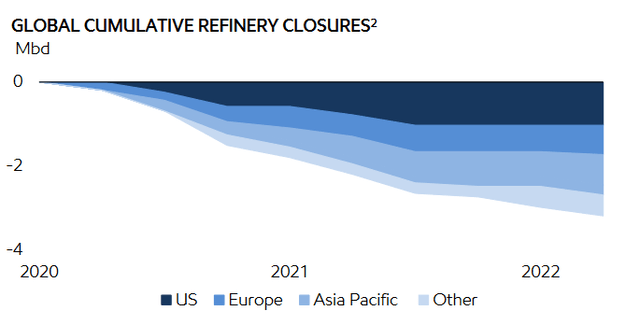

On the operational side things are looking good as well. Upstream volumes came in at 724k oebd and that is expected to increase in the fourth quarter as maintenance activities at Syncrude are completed. But with all the talk of diesel shortages, it’s no surprise that the downstream business is where the action is. Suncor’s four refineries worked flat out during Q3 as they hit a 100% utilization rate to take in 466,600 bbls/d of crude during the quarter. The third quarter saw the company hit the third highest crude refining throughput in its history. And this trend should continue in the near-term given the number of refinery closures and the cumulative loss of refining capacity in the last few years.

Narrower Business Focus

However, the best part of Suncor’s performance in recent months has not been its numbers, but rather the implementation of a much more focused business strategy along with a greater willingness to tackle longstanding problems.

In early October, Suncor sold its wind and solar energy portfolio to Canadian Utilities Ltd. (OTCPK:CDUAF) for $730 million. In my opinion, this is a wise move by Suncor’s management. Because while I believe that wind and solar should be part of the overall energy mix, I don’t believe those assets should be run by oil and gas companies. As an investor, I like to see oil and gas companies own and operate assets directly related to the oil and gas business. And by divesting those assets, Suncor became more focused and easier to understand.

That same logic of increased simplicity also applies to Suncor’s purchase of Teck’s 21.3% stake in the Fort Hills property. Granted, the purchase forced Suncor to mark-to-market its equity in the project which resulted in its poor quarterly net earnings number, but having fewer owners around the table generally translates to better planning and the ability to make decisions more quickly whenever problems crop up.

The other subject that management discussed extensively during the third quarter call were the company’s efforts to tackle longstanding safety performance and reliability issues. These are problems that have dogged the company for some time and contributed to its sector underperformance.

But management is taking the issue seriously and is making a strong effort to deal with the problem. Efforts are currently underway to reduce the contractor workforce in the mining and upgrading businesses by 20%, install industry-leading collision awareness technologies on mobile mine equipment, and placing a greater emphasis on better training staff.

These safety initiatives, combined with the company’s strategic moves, should lead to better and more reliable performance as well as a more highly focused operation. And these changes should help to greatly narrow the discount between Suncor and the rest of the sector.

Risk

In addition to a strong and sustained pull-back in the price of oil, the risk to this thesis is that management is unable to fully diagnose and fix the safety issues that have affected the company. If these issues persist, the market may continue to undervalue the stock.

Takeaway

Management is undertaking a series of steps to reduce debt, improve performance, and increase Suncor’s focus. This can be seen in the company’s sale of noncore assets, the purchase of a larger stake in the Fort Hills operation, and the numerous safety improvements currently being implemented. Management is serious in its pursuit of this new strategic direction and Suncor’s share price should soon begin to reflect that.

Be the first to comment